-- Non-GAAP Earnings Per Share of $1.40 --

-- 2015 Non-GAAP Earnings Per Share Expected to

Be in Excess of $6.00 --

Arrow Electronics, Inc. (NYSE:ARW) today reported third-quarter

2015 net income of $109.2 million, or $1.15 per share on a diluted

basis, compared with net income of $146.9 million, or $1.47 per

share on a diluted basis, in the third quarter of 2014. Excluding

certain items1 in the third quarters of 2015 and 2014, net income

would have been $133.4 million, or $1.40 per share on a diluted

basis, in the third quarter of 2015, compared with net income of

$140.2 million, or $1.40 per share on a diluted basis, in the third

quarter of 2014. Third-quarter sales of $5.7 billion increased 2

percent from sales of $5.61 billion in the prior year.

Third-quarter sales, adjusted for the impact of acquisitions and

changes in foreign currencies, decreased 1 percent year over year.

In the third quarter of 2015, changes in foreign currencies had

negative impacts on growth of approximately $280 million on sales

and $.07 or 5 percent on earnings per share on a diluted basis

compared to the third quarter of 2014.

“Both our global components and enterprise computing solutions

businesses continued to experience strong demand in Europe, while

our Americas businesses broadly performed as we had anticipated. In

Asia, the economic deterioration was worse than we expected,” said

Michael J. Long, chairman, president, and chief executive officer.

“We remain committed to continual productivity improvement, and

have enhanced our ongoing efficiency initiatives to drive $40

million of expense savings on an annual basis. We are principally

accelerating the integrations of some of our recent acquisitions,

increasing automation across multiple functions enabled by our

Unity enterprise resource planning tool, utilizing our enterprise

strengths for greater purchasing leverage, and rationalizing our

real estate footprint.”

Global components third-quarter sales of $3.69 billion declined

1 percent year over year. Third-quarter sales, as adjusted,

declined 3 percent year over year. Americas components sales

declined 4 percent year over year. Europe components sales grew 5

percent year over year. Sales in the region, as adjusted, grew 11

percent year over year. Asia-Pacific components sales declined 2

percent year over year. Core components sales in Asia declined 5

percent year over year.

Global enterprise computing solutions third-quarter sales of

$2.01 billion grew 7 percent year over year. Sales, as adjusted,

grew 1 percent year over year. Americas sales grew 11 percent year

over year. Sales in the region, as adjusted, declined 4 percent

year over year. Europe sales declined 3 percent year over year.

Sales in the region, as adjusted, grew 15 percent year over year.

“Enterprise computing solutions posted record third-quarter

operating income and operating margins, with our software sales a

greater percentage of our product mix,” added Mr. Long.

“Cash flow from operations on a trailing 12-month basis was $568

million as we continue to exceed our cash flow target,” said Paul

J. Reilly, executive vice president, finance and operations, and

chief financial officer. “During the quarter, we returned

approximately $50 million to shareholders through our stock

repurchase program, and approximately $307 million on a trailing

12-month basis. We had approximately $469 million of remaining

authorization under our share repurchase programs at the end of the

third quarter.”

1 A reconciliation of non-GAAP adjusted financial measures,

including sales, as adjusted, operating income, as adjusted, net

income attributable to shareholders, as adjusted, and net income

per share, as adjusted, to GAAP financial measures is presented in

the reconciliation tables included herein.

NINE-MONTH RESULTS

Arrow’s net income for the first nine months of 2015 was $339.2

million, or $3.52 per share on a diluted basis, compared with net

income of $381.9 million, or $3.80 per share on a diluted basis in

the first nine months of 2014. Excluding certain items1 in both the

first nine months of 2015 and 2014, net income would have been

$410.1 million, or $4.26 per share on a diluted basis, in the first

nine months of 2015 compared with net income of $408.6 million, or

$4.06 per share on a diluted basis, in the first nine months of

2014. In the first nine months of 2015, sales of $16.53 billion

increased 1 percent from sales of $16.37 billion in the first nine

months of 2014. Nine-month sales, adjusted for acquisitions and

changes in foreign currencies, increased 2 percent year over year.

For the first nine months of 2015, changes in foreign currencies

had negative impacts on growth of approximately $950 million on

sales and $.27 or 7 percent on earnings per share on a diluted

basis compared to the first nine months of 2014.

