TIDMAAZ

RNS Number : 1662L

Anglo Asian Mining PLC

17 July 2017

Anglo Asian Mining plc / Ticker: AAZ / Index: AIM / Sector:

Mining

17 July 2017

Anglo Asian Mining plc

Q2 & HY1 2017 Production Update and Operations Review

Gedabek Gold, Copper and Silver mine, Azerbaijan

Anglo Asian Mining plc ("Anglo Asian" or "the Company"), the AIM

listed gold, copper and silver producer focused in Azerbaijan, is

pleased to provide an operations and production update for its

Gedabek gold, copper and silver mine ("Gedabek") in western

Azerbaijan for the three months to 30 June 2017 ("Q2 2017") and the

six months to 30 June 2017 ("HY1 2017").

Note that all references to "$" are to United States

dollars.

Production overview

Q2 2017

-- Gold production for Q2 2017 totalled 12,140 ounces - 9,131

ounces contained within gold doré, 4 ounces from SART processing

and 3,005 ounces from flotation (Q1 2017: total 11,078 ounces)

-- Copper production for Q2 2017 totalled 716 tonnes - 187

tonnes from SART processing and 529 tonnes from flotation (Q1 2017:

total 606 tonnes)

-- Silver production for Q2 2017 totalled 45,718 ounces - 3,266

ounces contained within gold doré, 4,717 ounces from SART

processing and 37,735 ounces from flotation (Q1 2017: total 39,369

ounces)

-- Total production for Q2 2017 expressed as gold equivalent

ounces of 14,775 ounces (Q1 2017: 13,779 gold equivalent

ounces)

HY1 2017

-- Gold production for HY1 2017 totalled 23,218 ounces - 18,389

ounces contained within gold doré, 9 ounces from SART processing

and 4,820 ounces from flotation (HY1 2016: total 33,837 ounces)

-- Copper production for HY1 2017 totalled 1,322 tonnes - 397

tonnes from SART processing and 925 tonnes from flotation (HY1

2016: total 969 tonnes)

-- Silver production for HY1 2017 totalled 85,087 ounces - 5,713

ounces contained within gold doré, 10,240 ounces from SART

processing and 69,134 ounces from flotation (HY1 2016: total 90,782

ounces)

-- Total production for H1 2017 expressed as gold equivalent

ounces of 28,554 ounces (H1 2016: 36,729 gold equivalent

ounces)

FY 2017

-- Target production for the 12 months to 31 December 2017

expressed as gold equivalent ounces remains at between 64,000

ounces and 72,000 ounces compared to FY 2016 actual total

production of 72,304 gold equivalent ounces

Sales overview

-- Q2 2017 gold bullion sales of 7,406 ounces at an average of

$1,258 per ounce (Q1 2017: 8,283 ounces at an average of $1,220 per

ounce)

-- Q2 2017 copper concentrate shipments to the customer totalled

3,166 dry metric tonnes ("dmt") with a sales value of $6.1 million

(excluding Government of Azerbaijan production share) (Q1 2017:

2,230 dmt with a sales value of $4.4 million)

Operational update

-- Water treatment plant installation is complete and commissioning to start imminently

-- Development of Ugur deposit progressing on schedule with

anticipated commencement of mining in Q4 2017

-- Ugur development update by RNS news release expected before the end of July 2017

Company financials

-- Net debt, being interest-bearing loans and borrowings, less

cash and cash equivalents, totalled $29.0 million at 30 June 2017

($33.1 million at 31 March 2017)

Anglo Asian CEO Reza Vaziri commented, "This has been a strong

quarter for Anglo Asian with a 7 per cent. increase in production

to 14,775 ounces expressed as gold equivalent ounces despite the

introduction of our production optimisation activities which we had

anticipated would temporarily impact our production profile. Our

net debt also continues to decrease. The continuation of mining

activities at the Gedabek open pit, whilst simultaneously

developing the new open pit at the Ugur deposit, was possible due

to careful utilisation of equipment and personnel. Maintaining

production during this phase of optimisation is a significant

achievement for Anglo Asian and puts us in a strong position as we

look to increase production from current levels with the

introduction of ore from Ugur in Q4 2017.

"Our forecast for FY 2017 remains at between 64,000 ounces and

72,000 ounces whilst we continue our production optimisation

programme, providing a very solid platform for us to build on in

2018 and beyond."

Production and sales details

The Company has continued in Q2 2017 with its strategy for 2017

as announced on 18 April 2017. This strategy was in response to ore

mined from the open pit in H2 2016 having a lower gold grade and a

higher percentage of copper than ore previously mined. An extensive

programme of exploration and production optimisation is therefore

being carried out in 2017. Ore production from a new open pit at

the Ugur gold deposit discovered in 2016 is also planned to start

before the end of the year. The Company will also process part of

its 1.1 million tonnes of high copper content ore stockpiles in

2017. To process this stockpiled ore, the flotation plant is being

used to treat the ore to remove copper prior to leaching. Mining

will be temporarily reduced or stopped in the open pit during 2017

and approximately 15,000 metres of drilling will be carried out in

furtherance of this programme.

