Bristol-Myers Settles Bribery Probe

October 05 2015 - 1:30PM

Dow Jones News

Bristol-Myers Squibb Co. agreed to pay more than $14 million to

settle allegations that the pharmaceutical company's China joint

venture provided illegal payments and other benefits to Chinese

health-care providers to boost sales.

The U.S. Securities and Exchange Commission accused

Bristol-Myers of lacking internal controls over the BMS China

venture's interactions with health-care providers and failing to

respond effectively to signs that sales personnel were providing

bribes and other benefits to boost sales.

According to the SEC order, Bristol-Myers netted roughly $11

million in profit from the actions. The company agreed to turn over

$11.4 million of profit plus prejudgment interest of $500,000 and

pay a civil penalty of $2.75 million.

Bristol consented to the order without admitting or denying the

findings that it violated the internal controls and record-keeping

provisions of the Foreign Corrupt Practices Act. A Bristol-Myers

spokesman added that it has resolved the matter with the SEC.

The SEC accused BMS China sales representatives of providing

health-care providers in China over five years with cash, jewelry

and other gifts to secure and raise sales. According to the SEC,

the unit inaccurately recorded such spending as legitimate business

expenses.

Among the SEC's findings, Bristol is accused of failing to

investigate claims by terminated BMS China employees that faked

invoices, receipts and purchase orders were widely used to fund the

improper payments.

Write to Tess Stynes at tess.stynes@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 05, 2015 13:15 ET (17:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

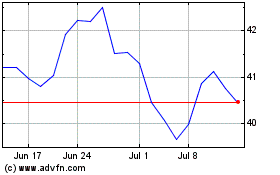

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

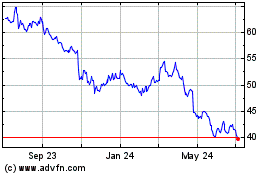

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Apr 2023 to Apr 2024