TIDMSDV

CHELVERTON SMALL COMPANIES DIVID TRUST PLC

Half-Yearly Report for the six months ended 31 October 2017

The full Annual Report and Accounts can be accessed via the Investment

Manager's website at www.chelvertonam.com or by contacting the Company

Secretary on telephone 01245 398984.

Investment Objective and Policy

The investment objective of Chelverton Small Companies Dividend Trust PLC ('the

Company') is to provide Ordinary shareholders with a high income and

opportunity for capital growth, having provided a capital return sufficient to

repay the final capital entitlement of the Zero Dividend Preference shares

issued by the subsidiary company, Chelverton Small Companies ZDP PLC ('SCZ').

Chelverton Small Companies Dividend Trust PLC, and its subsidiary Chelverton

Small Companies ZDP PLC, together form the Group ('the Group'). The Group's

funds are invested principally in smaller capitalised UK companies. The

portfolio comprises companies listed on the Official List and companies

admitted to trading on AIM. The Group does not invest in other investment

trusts or in unquoted companies. No investment is made in preference shares,

loan stock or notes, convertible securities or fixed interest securities. On 25

October 2017, a new wholly owned subsidiary, SDV 2025 ZDP PLC, was incorporated

with company number 11031268.

Financial Highlights

31 October 30 April

Capital 2017 2017 %

change

Total net assets (GBP'000) 47,431 41,724 13.68

Net asset value per Ordinary share 266.84p 248.35p 7.44

Mid-market price per Ordinary share 266.50p 230.00p 15.87

Discount 0.13% 7.39%

Net asset value per Zero Dividend 135.30p 131.65p 2.77

Preference share

Mid-market price per Zero Dividend 137.00p 136.00p 0.74

Preference share

Premium 1.25% 3.30%

Six months to Six months

to

31 October 31 October

Revenue 2017 2016 %

change

Earnings per Ordinary share 6.37p 6.67p (4.50)

Dividend per Ordinary share* 4.04p 3.70p 9.19

Total Return

Total return on Group's net assets** 16.27% (0.21)%

* Dividend per Ordinary share includes the first interim paid and second

interim declared for the period to 31 October 2017 and 2016 and will differ

from the amounts disclosed within the statement of changes in net equity, owing

to the timings of payments.

** Adding back dividends distributed in the period.

Interim Management Report

Results

This half-yearly report covers the six months to 31 October 2017. The net asset

value per Ordinary share at 31 October 2017 was 266.84p up from 248.35p at 30

April 2017, an increase of 7.44% in the past six months compared to an increase

of 7.4% in the MSCI Small Cap Index.

Since the beginning of the Company's financial year, the Ordinary share price

has increased from 230p to 266.5p at 31 October 2017, an increase of 15.87%,

whilst the discount of 7.4% at the year-end has been almost eliminated with the

shares traded at a negligible discount of 0.13% at the period end. Since then

the share price has increased to 269.5p as at 10 November 2017.

Dividend

A first interim dividend of 2.02p (2016: 1.85p) per Ordinary share was paid on

2 October 2017. The Board has declared a second interim dividend of 2.02p per

Ordinary share (2016: 1.85p) payable on 2 January 2017 to shareholders on the

register on 8 December 2017, making a total for the half year of 4.04p per

Ordinary share (2016: 3.70p) an increase of 9.2%. At present it is anticipated

that the Company will maintain this level of dividend for the third quarter and

will likewise maintain the same level for the fourth interim of 2.40p as was

paid last year making a total normal dividend of 8.46p for the year.

Portfolio

In the last six months we have increased our investment in seventeen of our

existing holdings, taking advantage of lower share prices and shares being

available, including Alumasc Group, Bloomsbury Publishing, Castings, Connect

Group, DFS Furniture, Diversified Gas & Oil, Epwin Group, Galliford Try,

Go-Ahead Group, Hilton Food Group, Kier Group, Marston's, Murgitroyd Group,

Produce Investments, Randall & Quilter Investment, RTC Group and Severfield.

