Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 11-K

ANNUAL REPORT PURSUANT TO

SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

OR

o TRANSITION REPORT PURSUANT TO SECTION 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-32749

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

Fresenius Medical Care North America 401(k) Savings Plan

920 Winter Street

Waltham, MA 02451-1457

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

Fresenius Medical Care AG & Co. KGaA

Else-Kröner Straße 1

61352 Bad Homburg, v.d. H. Germany

Table of Contents

FRESENIUS MEDICAL CARE

NORTH AMERICA 401(k) SAVINGS PLAN

FINANCIAL STATEMENTS

AND SUPPLEMENTAL SCHEDULE

DECEMBER 31, 2014 and 2013

Table of Contents

FRESENIUS MEDICAL CARE NORTH AMERICA 401(k) SAVINGS PLAN

FINANCIAL STATEMENTS AND SUPPLEMENTAL SCHEDULE

AND REPORTS OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRMS

The Fresenius Medical Care North America 401(k) Savings Plan (the “Plan”) is subject to the Employer Retirement Income Security Act of 1974 (“ERISA”). Therefore, in lieu of the requirements of Items 1-3 of Form 11-K, the following financial statements and schedules have been prepared in accordance with the financial reporting requirements of ERISA.

The following financial statements and schedules are filed as a part of this Annual Report on Form 11-K.

INDEX

*- Other schedules required by Section 2520.103-10 of the department of Labor Rules and Regulations for Reporting and Disclosure under ERISA have been omitted because they are not applicable.

Table of Contents

Report of Independent Registered Public Accounting Firm

To the Administrative Committee of

Fresenius Medical Care North America 401(k) Savings Plan

We have audited the accompanying statement of net assets available for benefits of Fresenius Medical Care North America 401(k) Savings Plan (the “Plan”) as of December 31, 2014 and the related statement of changes in net assets available for benefits for the year then ended. These financial statements are the responsibility of the plan’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of Fresenius Medical Care North America 401(k) Savings Plan as of December 31, 2014, and the changes in net assets available for benefits for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

The supplemental schedule of assets (held at end of year) at December 31, 2014 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental schedule reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule, we evaluated whether the supplemental schedule, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental schedule of assets (held at end of year) at December 31, 2014 is fairly stated, in all material respects, in relation to the Plan’s 2014 financial statements as a whole.

/s/WithumSmith+Brown, PC

Boston, Massachusetts

June 26, 2015

1

Table of Contents

Report of Independent Registered Public Accounting Firm

To the Administrative Committee of

Fresenius Medical Care North America 401(k) Savings Plan

We have audited the accompanying statement of net assets available for benefits of Fresenius Medical Care North America 401(k) Savings Plan (the “Plan”) as of December 31, 2013. This financial statement is the responsibility of the Plan’s management. Our responsibility is to express an opinion on this financial statement based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. We were not engaged to perform an audit of the Plan’s internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statement referred to above presents fairly, in all material respects, the net assets available for benefits of Fresenius Medical Care North America 401(k) Savings Plan as of December 31, 2013, in conformity with accounting principles generally accepted in the United States of America.

/s/Walsh, Jastrem & Browne, LLP

Boston, Massachusetts

June 26, 2014

2

Table of Contents

FRESENIUS MEDICAL CARE NORTH AMERICA 401(k) SAVINGS PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

DECEMBER 31, 2014 AND 2013

|

|

|

2014 |

|

2013 |

|

|

ASSETS: |

|

|

|

|

|

|

Participant Directed Investments, at fair value |

|

$ |

1,776,870,096 |

|

$ |

1,611,467,157 |

|

|

Cash |

|

6,818,136 |

|

7,046,215 |

|

|

Interest and dividends receivable |

|

199,207 |

|

182,347 |

|

|

Contributions receivable - employer |

|

42,173,636 |

|

39,350,302 |

|

|

Notes receivable from participants |

|

64,703,159 |

|

58,878,198 |

|

|

Receivable for investments sold |

|

0 |

|

494,699 |

|

|

|

|

|

|

|

|

|

Total assets |

|

1,890,764,234 |

|

1,717,418,918 |

|

|

|

|

|

|

|

|

|

LIABILITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Accrued administrative expenses |

|

2,165,429 |

|

1,786,716 |

|

|

|

|

|

|

|

|

|

NET ASSETS AVAILABLE FOR BENEFITS AT FAIR VALUE |

|

1,888,598,805 |

|

1,715,632,202 |

|

|

|

|

|

|

|

|

|

Adjustments from fair value to contract value (for interest in stable value fund) related to fully benefit-responsive investment contract |

|

(12,295,069 |

) |

492,061 |

|

|

|

|

|

|

|

|

|

NET ASSETS AVAILABLE FOR BENEFITS |

|

$ |

1,876,303,736 |

|

$ |

1,716,124,263 |

|

See accompanying notes to financial statements.

