TIDMCIC

RNS Number : 1732G

Conygar Investment Company PLC(The)

25 May 2017

25 May 2017

The Conygar Investment Company PLC

Interim Results for the six months ended 31 March 2017

Highlights

-- Net asset value per share 201p at 31 March 2017 increased from 197p at 30 September 2016.

-- Disposed of the majority of our investment properties for GBP129.8 million.

-- Acquired a 40 acre development site close to Nottingham train station for GBP13.5 million.

-- Received planning permission for the first phase of the Fishguard Marina development.

-- Started construction work at our sites in Cross Hands and Ashby de la Zouch.

-- Total cash available of GBP46 million and no debt.

Summary Group Net Assets as at 31 March 2017

Per Share

GBP'm p

Investment Properties Under Construction 28 40

Development Projects 40 56

Investment in Regional REIT Limited 27 38

Cash 46 65

Other Net Assets 1 2

------ ----------

Net Assets 142 201

Robert Ware, Chief Executive of The Conygar Investment Company,

commented:

"This has been an extremely busy and transformational six month

period for the Group and the Board is pleased to have disposed of

the majority of the investment property portfolio which

crystallises the significant capital growth achieved over the past

eight years.

The attention of the team now turns to the investment properties

under construction and the development projects we currently hold

and to sourcing further investment opportunities, such as the

recent Nottingham acquisition. The Group is in a strong position to

bring these projects to fruition with cash of GBP46 million

available for investment and no debt."

Enquiries:

The Conygar Investment Company PLC

Robert Ware: 020 7258 8670

Ross McCaskill: 020 7258 8670

Liberum Capital (Nominated Adviser)

Richard Bootle: 020 3100 2222

Henry Freeman: 020 3100 2222

Temple Bar Advisory (Public Relations)

Alex Child-Villiers: 07795 425 580

The Conygar Investment Company PLC

Interim Results

for the six months ended 31 March 2017

Chairman's and Chief Executive's Statement

Progress and Results Summary

We present the Group's results for the six months ended 31 March

2017. The net asset value per share increased to 201.0p from 196.9p

at 30 September 2016 (201.0p at 31 March 2016).

The profit before taxation of GBP0.5 million compares with a

loss of GBP2.1 million for the six months ended 31 March 2016. The

main reason for this increase in profit is that in the prior year

period there was a decrease in valuation of our investment

properties of GBP2.4 million.

On 24 March 2017, the Group completed the disposal of the

majority of the investment property portfolio, including the TAP,

Lamont and Edinmore portfolios, along with our asset in Mochdre,

North Wales to Regional Commercial Midco Limited, a wholly owned

subsidiary of Regional REIT Limited, for a consideration which

attributed a value of GBP129.8 million to the portfolio. The Group

sold the relevant property owning subsidiaries at their net asset

value and the net consideration amounted to GBP28 million, which

was satisfied by the issue of 26.3 million Regional REIT shares at

a price of 106.3p. This disposal resulted in the investment

properties being transferred to Regional REIT along with the debt

facilities held with Lloyds Banking Group and HSBC. In addition,

Regional REIT also acquired Conygar ZDP PLC and thereby, the

Group's obligation to fund the ZDP capital entitlement, which

equates to GBP39.9 million payable on 9 January 2019.

The transaction results in the Group being debt free and it is

anticipated that this will remain the case until the investment

properties under construction and the development programme require

further finance beyond our cash deposits, which are presently GBP46

million.

The disposal is a significant transaction for the Group and the

team worked hard to minimise the associated costs. This has

resulted in a profit on disposal of GBP1.5 million in the period.

More importantly, the disposal crystallises the substantial capital

gains which have been made across the portfolio since the

acquisitions of the TAP, Lamont and Edinmore portfolios during the

period following the global financial crisis of 2008. Through our

asset management and transaction structuring skills, we took

undervalued and distressed portfolios and transformed them into a

high yielding portfolio, which is well supported by competitive

bank finance and hence, was attractive to purchasers looking for

income producing assets.

The portfolios were acquired for a total cost of GBP113.4

million and the total capital gains realised over the period from

2008 to March 2017 were GBP48.2 million, subject to the disposal of

the Regional REIT shares. In addition to these capital gains, net

income of GBP47.0 million was generated over the same period,

excluding tax.

On 22 December 2016, the Group acquired the Nottingham Island

site, which was the former Boots headquarters and is now a cleared

city centre development site, for GBP13.5 million. It is located

within a short distance of Nottingham train station, to the

southeast of the city centre and measures approximately 40 acres.

Nottingham Island represents an exciting investment and development

opportunity with the potential for a mixture of office,

residential, leisure and student housing accommodation. The site

has a lapsed planning consent for a mixed-use scheme of over 2

million square feet and the Company is currently conducting a

master planning exercise and expects to submit a planning

application before the end of the calendar year.

On the financing side, the Group used GBP10.7 million surplus

cash to buy back 8.7% of its shares at a discount to net asset

value, at an average price of GBP1.61 per share and this has

enhanced net asset value per share by 3.4 pence. Since 31 March

2017, the Group has acquired another 1.9% of its share capital and

so, for the financial year to date, has bought back 10.6% of its

share capital at an average price of GBP1.63 per share.