During the period we added eight new names to the portfolio, BCA Marketplace -

manager of used car auctions, De La Rue - bank note manufacturer and security

printing, Flowtech Fluidpower - distributor of technical fluid power products,

Palace Capital - property investment, Premier Asset Management Group - asset

management, Restaurant Group - operator of chains of UK restaurants and public

houses, Revolution Bars Group - operator of premium bars, Strix Group -

manufacturer of kettle safety controls.

Funds were raised from the sale of nineteen of our holdings, Cape was the only

company taken over in the period whilst the holdings in Bioventix, UP Global

Sourcing Holdings, Morgan Sindall Group and Intermediate Capital Group were

sold in their entirety. The following holdings were reduced as they grew to

become larger weightings on lower yields, Acal, Amino Technologies, Brewin

Dolphin Holdings, Brown (N) Group, Conviviality, Curtis Banks Group, Dairy

Crest Group, Games Workshop Group, GVC Holdings, Huntsworth, Jarvis Securities,

McColls Retail Group, Polar Capital Holdings and StatPro Group.

Outlook

The fund has continued to see strong growth across the portfolio and with the

number of attractive opportunities available the portfolio has been increased

to 73 holdings and with steady growth in the UK economy we believe the

portfolio will continue to prosper.

We have been surprised that there has not been more takeover offers, building

on the increase last year however one can only suppose that the Brexit

uncertainty is holding corporates back from taking advantage of the sterling

discount.

UK Gross Domestic Product growth has been subdued for the last six months,

although there are signs that UK Growth will increase in the future mirroring

the recent pick-up in the Eurozone.

The Brexit position will likely remain unresolved until the "eleventh" hour,

that being the EU's usual modus operandi in negotiations. Repeatedly "experts"

have said that a deal is of equal importance to both sides however until the

Germans and the French properly engage then little or no obvious progress will

be made.

The dividends of the underlying companies continue to be increased and we

believe that this will continue into 2018 with company balance sheets remaining

in a strong state.

Chelverton Asset Management

15 November 2017

Principal Risks

The principal risks facing the Group are substantially unchanged since the date

of the Annual Report for the year ended 30 April 2017 and continue to be as set

out in that report on pages 9 to 10. Risks faced by the Group include, but are

not limited to, market risk, discount volatility, regulatory risk, financial

risk and risks associated with banking counterparties.

Responsibility Statement of the Directors in respect of the Half-Yearly Report

We confirm that to the best of our knowledge:

* the condensed set of financial statements has been prepared in compliance

with the IAS 34 'Interim Financial Reporting' and gives a true and fair

view of the assets, liabilities and financial position of the Group; and

* the interim management report and notes to the Half-Yearly Report include a

fair view of the information required by:

(a) DTR 4.2.7R of the Disclosure and Transparency Rules, being an indication of

the important events that have occurred during the first six months of the

financial year and their impact on the condensed set of financial statements;

and a description of the principal risks and uncertainties for the remaining

six months of the year; and

(b) DTR 4.2.8R of the Disclosure and Transparency Rules, being related party

transactions that have taken place in the first six months of the current

financial year and that have materially affected the financial position or

performance of the Group during that period; and any changes in the related

party transactions described in the last annual report that could do so. This

Half-Yearly Report was approved by the Board of Directors on 15 November 2017

and the above responsibility statement was signed on its behalf by Lord Lamont,

Chairman.