3

Table of Contents

FRESENIUS MEDICAL CARE NORTH AMERICA 401(k) SAVINGS PLAN

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

YEAR ENDED DECEMBER 31, 2014

|

ADDITIONS: |

|

|

|

|

Participant contributions - |

|

|

|

|

Salary deferrals |

|

$ |

130,198,552 |

|

|

Rollovers |

|

9,205,016 |

|

|

Employer contributions - |

|

|

|

|

Matching |

|

40,916,146 |

|

|

Defined contribution |

|

1,316,743 |

|

|

Interest income on notes receivable from participants |

|

3,233,296 |

|

|

Dividend and interest income |

|

11,739,668 |

|

|

Net Appreciation in value of investments |

|

104,922,684 |

|

|

|

|

|

|

|

Total additions |

|

301,532,105 |

|

|

|

|

|

|

|

DEDUCTIONS: |

|

|

|

|

Benefits paid to participants |

|

156,637,882 |

|

|

Administrative expenses |

|

3,651,657 |

|

|

|

|

|

|

|

Total deductions |

|

160,289,539 |

|

|

|

|

|

|

|

NET ADDITIONS BEFORE TRANSFERS |

|

141,242,566 |

|

|

|

|

|

|

|

TRANSFERS IN FROM OTHER PLANS |

|

18,936,907 |

|

|

|

|

|

|

|

NET ADDITIONS |

|

160,179,473 |

|

|

|

|

|

|

|

NET ASSETS AVAILABLE FOR BENEFITS, BEGINNING OF YEAR |

|

1,716,124,263 |

|

|

|

|

|

|

|

NET ASSETS AVAILABLE FOR BENEFITS, END OF YEAR |

|

$ |

1,876,303,736 |

|

See accompanying notes to financial statements.

4

Table of Contents

FRESENIUS MEDICAL CARE NORTH AMERICA 401(k) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

1. DESCRIPTION OF THE PLAN

Organization - Fresenius Medical Care North America 401(k) Savings Plan (the “Plan”) is sponsored by National Medical Care, Inc. d/b/a Fresenius Medical Care North America (the Company) for the benefit of the employees of the Company and employees of entities owned or controlled by the Company. The Company is a provider of dialysis products and services.

The administration of the Plan is the responsibility of the Administrative Committee, appointed by the Company’s Board of Directors. Mercer Trust Company is the trustee and recordkeeper of the Plan.

The following description of the Plan provides only general information. Special provisions may apply for certain participants who joined the Plan pursuant to Company acquisitions. Participants should refer to the Plan document for a complete description of the Plan’s provisions.

General - The Plan is a defined contribution plan covering all employees meeting the eligibility requirements of the Plan. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974 (ERISA). A summary description of the Plan is available from the Plan Administrator.

Eligibility - An employee becomes eligible for participation in the Plan on the first day of the month following the completion of ninety days of service, subject to further limitations, as described in the Plan document.

Participant Accounts - Each participant’s account is credited with the participant’s and Company’s contributions and allocations of Plan earnings. Participant and employer contributions are invested as directed by the participants into one or more designated investment options offered by the Plan. Additionally, participants have the option to establish a plan level brokerage account to allow the opportunity to invest in a wide array of securities. Participants may change their investment selections at any time. Allocations of Plan earnings are based on participant account balances. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

5

Table of Contents

FRESENIUS MEDICAL CARE NORTH AMERICA 401(k) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

1. DESCRIPTION OF THE PLAN (continued)

Participant and Company Matching Contributions - Each participant may contribute from 1% to 75% of his or her eligible earnings on a pre-tax basis, subject to certain limitations. The Company makes matching contributions to the Plan at an amount equal to 50% of the first 6% of eligible employee earnings, subject to certain limitations. Participating employees age 50 and above may elect to make “catch-up” pre-tax contributions to the Plan above the Plan maximums. The maximum additional “Catch Up’ contribution was $5,500 during both the 2014 and 2013 Plan years. Company matching contributions commence for participants who have completed one year of service. Company matching contributions are funded on an annual basis. Participants who are not employed by the Company at the end of the Plan year (December 31) will not be eligible for the matching contribution.

Participants are at all times 100% vested to the extent of their own contributions. Participants terminated prior to January 1, 2007 vest in the employer matching contributions according to the vesting schedule in effect at the time of termination. Active participants since January 1, 2007 vest in the employer matching contributions according to the following schedule:

|

Period of Service |

|

Percentage Vested |

|

|

Less than 1 year |

|

0 |

% |

|

1 but less than 2 years |

|

20 |

% |

|

2 but less than 3 years |

|

40 |

% |

|

3 but less than 4 years |

|

60 |

% |

|

4 but less than 5 years |

|

80 |

% |

|

5 years or more |

|

100 |

% |

Company Profit Sharing— The Company may make discretionary profit sharing contributions to the Plan for the benefit of all eligible participants. Employees who have completed a year of service for the plan year for which the contribution relates and are employed by the Company on the last day of the plan year for which the contribution relates are eligible to participate in this component of the plan. Any discretionary profit sharing contributions are immediately 100% vested and are allocated to eligible participants based on compensation, with participants having ten years or more of service as of January 1, 2002 entitled to a higher profit sharing allocation. There was no profit sharing contribution made to the Plan in 2014.

Forfeitures - At December 31, 2014, forfeited account balances totaled $631,841. Forfeitures are used to reduce Company contributions and/or offset administrative expenses of the Plan. In January 2015, the Company used $620,000 of the forfeited account balances to reduce Company matching contributions for 2014 that were funded in 2015.