GUIDANCE

“As we look to the fourth quarter, we believe that total sales

will be between $6.15 billion and $6.55 billion, with global

components sales between $3.45 billion and $3.65 billion, and

global enterprise computing solutions sales between $2.7 billion

and $2.9 billion. As a result of this outlook, we expect earnings

per share on a diluted basis, excluding any charges, to be in the

range of $1.75 to $1.91 per share. Our guidance assumes an average

tax rate in the range of 27 to 29 percent and average diluted

shares outstanding are expected to be 95 million. We are expecting

the average USD-to-Euro exchange rate for the fourth quarter to be

approximately $1.12 to €1. Based on this assumption, changes in

foreign currencies will have a negative impact of approximately

$215 million or 3 percent on sales and $.08 or 4 percent on

earnings per share on a diluted basis, respectively, when compared

with the fourth quarter of 2014. At the midpoint of our

fourth-quarter guidance range, full-year 2015 earnings per share,

on a diluted basis, excluding any charges, would total

approximately $6.08 and grow 3 percent compared to full-year 2014.

Adjusted for the impact of changes in foreign currencies, earnings

per share would grow 9 percent compared to full-year 2014,” said

Mr. Reilly.

Please refer to the CFO commentary, which can be found at

www.arrow.com/investor, as a supplement to the company’s earnings

release.

Arrow Electronics (www.arrow.com) is a global provider of

products, services and solutions to industrial and commercial users

of electronic components and enterprise computing solutions. Arrow

serves as a supply channel partner for more than 100,000 original

equipment manufacturers, contract manufacturers and commercial

customers through a global network of more than 460 locations in 56

countries.

Information Relating to Forward-Looking

Statements

This press release includes forward-looking statements that are

subject to numerous assumptions, risks, and uncertainties, which

could cause actual results or facts to differ materially from such

statements for a variety of reasons, including, but not limited to:

industry conditions, the company's implementation of its new

enterprise resource planning system, changes in product supply,

pricing and customer demand, competition, other vagaries in the

global components and global enterprise computing solutions

markets, changes in relationships with key suppliers, increased

profit margin pressure, the effects of additional actions taken to

become more efficient or lower costs, risks related to the

integration of acquired businesses, changes in legal and regulatory

matters, and the company’s ability to generate additional cash

flow. Forward-looking statements are those statements which are not

statements of historical fact. These forward-looking statements can

be identified by forward-looking words such as "expects,"

"anticipates," "intends," "plans," "may," "will," "believes,"

"seeks," "estimates," and similar expressions. Shareholders and

other readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date on

which they are made. The company undertakes no obligation to update

publicly or revise any of the forward-looking statements.

For a further discussion of factors to consider in connection

with these forward-looking statements, investors should refer to

Item 1A Risk Factors of the company’s Annual Report on Form 10-K

for the year ended December 31, 2014.

Certain Non-GAAP Financial

Information

In addition to disclosing financial results that are determined

in accordance with accounting principles generally accepted in the

United States (“GAAP”), the company also provides certain non-GAAP

financial information relating to sales, operating income, net

income attributable to shareholders, and net income per basic and

diluted share. The company provides sales on a non-GAAP basis

adjusted for the impact of changes in foreign currencies and the

impact of acquisitions by adjusting the company's operating results

for businesses acquired, including the amortization expense related

to acquired intangible assets, as if the acquisitions had occurred

at the beginning of the earliest period presented (referred to as

"impact of acquisitions"). Operating income, net income

attributable to shareholders, and net income per basic and diluted

share are adjusted for certain charges, credits, gains, and losses

that the company believes impact the comparability of its results

of operations. These charges, credits, gains, and losses arise out

of the company’s efficiency enhancement initiatives, acquisitions

(including intangible assets amortization expense), loss on

prepayment of debt, and (gain)/loss on investments. A

reconciliation of the company’s non-GAAP financial information to

GAAP is set forth in the tables below.

The company believes that such non-GAAP financial information is

useful to investors to assist in assessing and understanding the

company’s operating performance and underlying trends in the

company’s business because management considers these items

referred to above to be outside the company’s core operating

results. This non-GAAP financial information is among the primary

indicators management uses as a basis for evaluating the company’s

financial and operating performance. In addition, the company’s

Board of Directors may use this non-GAAP financial information in

evaluating management performance and setting management

compensation.