Condensed Consolidated Statement of Comprehensive Income (unaudited)

for the six months ended 31 October 2017

Six months to 31 October Year to 30 April

2017 2017

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

(audited)

Gains/(losses)gains on - 3,820 3,820 - 6,642 6,642

investments at fair value

through profit or loss

Investment income 1,314 - 1,314 2,361 - 2,361

Investment management fee (75) (223) (298) (119) (357) (476)

Other expenses (118) (6) (124) (224) (12) (236)

Net return/(deficit) before 1,121 3,591 4,712 2,018 6,273 8,291

finance costs and taxation

Finance costs

Appropriations in respect of

Zero Dividend

Preference shares - (341) (341) - (633) (633)

Net return/(deficit) before 1,121 3,250 4,371 2,018 5,640 7,658

taxation

Taxation (see note 2) (4) - (4) - - -

Total comprehensive income for 1,117 3,250 4,367 2,018 5,640 7,658

the period

Revenue Capital Total Revenue Capital Total

pence pence pence pence pence pence

Earnings per:

Ordinary share (see note 3) 6.63 18.53 24.90 12.17 34.03 46.20

Zero Dividend Preference share - 3.65 3.65 - 7.37 7.37

(see note 3)

Six months to 31 October 2016

Revenue Capital Total

GBP'000 GBP'000 GBP'000

Gains/(losses) on investments at fair value

- (690) (690) through profit or loss

1,270 - 1,270 Investment income

(56) (166) (222) Investment management fee

(110) (7) (117) Other expenses

Net return/(deficit) before finance costs

1,104 (863) 241 and taxation

Finance costs

Appropriations in respect of Zero Dividend

- (313) (313) Preference shares

1,104 (1,176) (72) Net return/(deficit) before taxation

- - - Taxation (see note 2)

1,104 (1,176) (72) Total comprehensive income for the period

Revenue Capital Total

pence pence pence

Earnings per:

Ordinary share

6.67 (7.11) (0.44) (see note 3)

Zero Dividend Preference share

- 3.68 3.68 (see note 3)

The total column of this statement is the Statement of Comprehensive Income of

the Group prepared in accordance with International Financial Reporting

Standards ('IFRS') as adopted by the European Union. All revenue and capital

items in the above statement derive from continuing operations. No operations

were acquired or discontinued during the period. All of the net return for the

period and the total comprehensive income for the period is attributed to the

shareholders of the Group. The supplementary revenue and capital return columns

are presented for information purposes as recommended by the Statement of

Recommended Practice issued by the Association of Investment Companies ('AIC').

Condensed Consolidated Statement of Changes in Net Equity (unaudited)

for the six months ended 31 October 2017

Share Share Capital Revenue Total

capital premium reserve reserve GBP'000

GBP'000 account GBP'000 GBP'000

GBP'000

Six months ended 31 October 2017

30 April 2017 4,200 12,915 21,632 2,977 41,724

Total comprehensive income for the - - 3,250 1,117 4,367

period

Ordinary shares issued 244 2,252 - - 2,496

Expenses of ordinary share issue - (73) - - (73)

Dividends paid (see note 4) - - - (1,083) (1,083)

31 October 2017 4,444 15,094 24,882 3,011 47,431

Year ended 30 April 2017 (audited)

30 April 2016 4,138 12,403 15,992 2,544 35,077

Total comprehensive income for the - - 5,640 2,018 7,658

year

Ordinary shares issued 62 519 - - 581

Expenses of ordinary share issue - (7) - - (7)

Dividends paid - - - (1,585) (1,585)

30 April 2017 4,200 12,915 21,632 2,977 41,724

Six months ended 31 October 2016

30 April 2016 4,138 12,403 15,992 2,544 35,077

Total comprehensive income for the - - (1,176) 1,104 (72)

period

Dividends paid - - - (968) (968)

31 October 2016 4,138 12,403 14,816 2,680 34,037

Condensed Consolidated Balance Sheet (unaudited)

as at 31 October 2017

30 April 31

31 October 2017 October

2017 GBP'000 2016

GBP'000 (audited) GBP'000

Non-current assets

Investments at fair value through 59,806 53,827 44,605

profit or loss

Current assets

Trade and other receivables 238 262 340

Cash and cash equivalents 377 89 59

615 351 399

Total assets 60,421 54,178 45,004

Current liabilities

Trade and other payables (341) (146) (125)

Zero Dividend Preference shares (12,649) (12,308) -

(12,990) (12,454) (125)

