UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 11-K

|

| |

(Mark One) |

| |

x | Annual Report Pursuant to Section 15(d) of the Securities Exchange Act of 1934 |

| For the fiscal year ended December 31, 2014 |

or

|

| |

¨ | Transition Report Pursuant to Section 15(d) of the Securities Exchange Act of 1934 |

| For the transition period from ______________ to ______________ |

Commission File Number 1-3548

ALLETE AND AFFILIATED COMPANIES

RETIREMENT SAVINGS AND STOCK OWNERSHIP PLAN

(Full title of the plan)

ALLETE, Inc.

30 West Superior Street

Duluth, Minnesota 55802-2093

(Name of issuer of securities

held pursuant to the plan and

the address of its principal

executive office)

Index

|

| |

| Page |

| |

Report of Independent Registered Public Accounting Firm | |

| |

Statement of Net Assets Available for Benefits - | |

December 31, 2014 and 2013 | |

| |

Statement of Changes in Net Assets Available for Benefits - | |

Year Ended December 31, 2014 | |

| |

Notes to Financial Statements | |

| |

Schedule 1: Schedule of Assets (Held at End of Year) - December 31, 2014 | |

| |

Signature | |

| |

Note: | Other schedules required by 29 CFR 2520.103.10 of the U.S. Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 are not applicable and as such, have been omitted. |

1

ALLETE 2014 RSOP Form 11-K

Report of Independent Registered Public Accounting Firm

To the Participants and Administrator of the

ALLETE and Affiliated Companies

Retirement Savings and Stock Ownership Plan

Duluth, MN

We have audited the accompanying statements of net assets available for benefits of the ALLETE and Affiliated Companies Retirement Savings and Stock Ownership Plan (“Plan”) as of December 31, 2014 and 2013, and the related statement of changes in net assets available for benefits for the year ended December 31, 2014. These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2014 and 2013, and the changes in its net assets available for benefits for the year ended December 31, 2014 in conformity with U.S. generally accepted accounting principles.

The accompanying Schedule of Assets Held (at year end) –December 31, 2014 has been subjected to audit procedures performed in conjunction with the audit of the Plan's financial statements. The information in the supplemental schedule is the responsibility of the Plan's management. Our audit procedures included determining whether the information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the information, we evaluated whether such information, including its form and content, is presented in conformity with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Reilly, Penner & Benton LLP

June 17, 2015

Milwaukee, Wisconsin

2

ALLETE 2014 RSOP Form 11-K

ALLETE and Affiliated Companies

Retirement Savings and Stock Ownership Plan

Statement of Net Assets Available for Benefits

|

| | | | | | |

| December 31, |

| 2014 | 2013 |

Thousands | | |

Assets | | |

Investments | | |

Participant Funds |

| $404,666 |

|

| $390,810 |

|

Unallocated Funds | 14,185 |

| 24,945 |

|

Total Investments | 418,851 |

| 415,755 |

|

Notes Receivable from Participants | 4,224 |

| 3,988 |

|

Employer Contributions Receivable | 231 |

| 372 |

|

Total Assets | 423,306 |

| 420,115 |

|

| | |

Liabilities | | |

Accrued Interest | 231 |

| 372 |

|

Long-Term Debt | 7,478 |

| 14,908 |

|

Total Liabilities | 7,709 |

| 15,280 |

|

Net Assets Available for Benefits |

| $415,597 |

|

| $404,835 |

|

3

ALLETE 2014 RSOP Form 11-K

ALLETE and Affiliated Companies

Retirement Savings and Stock Ownership Plan

Statement of Changes in Net Assets Available for Benefits

|

| | | | | | | | | |

| Year Ended December 31, 2014 |

| Participant Funds | Unallocated Funds | Total |

Thousands | | | |

Investment Income | | | |

Dividend Income |

| $2,101 |

|

| $772 |

|

| $2,873 |

|

Interest Income | 177 |

| 1 |

| 178 |

|

Net Appreciation in Fair Value of Investments | 28,984 |

| 1,359 |

| 30,343 |

|

Total Investment Income | 31,262 |

| 2,132 |

| 33,394 |

|

Contributions | | | |

Participant | 10,931 |

| — |

| 10,931 |

|

Employer | — |

| 4,364 |

| 4,364 |

|

Rollover | 1,127 |

| — |

| 1,127 |

|

Total Contributions | 12,058 |

| 4,364 |

| 16,422 |

|

Deductions | | | |

Benefits Paid to Participants | (20,142 | ) | — |

| (20,142 | ) |

Interest Expense | — |

| (797 | ) | (797 | ) |

Administrative Expenses | (186 | ) | — |

| (186 | ) |

Total Deductions | (20,328 | ) | (797 | ) | (21,125 | ) |

Transfers and Allocations | | | |

Transfers to Retirement Plans | (17,929 | ) | — |

| (17,929 | ) |

Allocations to Participants | 9,029 |

| (9,029 | ) | — |

|

Total Transfers and Allocations | (8,900 | ) | (9,029 | ) | (17,929 | ) |

Net Increase (Decrease) in Assets | 14,092 |

| (3,330 | ) | 10,762 |

|

Net Assets Available For Benefits | | | |

Beginning of Year | 394,798 |

| 10,037 |

| 404,835 |

|

End of Year |

| $408,890 |

|

| $6,707 |

|

| $415,597 |

|

The accompanying notes are an integral part of these statements.