As referred to above, the Group received 26.3 million shares in

Regional REIT as consideration for the disposal of the investment

properties. As at 31 March 2017, Regional REIT's share price was

101p and this resulted in a paper loss of GBP1.4 million as

reported in the income statement but the share price has since

recovered to 106.5p and as at the close of business on 23 May 2017,

the value of the investment was GBP28.0 million. The shares are

currently yielding 6% per annum and the dividend income we are due

to receive from this investment will substantially cover our

administrative expenses.

Development Projects

We continue to make good progress on our development projects

since we last reported.

Construction on our site at Cross Hands, south west Wales, began

in December 2016 after we received planning permission in September

2016 for a 106,000 square foot retail development. We have signed

legal agreements for leases with B&M Retail, Iceland and Costa

Coffee and negotiations are ongoing with four other national

retailers.

In December 2016, we received planning permission for an 11,000

square foot Marks & Spencer "Food Hall" at our development site

in Nottingham Road, Ashby-de-la-Zouch. This "Food Hall" is pre-let

to Marks & Spencer on a 15 year lease and we started

construction of this in February 2017, with completion expected to

take place in September of this year. There are another two acres

available for development at the site and discussions are ongoing

with potential occupiers.

At Fishguard Harbour, we received Reserved Matters planning

permission for the marine-based infrastructure and development

platform in February 2017. During the summer, we will submit our

applications to the Harbour Revision Order, in conjunction with

Stena Line Ltd, and once these permissions have been achieved, we

will be able to start the development of the marine platform and

marina. Simultaneously, we will continue to prepare the detailed

Reserved Matters application in respect of the 253 homes.

At Holyhead Waterfront, the Town and Village Green Application,

submitted by the Waterfront Action Group to prevent the development

from progressing, was rejected by the appointed Inspector and,

subsequently, acting on the Inspector's recommendation, Ynys Mon

County Council resolved to formally refuse the application at its

March 2017 planning committee. The period, during which this

decision can be called in for judicial review, ends at the

beginning of June 2017 and assuming that this impediment for the

development is removed, we will progress to the detailed design

stage of the scheme.

The Truckstop at Parc Cybi continues to trade well and we are

forecasting a modest uplift in transport/visitor numbers over the

summer months. Separate to our Truckstop joint venture, we are

continuing to progress our plans for an 80 bedroom hotel on our

land and expect to submit a planning application within the next 3

months.

In December 2016, we signed two option agreements with Horizon

Nuclear Power, the first enabling them to instruct us to build a

logistics centre on our 6.9 acre site at Parc Cybi. The second

option agreement covers all of our 203 acre site at Rhosgoch and

marks the site as a potential location for housing the temporary

workers required for the construction of the Wylfa B Nuclear Power

Station.

At Haverfordwest, we submitted two planning applications in June

2016 for approximately 124,000 square feet of retail floorspace, a

60 bedroom hotel, a 5 screen cinema and 602 car parking spaces. We

are continuing to speak to housebuilders on the residential element

of the wider development, with a view to bringing this forward as

soon as possible. We hope that these applications will be heard at

planning committee meetings in June 2017.

At Llandudno Junction, we continue to work with Conwy County

Council to bring this development site forward.

Dividend Policy

Given that the Group has sold the majority of its investment

property portfolio in the period, it is likely that a dividend will

not be declared for this financial year. The Board will continue to

review our dividend policy each year but our primary focus is, and

will continue to be, growth in net asset value per share.

Summary Group Net Assets

The Group net assets as at 31 March 2017 may be summarised as

follows:

Per Share

GBP'm p

Investment Properties Under Construction 28 40

Development Projects 40 56

Investment in Regional REIT Limited 27 38

Cash 46 65

Other Net Assets 1 2

------ ----------

Net Assets 142 201

Outlook

This has been an extremely busy and transformational six month

period for the Group and the Board is pleased to have disposed of

the majority of the investment property portfolio which

crystallises the significant capital growth achieved over the past

eight years.

The attention of the team now turns to the investment properties

under construction and the development projects we currently hold

and to sourcing further investment opportunities, such as the

recent Nottingham acquisition. The Group is in a strong position to

bring these projects to fruition with cash of GBP46 million

available for investment and no debt.

N J Hamway R T E Ware

Chairman Chief Executive

24 May 2017

Financial review

Net Asset Value

The net asset value at 31 March 2017 was GBP141.8 million (31

March 2016: GBP155.2 million; 30 September 2016: GBP152.0 million).

The primary movements in the six month period were GBP3.5 million

net rental income plus a GBP1.5m profit on the sale of Group

undertakings to Regional REIT Limited offset by GBP3.1 million of

finance and administrative costs, a GBP1.4 million write down of

the value of our investment in Regional REIT Limited and GBP10.7

million spent on purchasing our own shares. Excluding the amounts

incurred purchasing Conygar shares, net asset value increased by

0.3% in the period.

Cash Flow

The Group used GBP1.8 million cash in operating activities (31

March 2016: generated GBP0.4 million; 30 September 2016: generated

GBP2.5 million).

The primary cash outflows in the period were GBP13.5 million

incurred on purchasing the Nottingham Island site, GBP8.3 million

to repay Barclays debt and GBP10.2 million to buy back shares.