6

Table of Contents

FRESENIUS MEDICAL CARE NORTH AMERICA 4OI(K) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

1. DESCRIPTION OF THE PLAN (continued)

Defined Contribution- The Company makes payments to the Plan referred to as a “defined contribution” for the benefit of all eligible participants. Employees satisfying all of the following requirements are eligible to participate in this component of the Plan: (i) the employee was employed by the Company as of March 9, 2002; (ii) the employee was a participant in the Fresenius Medical Care North America Retirement Plan (“Pension Plan”) on March 9, 2002, and (iii) the employee had completed ten years of pension service as of March 9, 2002. Employees eligible to participate will only receive a defined contribution allocation for a given plan year after the completion of 15 years of pension service as long as the employee is employed by the Company on the last day of the plan year for which the contribution relates. Eligible participants are immediately 100% vested in such contributions.

The amount of the defined contribution for each eligible participant is actuarially determined and is principally based on the participant’s length of service, level of compensation, projected benefit from the Pension Plan, and the projected benefit from the profit sharing component of this Plan. Certain actuarial assumptions related to annual compensation percentage increases, annual investment returns and anticipated profit sharing funding levels are made in determining the defined contribution funding amounts.

Distributions — At termination of employment, the participant is entitled to withdraw his or her entire account balance from the Plan. Any remaining unpaid loan balances at termination of employment are treated as distributions. Terminated employees with account balances of less than $5,000 must withdraw their account balances from the Plan. Terminated employees with participant account balances greater than $5,000 may elect to leave their funds in the Plan until age 70 1/2. The Plan allows participants with account balances greater than $5,000 to elect payouts in the form of an annuity over a period not to exceed 25 years. In certain instances, prior to termination, participants may (subject to approval by the Administrative Committee and in compliance with ERISA) withdraw account balances to defray financial obligations. Plan participants are eligible to take an in service distributions at age 59 ½.

Plan Termination — Although the Company expects to continue the Plan as a permanent, tax-deferred savings program for the exclusive benefit of Company employees and employees of entities owned or controlled by the Company, the continuance of the Plan is not assumed by the Company as a contractual obligation. The Company reserves the right to amend or terminate the Plan subject to the provisions set forth by ERISA. If the Company terminates the Plan, accounts will be valued as of the termination date and distributed in a lump sum payment to each participant, subject to ERISA and/or other legal requirements that may exist at that time

7

Table of Contents

FRESENIUS MEDICAL CARE NORTH AMERICA 4OI(K) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

1. DESCRIPTION OF THE PLAN (continued)

and in compliance with ERISA. Affected plan participants will become 100% vested on Plan termination.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Method of Accounting - The accompanying financial statements have been prepared using the accrual method of accounting under accounting principles generally accepted in the United States of America (“U.S. GAAP”).

Investments — Investments are reported at fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. See Note 6 for discussion of fair value measurements.

As required under U.S. GAAP, the Plan’s investment in a stable value fund with underlying investments in an investment contract is presented in the statements of net assets available for benefits at fair value with an additional line item showing an adjustment of the fully benefit-responsive investment contract from fair value to contract value. The statement of changes in net assets available for benefits with respect to such contract is presented on a contract value basis. Contract value represents contributions made, plus earnings, less participant withdrawals and is the relative measurement attributable to a fully benefit-responsive investment contract because contract value is the amount participants would ordinarily receive if they were to initiate permitted transactions under the terms of the Plan. Certain events, such as Plan termination or a premature termination of the contract could limit the ability of the Plan to transact at contract value with the issuer. The Plan administrator does not believe that any events that would limit the Plan’s ability to transact at contract value with the Plan participants are probable of occurring (See Note 5).

Purchases and sales of securities are recorded on a trade-date basis. Dividend income is recorded on the ex-dividend date. Interest income is recorded on the accrual basis.

Notes Receivable from Participants — Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest.

8

Table of Contents

FRESENIUS MEDICAL CARE NORTH AMERICA 4OI(K) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Payment of Benefits — Benefits are recorded when paid.

Administrative Expenses — Certain administrative costs of the Plan have been absorbed by the Company. In addition, certain investment related administrative expenses are reflected as net reductions in income and are not determinable.

Estimates - The preparation of financial statements in conformity with U.S. GAAP requires the Plan administrator to make estimates and assumptions that affect certain reported amounts and disclosure of contigent assets and liabilities. Actual results may differ from those estimates.

3. INVESTMENTS

The following presents the Plan’s investments (all participant directed) at December 31, 2014 and 2013. Investments representing 5% or more of Plan net assets are separately identified:

|

|

|

2014 |

|

2013 |

|

|

Collective Investment Funds - |

|

|

|

|

|

|

|

|

|

|

|

|

|

BlackRock Institutional Trust Company N.A.: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity Index Fund F |

|

$ |

639,769,967 |

|

$ |

572,783,523 |

|

|

|

|

|

|

|

|

|

Russell 2000 Index Fund F |

|

144,569,520 |

|

138,236,573 |

|

|

|

|

|

|

|

|

|

Mid Capitalization Equity Index Fund F |

|

141,793,224 |

|

121,525,853 |

|

|

|

|

|

|

|

|

|

U.S. Debt Index Fund F |

|

146,325,698 |

|

133,523,020 |

|

|

|

|

|

|

|

|

|

BlackRock MSCI ACWI ex — U.S. Index Fund F |

|

160,282,643 |

|

149,947,812 |

|

|

|

|

|

|

|

|

|

Other Investment Funds |

|

55,955,191 |

|

49,333,724 |

|

|

|

|

|

|

|

|

|

MassMutual Stable Value Fund |

|

365,596,903 |

|

331,119,788 |

|

|

|

|

|

|

|

|

|

Fresenius Medical Care AG |

|

91,577,027 |

|

91,625,225 |

|

|

|

|

|

|

|

|

|

Mutual Funds |

|

18,161,971 |

|

12,573,949 |

|

|

|

|

|

|

|

|

|

Common Stocks |

|

12,316,796 |

|

10,030,629 |

|

|

|

|

|

|

|

|

|

Corporate Bonds |

|

521,156 |

|

767,061 |

|

|

|

|

|

|

|

|

|

Total investments, at fair value |

|

$ |

1,776,870,096 |

|

$ |

1,611,467,157 |

|

9

Table of Contents

FRESENIUS MEDICAL CARE NORTH AMERICA 4OI(K) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