4

ALLETE 2014 RSOP Form 11-K

ALLETE and Affiliated Companies

Retirement Savings and Stock Ownership Plan

Notes to Financial Statements

Note 1 - Description of the Plan

The ALLETE and Affiliated Companies Retirement Savings and Stock Ownership Plan (RSOP or Plan) is a defined contribution plan subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (ERISA), and qualifies as an employee stock ownership plan and profit sharing plan. At December 31, 2014, there were 2,116 participants in the RSOP. Participating affiliated companies (collectively, the Companies) at December 31, 2014, included:

| |

• | ALLETE, Inc., including Minnesota Power, a division of ALLETE, Inc. (ALLETE or Company); |

| |

• | Superior Water, Light and Power Company; |

| |

• | MP Affiliate Resources, Inc.; |

| |

• | ALLETE Renewable Resources, Inc. (ARR); |

| |

• | ALLETE Clean Energy, Inc.; |

| |

• | Florida Landmark Communities LLC (Florida Landmark); and |

| |

• | Palm Coast Holdings, Inc. (Palm Coast Holdings). |

The RSOP provides eligible employees of the Companies an opportunity to save for retirement by electing to make before-tax and after-tax contributions through payroll deduction, and directing the contributions into various 401(k) investment options. (See Participant Investment Options.) The RSOP also provides eligible employees of the Companies employee stock ownership benefits in ALLETE common stock (Common Stock).

Basis of Presentation

Participant funds represent the participants’ 401(k) investment funds and shares allocated to participants in the ALLETE RSOP Stock Fund. Unallocated funds represent unallocated shares to be allocated to the participants in the ALLETE RSOP Stock Fund in the future.

Administration

The Employee Benefit Plans Committee (Committee) administers the Plan for the Companies. The mailing address of the Committee is 30 West Superior Street, Duluth, Minnesota 55802-2093. The Committee consists of 11 members who are appointed by the Board of Directors of ALLETE. The Board of Directors of ALLETE has the power to remove members of the Committee from office. Members of the Committee are all employees of the Companies and receive no compensation for their services with respect to the Plan.

Committee responsibilities include the administration and payment of benefits in a manner consistent with the terms of the Plan and applicable law. The Committee has the authority to establish, modify, and repeal policies and procedures, as it deems necessary to carry out the provisions of the Plan. The Committee also has the authority to designate persons to carry out fiduciary responsibilities (other than trustee responsibilities) under the Plan. The Committee has the power to appoint an investment manager or managers (as defined by ERISA), attorneys, accountants, and such other persons as it shall deem necessary or desirable in the administration of the Plan. The Companies or the Plan pays administration fees and expenses of agents, outside experts, consultants, and investment managers. The Plan charges participants who take participant loans or use the Plan’s self-managed brokerage account feature for expenses relating to such loans or accounts.

5

ALLETE 2014 RSOP Form 11-K

Note 1 - Description of the Plan (Continued)

Wells Fargo Institutional Retirement and Trust (IRT), a service group of Wells Fargo Bank, N.A. (Wells Fargo), is the service provider for the Plan and handles participant recordkeeping, asset custody, trustee and certain other administrative responsibilities. IRT allows the Plan to value accounts daily and provides participants with on-line, call center and voice response capabilities to direct the investment of their account balances. Wells Fargo provides trustee and asset custody services and is located at 420 Montgomery Street, San Francisco, CA 94163. Wells Fargo carries professional liability coverage of $100 million per occurrence and in aggregate as well as errors and omissions coverage for the same amount.

Participant Investment Options

The Plan’s 401(k) investment fund options at December 31, 2014, are listed below. Detailed descriptions of the investment options and risk profiles are available to plan participants.

|

| | | |

• | Adirondack Small Cap Fund | • | LifePath Index 2050 Fund J |

• | ALLETE Stock Fund | • | LifePath Index 2055 Fund J |

• | Artisan International Investors Fund | • | MainStay Large Cap Growth I Fund |

• | Dodge & Cox International Stock Fund | • | Oakmark Equity & Income Fund I |

• | Dodge & Cox Stock Fund | • | Oppenheimer Developing Markets Y Fund |

• | LifePath Index Retirement Fund J | • | SSgA Russell Small Cap Index SL Series I |

• | LifePath Index 2020 Fund J | • | Small Cap Growth Fund |

• | LifePath Index 2025 Fund J | • | Vanguard Institutional Index Fund |

• | LifePath Index 2030 Fund J | • | Vanguard Mid-Cap Index Inst Fund |

• | LifePath Index 2035 Fund J | • | Vanguard Total Bond Market Index Inst Fund |

• | LifePath Index 2040 Fund J | • | Wells Fargo Stable Return Fund N25 |

• | LifePath Index 2045 Fund J | | |

Participants may also establish a self-managed brokerage account with Wells Fargo Advisors, LLC, which allows the participant to make investments in or transfers to a wide range of securities, including publicly traded stocks, bonds and mutual funds. Participants who have a self-managed brokerage account pay an annual fee in addition to any trading fees incurred upon investment changes.