These were partly offset by cash inflows of GBP20.8 million (net of

costs) from the HSBC debt, resulting in a net cash outflow during

the period of GBP17.6 million (31 March 2016: GBP15.8 million

outflow; 30 September 2016: GBP6.3 million inflow).

Net Income From Investment Property Activities

31 Mar 30 31

2017 Sept Mar

2016 2016

GBP'm GBP'm GBP'm

Rental income 4.9 9.4 4.8

Direct property costs (1.4) (2.9) (1.2)

------- ------ ------

Rental surplus 3.5 6.5 3.6

------- ------ ------

Profit on sale of group 1.5 - -

undertakings*

Loss on sale of investment

properties - (0.3) (0.1)

Total net income arising

from

investment property activities 5.0 6.2 3.5

======= ====== ======

*Profit arising from the sale of the investment property

portfolio to Regional REIT Limited.

Administrative Expenses

The administrative expenses for the six month period ended 31

March 2017 were GBP1.3 million (six month period ended 31 March

2016: GBP1.3 million). The major items were salary costs of GBP0.8

million and various costs arising as a result of the Group being

quoted on AIM.

Financing

At 31 March 2017, the Group had cash of GBP46.0 million (31

March 2016: GBP41.6 million; 30 September 2016: GBP63.7 million).

The decrease has resulted mainly from the cash used in buying back

shares, administrative costs and investing in the investment

properties under construction and developments projects.

All of the undertakings that were party to the Group's bank

loans were sold on 24 March 2017. As at 31 March 2017, the Group no

longer maintains any bank loan facilities.

Summary of Investment Properties Under Construction

31 March 30 September 31 March

2017 2016 2016

GBPm GBPm GBPm

Nottingham Island site 13.71 - -

Haverfordwest Retail 3.49 3.40 3.18

Cross Hands 5.06 2.68 2.55

Rhosgoch 3.45 3.40 3.23

Parc Cybi, Holyhead(2) 1.47 - -

Ashby Retail 1.33 - -

Total investment to date 28.51 9.48 8.96

========= ============= =========

Summary of Development Projects

31 March 30 September 31 March

2017 2016 2016

GBPm GBPm GBPm

Haverfordwest(1) 22.03 22.18 23.11

Holyhead Waterfront 10.77 10.48 10.25

Holyhead Truckstop 3.18 3.18 3.35

Parc Cybi, Holyhead(2) - 1.44 1.25

Fishguard Waterfront 1.54 1.52 1.46

Fishguard Lorry Stop 0.54 0.54 0.54

King's Lynn 0.87 0.87 0.87

Llandudno Junction 0.66 0.61 0.54

Pembroke Dock Waterfront

and Other - - 4.79

--------- ------------- ---------

Total investment to date 39.59 40.82 46.16

========= ============= =========

(1) The reduction in the Haverfordwest investment from 31 March

2016 arises due to the reimbursement of retention funds from

Pembrokeshire County Council following the completion of the

infrastructure works at Haverfordwest.

(2) Parc Cybi Business Park, Holyhead has been reclassified in

the period to an investment property under construction.

The Conygar Investment Company PLC

Consolidated Statement of Comprehensive Income

For the six months ended 31 March 2017

Note Six months ended Year ended

31 March 31 March 30 Sept

2017 2016 2016

GBP'000 GBP'000 GBP'000

Rental income 4,492 4,555 9,222

Other property income 363 242 213

Revenue 4,855 4,797 9,435

------------ ----------- -----------

Direct costs of:

Rental income 1,387 1,237 2,909

Development costs written

off 76 - 1,581

Direct Costs 1,463 1,237 4,490

------------ ----------- -----------

Gross Profit 3,392 3,560 4,945

Share of results of

joint ventures 27 (2) (3)

Profit on sale of group 1,496 - -

undertakings

Movement on revaluation

of investment in Regional (1,408) - -

REIT

Loss on sale of investment

properties - (126) (308)

Movement on revaluation

of investment properties 7 - (2,423) 992

Loss on impairment of

goodwill - - (3,173)

Other gains and losses 72 (10) (880)

Administrative expenses (1,298) (1,259) (2,440)

------------ ----------- -----------

Operating Profit/(Loss) 2,281 (260) (867)

Finance costs 3 (1,779) (1,920) (4,135)

Finance income 3 115 126 259

------------ ----------- -----------

Profit/(Loss) Before

Taxation 617 (2,054) (4,743)

Taxation (122) (229) (706)

------------ ----------- -----------

Profit/(Loss) and Total

Comprehensive Income/(Charge)

for the Period 495 (2,283) (5,449)

============ =========== ===========

Attributable to:

- equity shareholders 495 (2,283) (5,449)

- minority interests - - -

------------ ----------- -----------

495 (2,283) (5,449)

============ =========== ===========

Basic earnings/(loss)

per share 5 0.68p (2.83)p (6.90)p

Diluted earnings/(loss)

per share 5 0.68p (2.83)p (6.90)p

All of the activities of the Group are classed as

continuing.