Total assets less current liabilities 47,431 41,724 44,879

Non-current liabilities

Zero Dividend Preference shares - - (10,842)

Total liabilities (12,990) (12,454) (10,967)

Net assets 47,431 41,724 34,037

Represented by:

Share capital 4,444 4,200 4,138

Share premium account 15,094 12,915 12,403

Capital reserve 24,882 21,632 14,816

Revenue reserve 3,011 2,977 2,680

Equity shareholders' funds 47,431 41,724 34,037

Net asset value per: (see note 5) pence pence pence

Ordinary share 266.84 248.35 205.66

Zero Dividend Preference share 135.30 131.65 127.56

Condensed Consolidated Statement of Cash Flows (unaudited)

for the six months ended 31 October 2017

Operating activities Six months to Year to Six months

31 October 30 April to 31

2017 2017 October

GBP'000 GBP'000 2016

(audited) GBP'000

Investment income received 1,324 2,419 1,244

Investment management fee paid (278) (457) (221)

Administration and secretarial fees (32) (64) (37)

paid

Other cash payments (112) (185) (122)

Net cash inflow from operating 902 1,713 864

activities (see note 7)

Investing activities

Purchases of investments (8,960) (13,776) (3,314)

Sales of investments 7,006 11,988 3,448

Net cash (outflow)/inflow from (1,954) (1,788) 134

investing activities

Financing activities

Issue of Zero Dividend Preference - 1,146 -

shares

Issue of ordinary shares 2,496 581 -

Expenses of ordinary share issue (73) (7) -

Dividends paid (1,083) (1,585) (968)

Net cash inflow/(outflow) from 1,340 135 (968)

financing activities

Change in cash and cash equivalents for 288 60 30

period

Cash and cash equivalents at start of 89 29 29

period

Cash and cash equivalents at end of 377 89 59

period

Comprises of:

Cash and cash equivalents 377 89 59

Notes to the Condensed Half-Yearly Report

for the six months ended 31 October 2017

1 General information

The financial information contained in this Half-Yearly Report does not

constitute statutory financial statements as defined in Section 434 of the

Companies Act 2006. The statutory financial statements for the year ended 30

April 2017, which contained an unqualified auditors' report, have been lodged

with the Registrar of Companies and did not contain a statement required under

the Companies Act 2006. These statutory financial statements were prepared

under International Financial Reporting Standards ('IFRS') and in accordance

with the Statement of Recommended Practice ('SORP'): Financial Statements of

Investment Trust Companies and Venture Capital Trusts issued by the AIC in

November 2014, except to any extent where it conflicts with IFRS.

The Group has considerable financial resources and therefore the Directors

believe that the Group is well placed to manage its business risks and also

believe that the Group will have sufficient resources to continue in

operational existence for the foreseeable future. Accordingly, they continue to

adopt the going concern basis in preparing this report.

This report has not been reviewed by the Group's Auditors.

This report has been prepared using accounting policies adopted in the audited

financial statements for the year ended 30 April 2017. This report has also

been prepared in compliance with IAS 34 'Interim Financial Reporting' as

adopted by the European Union.

The Group has adequate financial resources and, as a consequence, the Directors

believe that the Group is well placed to manage its business risks successfully

and continue to adopt the going concern basis for this report.

2 Taxation

The Company has an effective tax rate of 0%. The estimated effective tax rate

is 0% as investment gains are exempt from tax owing to the Company's status as

an Investment Trust and there is expected to be an excess of management

expenses over taxable income and thus there is no charge for corporation tax.

3 Earnings per share

Ordinary shares

Revenue earnings per Ordinary share is based on revenue on ordinary activities

after taxation of GBP1,117,000 (30 April 2017: GBP2,018,000, 31 October 2016: GBP

1,104,000) and on 17,536,371 (30 April 2017: 16,575,343, 31 October 2016:

16,550,000) Ordinary shares, being the weighted average number of Ordinary

shares in issue during the period.

