SAMSUNG GROUP

Drug Unit Plans $2.5 Billion IPO

Samsung BioLogics Co., the contract drug-manufacturing unit of

South Korean conglomerate Samsung Group, is planning to raise as

much as $2.5 billion from an initial public offering that would

value it at roughly $10 billion, according to people familiar with

the matter.

The company, which makes biologic drugs on behalf of clients

like Bristol-Myers Squibb Co. and Roche Holding AG, expects to file

this week for approval to list shares in South Korea, one of the

people said. It expects to complete the share offering in the

fourth quarter of this year, the person said.

Samsung BioLogics is expected to offer between 10% and 25% of

its shares to the public based on South Korean listing requirements

and investor demand, meaning the company would raise between $1

billion and $2.5 billion, one of the people said.

The biggest IPO globally this year was in June, when Danish

utility Dong Energy AS raised $2.61 billion.

Samsung in April announced plans to list the unit, without

giving details on the exact timing or size of the IPO.

While Samsung is best known for its crown jewel, smartphone and

semiconductor maker Samsung Electronics Co., Lee Jae-yong, the vice

chairman and heir apparent of the conglomerate, has poured billions

of dollars into the emerging field of biologic drugs. Such drugs

are complex to make because they are based on living cells -- used

to treat a variety of illnesses, including cancer and arthritis --

differentiating them from simpler, chemically synthesized drugs

like aspirin.

Mr. Lee is betting that biologic drugs can become a new growth

engine for Samsung as the long-term outlook for smartphones and

semiconductors becomes more uncertain.

In addition to manufacturing biologic drugs on behalf of other

companies, Samsung has another affiliate, Samsung Bioepis Co.,

which develops near-replicas of existing biologic drugs that are

soon to lose patent protection, called biosimilars. Samsung Bioepis

was on track for an IPO on the Nasdaq Stock Market earlier this

year, but the offering was shelved amid market volatility.

Samsung BioLogics is 51% owned by the Samsung Group's de facto

holding company, Samsung C&T Corp. Samsung Electronics owns

about 47%. Samsung BioLogics owns 91.2% of Samsung Bioepis. Samsung

BioLogics said in May that Korea Investment Holdings Co. and NH

Investment & Securities Co. will lead the share sale

domestically, while overseas duties will be handled by Citigroup

Inc., J.P. Morgan Chase & Co. and Credit Suisse Group AG.

Samsung BioLogics is one of the world's largest manufacturers of

biologic drugs by capacity.

Late last year, the company broke ground on a third plant, which

is expected to have the world's largest production capacity of

180,000 liters. Samsung BioLogics also is already considering

additional plants.

When the third plant begins operations, expected in late 2018,

Samsung BioLogics will have a drug-manufacturing capacity of

360,000 liters, putting it ahead of rivals Lonza Group of

Switzerland and Germany's Boehringer Ingelheim GmbH.

--

Alec Macfarlane

and Jonathan Cheng

INSURANCE

Aetna-Humana Trial Is to Begin Dec. 5

WASHINGTON -- A federal judge said Wednesday that he would begin

trial proceedings on Dec. 5 in the Justice Department's antitrust

challenge to the proposed merger of Aetna Inc. and Humana Inc.

The start date is a compromise between the proposals of the two

sides, but it also amounted to a setback for the insurance

companies. When he opened a scheduling hearing Wednesday, U.S.

District Judge John Bates said he was leaning toward an early

November trial, which would have allowed him to decide the case

before the end of the year.

The health insurers had argued for such a time frame and

applauded the judge's initial proposal, noting that the current

contractual agreement between the two companies is subject to a

Dec. 31 deadline. If the merger isn't approved by then, Humana

would have the option of walking away from the deal and potentially

collecting a $1 billion breakup fee.

But the Justice Department during the course of the hearing

argued that such an accelerated timeline wouldn't give it a fair

chance to prove its case. The department also argued that nothing

prevented the companies from extending their merger agreement a

little longer to give the court time to issue a ruling.

The judge took a short break, then returned to the bench and

said he had been persuaded by some of the department's arguments.

Judge Bates set the Dec. 5 start date and allotted 13 days for

trial proceedings.

