Australia, NZ Dollars Fall

October 01 2015 - 9:19PM

RTTF2

The Australian and the New Zealand dollars weakened against

their major counterparts in the Asian session on Friday, as

regional investors are resorting to profit taking after recent

gains.

Meanwhile, commodity prices fell amid fears of a slowdown in

China and the uncertainty over the timing of the U.S. Federal

Reserve's interest rate hike.

China's manufacturing conditions deteriorated the most in

six-and-a-half years in September as orders declined sharply on

weak foreign demand, results of a private sector survey revealed

Thursday.

A Labor Department report showed first-time claims for U.S.

unemployment benefits to have increased more than expected in the

week ended September 26. Meanwhile, a report from the Institute for

Supply Management showed that activity in the U.S. manufacturing

sector dropped to a two-year low in September, partly reflecting

concerns about the global economy and customer confidence.

Traders await the U.S. employment data due later in the day to

get some clues on the possible timing of the first Fed rate

hike.

The report is expected to show an increase of about 203,000 jobs

in September following the addition of 173,000 jobs in August. The

jobs data could have a significant impact on expectations regarding

whether the Federal Reserve will raise interest rates later this

month.

Meanwhile, the Australian and the New Zealand dollars rose after

the release of Australian retail sales data but retreated shortly

after.

Data from the Australian Bureau of Statistics showed that the

total value of retail sales in Australia was up a seasonally

adjusted 0.4 percent on month in August, worth A$24.404

billion.That was in line with forecasts following the 0.1 percent

contraction in July.

In other economic news, data from ANZ showed that commodity

prices in New Zealand increased for the first time in six months in

September, driven by increases in dairy and aluminium prices. The

ANZ commodity prize index climbed 5.5 percent month-over-month in

September, reversing a 5.2 percent decrease in the previous

month.

Thursday, the Australian and the New Zealand dollars weakened

against their major rivals after the release of the Chinese

manufacturing data that was not as worse as feared. The Australian

dollar rose 0.66 percent against the U.S. dollar, 0.44 percent

against the yen and 0.30 percent against the euro. The NZ dollar

rose 0.67 percent against the U.S. dollar, 0.62 percent against the

yen and 0.14 percent against the euro.

In the Asian trading, the Australian dollar fell to an 8-day low

of 0.9283 against the Canadian dollar, from yesterday's closing

value of 0.9326. The aussie may test support near the 0.91

area.

The aussie dropped to 84.13 against the yen and 1.5957 against

the euro, from yesterday's closing quotes of 84.26 and 1.5916,

respectively. If the aussie extends its downtrend, it is likely to

find support around 82.00 against the yen and 1.63 against the

euro.

Against the U.S. and the New Zealand dollars, the aussie edged

down to 0.7018 and 1.0964 from yesterday's closing quotes of 0.7026

and 1.0976, respectively. On the downside, 0.68 against the

greenback and 1.08 against the kiwi are seen as the next support

levels for the aussie.

The NZ dollar fell to 2-day lows of 0.6384 against the U.S.

dollar and 1.7523 against the euro, from yesterday's closing quotes

of 0.6394 and 1.7491, respectively. If the kiwi extends its

downtrend, it is likely to find support around 0.62 against the

greenback and 1.80 against the euro.

Against the yen, the kiwi edged down to 76.59 from yesterday's

closing value of 76.69. The kiwi is likely to find support around

the 74.00 area.

Looking ahead, Markit/CIPS U.K. construction PMI for September

and Eurozone PPI for August are due to be released later in th

day.

In the New York session, U.S. jobs data for September and

factory orders for August are slated for release.

At 8:45 am ET, Federal Reserve Bank of Philadelphia President

Patrick Harker is scheduled to give opening remarks before the "New

Perspectives on Consumer Behavior in Credit and Payments Markets"

conference hosted by the Federal Reserve Bank of Philadelphia.

Half-an-hour later, Federal Reserve Bank of St. Louis President

James Bullard is expected to speak on the economy and monetary

policy before a Shadow Open Market Committee meeting hosted by the

Manhattan Institute for Policy Research, in New York.

At 1:30 pm ET, Federal Reserve Bank of Boston President Eric

Rosengren will give welcome and opening remarks before the "Macro

Prudential Monetary Policy" conference hosted by the Federal

Reserve Bank of Boston. Additionally, Federal Reserve Governor

Stanley Fischer is expected to speak at the conference.

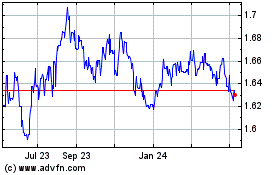

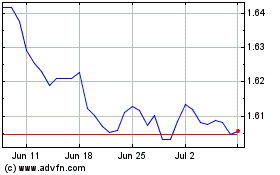

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024