Capital earnings per Ordinary share is based on the capital profit of GBP

3,250,000 (30 April 2017: capital profit of GBP5,640,000, 31 October 2016:

capital loss of GBP1,176,000) and on 17,536,371 (30 April 2017: 16,573,343, 31

October 2016: 16,550,000) Ordinary shares, being the weighted average number of

Ordinary shares in issue during the period.

Zero Dividend Preference shares

Capital earnings per Zero Dividend Preference share is based on allocations

from the Company of GBP341,000 (30 April 2017: GBP633,000, 31 October 2016: GBP

313,000) and on 9,349,000 (30 April 2017: 8,586,063, 31 October 2016:

8,500,000) Zero Dividend Preference shares being the weighted average number of

Zero Dividend Preference shares in issue during the period.

4 Dividends

During the period, a fourth interim dividend of 2.4p per Ordinary share and a

special dividend of 1.86p per Ordinary share for the year ended 30 April 2017,

together with a first interim dividend of 2.02p per Ordinary share for the year

ending 30 April 2018, have been paid to shareholders.

In addition the Board has declared a second interim dividend of 2.02p per

Ordinary share payable on 2 January 2018 to shareholders on the register at 18

December 2017.

5 Net asset values

Ordinary shares

The net asset value per Ordinary share is based on assets attributable of GBP

47,431,000 (30 April 2017: GBP41,724,000, 31 October 2016: GBP34,037,000) and on

17,775,000 (30 April 2017: 16,800,000, 31 October 2016: 16,550,000) Ordinary

shares being the number of shares in issue at the period end.

Zero Dividend Preference shares

The net asset value per Zero Dividend Preference shares is based on assets

attributable of GBP12,649,000 (30 April 2017: GBP12,308,000, 31 October 2016: GBP

10,842,000) and on 9,349,000 (30 April 2017: 9,349,000, 31 October 2016:

8,500,000) Zero Dividend Preference shares being the number of shares in issue

at the period end.

6 Fair value hierarchy

Financial assets and financial liabilities of the Company are carried in the

condensed Consolidated Balance Sheet at their fair value. The fair value is the

amount at which the asset could be sold or the liability transferred in a

current transaction between market participants, other than a forced or

liquidation sale. For investments actively traded in organised financial

markets, fair value is generally determined by reference to Stock Exchange

quoted market bid prices and Stock Exchange Electronic Trading Services

('SETS') at last trade price at the Balance Sheet date, without adjustment for

transaction costs necessary to realise the asset.

The Company measures fair values using the following hierarchy that reflects

the significance of the inputs used in making the measurements. Categorisation

within the hierarchy has been determined on the basis of the lowest level input

that is significant to the fair value measurement of the relevant assets as

follows:

Level 1 - Quoted prices (unadjusted) in active markets for identical assets or

liabilities.

An active market is a market in which transactions for the asset or liability

occur with sufficient frequency and volume on an ongoing basis such that quoted

prices reflect prices at which an orderly transaction would take place between

market participants at the measurement date. Quoted prices provided by external

pricing services, brokers and vendors are included in Level 1, if they reflect

actual and regularly occurring market transactions on an arm's length basis.

Level 2 - Inputs other than quoted prices included within Level 1 that are

observable for the asset or liability, either directly (that is, as prices) or

indirectly (that is, derived from prices).

Level 2 inputs include the following:

* quoted prices for similar (i.e. not identical) assets in active markets;

* quoted prices for identical or similar assets or liabilities in markets

that are not active. Characteristics of an inactive market include a

significant decline in the volume and level of trading activity, the

available prices vary significantly over time or among market participants

or the prices are not current;

* inputs other than quoted prices that are observable for the asset (for

example, interest rates and yield curves observable at commonly quoted

intervals); and

* inputs that are derived principally from, or corroborated by, observable

market data by correlation or other means (market-corroborated inputs).

Level 3 - Inputs for the asset or liability that are not based on

observable market data (unobservable inputs).