Participants may change their level of contribution, change their investment elections for future contributions, and make transfers between investment options at any time by contacting IRT.

Redemption Fees. Certain mutual funds charge redemption fees that are paid out of the participant’s account. A redemption fee is charged when shares are transferred or exchanged out of the fund before the fund’s minimum holding period has been met.

|

| | | |

Summary of Redemption Fees by Fund | Effective Date | Redemption Fee | Minimum Holding Period |

As of December 31, 2014 | | | |

Artisan International Investors Fund | May 16, 2013 | 2% | 90 days |

6

ALLETE 2014 RSOP Form 11-K

Note 1 - Description of the Plan (Continued)

ALLETE sponsors a leveraged employee stock ownership plan (ESOP) within the RSOP. Eligible employees of the Companies receive Common Stock ownership benefits in the ALLETE RSOP Stock Fund. These benefits are primarily funded by payments made by the Plan on a loan (see Loan Account). Shares of Common Stock are allocated to eligible employees as provided by the Plan (see Basic Account, Special Account, Partnership Account, Bargaining Unit Account, and Matching Account). The shares of Common Stock allocated to a participant’s account in the ALLETE RSOP Stock Fund come from the Loan Account, as determined by ALLETE. Each participant’s account value, however, is determined on a unit basis and consists of both Common Stock and cash (see Note 4 - Investments). The unit value is adjusted each business day to reflect investment results, including cash.

Dividends are automatically reinvested in Common Stock held in the ALLETE RSOP Stock Fund. However, participants may make an election, at any time, to receive cash dividends paid on certain eligible shares. Units within a participant’s Pre-1989 Basic Account can be withdrawn at any time, while all other units within a participant’s account in the ALLETE RSOP Stock Fund can be withdrawn when the participant reaches age 59 ½, terminates employment, becomes a participant of the Companies long-term disability plan or dies. Participants may transfer all or any part of their ALLETE RSOP Stock Fund to other 401(k) investment options at any time.

Loan Account. The RSOP was amended in 1990 to establish a leveraged Loan Account and borrow $75 million (RSOP Loan) to acquire 2,830,188 newly issued shares of Common Stock (1,886,792 shares adjusted for stock splits) from ALLETE for the benefit of eligible participants. Under this amendment, active participants with a Basic Account are allocated shares to their Special Account with a value at least equal to: (a) dividends payable on shares held by those participants in the Plan; and (b) tax savings generated from the deductibility of dividends paid on all shares of Common Stock held in the RSOP as of August 4, 1989. In accordance with this amendment, a promissory note was issued to ALLETE for $75 million at a 10.25 percent interest rate with a term not to exceed 25 years. In 2006, the RSOP loan was refinanced at a 6 percent interest rate. The Loan Account may also provide for other allocation types as determined by the Company.

Basic Account. Participants’ Basic Accounts received shares of Common Stock purchased with incremental investment tax credit contributions and payroll-based tax credit contributions. Contributions to the participants’ Basic Accounts ceased after 1986.

Special Account. For the years 1985 through 1989, the Companies received a tax deduction for cash dividends paid to participants on ALLETE RSOP Stock Fund shares in their Basic Account. The Companies contributed, to the ALLETE RSOP Stock Fund, an amount equal to the estimated income tax benefit of the dividend deduction associated with eligible shares in the Basic Account. Shares of Common Stock purchased with these contributions were allocated to the participants’ Special Account.

Partnership Account. The fixed-percentage partnership allocation to each nonunion participant hired before October 1, 2006, ranges from 6 percent to 12 percent depending on the participant’s age (not including ARR, Florida Landmark and Palm Coast Holdings participants). The fixed-percentage partnership allocation to each nonunion participant hired on or after October 1, 2006, is 6 percent (not including Florida Landmark and Palm Coast Holdings participants). The fixed-percentage partnership allocation to Florida Landmark and Palm Coast Holdings participants is 3 percent. The fixed-percentage partnership allocation to each Minnesota Power Bargaining Unit union participant hired on or after February 1, 2011, is 6 percent. The partnership allocations are made quarterly and are based on periodic pay for the period.

7

ALLETE 2014 RSOP Form 11-K

Note 1 - Description of the Plan (Continued)

Bargaining Unit Account. Quarterly non-elective allocations are made to the ALLETE RSOP Stock Fund equal to 1 percent of each union participant’s eligible compensation.

Matching Account. For nonunion participants hired before October 1, 2006, (not including Florida Landmark and Palm Coast Holdings participants), quarterly matching allocations are made to the ALLETE RSOP Stock Fund equal to 100 percent of each nonunion participant’s 401(k) before-tax contributions and Roth 401(k) contributions, disregarding contributions in excess of 4 percent of the participant’s periodic pay for the period.

For nonunion participants hired on or after October 1, 2006, (not including Florida Landmark and Palm Coast Holdings participants), quarterly matching allocations are made to the ALLETE RSOP Stock Fund equal to 100 percent of each nonunion participant’s 401(k) before-tax contributions and Roth 401(k) contributions, disregarding contributions in excess of 5 percent of the participant’s periodic pay for the period.