3. INVESTMENTS (continued)

For the year ended December 31, 2014, the Plan’s investments (including gains and losses on investments bought and sold, as well as held during the year) appreciated in value by $104,922,684 as follows:

|

|

|

Net |

|

|

|

|

Appreciation/(Depreciation) |

|

|

Collective Investment Funds |

|

$ |

99,456,246 |

|

|

Mutual Funds |

|

1,765,953 |

|

|

Fresenius Medical Care AG — shares |

|

3,826,920 |

|

|

Other Securities — Brokerage Link |

|

(126,435 |

) |

|

|

|

|

|

|

|

|

$ |

104,922,684 |

|

4. PARTICIPANT INVESTMENT OPTIONS

The following table presents a description of the investment options and the fair value of the investments of each fund option as of December 31, 2014 and 2013:

|

|

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

BlackRock Large Cap Blend Index Fund Option— This option invests in the Equity Index Fund F, a collective investment fund offered by BlackRock Institutional Trust Company N.A., that seeks to match the performance of the S&P 500® Index by investing in stocks that make up the index |

|

$ |

444,963,171 |

|

$ |

406,782,666 |

|

|

|

|

|

|

|

|

|

BlackRock Mid Cap Index Fund Option— This option invests in the Mid Capitalization Equity Index Fund F, a collective investment fund offered by BlackRock Institutional Trust Company N.A., that seeks to match the performance of the S&P 400® Index by investing in stocks that make up the index |

|

82,213,234 |

|

71,961,748 |

|

|

|

|

|

|

|

|

|

BlackRock Small Cap Index Fund Option — This option invests in the Russell 2000® Index Fund F, a collective investment fund offered by BlackRock Institutional Trust Company N.A., that seeks to match the performance of the Russell 2000® Index by investing in a diversified sample of stocks that make up the index |

|

106,942,789 |

|

107,997,380 |

|

10

Table of Contents

FRESENIUS MEDICAL CARE NORTH AMERICA 4OI(K) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

4. PARTICIPANT INVESTMENT OPTIONS (continued)

|

|

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

BlackRock International Index Fund Option— This option invests in the BlackRock MSCI ACWI ex — U.S. Index Fund F, a collective investment fund offered by BlackRock Institutional Trust Company N.A., that seeks to match the performance of the MSCI ACWI ex — U.S. Index by investing in stocks that make up the index |

|

53,476,804 |

|

55,045,260 |

|

|

|

|

|

|

|

|

|

BlackRock U.S. Debt Index Fund Option — This option invests in the U.S. Debt Index Fund F, a collective investment fund offered by BlackRock Institutional Trust Company N.A., that seeks to match the performance of the Barclays Capital Aggregate Bond Index by investing in a diversified sample of the bonds that make up the index |

|

64,113,329 |

|

62,191,262 |

|

|

|

|

|

|

|

|

|

BlackRock TIPS Index Fund Option— This option invests in the U.S. Treasury Inflation Protected Securities Fund F, a collective investment fund offered by BlackRock Institutional Trust Company N.A., that seeks to match the performance of the Barclays Capital U.S. TIPS Index by investing in some or all of the bonds that make up the index |

|

6,268,803 |

|

5,857,461 |

|

|

|

|

|

|

|

|

|

BlackRock Emerging Markets Index Fund Option— This fund invests in the Emerging Markets Index Non-Lendable Fund F, a collective investment fund offered by BlackRock Institutional Trust Company N.A., that seeks to match the performance of the MSCI Emerging Markets Index by investing in stocks that make up the index |

|

8,162,899 |

|

6,772,986 |

|

|

|

|

|

|

|

|

|

MassMutual Stable Value Fund Option— This option is designed to provide a stable rate of return, generated from performance of a Core Bond portfolio, that insulates the fund from daily fluctuations in the bond market. The fixed rate of return resets quarterly |

|

226,180,973 |

|

210,463,115 |

|

|

|

|

|

|

|

|

|

Target Date Retirement Funds Option— These options invest in a mix of the above underlying funds and are designed for plan participants expecting to retire around the year indicated in the fund name. The asset allocation strategy of these options generally become increasingly conservative as the target retirement date approaches. The target date options are as follows: |

|

|

|

|

|

|

Target Retirement Income Fund Option |

|

10,444,067 |

|

9,451,463 |

|

|

Target Retirement 2010 Fund Option |

|

16,347,940 |

|

16,901,922 |

|

|

Target Retirement 2015 Fund Option |

|

65,626,354 |

|

66,952,123 |

|

|

Target Retirement 2020 Fund Option |

|

121,032,978 |

|

104,800,853 |

|

11

Table of Contents

FRESENIUS MEDICAL CARE NORTH AMERICA 4OI(K) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