The level in the fair value hierarchy within which the fair value

measurement is categorised in its entirety is determined on the basis of

the lowest level input that is significant to the fair value measurement in

its entirety. If a fair value measurement uses observable inputs that

require significant adjustment based on unobservable inputs, that

measurement is a Level 3 measurement. Assessing the significance of a

particular input to the fair value measurement in its entirety requires

judgement, considering factors specific to the asset or liability.

As at 31 October 2017, 30 April 2017 and 31 October 2016 all of the

Company's investments are classified as Level 1.

7 Reconciliation of net return/(deficit) before and after taxation to net

cash flow from operating activities

31 October 30 April 31

2017 2017 October

GBP'000 GBP'000 2016

GBP'000

Net return/(deficit) before taxation 4,371 7,658 (72)

Taxation (4) - -

Net return/(deficit) after taxation 4,367 7,658 (72)

Net capital (gain)/loss (3,250) (5,640) 1,176

Decrease/(increase) in receivables 9 50 (43)

Decrease in payables 5 14 (24)

Interest and expenses charged to the (229) (369) (173)

capital reserve

Net cash inflow from operating activities 902 1,713 864

8 Related party transactions

The Group's investments are managed by Chelverton Asset Management Limited, a

company in which Mr van Heesewijk, a Director of the Company and the

subsidiary, has an interest. The amounts paid to the Investment Manager in the

period to 31 October 2017 were GBP298,000 (year ended 30 April 2017: GBP476,000,

six months to 31 October 2016: GBP222,000).

At 31 October 2017 there were amounts outstanding to be paid to the Investment

Manager of GBP92,000 (year ended 30 April 2017: GBP72,000, six months to 31 October

2016: GBP53,000).