For Minnesota Power Bargaining Unit union participants hired on or after February 1, 2011, quarterly matching allocations are made to the ALLETE RSOP Stock Fund equal to 100 percent of each union participant’s 401(k) before-tax contributions and Roth 401(k) contributions, disregarding contributions in excess of 5 percent of the participant’s periodic pay for the period.

Florida Landmark and Palm Coast Holdings participants are not eligible for matching allocations.

Contributions

Participant Contributions to the Plan consist of the following:

| |

• | Before-Tax Contributions. Before-tax contributions are salary reduction contributions equal to an amount the participant has elected to reduce his or her compensation pursuant to a salary reduction agreement. |

| |

• | Voluntary Contributions (After-Tax Contributions). Each participant is also allowed to make voluntary after-tax contributions to the Plan through payroll deductions. Total voluntary contributions made by a participant may not exceed 25 percent of the participant’s compensation in any pay period. |

| |

• | Rollovers. Contributions by participants may also be made through rollovers from other qualified plans or individual retirement accounts. |

| |

• | Roth 401(k) Contributions. Roth 401(k) contributions are after-tax salary reduction contributions equal to an amount the participant has elected to reduce his or her compensation pursuant to a salary reduction agreement. |

Contribution Limits. Total combined before-tax and Roth 401(k) contributions in 2014 could not exceed $17,500 for participants less than age 50 or $23,000 for participants at least age 50, as permitted under Section 401(k) of the Internal Revenue Code (Code).

Employer Contributions. Each year employer contributions are paid to the trustee either in cash or in Common Stock. Expenses incurred in discretionary activities relating to the design, formation, and modification of the Plan (commonly characterized as “settlor” functions) are paid by the Companies.

8

ALLETE 2014 RSOP Form 11-K

Note 1 - Description of the Plan (Continued)

Vesting and Forfeiture Account

As of July 1, 2001, all contributions to the Plan, plus actual earnings thereon, are fully vested and non-forfeitable. In 2005, the Plan was amended to allow distribution checks issued and outstanding for more than 180 days (unclaimed benefits) to be re-deposited into the Plan and treated as forfeitures. The forfeiture account consists of previously forfeited non-vested accounts and unclaimed benefits, totaling $5,463 at December 31, 2014 ($7,861 at December 31, 2013), and is invested in the LifePath Index Retirement Fund J and the Wells Fargo Stable Return Fund N25. In 2014, amounts in the forfeiture account were used for Plan expenses and may be used to reduce future Plan expenses.

Distributions and Withdrawals

A participant may elect, at any time, to receive future cash dividends paid on Common Stock shares in their eligible ALLETE RSOP Stock Fund accounts and ALLETE Stock Fund.

Prior to termination of employment, participants may withdraw, at any time, all or any part of the amounts in their:

| |

• | Plan accounts, if the participant has attained age 59 ½; |

| |

• | After-tax account, regardless of the participant’s age; or |

| |

• | Pre-1989 Basic Account, regardless of the participant’s age. |

When participants terminate employment, become disabled or die, they or their beneficiaries may elect to receive all or any part of their Plan accounts.

Transfers to Retirement Plans. Upon retirement, eligible participants may elect to transfer their Plan account balances to the ALLETE and Affiliated Companies Retirement Plan A or Plan B if the participant has elected to receive a benefit from one of these retirement plans. The amount of transfers to these retirement plans totaled $17,929,175 for 2014 ($17,459,848 for 2013). Starting in plan year 2015, certain limitations were implemented regarding eligibility, timing of elections, and the value of account balances that can be transferred to retirement plans.

Notes Receivable from Participants. The Plan allows participants to borrow money from their Plan accounts. The maximum amount a participant may borrow is equal to the lesser of: (a) the participant’s aggregate before-tax account, after-tax account and rollover account balances (excluding Roth 401(k) rollover balances); (b) 50 percent of their total Plan balance; or (c) $50,000, less the largest outstanding loan balance owed in the prior 12-month period. The loans may not be less than $1,000. The loans are for terms up to five years for a general-purpose loan and ten years for the acquisition of a primary residence. A fixed interest rate of the prime rate plus 1 percent on the first day of the month that the loan is originated is charged until the loan is repaid. As loans are repaid, generally through payroll deductions, principal and interest amounts are re-deposited into the participant’s Plan accounts. Participants are required to pay a $50 loan application fee to cover the cost of processing the loan.

Plan Termination

The Companies reserve the right to reduce, suspend, or discontinue their contributions to the Plan at any time, or to terminate the Plan in its entirety subject to the provisions of ERISA and the Code. If the Plan is terminated, all of the account balances of the participants will be distributed in accordance with the terms of the Plan. The Companies have no intention of terminating the Plan.

9

ALLETE 2014 RSOP Form 11-K

Note 2 - Summary of Accounting Policies

The Plan uses the accrual basis of accounting and, accordingly, reflects income in the year earned and expenses when incurred. Common stock and mutual fund investments are reported at fair value based on quoted market prices. Collective fund investments are reported at net asset value, which approximates fair value. Participant loans are classified as notes receivable from participants, which are segregated from plan investments and measured at their unpaid principal balance plus any accrued but unpaid interest.