The presentation of this additional non-GAAP financial

information is not meant to be considered in isolation or as a

substitute for, or alternative to, sales, operating income, net

income and net income per basic and diluted share determined in

accordance with GAAP. Analysis of results and outlook on a non-GAAP

basis should be used as a complement to, and in conjunction with,

data presented in accordance with GAAP.

ARROW ELECTRONICS, INC.

CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands except per share data) (Unaudited)

Quarter Ended Nine Months Ended

September 26,2015

September 27,2014

September 26,2015

September 27,2014

Sales

$ 5,698,304 $ 5,613,216 $ 16,530,678 $ 16,371,795

Costs and expenses:

Cost of sales

4,955,937 4,884,529 14,334,394 14,191,759

Selling, general, and administrative

expenses

497,876 485,864 1,457,160 1,453,675

Depreciation and amortization

40,941 39,072 117,854 115,355

Restructuring, integration, and other

charges

17,756 3,935 51,099 25,181

5,512,510 5,413,400 15,960,507 15,785,970

Operating income

185,794 199,816 570,171 585,825

Equity in earnings of affiliated

companies

1,674 2,192 4,890 4,790

Gain on sale of investment

- 29,743 2,008 29,743

Interest and other financing expense,

net

35,409 27,522 100,959 86,079 - - 4,443

-

Income before income taxes

152,059 204,229 471,667 534,279

Provision for income taxes

41,755 57,377 130,589 152,175

Consolidated net income

110,304 146,852 341,078 382,104

Noncontrolling interests

1,060 (12 ) 1,844 236

Net income attributable to

shareholders

$ 109,244 $ 146,864 $ 339,234 $ 381,868

Net income per share:

Basic

$ 1.16 $ 1.49 $ 3.56 $ 3.84

Diluted

$ 1.15 $ 1.47 $ 3.52 $ 3.80

Weighted average shares outstanding:

Basic

94,302 98,631 95,277 99,336

Diluted

95,363 99,866 96,302 100,609 ARROW

ELECTRONICS, INC.

CONSOLIDATED BALANCE

SHEETS

(In thousands except par value)

September 26,2015

December 31,2014

(Unaudited) ASSETS Current assets: Cash and cash equivalents $

336,744 $ 400,355 Accounts receivable, net 5,065,503 6,043,850

Inventories 2,478,907 2,335,257 Other current assets 300,647

253,145 Total current assets 8,181,801

9,032,607 Property, plant, and equipment, at cost: Land 23,595

23,770 Buildings and improvements 164,568 144,530 Machinery and

equipment 1,234,206 1,146,045 1,422,369 1,314,345

Less: Accumulated depreciation and amortization (732,374 )

(678,046 ) Property, plant, and equipment, net

689,995 636,299 Investments in affiliated companies 72,498

69,124

Intangible assets, net 414,428 335,711 Cost in excess of net assets

of companies acquired 2,366,968 2,069,209 Other assets

280,508 292,351 Total assets $ 12,006,198 $ 12,435,301

LIABILITIES AND EQUITY Current liabilities: Accounts payable $

3,852,306 $ 5,027,103 Accrued expenses 695,620 797,464 Short-term

borrowings, including current portion of long-term debt

85,796 13,454 Total current liabilities 4,633,722

5,838,021 Long-term debt 2,748,283 2,067,898 Other

liabilities 411,582 370,471 Equity: Shareholders' equity: Common

stock, par value $1:

Authorized – 160,000 shares in both 2015

and 2014

Issued – 125,424 shares in both 2015 and 2014 125,424 125,424

Capital in excess of par value 1,094,859 1,086,082 Treasury stock

(31,895 and 29,529 shares in 2015 and 2014, respectively), at cost

(1,330,916 ) (1,169,673 ) Retained earnings 4,515,988 4,176,754

Accumulated other comprehensive loss (247,115 )

(64,617 ) Total shareholders' equity 4,158,240 4,153,970

Noncontrolling interests 54,371 4,941 Total equity

4,212,611 4,158,911 Total liabilities and equity $

12,006,198 $ 12,435,301 ARROW ELECTRONICS, INC.

CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands) (Unaudited) Quarter Ended

September 26,2015

September 27,2014

Cash flows from operating activities: Consolidated net income $

110,304 $ $146,852 Adjustments to reconcile consolidated net income

to net cash used for operations: Depreciation and amortization

40,941 39,072 Amortization of stock-based compensation 11,777

11,116 Equity in earnings of affiliated companies (1,674 ) (2,192 )

Deferred income taxes 375 (4,611 ) Restructuring, integration, and

other charges 12,643 2,556 Gain on sale of investment - (18,269 )

Excess tax benefits from stock-based compensation arrangements (21

) (729 ) Other 1,475 657 Change in assets and liabilities, net of

effects of acquired businesses: Accounts receivable (22,871 )

(41,481 ) Inventories 37,935 32,740 Accounts payable (298,552 )

(222,128 ) Accrued expenses 13,995 (42,228 ) Other assets and

liabilities (14,821 ) 31,421 Net cash used for

operating activities (108,494 ) (67,224 ) Cash

flows from investing activities: Cash consideration paid for

acquired businesses (42,236 ) (69,298 ) Acquisition of property,

plant, and equipment (44,236 ) (25,878 ) Proceeds from sale of

investment - 40,542 Net cash used for investing

activities (86,472 ) (54,634 ) Cash flows from

financing activities: Change in short-term and other borrowings

(252 ) 661 Proceeds from (repayment of)long-term bank borrowings,

net 204,300 109,800 Proceeds from exercise of stock options 248

2,692 Excess tax benefits from stock-based compensation

arrangements 21 729 Repurchases of common stock (50,177 ) (50,600 )

Other (2,831 ) - Net cash provided by financing

activities 151,309 63,282 Effect of exchange rate

changes on cash (19,320 ) 7,873 Net decrease in cash

and cash equivalents (62,977 ) (50,703 ) Cash and cash equivalents

at beginning of period 399,721 308,936 Cash and cash

equivalents at end of period $ 336,744 $ $258,233

ARROW ELECTRONICS, INC.

CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands) (Unaudited) Nine Months Ended

September 26,2015

September 27,2014

Cash flows from operating activities: Consolidated net income $

341,078 $ 382,104 Adjustments to reconcile consolidated net income

to net cash provided by operations: Depreciation and amortization

117,854 115,355 Amortization of stock-based compensation 33,783

31,283 Equity in earnings of affiliated companies (4,890 ) (4,790 )

Deferred income taxes 26,881 11,368 Restructuring, integration, and

other charges 38,106 18,102 Gain on sale of investment (2,008 )

(18,269 ) Excess tax benefits from stock-based compensation

arrangements (5,863 ) (6,977 ) Other 8,057 2,029 Change in assets

and liabilities, net of effects of acquired businesses: Accounts

receivable 1,056,282 556,445 Inventories (44,890 ) (97,929 )

Accounts payable (1,318,702 ) (632,191 ) Accrued expenses (110,834

) (150,165 ) Other assets and liabilities (23,910 )

9,883 Net cash provided by operating activities 110,944

216,248 Cash flows from investing activities: Cash

consideration paid for acquired businesses (512,910 ) (129,522 )

Acquisition of property, plant, and equipment (113,056 ) (87,881 )

Proceeds from sale of investment 2,008 40,542 Net

cash used for investing activities (623,958 )

(176,861 ) Cash flows from financing activities: Change in

short-term and other borrowings (4,069 ) (9,243 ) Proceeds from

(repayment of) long-term bank borrowings, net 238,700 (10,200 ) Net

proceeds from note offering 688,162 - Redemption of notes (254,313

) - Proceeds from exercise of stock options 14,722 21,013 Excess

tax benefits from stock-based compensation arrangements 5,863 6,977

Repurchases of common stock (206,601 ) (189,411 ) Other

(5,831 ) - Net cash provided by (used for) financing

activities 476,633 (180,864 ) Effect of exchange rate

changes on cash (27,230 ) 9,108 Net decrease in cash

and cash equivalents (63,611 ) (132,369 ) Cash and cash equivalents

at beginning of period 400,355 390,602 Cash and cash

equivalents at end of period $ 336,744 $ $258,233

ARROW ELECTRONICS, INC. (In thousands except

per share data) (Unaudited)