During Q2 2017, the Company mined 336,096 tonnes of ore from its

Gedabek open pit (Q1 2017: 398,028 tonnes of ore from its Gedabek

open pit). Continued mining was made possible during the quarter

due to careful utilisation of equipment and human resources. 9,591

tonnes of ore with an average grade of 5.17 grammes per tonne was

also mined, in conjunction with its exploration programme, from the

Gadir underground mine in Q2 2017.

As previously reported, low grade ore (less than 1.5 grammes per

tonne of gold) is being treated by heap leaching, whilst higher

grade ore (more than 1.5 grammes per tonne of gold) is being

processed through the combined agitation leaching and flotation

plants.

During Q2 2016, the Company stacked 162,147 tonnes of dry

crushed ore onto heap leach pads with an average gold grade of 1.05

grammes per tonne (Q1 2017: 110,348 tonnes with an average gold

content of 1.00 grammes per tonne). The Company also heap leached

uncrushed (Run of Mine - "ROM") ore. During Q2 2017, the Company

stacked 115,559 tonnes of ROM ore onto heap leach pads with an

average gold grade of 0.89 grammes per tonne (Q1 2017: 103,622

tonnes with an average gold grade of 0.87 grammes per tonne).

During Q2 2017, the Company processed 179,454 tonnes of ore with

an average gold content of 1.77 grammes per tonne through the

combined agitation leaching and flotation plants (Q1 2017: 184,074

tonnes of ore with an average gold content of 1.52 grammes per

tonne). Of the ore processed, 108,417 tonnes were mined during Q2

2017 from the open pit and the Gadir and Gosha underground mines

and 71,037 tonnes were from the Company's stockpiles.

During Q2 2017, the Company produced gold doré containing 9,131

ounces of gold and 3,266 ounces of silver at Gedabek. The agitation

leaching plant produced 4,606 and 1,641 ounces of gold and silver,

respectively, and the heap leach operations produced 4,525 and

1,625 ounces of gold and silver, respectively. (Q1 2017, gold doré

containing 9,258 ounces of gold and 2,447 ounces of silver at

Gedabek. The agitation leaching plant produced 5,508 and 1,352

ounces of gold and silver, respectively, and the heap leach

operations produced 3,750 and 1,095 ounces of gold and silver,

respectively).

Operational update

The Company continues to make solid progress with its water

treatment plant and installation of the plant is finished.

Commissioning is expected to start imminently and take around two

weeks to complete.

Development of the new Ugur gold deposit continues on schedule

with good progress being made building the road between the deposit

and the Company's processing facilities. A full update on the

exploration and development activities at Ugur is anticipated by

RNS news release before the end of July 2017.

Production Details

The following table summarises gold doré production and sales at

Gedabek for FY 2016 and H1 2017:

Gold produced* Silver Gold sales** Gold Sales

(ounces) Produced* (ounces) price

(ounces) ($/ounce)

Quarter ended

31 March 2016 13,383 1,958 12,143 1,184

30 June 2016 17,926 2,983 15,661 1,265

H1 2016 31,309 4,941 27,804 1,230

30 Sept 2016 15,407 2,502 12,567 1,332

31 Dec 2016 14,221 2,845 12,995 1,227

H2 2016 29,628 5,347 25,562 1,278

FY 2016 60,937 10,288 53,366 1,253

31 March 2017 9,258 2,447 8,283 1,220

30 June 2017 9,131 3,266 7,406 1,258

H1 2017 18,389 5,713 15,689 1,238

-------------- -------------- ----------- ------------- ----------

* including Government of Azerbaijan's share

** excludes Government of Azerbaijan's share

The following table summarises copper concentrate production

from both its SART and flotation plants at Gedabek for FY 2016 and

H1 2017:

Concentrate Copper Gold Silver

production* content* content* content*

2016 (dmt) (tonnes) (ounces) (ounces)

Quarter ended 31

March

SART processing 363 181 12 7,789

Flotation** 1,458 200 607 19,055

Total 1,821 381 619 26,844

Quarter ended 30

June

SART processing 373 195 4 10,047

Flotation** 1,988 302 1,445 39,184

Total 2,361 497 1,449 49,231

Quarter ended 30

Sept

SART processing 418 225 4 7,291

Flotation 1,426 260 1,123 24,106

Total 1,844 485 1,127 31,397

Quarter ended 31

December

SART processing 445 219 7 6,751

Flotation 2,059 359 1,255 40,620

Total 2,504 578 1,262 47,371

2017

Quarter ended 31

March

SART processing 428 210 5 5,523

Flotation 2,312 396 1,815 31,399

Total 2,740 606 1,820 36,922

Quarter ended 30

June

SART processing 418 187 4 4,717

Flotation 3,273 529 3,005 37,735

Total 3,691 716 3,009 42,452

------------------ ------------ --------- --------- ---------

* including Government of Azerbaijan's share.

** certain amounts for flotation production are different to

those previously disclosed due to final reconciliation of

production and sales.

