AvalonBay Revenue and Profit Rise, Powered by Rising Rental Rates

February 03 2016 - 6:25PM

Dow Jones News

By Ezequiel Minaya

AvalonBay Communities Inc.'s profit and revenue rose in its

latest quarter, driven in part by climbing rental rates at

established properties.

Average rental rates in properties AvalonBay has owned for at

least a year rose 5.8%.

The Arlington, Va., REIT now projects 2016 profit between $6.86

a share and $7.26 a share, funds from operations between $8.12 and

$8.52 and core funds from operations in the range of $8.03 to

$8.43.

For the 2015 year, the company posted funds from operations per

share of $8.05 from $7.25 the previous year and above analysts'

estimates of $8.02. Core FFO landed at $7.55 a share from $6.78, a

penny below analysts' estimates of $7.56 while earnings on a per

share basis was $5.51, up from $5.21 the previous year and above

estimates of $5.32.

For the December quarter, AvalonBay reported a profit of $155.4

million, or $1.13 a share, compared with $142.6 million, or $1.08 a

share, a year earlier.

AvalonBay's funds from operations, the REIT industry's widely

cited earnings benchmark also known as FFO, increased to $1.97 from

$1.76, in line with the company's projection of $1.95 to $2.01.

Excluding acquisition costs and other items, core FFO rose to $1.99

from $1.74, at the high-end of the company's projected $1.95 to

$2.01 a share.

Revenue rose 9.1% to $480.8 million, compared with analysts'

projections of $480 million.

Shares of the company were inactive after hours.

Write to Ezequiel Minaya at Ezequiel.Minaya@wsj.com

(END) Dow Jones Newswires

February 03, 2016 18:10 ET (23:10 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

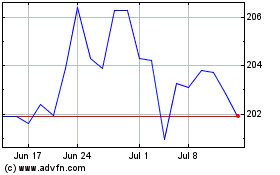

Avalonbay Communities (NYSE:AVB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Avalonbay Communities (NYSE:AVB)

Historical Stock Chart

From Apr 2023 to Apr 2024