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities and changes therein and disclosure of contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates.

The Plan presents, in the statement of changes in net assets available for benefits, the net appreciation (depreciation) in the fair value of its investments which consists of the realized gains or losses on disposed investments and the unrealized appreciation (depreciation) on those investments owned at year-end.

The Plan invests in various funds that contain a combination of stocks, bonds and other investment securities. Investment securities are exposed to various risks such as interest rate, market and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and such changes could materially affect the amounts reported in the statement of net assets available for benefits.

New Accounting Standards. In May 2015, the FASB issued revised guidance removing the requirement to categorize within the fair value hierarchy all investments for which fair value is measured using the net asset value per share practical expedient. The revised guidance is effective for the Plan in fiscal years beginning after December 15, 2015.

Subsequent Events. Management has evaluated subsequent events for possible recognition or disclosure through the date of financial statement issuance (June 17, 2015).

Starting in plan year 2015, certain limitations were implemented regarding eligibility, timing of elections, and the value of account balances that can be transferred to retirement plans.

Note 3 - Income Tax Status

A favorable determination letter dated September 19, 2013, was obtained from the Internal Revenue Service (IRS) stating that the RSOP, as amended and restated effective January 1, 2011, qualified as an employee stock ownership plan and a profit sharing plan under Section 401(a) of the Code. Consistent with the requirement that qualified plans receive a favorable determination from the IRS at least once every five years, another determination letter request will be filed with the IRS before January 31, 2017.

The Plan administrator believes that the Plan is designed and is currently being operated in compliance with the applicable requirements of the Code. Therefore, no provision for income tax has been made in the Plan financial statements. The Company is required to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that “more-likely-than-not” would not be sustained upon audit. The Plan administrator has analyzed the tax positions taken by the Plan, and has concluded as of December 31, 2014, there were no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset), or disclosure in the financial statements. The Plan is subject to routine audits by taxing authorities; however, there are currently no audits for any tax periods in process. The Plan is no longer subject to income tax examinations for years prior to 2011.

10

ALLETE 2014 RSOP Form 11-K

Note 4 - Investments

|

| | | | | | |

Fair Value of Investments | | |

Representing 5% or More of Net Assets | | |

At December 31, | 2014 |

| 2013 |

|

Thousands | | |

ALLETE RSOP Stock Fund |

| $120,378 |

|

| $123,089 |

|

ALLETE Stock Fund |

| $29,909 |

|

| $30,247 |

|

Wells Fargo Stable Return Fund N25 |

| $54,148 |

| — |

|

Vanguard Institutional Index Fund |

| $29,211 |

|

| $27,140 |

|

Oakmark Equity & Income Fund I |

| $24,072 |

|

| $23,413 |

|

Diversified Stable Value Trust | — |

|

| $59,922 |

|

The ALLETE RSOP Stock Fund represents shares of Common Stock allocated to participants, unallocated shares to be allocated to the participants in the ALLETE RSOP Stock Fund in the future, and cash invested in a money market fund.

|

| | | | | | | | | | |

| | | | Number | | Fair |

ALLETE RSOP Stock Fund | | | of Shares | Cost | Value |

Thousands | | | | | | |

December 31, 2014 | Allocated | — | Common Stock | 1,936 |

| $46,379 |

|

| $106,454 |

|

| | | Pending Transfer | | (789 | ) | (789 | ) |

| | | Money Market | | 528 |

| 528 |

|

| | | | | 46,118 |

| 106,193 |

|

| | | | | | |

| Unallocated | — | Common Stock | 238 | 3,663 |

| 13,389 |

|

| | | Pending Transfer | | 789 |

| 789 |

|

| | | Money Market | | 7 |

| 7 |

|

| | | | | 4,459 |

| 14,185 |

|

| | | | |

| $50,577 |

|

| $120,378 |

|

| | | | | | |

December 31, 2013 | Allocated | — | Common Stock | 1,973 |

| $48,421 |

|

| $98,436 |

|

| | | Pending Transfer | | (754 | ) | (754 | ) |

| | | Money Market | | 462 |

| 462 |

|

| | | | | 48,129 |

| 98,144 |

|

| | | | | | |

| Unallocated | — | Common Stock | 484 | 7,427 |

| 24,184 |

|

| | | Pending Transfer | | 754 |

| 754 |

|

| | | Money Market | | 7 |

| 7 |

|

| | | | | 8,188 |

| 24,945 |

|

| | | | |

| $56,317 |

|

| $123,089 |

|

11

ALLETE 2014 RSOP Form 11-K

Note 4 - Investments (Continued)

For the ALLETE Stock Fund and the ALLETE RSOP Stock Fund, each participant’s account value is determined on a unit basis and consists of both Common Stock and cash invested in a money market fund. The unit value is adjusted each business day to reflect investment results including cash.