The following table summarises copper concentrate production and

sales at Gedabek for FY 2016 and H1 2017. Note that sales of

concentrates are initially recorded at provisional amounts until

agreement of final assay:

Concentrate Copper Gold Silver Concentrate Concentrate

production* content* content* content* sales** sales**

(dmt) (tonnes) (ounces) (ounces) (dmt) ($000)

Quarter

ended

31 March

2016 1,821 381 619 26,844 1,319 2,137

30 June

2016 2,361 497 1,449 49,231 1,582 2,977

H1 2016 4,182 878 2,068 76,075 2,901 5,114

30 Sept

2016 1,844 485 1,127 31,397 1,782 3,612

31 Dec

2016 2,504 578 1,262 47,371 2,147 3,865

H2 2016 4,348 1,063 2,389 78,768 3,929 7,477

FY 2016 8,530 1,941 4,457 154,843 6,830 12,591

31 March

2017 2,740 606 1,820 36,922 2,230 4,424

30 June

2017 3,691 716 3,009 42,452 3,166 6,104

H1 2017 6,431 1,322 4,829 79,374 5,396 10,528

---------- ------------ --------- --------- --------- ------------- --------------

* including Government of Azerbaijan's share

** excludes Government of Azerbaijan's share

The Company had net debt at 30 June 2017 of $29.0 million, a

reduction of $4.1 million since 31 March 2017. The net debt at 30

June 2017 was as follows:

$m

Amsterdam Trade Bank - Agitation plant

loan 6.2

Gazprombank - Agitation plant loan 6.2

International Bank of Azerbaijan - loan 3.9

International Bank of Azerbaijan - credit

line 0.5

Atlas Copco equipment finance loan 0.5

YapiKredit 2.6

Pasha Bank 6.2

Kapital bank 0.5

Director 3.8

Total loans 30.4

Cash on hand and at bank (1.4)

Net debt 29.0

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

**ENDS**

For further information please visit www.angloasianmining.com or

contact:

Anglo Asian Mining Tel: +994 12 596

Reza Vaziri plc 3350

-------------------- ------------------- ------------------

Anglo Asian Mining Tel: +994 502 910

Bill Morgan plc 400

-------------------- ------------------- ------------------

Ewan Leggat SP Angel Corporate Tel: +44 (0) 20

Finance LLP 3470 0470

Nominated Adviser

and Broker

-------------------- ------------------- ------------------

Soltan Tagiev SP Angel Corporate Tel + 44 (0) 20

Finance LLP 3470 0470

-------------------- ------------------- ------------------

Susie Geliher St Brides Partners Tel: +44 (0) 20

Ltd 7236 1177

-------------------- ------------------- ------------------

Lottie Brocklehurst St Brides Partners Tel: +44 (0) 20

Ltd 7236 1177

-------------------- ------------------- ------------------

Notes:

Anglo Asian Mining plc (AIM:AAZ) is a gold, copper and silver

producer in Central Asia with a broad portfolio of production and

exploration assets in Azerbaijan. The Company has a 1,962 square

kilometre portfolio, assembled from analysis of historic Soviet

geological data and held under a Production Sharing Agreement

modelled on the Azeri oil industry.

The Company developed Azerbaijan's first operating

gold/copper/silver mine, Gedabek, which commenced gold production

in May 2009. Gedabek is an open cast mine with a series of

interconnected pits. The Company also operates the high grade Gadir

underground mine which is co-located at the Gedabek site. The

Company has a second underground mine, Gosha, which is 50

kilometres from Gedabek. Ore mined at Gosha is processed at Anglo

Asian's Gedabek plant.

Gold production for the year ended 31 December 2016 from Gedabek

totalled 65,394 ounces with 1,941 tonnes of copper also produced.

Gedabek is a polymetallic deposit and its ore has a high copper

content, and as a result the Company produces copper concentrate

from its Sulphidisation, Acidification, Recycling, and Thickening

(SART) plant. Anglo Asian also produces a copper and precious metal

concentrate from its flotation plant, which is processing tailings

from the agitation leach plant.

Anglo Asian is also actively seeking to exploit its first mover

advantage in Azerbaijan to identify additional projects, as well as

looking for other properties in order to fulfil its expansion

ambitions and become a mid-tier gold and copper metal production

company.

This information is provided by RNS

The company news service from the London Stock Exchange

END

UPDEZLFFDDFBBBQ

(END) Dow Jones Newswires

July 17, 2017 02:00 ET (06:00 GMT)

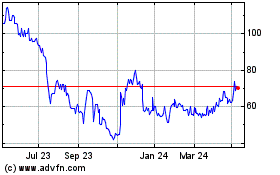

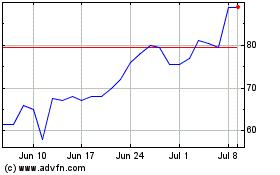

Anglo Asian Mining (LSE:AAZ)

Historical Stock Chart

From Aug 2024 to Sep 2024

Anglo Asian Mining (LSE:AAZ)

Historical Stock Chart

From Sep 2023 to Sep 2024