Cranswick PLC Trading statement & sale of sandwich business (0590F)

July 25 2016 - 2:00AM

UK Regulatory

TIDMCWK

RNS Number : 0590F

Cranswick PLC

25 July 2016

25 July 2016

Cranswick plc

("Cranswick" or "the Company" or "the Group")

First quarter trading statement and sale of sandwich

business

Cranswick, a leading UK food producer, today provides an update

on trading for the three months to 30 June 2016 and announces the

sale of its sandwich business.

Current trading

The Group has made a positive start to the current financial

year.

Revenue in the three months to 30 June 2016 was 11% ahead of the

same period last year, driven by strong volume growth.

Underlying revenue(*) was 5% higher than the same period last

year, with corresponding volumes up 12% as the benefit of lower

input prices continued to be passed on to the Group's customers.

Export volumes to Far Eastern markets were 60% ahead of the same

period last year, reflecting both ongoing robust demand from the

region and increased output from the Group's two primary processing

facilities.

Investment

The integration of Crown Chicken Limited ("Crown"), acquired in

April 2016, is progressing to plan with the business making a

positive contribution in line with the Board's expectations.

During the period, the Group continued to invest heavily across

its asset base to increase capacity, add new capability and drive

further operating efficiencies.

Financial position

Notwithstanding the GBP39 million spent on acquiring Crown

during the period and the substantial ongoing capital investment

programme across the Group, net debt stood at GBP22 million at 30

June 2016. This level was just GBP10 million higher than at the

same point last year and compared to GBP18 million of net funds at

31 March 2016. The Group is in a robust financial position, with

committed, unsecured facilities of GBP120 million which provide

comfortable headroom.

Sale of sandwich business

As part of Cranswick's strategy to focus on its core protein

businesses, the Board is pleased to announce the sale of the

Group's sandwich business, The Sandwich Factory Holdings Limited,

to Greencore plc for a cash consideration of GBP15 million. In the

year to 31 March 2016, the sandwich business generated revenues of

GBP54 million.

Adam Couch, CEO of Cranswick, commented:

"I am pleased to announce the sale of our sandwich business to

Greencore which is very much in line with our strategy of focusing

on our core protein businesses. Moreover I am particularly

delighted that the sandwich division is being acquired by a proven

global leader in Greencore who will bring new opportunities and

strengths to this business, its customers and the staff to whom, on

the Board's behalf, I would like to extend our thanks for their

long standing loyalty and commitment to Cranswick."

Outlook

With experienced management at all levels of the Group, a strong

range of products, a well-invested asset base and a robust

financial position, the Board is confident in both the prospects

for the current financial year and the continued long term success

and development of the business.

Interim results

The Company's next scheduled comment on trading will be the

interim results announcement on 29 November 2016.

Enquiries:

Cranswick plc 01482 372 000

---------------------------- --------------------------------

Mark Bottomley, Finance

Director

---------------------------- --------------------------------

Powerscourt 020 7250 1446

---------------------------- --------------------------------

Nick Dibden / Sophie Moate cranswick@powerscourt-group.com

/ Samantha Trillwood

---------------------------- --------------------------------

Notes:

1. Cranswick's activities are focused within the UK and include

the processing and supply of fresh pork, sausage, bacon, cooked

meats, premium fresh and cooked poultry, charcuterie, pastry

products and sandwiches. Products are primarily supplied into the

UK food retail, food service and food manufacturing sectors.

Results for the year to 31 March 2016 showed revenues of GBP1,070m

and profit before tax of GBP58.7m.

2. This announcement is based on information sourced from unaudited management accounts.

3. This announcement contains certain forward looking statements

with respect to the financial conditions, results of operations and

businesses of Cranswick. These statements involve risk and

uncertainty because they relate to events and depend upon

circumstances that will occur in the future. There are a number of

factors that could cause actual results or developments to differ

materially from those expressed or implied by these forward looking

statements. Nothing in this announcement should be construed as a

profit forecast.

* Underlying revenue excludes the contribution from Crown in the current year

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTPGUUWMUPQPUC

(END) Dow Jones Newswires

July 25, 2016 02:00 ET (06:00 GMT)

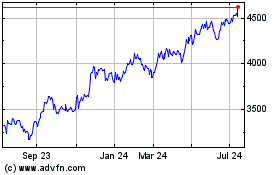

Cranswick (LSE:CWK)

Historical Stock Chart

From Mar 2024 to Apr 2024

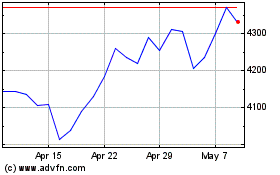

Cranswick (LSE:CWK)

Historical Stock Chart

From Apr 2023 to Apr 2024