|

| | | | | | | | | | | | | |

| ALLETE | | ALLETE |

| Stock Fund | | RSOP Stock Fund |

At December 31, | 2014 |

| 2013 |

| | 2014 |

| 2013 |

|

Thousands | | | | | |

Number of Units | 4,336 |

| 4,837 |

| | 14,402 |

| 14,702 |

|

| | | | | |

Common Stock |

| $29,484 |

|

| $29,449 |

| |

| $106,454 |

|

| $98,436 |

|

Money Market | 425 |

| 798 |

| | 528 |

| 462 |

|

Net Value |

| $29,909 |

|

| $30,247 |

| |

| $106,982 |

|

| $98,898 |

|

During the year ended December 31, 2014, the Plan's investments (including gains and losses on investments bought and sold, as well as held during the year) appreciated (depreciated) in value as follows:

|

| | | |

Net Appreciation in Plan Investments | |

Year Ended December 31, | 2014 |

|

Thousands | |

Common Stocks - Utilities |

| $19,540 |

|

Mutual Funds | 8,716 |

|

Collective Funds | 2,583 |

|

Self-Managed Brokerage Accounts | (198 | ) |

Managed Brokerage Funds - Stock | (298 | ) |

Net Appreciation in Plan Investments |

| $30,343 |

|

12

ALLETE 2014 RSOP Form 11-K

Note 5 - Fair Value Measurements

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (exit price). We utilize market data or assumptions that market participants would use in pricing the asset or liability, including assumptions about risk and the risks inherent in the inputs to the valuation technique. These inputs can be readily observable, market corroborated, or generally unobservable. These inputs, which are used to measure fair value, are prioritized through the fair value hierarchy. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are as follows:

Level 1 - Quoted prices are available in active markets for identical assets or liabilities as of the reported date. Active markets are those in which transactions for the asset or liability occur in sufficient frequency and volume to provide pricing information on an ongoing basis.

Level 2 - Pricing inputs are other than quoted prices in active markets, but are either directly or indirectly observable as of the reported date. The types of assets and liabilities included in Level 2 are typically either comparable to actively traded securities or contracts, such as treasury securities with pricing interpolated from recent trades of similar securities, or priced with models using highly observable inputs, such as commodity options priced using observable forward prices and volatilities. Collective trust funds and managed brokerage funds are valued at the net asset value (NAV) of shares of bank collective trust and managed brokerage fund held by the Plan on a daily basis. The NAV is based on the fair value of the underlying investments held by the funds. Participant transactions (issuances and redemptions) may occur daily. If the Plan were to initiate a full redemption of the collective trust, the investment advisor reserves the right to temporarily delay withdrawal from the trust in order to ensure that securities liquidations will be carried out in an orderly business manner.

Level 3 - Significant inputs that are generally less observable from objective sources. The types of assets and liabilities included in Level 3 are those with inputs requiring significant management judgment or estimation, such as the complex and subjective models and forecasts used to determine the fair value.

13

ALLETE 2014 RSOP Form 11-K

Note 5 - Fair Value Measurements (Continued)

The following table presents, for each of these hierarchy levels, the Plan’s assets that are measured at fair value on a recurring basis as of December 31, 2014.

|

| | | | | | | | | | | |

| Fair Value as of December 31, 2014 |

Recurring Fair Value Measures | Level 1 | Level 2 | Level 3 | Total |

Thousands | | | | |

Assets: | | | | |

Common Stock - Utilities |

| $149,327 |

| — |

| — |

|

| $149,327 |

|

Mutual Funds: | | | | |

Stock Funds | 70,719 |

| — |

| — |

| 70,719 |

|

Index Funds | 61,895 |

| — |

| — |

| 61,895 |

|

Balanced Funds | 24,072 |

| — |

| — |

| 24,072 |

|

Collective Funds: | | | | |

Fixed Income Funds | — |

|

| $54,148 |

| — |

| 54,148 |

|

Lifestyle Funds | — |

| 34,454 |

| — |

| 34,454 |

|

Index Funds | — |

| 5,071 |

| — |

| 5,071 |

|

Managed Brokerage Funds - Stock | — |

| 8,521 |

| — |

| 8,521 |

|

Money Market Funds | — |

| 960 |

| — |

| 960 |

|

Self-Managed Brokerage Accounts (a) | 9,684 |

| — |

| — |

| 9,684 |

|

Total Assets |

| $315,697 |

|

| $103,154 |

| — |

|

| $418,851 |

|

(a) All investments held in the Self-Managed Brokerage Accounts are classified as Level 1 due to the observable market data for

these securities.

The following table presents, for each of these hierarchy levels, the Plan’s assets that are measured at fair value on a recurring basis as of December 31, 2013.

|

| | | | | | | | | | | |

| Fair Value as of December 31, 2013 |

Recurring Fair Value Measures | Level 1 | Level 2 | Level 3 | Total |

Thousands | | | | |

Assets: | | | | |

Common Stock - Utilities |

| $152,069 |

| — |

| — |

|

| $152,069 |

|

Mutual Funds: | | | | |

Stock Funds | 71,837 |

| — |

| — |

| 71,837 |

|

Index Funds | 55,335 |

| — |

| — |

| 55,335 |

|

Balanced Funds | 23,413 |

| — |

| — |

| 23,413 |

|

Collective Funds: | | | |

|

|

Fixed Income Funds | — |

|

| $59,922 |

| — |

| 59,922 |

|

Lifestyle Funds | — |

| 27,784 |

| — |

| 27,784 |

|

Index Funds | — |

| 4,941 |

| — |

| 4,941 |

|

Managed Brokerage Funds - Stock | — |

| 9,950 |

| — |

| 9,950 |

|

Money Market Funds | — |

| 1,267 |

| — |

| 1,267 |

|

Self-Managed Brokerage Accounts (a) | 9,237 |

| — |

| — |

| 9,237 |

|

Total Assets |

| $311,891 |

|

| $103,864 |

| — |

|

| $415,755 |

|

(a) All investments held in the Self-Managed Brokerage Accounts are classified as Level 1 due to the observable market data for

these securities.