The Conygar Investment Company PLC

Consolidated Statement of Changes in Equity

For the six months ended 31 March 2017

Share Share Capital Treasury Retained Total Non-controlling Total

Capital Premium Redemption Shares Earnings Interests Equity

Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 October

2015 4,985 125,371 1,568 (23,321) 59,173 167,776 20 167,796

Loss for

the period - - - - (2,283) (2,283) - (2,283)

--------- ---------- ------------ --------- ---------- --------- ---------------- ---------

Total

recognised

income

and expense

for the

period - - - - (2,283) (2,283) - (2,283)

Dividend

paid - - - - (1,415) (1,415) - (1,415)

Purchase

of own

shares - - - (8,873) - (8,873) - (8,873)

At 31

March

2016 4,985 125,371 1,568 (32,194) 55,475 155,205 20 155,225

At 1 October

2015 4,985 125,371 1,568 (23,321) 59,173 167,776 20 167,796

Loss for

the year - - - - (5,449) (5,449) - (5,449)

--------- ---------- ------------ --------- ---------- --------- ---------------- ---------

Total

comprehensive

chanrge

for the

year - - - - (5,449) (5,449) - (5,449)

Cancellation

of share

premium

account - (125,371) - _- 125,371 - - -

Dividend

paid - - - - (1,415) (1,415) - (1,415)

Purchase

of own

shares - - - (8,873) - (8,873) - (8,873)

Purchase

of

non-controlling

interest - - - - - - (20) (20)

At 30

September

2016 4,985 - 1,568 (32,194) 177,680 152,039 - 152,039

========= ========== ============ ========= ========== ========= ================ =========

Changes

in equity

for six

months

ended

31 March

2017

At 1 October

2016 4,985 - 1,568 (32,194) 177,680 152,039 - 152,039

Profit

for the

period - - - - 495 495 - 495

--------- ---------- ------------ --------- ---------- --------- ---------------- ---------

Total

recognised

income

and expense

for the

period - - - - 495 495 - 495

Purchase

of own

shares - - - (10,741) - (10,741) - (10,741)

At 31

March

2017 4,985 - 1,568 (42,935) 178,175 141,793 - 141,793

========= ========== ============ ========= ========== ========= ================ =========

The Conygar Investment Company PLC

Consolidated Balance Sheet

As at 31 March 2017

31 March 31 March 30 Sept

2017 2016 2016

Note GBP'000 GBP'000 GBP'000

Non-Current Assets

Property, plant and

equipment 28 15 21

Investment in Regional

REIT 6 26,590 - -

Investment properties 7 - 126,710 130,680

Investment properties

under construction 8 28,513 8,957 9,476

Investment in joint

ventures 9 10,365 10,152 10,110

Goodwill - 3,173 -

65,496 149,007 150,287

--------- --------- ---------

Current Assets

Development and trading

properties 10 29,230 32,912 30,739

Trade and other receivables 3,452 3,922 3,675

Derivatives - 8 44

Cash and cash equivalents 46,031 41,621 63,662

--------- --------- ---------

78,713 78,463 98,120

--------- --------- ---------

Total Assets 144,209 227,470 248,407

Current Liabilities

Trade and other payables 2,416 2,990 4,263

Bank loans 11 - 33,857 8,335

Tax liabilities - 516 243

--------- --------- ---------

2,416 37,363 12,841

--------- --------- ---------

Non-Current Liabilities

Bank loans 11 - - 47,210

Zero dividend preference

shares 12 - 33,427 34,415

Deferred tax - 1,455 1,902

- 34,882 83,527

--------- --------- ---------

Total Liabilities 2,416 72,245 96,368

--------- --------- ---------

Net Assets 13 141,793 155,225 152,039

========= ========= =========

Equity

Called up share capital 4,985 4,985 4,985

Share premium account - 125,371 -

Capital redemption

reserve 1,568 1,568 1,568

Treasury Shares (42,935) (32,194) (32,194)

Retained earnings 178,175 55,475 177,680

--------- --------- ---------

Equity Attributable

to Equity Holders 141,793 155,205 152,039

Minority interests - 20 -

Total Equity 141,793 155,225 152,039

========= ========= =========

Net Assets Per Share 201.0p 201.0p 196.9p

The Conygar Investment Company PLC

Consolidated Cash Flow Statement

For the six months ended 31 March 2017

Six months ended Year ended

31 March 31 March 30 Sept

2017 2016 2016

GBP'000 GBP'000 GBP'000

Cash Flows From Operating

Activities

Operating profit/(loss) 2,281 (260) (867)

Depreciation and amortisation 5 14 21

Amortisation of reverse

lease premium - 51 104

Share of results of joint

ventures (27) 2 3

Other gains and losses 25 17 17

Profit on sale of group (1,496) - -

undertakings

Movement on revaluation 1,408 - -

of investments

Loss on sale of investment

properties - 126 308

Movement on revaluation

of investment properties - 2,423 (992)

Loss on impairment of goodwill - - 3,173

Development costs written

off 76 - 1,581

Cash Flows From Operations

Before Changes In Working

Capital 2,272 2,373 3,348

Change in trade and other

receivables (859) 1,047 1,294

Change in land, developments

and trading properties (47) (325) 267

Change in trade and other

payables (2,394) (1,595) (320)