4. PARTICIPANT INVESTMENT OPTIONS (continued)

|

|

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

Target Retirement 2025 Fund Option |

|

122,526,251 |

|

102,034,173 |

|

|

Target Retirement 2030 Fund Option |

|

97,145,010 |

|

80,429,374 |

|

|

Target Retirement 2035 Fund Option |

|

92,734,591 |

|

77,376,568 |

|

|

Target Retirement 2040 Fund Option |

|

61,564,038 |

|

51,740,111 |

|

|

Target Retirement 2045 Fund Option |

|

41,114,851 |

|

33,812,224 |

|

|

Target Retirement 2050 Fund Option |

|

33,435,064 |

|

25,899,604 |

|

|

|

|

|

|

|

|

|

Vanguard Long Term Bond Index Fund Option— This option is a publicly traded mutual fund that seeks to match the performance of the Barclays Capital U.S. Long Government/Credit Float Adjusted Bond Index |

|

13,393,162 |

|

7,918,439 |

|

|

|

|

|

|

|

|

|

Fresenius Company Stock Fund Option — This option invests in Fresenius Medical Care AG Company stock |

|

91,577,027 |

|

91,625,225 |

|

|

|

|

|

|

|

|

|

Brokerage Link— This investment option allows participants to establish a plan level brokerage account with TD Ameritrade for the opportunity to invest in common stocks, mutual funds, corporate bonds and other securities |

|

17,606,761 |

|

15,453,200 |

|

|

|

|

|

|

|

|

|

Total |

|

$ |

1,776,870,096 |

|

$ |

1,611,467,157 |

|

|

|

|

|

|

|

|

|

5. STABLE VALUE FUND

The Plan provides a stable value fund option to participants, referred to as the “MassMutual Stable Value Fund”, consisting of an investment in an underlying guaranteed investment contract. This fund option is designed to provide a guaranteed rate of return with crediting interest rates that reset on a quarterly basis. The Plan has entered into a group annuity contract with Massachusetts Mutual Life Insurance Company (“MassMutual”), whereby deposits made by the Plan to the contract are maintained in an account separate from MassMutual’s general investment account thereby insulating the account from liability arising out of other business activities conducted by MassMutual. The separate account invests in a diversified portfolio of fixed income securities, including corporate, mortgage backed, and government and agency bonds and may include derivative instruments. At December 31, 2014, the contract value and fair value of the Plan’s investment in the contract was $353,301,834 and $365,596,903, respectively. At December 31, 2013, the contract value and fair value of the Plan’s investment

12

Table of Contents

FRESENIUS MEDICAL CARE NORTH AMERICA 401(K) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

5. STABLE VALUE FUND (continued)

in the contract was $331,611,849 and $331,119,788, respectively. The crediting interest rates ranged from 2.70% to 3.10% in 2014 and 2.85% to 3.05% in 2013. The average yield was 2.86% in 2014 and 2.89% in 2013.

The stable value fund is considered fully benefit-responsive whereby participants are permitted to make withdrawals at contract value for benefit payments, loans or transfers to other investment options.

6. FAIR VALUE MEASUREMENTS

Under U.S. GAAP, fair value is defined as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. A fair value hierarchy has been established under U.S. GAAP that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

The three levels of the fair value hierarchy are as follows:

|

Level 1 |

Observable inputs based on unadjusted quoted prices for identical assets or liabilities in active markets that the Plan has the ability to access. |

|

|

|

|

Level 2 |

Inputs for assets or liabilities, other than quoted prices included in Level 1, which are either directly or indirectly observable as of the measurement date. Inputs include quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in inactive markets; and inputs derived principally from or corroborated by observable market data by correlation or other means. |

|

|

|

|

Level 3 |

Unobservable inputs where there is little or no market activity for the assets or liabilities. These inputs reflect Plan management’s assumptions of the data market participants would use in pricing an asset or liability, based on the best information available in the circumstances. |

13

Table of Contents

FRESENIUS MEDICAL CARE NORTH AMERICA 401(K) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

6. FAIR VALUE MEASUREMENTS (continued)

Following is a description of the valuation methodologies used for Plan assets measured at fair value at December 31, 2014 and 2013.

Collective Investment Funds — Investments in collective investment funds are stated at fair value, which represents the net asset value of the units held by the Plan at year end, as determined by the issuer of the collective investment funds based on the fair value of the underlying investments.

Stable Value Fund — The Plan’s investment in the stable value fund is stated at fair value of the underlying contract, as provided by the insurance company issuing the contract, based on the fair value of the securities underlying the contract.

Fresenius Medical Care AG shares — The Plan’s investment in shares of Fresenius Medical Care AG (the parent company of the Plan sponsor), which trade on the New York Stock Exchange in the form of American Depository Receipts (ADRs), is valued at the share’s closing price on the last business day of the Plan year.

Mutual Funds — Shares of mutual funds are valued at quoted market prices, which represent the net asset value (NAV) of the shares held by the Plan at year end.

Common Stocks — Common stocks are valued at end of year quoted prices on the market on which the individual securities are traded.

Corporate Bonds — Certain corporate bonds are valued at the closing price on the market on which the bonds are traded. Corporate bonds traded in the over-the-counter market are valued at the average of the last reported bid and asked prices.