14

ALLETE 2014 RSOP Form 11-K

Note 5 - Fair Value Measurements (Continued)

The Plan’s policy is to recognize transfers in and transfers out of a given hierarchy level as of the actual date of the event or of the change in circumstances that caused the transfer. For the years ended December 31, 2014 and 2013, there were no transfers in or out of Levels 1, 2 or 3. There was no activity in Level 3 during the years ended December 31, 2014 and 2013.

The following table summarizes investments measured at fair value based on net asset value (NAVs) per share as of December 31, 2014.

|

| | | | | | |

Fair Value Estimated Using Net Asset Value per Share as of December 31, 2014 |

| Fair Value | Unfunded Commitments | Redemption Frequency (if currently eligible) | Redemption Notice Period |

Thousands | | | | |

Collective Funds: | | | | |

Fixed Income Funds (a) |

| $54,148 |

| n/a | Daily | Trade Date |

Lifestyle Funds (b) |

| $34,454 |

| n/a | Daily | Trade Date |

Index Funds (c) |

| $5,071 |

| n/a | Daily | Trade Date |

Managed Brokerage Funds - Stock (d) |

| $8,521 |

| n/a | Daily | Trade Date |

(a) The fixed income funds seek to preserve principal through investment in a diversified portfolio of high quality fixed income

investments.

(b) The lifestyle funds seek to provide an asset allocation strategy designed to maximize assets for retirement, or for other purposes,

consistent with the risk that investors, on average, may be willing to accept given their investment time horizon.

(c) The index funds seek an investment fund that approximates as closely as practicable, before expenses, the performance of the

Russell 2000 Index over the long term.

(d) The managed brokerage funds seek long-term capital appreciation by normally investing in small capitalization U.S. common

stocks of publicly traded companies that demonstrate strong growth characteristics.

The following table summarizes investments measured at fair value based on net asset value (NAVs) per share as of December 31, 2013.

|

| | | | | | |

Fair Value Estimated Using Net Asset Value per Share as of December 31, 2013 |

| Fair Value | Unfunded Commitments | Redemption Frequency (if currently eligible) | Redemption Notice Period |

Thousands | | | | |

Collective Funds: | | | | |

Fixed Income Funds (a) |

| $59,922 |

| n/a | Daily | Trade Date |

Lifestyle Funds (b) |

| $27,784 |

| n/a | Daily | Trade Date |

Index Funds (c) |

| $4,941 |

| n/a | Daily | Trade Date |

Managed Brokerage Funds - Stock (d) |

| $9,950 |

| n/a | Daily | Trade Date |

investments.

(b) The lifestyle funds seek to provide an asset allocation strategy designed to maximize assets for retirement, or for other purposes,

consistent with the risk that investors, on average, may be willing to accept given their investment time horizon.

(c) The index funds seek an investment fund that approximates as closely as practicable, before expenses, the performance of the

Russell 2000 Index over the long term.

(d) The managed brokerage funds seek long-term capital appreciation by normally investing in small capitalization U.S. common

stocks of publicly traded companies that demonstrate strong growth characteristics.

15

ALLETE 2014 RSOP Form 11-K

Note 6 - Repayment of Loan

The trustee repays principal and interest on the RSOP Loan with dividends paid on the shares of Common Stock in the Loan Account and with certain employer contributions to the Plan. The shares of Common Stock acquired by the trustee are held in the Loan Account, and allocated to the accounts of Plan participants as the RSOP Loan is repaid.

The RSOP Loan was obtained from ALLETE. There were 238,594 unallocated shares of Common Stock in the Plan pledged as collateral at December 31, 2014. Prepayments of principal can be made without penalty. The lender has no rights to shares of Common Stock that are allocated under the Plan.

|

| | | |

Principal Payments |

$75 Million 6% Loan |

Thousands |

2015 |

| $146 |

|

2016 | 7,332 |

|

|

| $7,478 |

|

16

ALLETE 2014 RSOP Form 11-K

ALLETE and Affiliated Companies

Retirement Savings and Stock Ownership Plan

Plan Number 002 / Employer Identification Number 41-0418150

Schedule of Assets (Held at End of Year)

