TIDMAUK

RNS Number : 4366D

Aukett Swanke Group PLC

29 January 2015

Aukett Swanke Group Plc

Announcement of final audited results

for the year ended 30 September 2014

Aukett Swanke Group Plc (the "Group"), the international group

of architects and interior designers, announces its final audited

results for the year ended 30 September 2014.

Highlights

-- Revenue up 106% to GBP17,326,000 (2013: GBP8,406,000)

-- Profit before tax up 155% to GBP1,400,000 (2013: GBP550,000)

-- Earnings per share up to 0.65p (2013: 0.26p)

-- Net assets increased to GBP5,053,000 from GBP3,029,000

-- Net funds of GBP1,778,000 (2013: GBP1,080,000)

-- Return to two annual dividends

Nicholas Thompson, Chief Executive Officer of Aukett Swanke

commented:

"The 2014 results have shown the promise that the new 'Aukett

Swanke' brand can create. We see 2015 as a year of opportunity to

continue on our growth strategy".

Enquiries

Aukett Swanke - 020 7843 3000

Nicholas Thompson, Chief Executive Officer

Beverley Wright, Group Finance Director

finnCap - 020 7220 0500

Corporate Finance: Julian Blunt / James Thompson

Corporate Broking: Stephen Norcross

Hermes Financial PR

Trevor Phillips - 07889 153628

Chris Steele - 07979 604687

Chairman's statement

It is a pleasure to report on a highly successful year for your

Company. During the year ended 30 September 2014 profit before tax

increased by 155% to GBP1.4m (2013: GBP550k) whilst revenue more

than doubled to GBP17.3m (2013: GBP8.4m). Earnings per share

continue to grow and now stand at 0.65 pence per share (2013: 0.26

pence per share).

In accordance with the Company's previously stated policy, the

Company intends to resume a regular pattern of dividend payments.

Two payments were made during the year, one of which was in respect

of the prior year. A further dividend payment was also made after

the year end relating to the year ending September 2014.

Our net funds have continued to increase and stood at GBP1.8m by

the year end. This was achieved notwithstanding that our

acquisition of Swanke Hayden Connell Europe Limited ('SHCE') was,

in part, cash funded. At the time of writing the Group is free of

debt.

As noted above, in December 2013 we acquired SHCE. Much of 2014

involved integrating SHCE and consolidating our enlarged Group's

operations. We anticipate the full benefit of this will begin to be

enjoyed in 2015.

The year also saw some changes to the Board. Beverley Wright has

joined us as the new Group Financial Director bringing with her

experience and expertise from a successful career with major

companies in the construction arena including Mowlem Plc and CH2M

Hill. John Bullough has joined as a Non Executive Director and

chairs the Remuneration Committee. He brings with him a vast

knowledge of the commercial property sector through his senior

level management experience within Grosvenor and ALDAR in the

Middle East.

The only negative aspect to report upon has been the unfolding

events in Russia which have tempered this year's performance.

I am confident that 2015 will again reflect a further overall

improvement on current year performance with respect to revenues,

profits, cash and dividends.

It is gratifying to report results ahead of our original

forecasts, in no small measure due to the excellence of our

offering to our clients and the enthusiasm, loyalty and diligence

of our staff. I would like to convey my thanks to all our staff for

their hard work during the year in achieving these results which,

yet again, provide a stronger platform for the year ahead.

I am confident about your Company's future.

Anthony Simmonds

Non Executive Chairman

28 January 2015

Extracts from strategic and directors' reports

Overview

Revenues in the year increased to GBP17.3m (2013: GBP8.4m), with

revenue less sub consultants at GBP14.7m (2013: GBP7.1m). Profit

before tax by comparison rose 155% to GBP1.4m (2013: GBP550k). This

result provides 3.6 times dividend cover.

Net funds continued to climb at GBP1.8m (2013: GBP1.1m) leaving

the Group virtually debt free. Post year end the small residual

outstanding bank loan was repaid.

The result would have been significantly better had our pre

acquisition Russian operation not continued to under perform, and

the former SHCE business not suffered from a number of project

delays in both Russia and the UK in the final quarter.

Architectural and interior design success is highlighted with

three awards, two for 62 Buckingham Gate and one for M&S

Cheshire Oaks.

The acquisition of SHCE and organic growth in the year has

substantially bolstered our rankings. In the 2015 World

Architecture 100 listings, published by Building Design, Aukett

Swanke Group Plc ('Aukett Swanke') is ranked 53(rd) (2014: 71(st)

), making us the 5(th) (2014: 8(th) ) largest UK practice by

international measurement.

United Kingdom

The UK has had an excellent year with revenue less sub

consultant costs rising 110% to GBP12.8m (2013: GBP6.1m). SHCE

contributed 58% of this increase with organic growth accounting for

42%. We gained an additional 42 technical staff with SHCE and added

33 more through direct recruitment in a tightening labour market.

