Current Report Filing (8-k)

December 04 2014 - 6:37AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) December 4, 2014

BEST BUY CO., INC.

(Exact name of registrant as specified in its charter)

|

| | | | |

Minnesota | | 1-9595 | | 41-0907483 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

7601 Penn Avenue South | | |

Richfield, Minnesota | | 55423 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (612) 291-1000

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

Item 7.01 | Regulation FD Disclosure. |

On December 4, 2014, Best Buy Co., Inc. (the “registrant”) issued a news release announcing that it had entered into a definitive agreement providing for the sale of its Five Star business to the Jiayuan Group. A copy of the release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to liability of that Section unless the registrant specifically incorporates it by reference in a document filed under the Securities Act of 1933, as amended, or the Exchange Act, of the Securities Exchange Act of 1934, as amended.

| |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

|

| | |

Exhibit No. | | Description of Exhibit |

99.1 | | Best Buy Co., Inc. news release issued December 4, 2014. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | BEST BUY CO., INC. |

| | (Registrant) |

| | |

Date: December 4, 2014 | By: | /s/ SHARON L. McCOLLAM |

| | Sharon L. McCollam |

| | Chief Administrative Officer and Chief Financial Officer |

Exhibit 99.1

Best Buy to Sell its Five Star Business in China

MINNEAPOLIS – Dec. 4, 2014 – Best Buy Co., Inc. (NYSE:BBY) today announced that it has entered into a definitive agreement for the sale of its Five Star business to the Jiayuan Group, a prominent China-based real estate firm led by Chairman Yuxing Shen. This sale does not affect Best Buy’s private label operations in China.

“Over the last two years we have worked to improve our business in China and are proud of the progress we have made there,” said Hubert Joly, president and chief executive officer of Best Buy. “We were recently approached by Jiayuan Group, a respected Chinese investment group, which offered to acquire the business with plans to further expand it. The Jiayuan Group has agreed to work with Five Star Chief Operating Officer Yiqing Pan, who will become chief executive officer of Five Star. Mr. Pan has been with the business for many years and has a deep respect for Five Star employees, as well as a vested interest in continuing to work with them to build a stronger presence in China,” Joly said.

“The sale of Five Star does not suggest any similar action in Canada or Mexico. Instead, it allows us to focus even more on our North American business. We will also continue to invest in and grow our China-based private label operations, with brand names that include Dynex, Insignia, Modal, Platinum and Rocketfish,” Joly added.

Best Buy entered the Chinese retail market by purchasing a majority interest in Jiangsu Five Star in 2006 and now operates 184 stores in China, all under the Five Star brand. The transaction, which is subject to regulatory approval, is expected to close in the first quarter of fiscal 2016. The sale of the Five Star business is not expected to have a material impact on the results of operations, financial position or cash flow of Best Buy.

Forward-Looking and Cautionary Statements:

This news release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 as contained in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that reflect management’s current views and estimates regarding future market conditions, company performance and financial results, business prospects, new strategies, the competitive environment and other events. You can identify these statements by the fact that they use words such as “anticipate,” “believe,” ”assume,” “estimate,” “expect,” “intend,” “project,” “guidance,” “plan,” “outlook,” and other words and terms of similar meaning. These statements involve a number of risks and uncertainties that could cause actual results to differ materially from the potential results discussed in the forward-looking statements. Factors that could cause such differences include: uncertainties regarding the expected benefits from and effects of the transaction; the parties’ ability to satisfy the other conditions and terms of the transaction, and to execute the transaction in the estimated time frame, if at all; and other risks and uncertainties, including those detailed from time to time in the registrant’s periodic reports (whether under the caption Risk Factors or Forward-Looking Statements or elsewhere). The registrant assumes no obligation to revise or update any forward-looking statement, except as otherwise required by law.

Investor Contact:

Mollie O'Brien

(612) 291-7735 or Mollie.obrien@bestbuy.com

Media Contact:

Amy von Walter

(612) 437-5956 or Amy.vonwalter@bestbuy.com

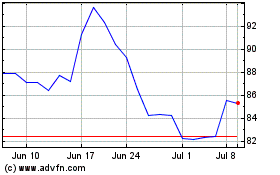

Best Buy (NYSE:BBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

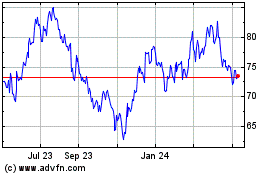

Best Buy (NYSE:BBY)

Historical Stock Chart

From Apr 2023 to Apr 2024