----------- ---------- -----------

Cash Flows (Used In)/Generated

From Operations (1,028) 1,500 4,589

Finance costs (687) (713) (1,450)

Finance income 67 81 167

Tax paid (137) (512) (815)

----------- ---------- -----------

Cash Flows (Used In)/Generated

From

Operating Activities (1,785) 356 2,491

----------- ---------- -----------

Cash Flows From Investing

Activities

Acquisition of and additions

to investment properties (15,617) (7,290) (9,759)

Sale proceeds of investment

properties - 5,424 6,842

Cash transfer on disposal (1,896) - -

of group undertakings

Costs paid on disposal (269) - -

of group undertakings

Investment in joint ventures (255) (81) (215)

Loans repaid by joint venture - - 175

Purchase of plant and equipment (12) (1) (14)

Cash Flows Used In

Investing Activities (18,049) (1,948) (2,971)

----------- ---------- -----------

Cash Flows From Financing

Activities

Bank loans drawn down 21,298 - 48,100

Bank loans repaid (8,335) (3,885) (29,816)

Costs paid on new bank

loan (548) - (971)

Purchase of interest rate

cap - - (269)

Dividend paid - (1,415) (1,415)

Purchase of own shares (10,212) (8,873) (8,873)

Cash Flows Generated From/(Used

In)

Financing Activities 2,203 (14,173) 6,756

----------- ---------- -----------

Net (decrease) / increase

in cash and cash equivalents (17,631) (15,765) 6,276

Cash and cash equivalents

at Start of Period 63,662 57,386 57,386

----------- ---------- -----------

Cash and Cash Equivalents

at End of Period 46,031 41,621 63,662

----------- ---------- -----------

Notes to the Interim Results

1. Basis of Preparation

The accounting policies used in preparing the condensed

financial information are consistent with those of the annual

financial statements for the year ended 30 September 2016 other

than the mandatory adoption of new standards, revisions and

interpretations that are applicable to accounting periods

commencing on or after 1 October 2016, as detailed in the annual

financial statements.

The condensed financial information for the six month period

ended 31 March 2017 and the six month period ended 31 March 2016

has been reviewed but not audited and does not constitute full

financial statements within the meaning of section 435 of the

Companies Act 2006.

The financial information for the year ended 30 September 2016

does not constitute the Group's statutory accounts for that period

but it is derived from those accounts. Statutory accounts for the

year ended 30 September 2016 have been delivered to the Registrar

of Companies. The auditors have reported on these accounts; their

report was unqualified and did not contain statements under section

498(2) or (3) of the Companies Act 2006.

The board of directors approved the above results on 24 May

2017.

Copies of the interim report may be obtained from the Company

Secretary, The Conygar Investment Company PLC, Fourth Floor, 110

Wigmore Street, London, W1U 3RW.

2. Segmental Information

IFRS 8 requires the identification of the Group's operating

segments which are defined as being discrete components of the

Group's operations whose results are regularly reviewed by the

board of directors. The Group divides its business into the

following segments:

-- Investment in the shares of Regional REIT Limited;

-- Investment properties, which are owned or leased by the Group

for long-term income and for capital appreciation, and trading

properties, which are owned or leased with the intention to sell;

and,

-- Development properties, which include sites, developments in

the course of construction and sites available for sale.

The only item of revenue or profit/loss relating to the

investment in Regional REIT Limited is the fair value movement from

acquisition until the balance sheet date. The only item of revenue

or profit/loss relating to the development properties was the write

off of development costs in the year ended 30 September 2016 and

therefore only the segmented balance sheet is reported.

Balance Sheet

31-Mar-17 31-Mar-16

Investment Development Group Investment Development Group

Investment Properties Properties Other Total Properties Properties Other Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Investment

in

Regional

REIT

Limited 26,590 - - - 26,590 - - - -

Investment

properties - 28,513 - - 28,513 135,667 - - 135,667

Investment

in

joint

ventures - - 10,365 - 10,365 - 10,152 - 10,152

Goodwill - - - - - - 3,173 - 3,173

Development

&

trading

properties - - 29,230 - 29,230 - 32,912 - 32,912

----------- ----------- ------------ -------- -------- ----------- ------------ --------- ---------

26,590 28,513 39,595 - 94,698 135,667 46,237 - 181,904

Other assets - 3,245 28 46,238 49,511 25,055 - 20,511 45,566

----------- ----------- ------------ -------- -------- ----------- ------------ --------- ---------

Total assets 26,590 31,758 39,623 46,238 144,209 160,722 46,237 20,511 227,470

Liabilities - (966) - (1,450) (2,416) (38,618) - (33,627) (72,245)

----------- ----------- ------------ -------- -------- ----------- ------------ --------- ---------

Net assets 26,590 30,792 39,623 44,788 141,793 122,104 46,237 (13,116) 155,225

=========== =========== ============ ======== ======== =========== ============ ========= =========

3. Finance Income/Costs

Six months ended Year ended

31 March 31 March 30 Sept

2017 2016 2016

GBP'000 GBP'000 GBP'000

Finance income

Bank interest 115 126 259

=============== ============== ================

Finance costs

Bank loans (751) (713) (1,584)

Amortisation of arrangement

fees (127) (251) (741)

ZDP interest payable (901) (956) (1,810)

(1,779) (1,920) (4,135)

=============== ============== ================

4. Dividend

No dividend was paid in respect of the year ended

30 September 2016 (year ended 30 September 2015:

1.75 pence per share amounting to GBP1,415,000).