The methods described above may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, although the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

14

Table of Contents

FRESENIUS MEDICAL CARE NORTH AMERICA 401(K) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

6. FAIR VALUE MEASUREMENTS (continued)

The following tables set forth by level, within the fair value hierarchy, the Plan’s investments at fair value as of December 31, 2014 and 2013:

|

|

|

December 31, 2014 |

|

|

|

|

Level 1 |

|

Level 2 |

|

Level 3 |

|

Total |

|

|

Mutual Funds — |

|

|

|

|

|

|

|

|

|

|

Bond |

|

$ |

13,393,162 |

|

$ |

— |

|

$ |

— |

|

$ |

13,393,162 |

|

|

Other (a) |

|

4,768,809 |

|

— |

|

— |

|

4,768,809 |

|

|

Collective Investment Funds - |

|

|

|

|

|

|

|

|

|

|

Equity — domestic largecap |

|

— |

|

639,769,967 |

|

— |

|

639,769,967 |

|

|

Equity — domestic midcap |

|

— |

|

141,793,224 |

|

— |

|

141,793,224 |

|

|

Equity — domestic smallcap |

|

— |

|

144,569,520 |

|

— |

|

144,569,520 |

|

|

Equity - international |

|

— |

|

160,282,643 |

|

— |

|

160,282,643 |

|

|

Equity — emerging markets |

|

— |

|

43,660,094 |

|

— |

|

43,660,094 |

|

|

U.S. Bond |

|

— |

|

146,325,698 |

|

— |

|

146,325,698 |

|

|

U.S. Bond — inflation protected |

|

— |

|

12,295,097 |

|

— |

|

12,295,097 |

|

|

Stable Value Fund |

|

— |

|

365,596,903 |

|

— |

|

365,596,903 |

|

|

Fresenius Medical |

|

|

|

|

|

|

|

|

|

|

Care AG - Shares |

|

91,577,027 |

|

— |

|

— |

|

91,577,027 |

|

|

Common Stocks (a) |

|

12,316,796 |

|

— |

|

— |

|

12,316,796 |

|

|

Corporate Bonds (a) |

|

— |

|

521,156 |

|

— |

|

521,156 |

|

|

Total Investments |

|

$ |

122,055,794 |

|

$ |

1,654,814,302 |

|

$ |

— |

|

$ |

1,776,870,096 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2013 |

|

|

|

|

Level 1 |

|

Level 2 |

|

Level 3 |

|

Total |

|

|

Mutual Funds — |

|

|

|

|

|

|

|

|

|

|

Bond |

|

$ |

7,918,439 |

|

$ |

— |

|

$ |

— |

|

$ |

7,918,439 |

|

|

Other (a) |

|

4,655,510 |

|

— |

|

— |

|

4,655,510 |

|

|

Collective Investment Funds - |

|

|

|

|

|

|

|

|

|

|

Equity — domestic largecap |

|

— |

|

572,783,523 |

|

— |

|

572,783,523 |

|

|

Equity — domestic midcap |

|

— |

|

121,525,853 |

|

— |

|

121,525,853 |

|

|

Equity — domestic smallcap |

|

— |

|

138,236,573 |

|

— |

|

138,236,573 |

|

|

Equity - international |

|

— |

|

149,947,812 |

|

— |

|

149,947,812 |

|

|

Equity — emerging markets |

|

— |

|

37,366,178 |

|

— |

|

37,366,178 |

|

|

U.S. Bond |

|

— |

|

133,523,020 |

|

— |

|

133,523,020 |

|

|

U.S. Bond — inflation protected |

|

— |

|

11,967,546 |

|

— |

|

11,967,546 |

|

|

Stable Value Fund |

|

— |

|

331,119,788 |

|

— |

|

331,119,788 |

|

|

Fresenius Medical |

|

|

|

|

|

|

|

|

|

|

Care AG - Shares |

|

91,625,225 |

|

— |

|

— |

|

91,625,225 |

|

|

Common Stocks (a) |

|

10,030,629 |

|

— |

|

— |

|

10,030,629 |

|

|

Corporate Bonds (a) |

|

— |

|

767,061 |

|

— |

|

767,061 |

|

|

Total Investments |

|

$ |

114,229,803 |

|

$ |

1,497,237,354 |

|

$ |

— |

|

$ |

1,611,467,157 |

|

15

Table of Contents

FRESENIUS MEDICAL CARE NORTH AMERICA 401(K) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

6 . FAIR VALUE MEASUREMENTS (continued)

(a) - Investments in brokerage accounts of Plan participants choosing the “Brokerage Link” investment option. Such investments consist of a variety of classes of common stocks, mutual funds, corporate bonds and other investments as directed by Plan participants.

For the year ended December 31, 2014, there were no transfers among Levels 1, 2 or 3.

The following table for December 31, 2014 and 2013 sets forth a summary of the Plan’s investments with a reported NAV.

|

|

|

|

|

|

|

|

|

Other |

|

Redemption |

|

|

|

|

Fair Value - |

|

Fair Value |

|

Redemption |

|

Redemption |

|

Notice |

|

|

Investments |

|

December 31, 2014* |

|

December 31, 2013* |

|

Frequency |

|

Restrictions |

|

Period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity Index Fund |

|

$ |

639,769,967 |

|

$ |

572,783,523 |

|

Daily |

|

None |

|

None |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Russell 2000 Index Fund |

|

144,569,520 |

|

138,236,573 |

|

Daily |

|

None |

|

None |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mid Capitalization Equity Index Fund |

|

141,793,224 |

|

121,525,853 |

|

Daily |

|

None |

|

None |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Debt Index Fund |

|

146,325,698 |

|

133,523,020 |

|

Daily |

|

None |

|

None |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Blackrock MSCI ACWI ex- U.S. Index Fund |

|

160,282,643 |

|

149,947,812 |

|

Daily |

|

None |

|

None |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Treasury Inflation Protection Securities Fund |

|

12,295,097 |

|

11,967,546 |

|

Daily |

|

None |

|

None |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging Markets Index Non-Lendable Fund |

|

43,660,094 |

|

37,366,178 |

|

Daily |

|

None |

|

None |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MassMutual Stable Value Fund |

|

365,596,903 |

|

331,119,788 |

|

Daily |

|

None |

|

None |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

$ |

1,654,293,146 |

|

$ |

1,496,470,293 |

|

|

|

|

|

|

|

* The fair value of the investments has been estimated using the net asset value of the investment.