NON-GAAP SALES

RECONCILIATION

Quarter Ended

September 26,2015

September 27,2014

% Change Consolidated sales, as reported $ 5,698,304 $ 5,613,216

1.5% Impact of changes in foreign currencies - (278,778 ) Impact of

acquisitions 5,413 453,596 Consolidated sales, as

adjusted $ 5,703,717 $ 5,788,034 (1.5)% Global components

sales, as reported $ 3,692,051 $ 3,731,289 (1.1)% Impact of changes

in foreign currencies - (163,753 ) Impact of acquisitions

5,413 240,618 Global components sales, as adjusted $

3,697,464 $ 3,808,154 (2.9)% Europe components sales, as

reported $ 992,623 $ 949,232 4.6% Impact of changes in foreign

currencies - (145,742 ) Impact of acquisitions 5,413

97,356 Europe components sales, as adjusted $ 998,036 $ 900,846

10.8% Asia components sales, as reported $ 1,241,190 $

1,269,792 (2.3)% Impact of changes in foreign currencies - (12,524

) Impact of acquisitions - 126,394 Asia components

sales, as adjusted $ 1,241,190 $ 1,383,662 (10.3)% Global

ECS sales, as reported $ 2,006,253 $ 1,881,927 6.6% Impact of

changes in foreign currencies - (115,025 ) Impact of acquisitions

- 212,978 Global ECS sales, as adjusted $ 2,006,253 $

1,979,880 1.3% Europe ECS sales, as reported $ 599,128 $

619,045 (3.2)% Impact of changes in foreign currencies - (98,803 )

Impact of acquisitions - - Europe ECS sales, as

adjusted $ 599,128 $ 520,242 15.2% Americas ECS sales, as

reported $ 1,407,125 $ 1,262,882 11.4% Impact of changes in foreign

currencies - (16,222 ) Impact of acquisitions -

212,978 Americas ECS sales, as adjusted $ 1,407,125 $ 1,459,638

(3.6)% ARROW ELECTRONICS, INC. (In thousands except

per share data) (Unaudited)

NON-GAAP SALES

RECONCILIATION

Nine Months Ended

September 26,2015

September 27,2014

% Change Consolidated sales, as reported $ 16,530,678 $ 16,371,795

1.0% Impact of changes in foreign currencies - (949,150 ) Impact of

acquisitions 369,133 1,212,245 Consolidated sales, as

adjusted $ 16,899,811 $ 16,634,890 1.6% Global components

sales, as reported $ 10,736,989 $ 10,721,814 0.1% Impact of changes

in foreign currencies - (538,462 ) Impact of acquisitions

286,132 752,783 Global components sales, as adjusted $

11,023,121 $ 10,936,135 0.8% Europe components sales, as

reported $ 2,902,619 $ 2,923,093 (0.7)% Impact of changes in

foreign currencies - (498,741 ) Impact of acquisitions

95,087 295,666 Europe components sales, as adjusted $

2,997,706 $ 2,720,018 10.2% Asia components sales, as

reported $ 3,504,969 $ 3,412,441 2.7% Impact of changes in foreign

currencies - (28,114 ) Impact of acquisitions 187,699

377,493 Asia components sales, as adjusted $ 3,692,668 $ 3,761,820

(1.8)% Global ECS sales, as reported $ 5,793,689 $ 5,649,981

2.5% Impact of changes in foreign currencies - (410,688 ) Impact of

acquisitions 83,001 459,462 Global ECS sales, as

adjusted $ 5,876,690 $ 5,698,755 3.1% Europe ECS sales, as

reported $ 1,859,069 $ 2,061,057 (9.8)% Impact of changes in

foreign currencies - (371,032 ) Impact of acquisitions -

- Europe ECS sales, as adjusted $ 1,859,069 $ 1,690,025 10.0

%

Americas ECS sales, as reported $ 3,934,620 $ 3,588,923 9.6% Impact

of changes in foreign currencies - (39,656 ) Impact of acquisitions

83,001 459,462 Americas ECS sales, as adjusted $

4,017,621 $ 4,008,729 0.2% ARROW ELECTRONICS, INC.