5. Earnings per Share

The calculation of earnings per ordinary share is based on the

profit after tax of GBP495,000 (31 March 2016: loss of

GBP2,283,000; 30 September 2016: loss of GBP5,449,000) and on the

number of shares in issue being the weighted average number of

shares in issue during the period of 72,708,193 (net of 29,172,688

shares purchased by the Company and held as treasury shares) (31

March 2016: 80,618,599; 30 September 2016: 78,920,377). The

weighted average number of shares on a fully diluted basis was

72,708,193 (31 March 2016: 80,618,599; 30 September 2016:

78,920,377) and profit after tax of GBP495,000 (31 March 2016: loss

of GBP2,283,000; 30 September 2016: loss of GBP5,449,000). No

adjustment has been made for anti-dilutive potential ordinary

shares. The total number of ordinary shares in issue (net of

29,172,688 shares purchased by the Company and held as treasury

shares) at the date of this report was 70,541,435.

6. Investment in Regional REIT

As set out in the Chairman's and Chief Executive's Statement,

the Group completed the disposal of various Group undertakings on

24 March 2017. The net consideration was satisfied by the issue of

26,326,644 ordinary shares in Regional REIT Limited at a price of

106.347 pence per share.

Regional REIT is a United Kingdom based real estate investment

trust whose shares were admitted to the premium segment of the

Official List and to trading on the main market of the London Stock

Exchange on 6 November 2015. Regional REIT is managed by London

& Scottish Investments Limited, as asset manager, and Toscafund

Asset Management LLP, as investment manager.

The consideration is subject to adjustment by reference to

completion accounts which at the date of signing this interim

report are yet to be agreed. To the extent that the net assets of

the disposed companies have decreased, the Company is obliged to

pay any shortfall in cash and to the extent that the net assets

have increased, Regional REIT Limited is obliged to issue further

consideration shares (at an issue price of 106.347p per

consideration share) or pay the amount of the increase in cash at

its election.

The movement in the value of the shares during the period was as

follows:

GBP'000

Consideration shares at

issue price 27,998

Movement in fair value of

investment (1,408)

Valuation at 31 March 2017 26,590

========

Under the terms of the sale agreement, the Company has agreed a

lock-in arrangement in respect of the consideration shares.

Specifically, the Company will not be permitted to dispose

(directly or indirectly) of the legal or beneficial ownership

of:

- one-third of the consideration shares until the date falling 6

months after completion;

- one-third of the consideration shares until the date falling

12 months after completion;

- one third of the consideration shares until the date falling

18 months after completion.

7. Investment Properties

Reverse

Long- Lease

Freehold Leasehold Premiums Total

GBP'000 GBP'000 GBP'000 GBP'000

Valuation at 30 September

2016 106,390 23,902 388 130,680

Reclassification to investment

properties under construction (1,170) - - (1,170)

Reverse lease premium amortisation - - (57) (57)

Disposal of group undertakings (105,220) (23,902) (331) (129,453)

At 31 March 2017 - - - -

========== =========== ========== ==========

With the exception of the investment properties under

construction, set out in note 8, the Group's investment property

portfolio was disposed of on 24 March 2017. The historical cost of

properties held at 31 March 2016 was GBP160,744,000 (30 September

2016: GBP161,164,000).

The property rental income earned from investment property up

until the date of disposal, all of which was leased out under

operating leases, amounted to GBP4,855,000 (March 2016:

GBP4,797,000; September 2016: GBP9,435,000).

As at 31 March 2017, the Group had pledged GBPnil (31 March

2016: GBPnil; 30 September 2016 GBP89,955,000) of investment

property to secure Lloyds Bank, Jersey debt facilities and GBPnil

(31 March 2016: GBP32,920,000; 30 September 2016: GBP33,260,000) to

secure Barclays Bank PLC debt facilities. Further details of these

facilities are provided in note 11.

The properties were valued by Jones Lang La Salle, independent

valuers not connected with the Group, at 31 March 2016 and 30

September 2016, at market value in accordance with the Practice

Statements contained in the RICS Appraisal and Valuation Standards

published by the Royal Institution of Chartered Surveyors which

conform to international valuation standards.

8. Investment properties under construction

Investment properties under construction are freehold land and

buildings representing investment properties under development or

construction and they amount to GBP28,513,000 as at 31 March 2017

(31 March 2016: GBP8,957,000; 30 September 2016: GBP9,476,000).

These properties comprise landholdings for current or future

development as investment properties. This methodology has been

adopted because the value of these properties is dependent on a

detailed knowledge of the planning status, the competitive position

of the assets and a range of complex development appraisals. The

fair value of these properties rests in the planned developments,

and is difficult to estimate pending confirmation of designs and

planning permission, and hence has been estimated by the directors

at cost as an approximation to fair value. Additions during the

year include the acquisition of the Nottingham Island site for

GBP13.5m including costs.