16

Table of Contents

FRESENIUS MEDICAL CARE NORTH AMERICA 401(K) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

7. NOTES RECEIVABLE FROM PARTICIPANTS

Participants may at any time borrow up to 50% (but not more than $50,000) of their vested account balances with a minimum loan amount of $500. Such loans are secured by the participants’ account balances. The loans bear a reasonable rate of interest which ranged from 3.25% to 10.75% per annum as of December 31, 2014 and must be repaid in equal payments in five years or less. A longer repayment period may be allowed for loans granted to purchase a primary residence.

8. RELATED PARTY TRANSACTIONS

The Plan invests in collective investment funds offered and managed by BlackRock Institutional Trust Company N.A. (“BlackRock”). BlackRock charged the Plan investment management fees of $500,175 in 2014 of which $127,563 is payable at December 31, 2014 and is included in accrued administrative expenses.

Mercer Trust Company, the trustee and recordkeeper of the Plan, charged the Plan $2,083,183 in 2014 for recordkeeping services, of which $514,330 is payable at December 31, 2014 and is included in accrued administrative expenses.

The Plan invests in shares of the Plan Sponsor. Transactions in such investments are considered party-in-interest transactions as defined by ERISA but are exempt from the prohibited transaction rules.

17

Table of Contents

FRESENIUS MEDICAL CARE NORTH AMERICA 401(k) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

9. RECONCILIATION OF FINANCIAL STATEMENTS TO FORM 5500

The following is a reconciliation of amounts per the financial statements to Form 5500 for the years ended December 31, 2014 and 2013:

|

|

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

Net assets available for benefits per the financial statements |

|

$ |

1,876,303,736 |

|

$ |

1,716,124,263 |

|

|

|

|

|

|

|

|

|

Adjustment from contract value to fair value (for interest in stable value fund) related to fully benefit-responsive investment contract |

|

12,295,069 |

|

(492,061 |

) |

|

|

|

|

|

|

|

|

Net assets available for benefits per Form 5500 |

|

$ |

1,888,598,805 |

|

$ |

1,715,632,202 |

|

|

|

|

|

|

|

|

|

Total net additions in net assets per the financial statements |

|

$ |

160,179,473 |

|

|

|

|

|

|

|

|

|

|

|

Adjustment from contract value to fair value (for interest in stable value fund) related to fully benefit-responsive investment contract |

|

12,787,130 |

|

|

|

|

|

|

|

|

|

|

|

Total net additions in net assets per Form 5500 |

|

$ |

172,966,603 |

|

|

|

10. TAX STATUS OF THE PLAN

The Internal Revenue Service, by letter dated April 30, 2015, determined that the Plan constitutes a qualified trust under Section 401(a) of the Internal Revenue Code (the “Code”) and is, therefore, considered to be exempt from Federal income taxes under the provisions of Section 501(a). The Plan has been amended since receiving the determination letter, however, the Plan administrator and the Plan’s tax counsel believe that the Plan is designed and is currently being operated in compliance with the applicable requirements of the Code. Accordingly, no provision for income taxes has been included in the Plan’s financial statements.

18

Table of Contents

FRESENIUS MEDICAL CARE NORTH AMERICA 401(k) SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

10. TAX STATUS OF THE PLAN (continued)

U.S. GAAP requires Plan management to evaluate tax positions taken by the Plan and recognize a tax liability if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the tax authorities. The Plan administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2014, there are no uncertain tax positions taken or expected to be taken that would require recognition of a liability or disclosure in the financial statements. The Plan is subject to routine audits by the tax authorities; however, there are currently no audits for any tax periods in progress. The Plan administrator believes it is no longer subject to income tax examinations for years prior to 2011. In addition, there are no tax related interest or penalties for the periods presented in these financial statements.

11. RISKS AND UNCERTAINTIES

The Plan provides for various investment options in any combination of collective investment funds, stable value fund, mutual funds and shares of Fresenius Medical Care AG. Additionally, Plan participants can invest in a wide array of securities through a plan level brokerage account. Such investments are exposed to various risks, such as interest rate, market, and credit risks. Due to such risks, it is at least reasonably possible that changes in market values, interest rates or other factors in the near term would materially affect participants’ account balances and the amounts reported in the statement of net assets available for benefits.

12. TRANSFERS FROM/TO OTHER PLANS

Pursuant to acquisitions by the Company, the H.R. Administration 401(k) Plan, the Sheil Dialysis 401(k) Plan, the Dialysis Service Inc. (DSI) 401(k) Retirement Plan, Liberty Dialysis Hawaii Union Group 401(k) Plan, Nephrologist Physicians of Mishawaka 401 k Plan and Kidney Care Services 401 (k) loans were merged into the Plan in 2014. The aggregate amount of the assets merged into the Plan totaled $18,936,907.