Portfolio Investments

as at 31 October 2017

Market % of

value

Holding Sector GBP'000 portfolio

Diversified Gas & Oil Oil & Gas Producers 1,665 2.8

McColl's Retail Group Food & Drug Retailers 1,429 2.4

Jarvis Securities Financial Services 1,403 2.4

StatPro Group Software & Computer Services 1,368 2.3

Acal Support Services 1,268 2.1

Belvoir Lettings Real Estate Investment & 1,260 2.1

Services

Alumasc Group Construction & Materials 1,230 2.1

Gattaca Support Services 1,220 2.0

Galliford Try Household Goods & Home 1,218 2.0

Construction

Personal Group Holdings Nonlife Insurance 1,215 2.0

Connect Group Support Services 1,102 1.8

Amino Technologies Technology Hardware & 1,097 1.8

Equipment

Braemar Shipping Services Industrial Transportation 1,078 1.8

Numis Corporation Financial Services 1,070 1.8

Curtis Banks Group Financial Services 1,067 1.8

Marston's Travel & Leisure 1,066 1.8

Ramsdens Holdings Financial Services 1,062 1.8

Brown (N) Group General Retailers 1,054 1.8

De La Rue Support Services 1,048 1.8

Mucklow (A&J) Group Real Estate Investment Trusts 980 1.6

Strix Group Electronic & Electrical 978 1.6

Equipment

Moss Bros Group General Retailers 900 1.5

Polar Capital Holdings Financial Services 900 1.5

Randall & Quilter Nonlife Insurance 896 1.5

Investment

Photo-Me International Leisure Goods 894 1.5

Park Group Financial Services 891 1.5

Hilton Food Group Food Producers 852 1.4

Conviviality Food & Drug Retailers 849 1.4

GVC Holdings Travel & Leisure 842 1.4

Kier Group Construction & Materials 832 1.4

Bloomsbury Publishing Media 818 1.4

Severfield Industrial Engineering 816 1.4

Coral Products General Industrials 810 1.4

Premier Asset Management Financial Services 804 1.3

Group

Centaur Media Media 803 1.3

Huntsworth Media 800 1.3

Go-Ahead Group Travel & Leisure 797 1.3

Shoe Zone General Retailers 790 1.3

Chesnara Life Insurance 767 1.3

Town Centre Securities Real Estate Investment Trusts 762 1.3

Dairy Crest Group Food Producers 759 1.3

Orchard Funding Group Financial Services 750 1.3

Clarke (T) Construction & Materials 745 1.2

Flowtech Fluidpower Industrial Engineering 728 1.2

Macfarlane Group General Industrials 715 1.2

Breakdown by Sector

Market % of

value

Security Sector GBP'000 portfolio

Brewin Dolphin Financial Services 706 1.2

Holdings

Sanderson Group Software & Computer Services 700 1.2

XP Power Electronic & Electrical Equipment 694 1.2

Low & Bonar Construction & Materials 690 1.2

Murgitroyd Group Support Services 690 1.2

GLI Finance Equity Investment Instruments 687 1.1

Produce Food Producers 684 1.1

Investments

Regional REIT Real Estate Investment Trusts 676 1.1

Epwin Group Construction & Materials 672 1.1

Palace Capital Real Estate Investment & Services 670 1.1

KCOM Group Fixed Line Telecommunications 638 1.1

Restaurant Group Travel & Leisure 607 1.0

Hansard Global Life Insurance 602 1.0

RPS Group Support Services 589 1.0

Wilmington Group Media 585 1.0

Castings Industrial Engineering 576 1.0

Games Workshop Leisure Goods 568 1.0

Group

Foxtons Group Real Estate Investment & Services 555 0.9

St.Ives Support Services 551 0.9

RTC Group Support Services 530 0.9

DFS Furniture General Retailers 522 0.9

Revolution Bars Travel & Leisure 507 0.8

Group

Titon Holdings Construction & Materials 419 0.7

Chamberlin Industrial Engineering 375 0.6

Anglo African Oil Oil & Gas Producers 369 0.6

& Gas

DX Group Industrial Transportation 338 0.6

BCA Marketplace Industrial Transportation 208 0.3

Fairpoint Group Financial Services 0 0.0

Total Investments 59,806 100.0

Breakdown of portfolio by industry

Financial Services 14.6%

Support Services 11.7%

Construction & Materials 7.7%

Travel & Leisure 6.3%

General Retailers 5.5%

Media 5.0%

Industrial Engineering 4.2%

Real Estate Investment & Services 4.1%

Real Estate Investment Trusts 4.0%

Food & Drug Retailers 3.8%

Food Producers 3.8%,

Software & Computer Services 3.5%

Nonlife Insurance 3.5%

Oil & Gas Producers 3.4%

Electronic & Electrical Equipment 2.8%

Industrial Transportation 2.7%

General Industrials 2.6%

Leisure Goods 2.5%

Life Insurance 2.3%

Household Goods & Home Construction 2.0%

Technology Hardware & Equipment 1.8%

Equity Investment Instruments 1.1%

Fixed Line Telecommunications 1.1%

Shareholder Information

Financial calendar

Group's year end 30 April

Interim dividends paid April, July, October and January

Annual results announced June

Annual General Meeting September

Group's half year 31 October

Half-Year results announced December

Share prices and performance information

The Company's Ordinary and Zero Dividend Preference shares issued through SCZ

are listed on the London Stock Exchange.

The net asset values are announced weekly to the London Stock Exchange and

published monthly via the AIC.

Information about the Group can be obtained on the Chelverton website at

www.chelvertonam.com. Any enquiries can also be e-mailed to

cam@chelvertonam.com.

Share register enquiries

The registers for the Ordinary shares and Zero Dividend Preference shares are

maintained by Share Registrars Limited. In the event of queries regarding your

holding, please contact the Registrar on 01252 821390. Changes of name and/or

address must be notified in writing to the Registrar.

Capital Structure

Chelverton Small Companies Dividend Trust PLC ('the Company')

The Company has in issue one class of Ordinary share. In addition, it has a

wholly owned subsidiary SCZ, through which Zero Dividend Preference shares have

been issued.