9. Investment in Joint Ventures

The group has a 50% interest in a joint venture, Conygar Stena

Line Limited, which is a property development company. It also has

a 50% interest in a joint venture, CM Sheffield Limited, which is a

property trading company, and another 50% interest in a joint

venture, Roadking Holyhead Limited, which is a property development

company and truck-stop operator.

The following amounts represent the group's 50% share of the

assets and liabilities, and results of the joint ventures. They are

included in the balance sheet and income statement:

31 March 2017 31 30 Sept

March 2016 2016

GBP'000 GBP'000 GBP'000

Assets

Current assets 10,395 10,222 10,203

Liabilities

Current liabilities (30) (70) (93)

Net assets 10,365 10,152 10,110

========= ========= ===========

Six months ended Year ended

31 March 31 March 30 Sept

2017 2016 2016

GBP'000 GBP'000 GBP'000

Operating profit/(loss) 27 (2) (3)

Finance income - - -

--------- --------- -----------

Profit/(loss) before tax 27 (2) (3)

Tax - - -

--------- --------- -----------

Profit/(loss) after tax 27 (2) (3)

========= ========= ===========

10. Property Inventories

31 March 31 March 30 Sept

2017 2016 2016

GBP'000 GBP'000 GBP'000

Properties held for resale

or development 29,230 32,912 30,739

========= ========= ========

The above amounts relate to development properties, which

include sites, developments in the course of construction and sites

available for sale.

11. Bank Loans

31 March 2017 31 30 Sept

March 2016 2016

GBP'000 GBP'000 GBP'000

Bank loans - 34,266 56,435

Debt issue costs - (409) (890)

---------- -------- --------

- 33,857 55,545

========== ======== ========

All of the undertakings that were party to the Group's bank

loans were sold on 24 March 2017 and therefore, as at the balance

sheet date, the Group no longer maintains any bank loan

facilities.

As at 30 September 2016 and up to the date of disposal of the

Group undertakings, TAPP Property Limited, TOPP Property Limited,

TOPP Bletchley Limited, Lamont Property Acquisition (Jersey) I

Limited, Lamont Property Acquisition (Jersey) II Limited and Lamont

Property Acquisition (Jersey) IV Limited ("the borrowers") jointly

maintained a facility with Lloyds Bank, Jersey of GBP48,100,000 (31

March 2016: GBPnil) under which GBP48,100,000 had been drawn down.

This facility was repayable on or before 27 April 2021 and was

secured by fixed and floating charges over the assets of the

borrowers. The facility was subject to a maximum loan to value

covenant of 65%, a historical interest cover ratio covenant of 200%

and a historical debt service cover ratio of 110%.

On 26 October 2016, Conygar Dundee Limited, Conygar Hanover

Street Limited, Conygar Stafford Limited and Conygar St Helens

Limited repaid the outstanding balances of their facilities with

Barclays Bank PLC of GBP8,335,000 (31 March 2016:

GBP8,335,000).

From 2 December 2016 and up to the date of disposal of the Group

undertakings, Conygar Dundee Limited, Conygar Hanover Street

Limited, Conygar Strand Limited and Conygar St Helens Limited

jointly maintained a facility with HSBC Bank PLC of GBP21,397,500

(31 March 2016: GBPnil) under which GBP21,397,500 had been drawn

down. This facility was repayable on or before 2 December 2021 and

was secured by fixed and floating charges over the assets of

Conygar Dundee Limited, Conygar Hanover Street Limited, Conygar

Strand Limited and Conygar St Helens Limited. The facility was

subject to a maximum loan to value covenant of 65%, a historical

and projected interest cover ratio covenant of 200% and a

historical and projected debt service cover ratio of 120%.

All of the undertakings that were party to the Group's

derivative financial instruments were sold on 24 March 2017,

therefore, as at the balance sheet date, the Group no longer

maintains any derivative financial instruments.

At 30 September 2016, the Group had the following derivative

financial instruments:

An interest rate cap was in place relating to the loan with

Lloyds Bank, Jersey. The cap had a notional amount of GBP37,000,000

(31 March 2016: GBP37,000,000), a strike rate of 2% and a

termination date of 5 February 2018.

An interest rate cap was in place relating to the loan with

Lloyds Bank, Jersey. The cap had a notional amount of GBP36,075,000

(31 March 2016: GBPnil), a strike rate of 2.5% and a termination

date of 27 April 2021.

At 30 September 2016, the fair value of the hedging instruments

was GBP44,000 (31 March 2016: GBP8,000). The valuation of the

hedging instruments was provided by JC Rathbone Associates and

represented the change in fair value since execution.

12. Zero Dividend Preference Shares

Part of the consideration for the sale of its investment

property portfolio was the transfer to Regional REIT Limited of the

Group's interest in and obligations under the 30,000,000 zero

dividend preference shares ("ZDP Shares").

The ZDP shares have an entitlement to receive a fixed cash

amount on 9 January 2019, being the maturity date, but do not

receive any dividends or income distributions. Additional capital

accrues to the ZDP shares on a daily basis at a rate equivalent to

5.5% per annum. During the period ended 24 March 2017, the Group

accrued for GBP901,000 (31 March 2016: GBP889,000; 30 September

2016 GBP1,810,000) of additional capital.

The movement on the zero dividend preference share liability

during the period was as follows:

Six months

ended

31 March

2017

GBP'000

Balance at start of period 34,415

Amortisation of share issue costs 64

Accrued capital 901

Transfer of obligation on sale of group

undertakings (35,380)

-----------

Balance at end of period -

===========

13. Net Asset Value per share

Net asset value per share is calculated as the net assets of the

Group divided by the number of shares in issue.