The judge pledged to rule in the case promptly but said he was

making no promises that he would be able to decide it by the end of

the year. Instead, he said the parties should proceed with the

"expectation" that he will issue a ruling in mid-January.

The Justice Department filed suit last month to block two major

proposed health insurance mergers, the Aetna-Humana deal and Anthem

Inc.'s proposed acquisition of Cigna Corp., arguing the

transactions would suppress competition and hurt consumers.

Both cases were initially assigned to Judge Bates, a George W.

Bush appointee, but last week the judge sent the Anthem case for

reassignment to another judge, saying it wasn't feasible for him to

handle both in an expeditious fashion.

Judge Amy Berman Jackson, an Obama appointee, is now presiding

over the Anthem matter. She has set a hearing this Friday to

discuss trial scheduling for that case.

--Brent Kendall

CHESAPEAKE ENERGY

Company to Shed Barnett Shale Assets

Chesapeake Energy Corp. is exiting the Barnett Shale in Texas,

which will eliminate about $1.9 billion of future commitments and

improve its operating income over the next few years.

Chesapeake, which noted the "significant negative cash flow

profile" of the Barnett assets, said it would convey its Barnett

interests to Saddle Barnett Resources LLC, which is backed by

private-equity firm First Reserve Corp.

Meanwhile, Chesapeake and Williams Partners LP will terminate a

gathering agreement. Chesapeake will pay Williams $400 million in

connection with the termination and a renegotiation of an agreement

in the Mid-Continent area.

The proposed Barnett transaction includes about 215,000 net

developed and undeveloped acres and about 2,800 operated wells.

Chesapeake expects the moves to increase its operating income

for the rest of 2016 through 2019 by $200 million to $300 million

annually.

--Josh Beckerman

PERRIGO

Profit Falls Short of Expectations

Drugmaker Perrigo Co. on Wednesday said it missed earnings

expectations for the latest quarter and cut its guidance for the

year as it continues to battle pricing pressure and competition in

the market.

Perrigo stock, which has lost more than half its value over the

past 12 months, dropped 12% premarket to $83.39.

"Our financial results were below our expectations primarily due

to competition and price erosion in the Rx business," Chief

Executive John Hendrickson said. Mr. Hendrickson was named to his

position after Joseph Papa resigned to take on the CEO role in

early May at troubled Valeant Pharmaceuticals International

Inc.

Perrigo's performance has waned and its stock has plunged after

Mr. Papa rallied shareholders to reject a takeover offer in

November from Mylan NV that valued Perrigo at $26 billion,

insisting the company's growth prospects would be brighter as a

stand-alone firm. At Perrigo's premarket level Wednesday morning,

the company's market value would be about $12 billion.

The over-the-counter specialty-pharmaceutical company says it

now expects 2016 adjusted earnings of $6.85 to $7.15 a share, down

from the forecast three months ago of $8.20 to $8.60 a share.

Perrigo also said it is expecting lower performance from its

branded-consumer-healthcare segment, where second-quarter sales

fell 2% to $394 million.

Sales in the consumer healthcare segment fell 8% to $686 million

during the quarter, dragged down by lower existing products sales,

particularly in the cough/cold category as the past allergy season

was relatively weak. The prescription pharmaceuticals segment saw

its sales rise 5% to $293 million, led by new product sales and

product acquisitions.

For the quarter ended July 2, Perrigo posted a profit of $194

million, or $1.35 a share, more than double last year's profit of

$56 million, or 38 cents a share. Sales fell 3.3% to $1.48

billion.

Adjusted earnings came in at $1.93 a share, a decline from $2.18

a share a year ago.

Analysts polled by Thomson Reuters had expected $1.98 in

per-share earnings on $1.43 billion in revenue.

--Brittney Laryea

(END) Dow Jones Newswires

August 11, 2016 02:49 ET (06:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

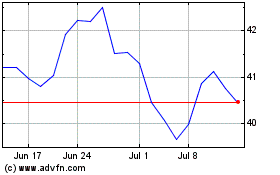

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Aug 2024 to Sep 2024

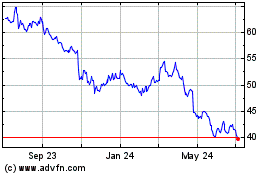

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Sep 2023 to Sep 2024