Ordinary shares of 25p each ('Ordinary shares') - 17,775,000 in issue

Share Capital Events

During the period, the Company announced the issue of 975,000 Ordinary shares

at an average price of 256.04p each, which were to rank pari passu in all

respects with the Ordinary shares in issue. The shares were issued for cash in

order to meet investor demand. Following this admission there were 17,775,000

Ordinary shares in issue. The Company has only one class of share and this

figure represents 100% of the Company's share capital and voting rights.

Dividends

Holders of Ordinary shares are entitled to dividends.

Capital

On a winding-up of the Company, Ordinary shareholders will be entitled to all

surplus assets of the Company available after payment of the Company's

liabilities including the capital entitlement of the Zero Dividend Preference

shares.

Voting

Each holder, on a show of hands, will have one vote and on a poll will have one

vote for each Ordinary share held.

Chelverton Small Companies ZDP PLC ('SCZ')

Ordinary shares of 100p each ('SCZ ordinary shares') - 50,000 in issue (partly

paid up as to 25p each)

The SCZ ordinary shares are wholly owned by the Company. References to Ordinary

shares within this Half-Yearly Report are to the Ordinary shares of Chelverton

Small Companies Dividend Trust PLC.

Capital

Following payment of any liabilities and the capital entitlement to the Zero

Dividend Preference shareholders, ordinary shareholders are entitled to any

surplus assets of SCZ.

Voting

Each holder, on a show of hands, will have one vote and on a poll will have one

vote for each ordinary share held.

Zero Dividend Preference shares of 100p each - 9,349,000 in issue

Dividends

Holders of Zero Dividend Preference shares are not entitled to dividends.

Capital

On a winding up of SCZ, after the satisfaction of prior ranking creditors and

subject to sufficient assets being available, Zero Dividend Preference

shareholders are entitled to an amount equal to 100p per share increased daily

from 28 August 2012 at such compound rate as will give an entitlement to 136.7

pence per share at 8 January 2018.

Voting

Holders of Zero Dividend Preference shares are not entitled to attend, speak or

vote at a general meeting of the Company (including the Company's Annual

General Meeting) unless the business of the meeting includes a resolution to

vary, modify or abrogate the rights attached to the Zero Dividend Preference

shares.

In the event that Zero Dividend Preference shareholders are entitled to attend

a General Meeting each holder of Zero Dividend Preference shares, on a show of

hands, will have one vote for every Zero Dividend Preference share held in

relation to any resolutions applicable to Zero Dividend Preference shares.

Directors and Advisers

Directors

Lord Lamont of Lerwick (Chairman)

David Harris

William van Heesewijk

Howard Myles

Investment Manager

Chelverton Asset Management Limited

11 Laura Place Bath BA2 4BL

Tel: 01225 483030

Secretary and Registered Office

Maitland Administration Services Limited

Springfield Lodge Colchester Road, Chelmsford

Essex

CM2 5PW

Tel: 01245 398950

Corporate Broker

Stockdale Securities Limited

Beaufort House

15 St. Botolph Street

London EC3A 7BB

Registrar and

Transfer Office

Share Registrars Limited

The Courtyard

17 West Street

Farnham

Surrey GU9 7DR

Tel: 01252 821390

www.shareregistrars.uk.com

Auditors

Hazlewoods LLP

Windsor House

Bayshill Road

Cheltenham GL50 3AT

Custodian

Jarvis Investment Management Limited

78 Mount Ephraim, Tunbridge Wells

Kent TN4 8BS

Registered in England No. 3749536

A member of the Association of Investment Companies

END

END

(END) Dow Jones Newswires

November 16, 2017 02:01 ET (07:01 GMT)

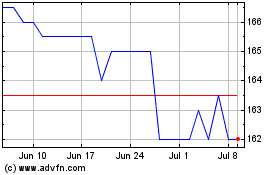

Chelverton Uk Dividend (LSE:SDV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chelverton Uk Dividend (LSE:SDV)

Historical Stock Chart

From Apr 2023 to Apr 2024