31 March 31 March 30 Sept

2017 2016 2016

GBP'000 GBP'000 GBP'000

Diluted net asset value 141,793 159,275 156,089

Adjustments:

Fair value of hedging instruments - (8) (44)

Adjusted net asset value 141,793 159,267 156,045

=========== =========== ===========

No. No. No.

Shares in issue 70,541,435 79,256,435 79,256,435

=========== =========== ===========

Adjusted net asset value

per share 201.0p 201.0p 196.9p

=========== =========== ===========

The above calculations exclude the fair value of

the Group's development properties. We have not sought

to value these assets as, in our opinion, they are

at too early a stage in their development to provide

a meaningful figure.

14. Related Party Transactions

The Group has made advances to the following joint ventures in

order to provide both long term and additional working capital

funding. All amounts are repayable upon demand and will be repaid

from the trading activities of those subsidiaries. No provisions

have been made against the outstanding amounts.

31 March 31 March 30 Sept

2017 2016 2016

GBP'000 GBP'000 GBP'000

Joint Ventures

Conygar Stena Line Limited 8,023 7,554 7,733

CM Sheffield 2 2 2

Roadking Holyhead Limited 3,235 3,410 3,235

--------- --------- --------

11,260 10,966 10,970

========= ========= ========

The loans to Conygar Stena Line Limited may be analysed as

follows:

31 March 31 March 30 Sept

2017 2016 2016

GBP'000 GBP'000 GBP'000

Secured interest bearing

loan 5,003 4,534 4,713

Unsecured non-interest

bearing shareholder loan 3,020 3,020 3,020

--------- --------- --------

8,023 7,554 7,733

========= ========= ========

Key Management Compensation

Key management personnel have the authority and responsibility

for planning, directing and controlling the activities of the Group

and are considered to be the directors of the Company. Amounts paid

in respect of key management compensation were as follows:

Six months ended Year ended

31 March 31 March 30 Sept

2017 2016 2016

GBP'000 GBP'000 GBP'000

Short term employee benefits 467 417 834

467 417 834

========= ========= ===========

Independent Review Report to The Conygar Investment Company

PLC

Introduction

We have been engaged by the Company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 31 March 2017 which comprises the consolidated

statement of comprehensive income, the consolidated statement of

changes in equity, the consolidated balance sheet, the consolidated

cash flow statement and the related notes. We have read the other

information contained in the half-yearly financial report and

considered whether it contains any apparent misstatements or

material inconsistencies with the information in the condensed set

of financial statements.

This report is made solely to the Company in accordance with the

terms of our engagement to assist the Company in meeting the

requirements of the AIM Rules ("the AIM rules"). Our review has

been undertaken so that we might state to the Company those matters

we are required to state to it in this report and for no other

purpose. To the fullest extent permitted by law, we do not accept

or assume responsibility to anyone other than the Company for our

review work, for this report, or for the conclusions we have

reached.

Directors' Responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the AIM Rules.

As disclosed in note 1, the annual financial statements of the

Group are prepared in accordance with IFRS as adopted by the

European Union. The condensed set of financial statements included

in this half-yearly financial report has been prepared in

accordance with International Accounting Standard 34, "Interim

Financial Reporting," as adopted by the European Union.

Our Responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Scope of Review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK and Ireland) and consequently does not enable us to

obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 31

March 2017 is not prepared, in all material aspects, in accordance

with International Accounting Standard 34 as adopted by the

European Union and the AIM Rules.

Rees Pollock

Chartered Accountants and Registered Auditors

London

24 May 2017

Notes:

(a) The maintenance and integrity of The Conygar Investment

Company PLC website is the responsibility of the directors; the

work carried out by the auditors does not involve consideration of

these matters and, accordingly, the auditors accept no

responsibility for any changes that may have occurred to the

interim report since it was initially presented on the website.

(b) Legislation in the United Kingdom governing the presentation

and dissemination of financial information may differ from

legislation in other jurisdictions.

The directors of Conygar accept responsibility for the

information contained in this announcement. To the best knowledge

and belief of the directors of Conygar (who have taken all

reasonable care to ensure that such is the case), the information

contained in this announcement is in accordance with the facts and

does not omit anything likely to affect the import of such

information.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BZLLLDEFLBBF

(END) Dow Jones Newswires

May 25, 2017 02:01 ET (06:01 GMT)

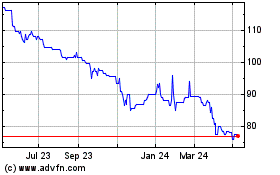

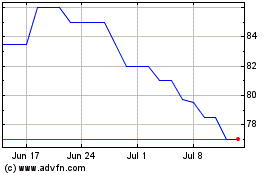

Conygar Investment (LSE:CIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Conygar Investment (LSE:CIC)

Historical Stock Chart

From Apr 2023 to Apr 2024