Form 5500 Schedule H Line 4i

At December 31, 2014

Thousands

|

| | | | | | | | |

| Identity of Issuer | Description of Investment | Cost (a) | Current Value |

| ALLETE RSOP Stock Fund | | | |

* | ALLETE, Inc. | Common Stock - 2,174 Shares |

| $50,042 |

|

| $119,843 |

|

* | Wells Fargo Advantage Heritage Money Market Fund Institutional | Money Market | 535 |

| 535 |

|

| Total ALLETE RSOP Stock Fund | |

| $50,577 |

| 120,378 |

|

| | | | |

| ALLETE Stock Fund | | | |

* | ALLETE, Inc. | Common Stock - 535 Shares | | 29,484 |

|

* | Wells Fargo Advantage Heritage Money Market Fund Institutional | Money Market | | 425 |

|

| Total ALLETE Stock Fund | | | 29,909 |

|

| | | | |

| Collective Fund Securities | | | |

| LifePath Index Retirement Fund J | Collective Fund - 698 Shares | | 9,815 |

|

| LifePath Index 2020 Fund J | Collective Fund - 358 Shares | | 4,863 |

|

| LifePath Index 2025 Fund J | Collective Fund - 289 Shares | | 3,927 |

|

| LifePath Index 2030 Fund J | Collective Fund - 318 Shares | | 4,325 |

|

| LifePath Index 2035 Fund J | Collective Fund - 200 Shares | | 2,714 |

|

| LifePath Index 2040 Fund J | Collective Fund - 224 Shares | | 3,026 |

|

| LifePath Index 2045 Fund J | Collective Fund - 173 Shares | | 2,338 |

|

| LifePath Index 2050 Fund J | Collective Fund - 188 Shares | | 2,562 |

|

| LifePath Index 2055 Fund J | Collective Fund - 54 Shares | | 884 |

|

| SSgA Russell Small Cap Index SL Series I | Collective Fund - 309 Shares | | 5,071 |

|

* | Wells Fargo Stable Return Fund N25 | Collective Fund - 4,740 Shares | | 54,148 |

|

| Total Collective Fund Securities | | | 93,673 |

|

| | | | |

| Mutual Fund Securities | | | |

| Adirondack Small Cap Fund | Mutual Fund - 472 Shares | | 9,999 |

|

| Artisan International Investors Fund | Mutual Fund - 266 Shares | | 7,983 |

|

| Dodge & Cox International Stock Fund | Mutual Fund - 194 Shares | | 8,190 |

|

| Dodge & Cox Stock Fund | Mutual Fund - 104 Shares | | 18,749 |

|

| MainStay Large Cap Growth I Fund | Mutual Fund - 873 Shares | | 9,127 |

|

| Oakmark Equity & Income Fund I | Mutual Fund - 754 Shares | | 24,072 |

|

| Oppenheimer Developing Markets Y Fund | Mutual Fund - 476 Shares | | 16,671 |

|

| Vanguard Institutional Index Fund | Mutual Fund - 155 Shares | | 29,211 |

|

| Vanguard Mid-Cap Index Inst Fund | Mutual Fund - 585 Shares | | 19,771 |

|

| Vanguard Total Bond Market Index Inst Fund | Mutual Fund - 1,188 Shares | | 12,913 |

|

| Total Mutual Fund Securities | | | 156,686 |

|

| | | | |

| Small Cap Growth Fund | Managed Brokerage Fund - 715 Shares | | 8,521 |

|

| | | | |

| Self-Managed Brokerage Accounts | | | 9,684 |

|

| | | | |

* | Participant Loans | Loans Receivable from Participants - 3.75% to 9.25% | | 4,224 |

|

| Total Investments | | |

| $423,075 |

|

(a) Not required for participant-directed transactions.

* Party in Interest

See Independent Auditors’ Report

17

ALLETE 2014 RSOP Form 11-K

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, ALLETE, Inc., as plan administrator, has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | ALLETE and Affiliated Companies |

| | Retirement Savings and Stock Ownership Plan |

| | | |

| | By: | ALLETE, Inc., its Plan Administrator |

| | | |

| | | |

| | | |

June 17, 2015 | | | /s/ Alan R. Hodnik |

| | | Alan R. Hodnik |

| | | Chairman, President and Chief Executive Officer |

18

ALLETE 2014 RSOP Form 11-K

Exhibit 23

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the Registration Statement (333-162890) on Form S-8 of ALLETE, Inc. of our report dated June 17, 2015, with respect to the statements of net assets available for benefits of the ALLETE and Affiliated Companies Retirement Savings and Stock Ownership Plan for the years ended December 31, 2014 and 2013, the related statement of changes in net assets available for benefits for the year ended December 31, 2014, and the related supplemental schedule as of December 31, 2014, which report appears in the December 31, 2014, annual report on Form 11-K of the ALLETE and Affiliated Companies Retirement Savings and Stock Ownership Plan.

/s/ Reilly, Penner & Benton LLP

Reilly, Penner & Benton LLP

Milwaukee, Wisconsin

June 17, 2015

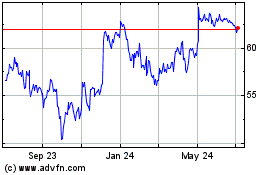

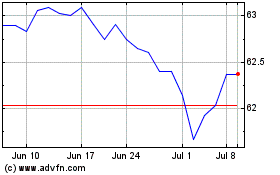

Allete (NYSE:ALE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Allete (NYSE:ALE)

Historical Stock Chart

From Apr 2023 to Apr 2024