Assura PLC Trading Update (4402O)

February 09 2016 - 2:05AM

UK Regulatory

TIDMAGR

RNS Number : 4402O

Assura PLC

09 February 2016

9 February 2016

Assura plc

Trading Update

For the period to 8 February 2016

Period of significant growth

Assura plc ("Assura"), the UK's leading healthcare REIT, today

publishes a trading update for the period from 1 October to 8

February 2016.

Step change following successful equity raise

On 11 October 2015 Assura completed an equity raise of GBP300

million, net of expenses, to fund further acquisitions and

developments and significantly strengthens the balance sheet. This

strengthened financial position improves Assura's standing with its

primary customers in the NHS and GPs, greatly increases its ability

to take advantage of the considerable ongoing opportunities in the

sector and provides scope for negotiating better terms and pricing

on future debt facilities.

Since the equity raise, the proceeds have been applied in a

reduction of long-term debt by GBP181 million (with additional

early prepayment costs as set out below), the temporary repayment

of the revolving credit facility of GBP35 million and 12 property

additions with a gross value on completion of GBP39 million. The

property additions consist of ten property acquisitions, one

completed development and one completed forward funding agreement

and increases the rent roll by GBP2.3 million with a weighted

average unexpired lease term of 21.9 years.

New acquisition and development opportunities continue to be

identified at a faster pace than the conversion of heads of terms

into contractual completion. As a result the immediate pipeline of

such opportunities has risen to GBP135 million from the GBP125

million announced in October.

Further rental growth achieved

The annualised rent roll is now GBP61.8 million (September 2015:

GBP59.6 million) with growth driven primarily from

acquisitions.

The weighted average annual rent increase was 1.40% on the basis

of 111 reviews settled in the financial year to date, which

includes an average annual rental growth of 0.89% arising from

settled open market rent reviews. 85 of the reviews settled in the

period related to 2015 review dates with an annualised increase of

1.51%, mostly driven by stepped uplifts in a small number of rent

review clauses and RPI based reviews.

Strong financial position

As outlined to investors at the time of the recent fundraise a

key objective was to strengthen the financial position of Assura

and a new medium term target loan to value range of 40% to 50% was

announced. Currently the loan to value ratio is below 30%, allowing

for significant further investment.

In the period Assura successfully negotiated the redemption of

GBP181 million of long term debt held by Aviva Commercial Finance,

which had associated early repayment costs of GBP34 million.

Assura currently has GBP120 million of undrawn facilities and is

well placed to take advantage of the opportunities for further

consolidation in our sector.

Secure and growing dividend

A key part of Assura's strategy is providing a secure and

growing dividend stream for investors. The quarterly dividend was

increased by 10% for the January 2016 payment to 0.55 pence per

share or 2.2 pence per share on an annualised basis. At this time

Assura also introduced a scrip alternative for shareholders to

provide greater flexibility on how dividends are received.

Graham Roberts, Chief Executive, commented:

"There has been a renewed emphasis from the NHS and politicians

recently on addressing the chronic shortage of primary care space

in the UK. Assura is ideally placed with the expertise, scale and

financial flexibility to support this essential investment in our

nation's primary care infrastructure."

-ENDS-

For more information, please contact:

Assura plc Tel: 01925 420660

Jonathan Murphy

Orla Ball

Carolyn Jones

Finsbury Tel: 0207 251 3801

Gordon Simpson

Notes to Editors

Assura plc, a constituent of the FTSE 250, is a UK REIT and

long-term investor in and developer of primary care property. The

company, headquartered in Warrington, works with GPs, health

professionals and the NHS to create innovative property solutions

in order to facilitate delivery of high quality patient care in the

community. It owns 305 medical centres nationwide, serving over 3

million patients. At 30 September 2015, Assura's property portfolio

was valued at GBP1,030 million.

Further information is available at www.assuraplc.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTLLFITFIITIIR

(END) Dow Jones Newswires

February 09, 2016 02:05 ET (07:05 GMT)

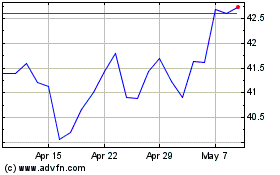

Assura (LSE:AGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

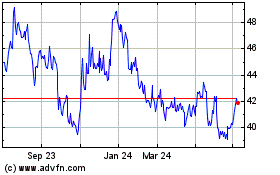

Assura (LSE:AGR)

Historical Stock Chart

From Apr 2023 to Apr 2024