(In thousands except per share data) (Unaudited)

NON-GAAP EARNINGS

RECONCILIATION

Quarter Ended Nine Months Ended

September 26,2015

September 27,2014

September 26,2015

September 27,2014

Operating income, as reported $ 185,794 $ 199,816 $ 570,171

$ 585,825 Intangible assets amortization expense 14,269 11,108

39,293 32,925 Restructuring, integration, and other charges

17,756 3,935 51,099 25,181 Operating income,

as adjusted $ 217,819 $ 214,859 $ 660,563 $ 643,931 Net

income attributable to shareholders, as reported $ 109,244 $

146,864 $ 339,234 $ 381,868 Intangible assets amortization expense

11,521 9,086 31,719 26,860 Restructuring, integration, and other

charges 12,642 2,556 38,106 18,102 Loss on prepayment of debt

-

-

1,808

-

(Gain)/loss on investments - (18,269 ) (746 )

(18,269 ) Net income attributable to shareholders, as

adjusted $ 133,407 $ 140,237 $ 410,121 $ 408,561 Net income

per basic share, as reported $ 1.16 $ 1.49 $ 3.56 $ 3.84 Intangible

assets amortization expense .12

.09

.33

.27

Restructuring, integration, and other charges .13

.03

.40

.18

Loss on prepayment of debt -

-

.02

-

(Gain)/loss on investments -

(.19

) (.01 )

(.18

) Net income per basic share, as adjusted $ 1.41 $ 1.42 $ 4.30 $

4.11 Net income per diluted share, as reported $ 1.15 $ 1.47

$ 3.52 $ 3.80 Intangible assets amortization expense .12

.09

.33

.27

Restructuring, integration, and other charges .13

.03

.40

.18

Loss on prepayment of debt -

-

.02

-

(Gain)/loss on investments -

(.18

) (.01 )

(.18

) Net income per diluted share, as adjusted $ 1.40 $ 1.40 $ 4.26 $

4.06

The sum of the components for basic and

diluted net income per share, as adjusted, may not agree to totals,

as presented, due to rounding.

ARROW ELECTRONICS, INC. (In thousands except

per share data) (Unaudited)

SEGMENT

INFORMATION

Quarter Ended

Nine Months Ended

September 26,2015

September 27,2014

September 26,2015

September 27,2014

Sales: Global components $ 3,692,051 $ 3,731,289 $

10,736,989 $ 10,721,814 Global ECS 2,006,253

1,881,927 5,793,689 5,649,981 Consolidated $

5,698,304 $ 5,613,216 $ 16,530,678 $ 16,371,795 Operating

income (loss): Global components $ 164,744 $ 179,451 $ 499,456 $

500,239 Global ECS 84,233 69,172 250,144 229,320 Corporate (a)

(63,183 ) (48,807 ) (179,429 ) (143,734

) Consolidated $ 185,794 $ 199,816 $ 570,171 $ 585,825

(a) Includes restructuring, integration,

and other charges of $17.8 million and $51.1 million for the third

quarter and first nine months of 2015 and $3.9 million and $25.2

million for the third quarter and first nine months of 2014,

respectively.

NON-GAAP SEGMENT

RECONCILIATION

Quarter Ended Nine Months Ended

September 26,2015

September 27,2014

September 26,2015

September 27,2014

Global components operating income, as reported $ 164,744 $ 179,451

$ 499,456 $ 500,239 Intangible assets amortization expense

7,540 5,493 20,468 16,499 Global components

operating income, as adjusted $ 172,284 $ 184,944 $ 519,924 $

516,738 Global ECS operating income, as reported $ 84,233 $

69,172 $ 250,144 $ 229,320 Intangible assets amortization expense

6,729 5,615 18,825 16,426 Global ECS

operating income, as adjusted $ 90,962 $ 74,787 $ 268,969 $

245,746

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151028005486/en/

Arrow Electronics, Inc.Steven O’BrienDirector, Investor

Relations303-824-4544orPaul J. ReillyExecutive Vice President,

Finance and Operations, andChief Financial

Officer631-847-1872orMedia Contact:John HouriganVice President,

Global Communications303-824-4586

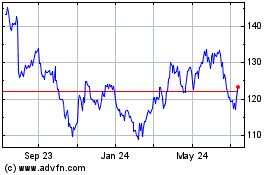

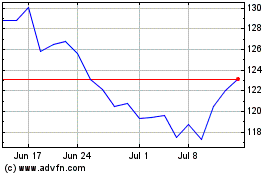

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Apr 2023 to Apr 2024