The need to recruit in advance of project conversion through the

various work stages along with an unexpected delay in two projects

in the fourth quarter, restricted the profit rise, however we are

able to report a profit rise of 90% at GBP1.8m (2013: GBP961k).

Nine major projects were either in the site phase or moved into

construction during the year including Verde SW1 in Victoria for

Tishman Speyer, Imperial West Phase 2 for Imperial College in West

London, 10 Trinity Square in the City, two stores for Fenwick, the

Adelphi building for Blackstone, Forbury Place in Reading for

M&G, 125 Wood Street for Orchard Street Investment Management

and Uxbridge Business Park for Goodman.

Veretec, our Executive architecture division, had its best year

with revenue less sub consultant costs of over GBP3.3m for the

first time. Five schemes represented approximately 70% of its

revenue including clients such as Sir Robert McAlpine, McLaren

Construction, Candy & Candy, and the Qatari Foundation. Our

interior design offer was substantially augmented by the addition

of SHCE's client base including projects with Ascot Underwriting,

BNP Paribas, European Medicines Agency and Symantec.

Significantly, the UK out of town portfolio has returned through

our existing client base with schemes in Birmingham, Bristol,

Cambourne, Cambridge, Farnham, Harwell near Oxford, Hemel Hempstead

and Sheffield.

The UK studio approaches 2015 with renewed optimism.

Russia

Despite a fillip from the addition of a new office and our

teams' joint efforts post acquisition, the final result for the

year is a loss of GBP350k.

We expected to avoid any losses in the second half in the pre

acquisition operation and this was achieved with a small profit of

GBP19k, reducing its annual loss to GBP304k (2013: GBP270k).

Unfortunately, the SHCE branch suffered a project delay, in tandem

with the UK operation in the final quarter, which reversed the

first half profit and returned a loss of GBP46k.

The Board is mindful of this important market and the time taken

to establish our credentials in it. However, such losses are

unsustainable and we have given ourselves a short period in which

to rectify the situation or consider alternative solutions. This

process is further exacerbated by the recent troubles in the

Russian financial markets brought about by Russian foreign policy

and the collapse in the oil price. In the short term management's

strategy is to concentrate on local Russian commissions where there

is limited exposure to third party sub consultant costs and hard

currency liabilities.

Given the continuing losses the remaining goodwill balance of

GBP125,000 relating to the pre acquisition Russian operation, ZAO

Aukett Fitzroy Vostok, has been impaired.

Turkey

This is a new operation to the Aukett Swanke Group and has

performed well in the period. During the year we moved to slightly

larger premises in order to provide a base for continued growth.

With a profit of GBP90k on revenues of GBP687k this has been the

best performer from the SHCE portfolio of offices. The office

primarily works for local Turkish clients including: Tahincioglu

Real Estate A.S. NIDA Insaat, FIBA Group, Cengiz Holding A.S, ER

Yaterim Turizm Insaat A.S. and Vodafone. During the year the office

successfully completed the 42 storey Palladium commercial office

building in Istanbul. Our business plan assumes reasonable growth

in this market.

Middle East

Revenues have almost doubled in the year at GBP492k (2013:

GBP252k) enabling the operation to return a small profit of GBP14k

(2013: loss GBP132k). The key project won with Majid Al Futtaim at

the end of last year continued throughout the period to provide

much needed local stability.

During the year we have seen the number of enquiries rise as the

region returns to a more active market. However, critical mass

remains a challenge to achieving our growth strategy. A number of

independent potential solutions have now been identified, which we

are considering. This operation could easily double or treble its

size.

Berlin

A veritable jewel in the crown. For a fourth successive year

this operation has returned an improved performance based on its

leading position in the Berlin market. The studio is one of the few

"go to" practices for working drawing expertise. Pre tax profits

rose by 8.7% to GBP1.5m (2013: GBP1.3m) on revenue less sub

consultants up 5.6% at GBP4.3m (2013: GBP4.1m). Our net share (post

tax) amounted to GBP254k (2013: GBP234k)

Major projects during the year included assistance on the Berlin

Airport, Elbphilharmoine working drawings in Hamburg, KfW Bank

refurbishment works in Berlin, Siemens office in Forchheim,

Spindlershof refurbishment in Berlin, the shopping mall Gropius

Passagen for the developer mfi and the Kaiserstrand Hotel in

Bamsin.

Frankfurt

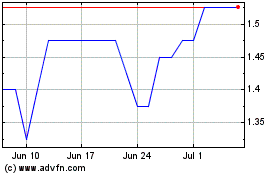

Aukett Swanke (LSE:AUK)

Historical Stock Chart

From Mar 2024 to Apr 2024

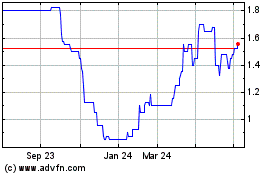

Aukett Swanke (LSE:AUK)

Historical Stock Chart

From Apr 2023 to Apr 2024