13. SUBSEQUENT EVENTS

At the March 16, 2015 Administrative Committee meeting, the members of the committee voted and approved a freeze in the purchase of Fresenius Medical Care Stock as a funding option effective June 15, 2015. Participants who had investments in the stock were allowed to keep those shares and sell them at any point in the future. Any future purchase of Fresenius Medical Care Stock through the Plan would need to occur through the Brokerage Account.

19

Table of Contents

FRESENIUS MEDICAL CARE NORTH AMERICA 401(k) SAVINGS PLAN

I.D. NO. - 04-2835488

PLAN NO. - 002

FORM 5500, SCHEDULE H, PART IV, LINE 4i -

SCHEDULE OF ASSETS

(HELD AT END OF YEAR)

DECEMBER 31, 2014

|

|

|

(b) |

|

(c) |

|

(d) |

|

(e) |

|

|

(a) |

|

Identity of Issuer |

|

Description |

|

Cost |

|

Current Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Collective Investment Funds - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* |

|

BlackRock Institutional Trust Company N.A.: |

|

|

|

|

|

|

|

|

|

|

|

|

Equity Index Fund F |

|

17,732,312 |

|

Units |

|

** |

|

$ |

639,769,967 |

|

|

|

|

Russell 2000 Index Fund F |

|

4,176,221 |

|

Units |

|

** |

|

144,569,520 |

|

|

|

|

Mid Capitalization Equity Index Fund F |

|

2,205,922 |

|

Units |

|

** |

|

141,793,224 |

|

|

|

|

U.S. Debt Index Fund F |

|

5,042,114 |

|

Units |

|

** |

|

146,325,698 |

|

|

|

|

BlackRock MSCI ACWI ex - U.S. Index Fund F |

|

7,519,534 |

|

Units |

|

** |

|

160,282,643 |

|

|

|

|

U.S. Treasury Inflation Protected Securities Fund F |

|

636,037 |

|

Units |

|

** |

|

12,295,097 |

|

|

|

|

Emerging Markets Index Non-Lendable Fund F |

|

2,363,927 |

|

Units |

|

** |

|

43,660,094 |

|

|

|

|

|

|

|

|

|

|

|

|

1,288,696,243 |

|

|

* |

|

Fresenius Medical Care AG |

|

2,465,725 |

|

Shares (ADRs) |

|

** |

|

91,577,027 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mutual Fund - |

|

|

|

|

|

|

|

|

|

|

|

|

Vanguard Long Term Bond Index Fund |

|

939,212 |

|

Shares |

|

** |

|

13,393,162 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MassMutual Stable Value Fund |

|

Group annuity contract |

|

** |

|

365,596,903 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brokerage Link |

|

Brokerage accounts |

|

** |

|

17,606,761 |

|

|

|

|

|

|

|

|

|

|

|

|

|

* |

|

Participant loans |

|

Interest range of 3.25%-10.75% Maturing through January 2044 |

|

— |

|

64,703,159 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

$ |

1,841,573,255 |

|

|

* |

- |

denotes a party-in-interest as defined by ERISA |

|

** |

- |

participant directed |

SEE REPORTS OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRMS

20

Table of Contents

SIGNATURES

The Plan. Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

Fresenius Medical Care North America |

|

|

|

|

401(k) Savings Plan |

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

June 26, 2015 |

|

By: |

/s/ Mark Fawcett |

|

|

|

|

|

Mark Fawcett, Trustee |

21

Table of Contents

EXHIBIT INDEX

|

Exhibit No. |

|

Description of Exhibit |

|

Internal Page No. |

|

Sequential Page No. |

|

|

|

|

|

|

|

|

|

23.1 |

|

Consent of WithumSmith+Brown, PC |

|

23 |

|

26 |

|

|

|

|

|

|

|

|

|

23.2 |

|

Consent of Walsh, Jastrem & Browne, LLP |

|

24 |

|

27 |

22

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We hereby consent to the incorporation by reference in the Registration Statement on Form S-8 (Registration No. 333-8686) of our report dated June 26, 2015, relating to the financial statements and supplemental schedule of Fresenius Medical Care North America 401(k) Savings Plan included in this Annual Report on Form 11-K for the year ended December 31, 2014.

/s/WithumSmith+Brown, PC

Boston, Massachusetts

June 26, 2015

1

Exhibit 23.2

Consent of Independent Registered Public Accounting Firm

We hereby consent to the incorporation by reference in the Registration Statement on Form S-8 (Registration No. 333-8686) of our report dated June 26, 2014, relating to the financial statements and schedule of Fresenius Medical Care North America 401(k) Savings Plan included in this Annual Report on Form 11-K for the year ended December 31, 2014.

/s/Walsh, Jastrem & Browne, LLP

Boston, Massachusetts

June 26, 2015

1

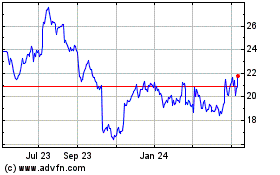

Fresenius Medical Care (NYSE:FMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

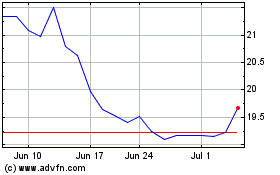

Fresenius Medical Care (NYSE:FMS)

Historical Stock Chart

From Apr 2023 to Apr 2024