TIDMAML

RNS Number : 3877X

Amlin PLC

19 November 2014

Amlin plc

PRESS RELEASE

For immediate release

19 November 2014

Interim Management Statement for the nine month period to 30

September 2014

Amlin has continued to generate healthy returns despite the

ongoing challenging trading environment, supported by its

increasingly diversified nature and strong client proposition.

Underwriting

Gross written premium for the nine months ended 30 September

2014 was up 4.2% at GBP2,288.1 million (30 September 2013:

GBP2,195.7 million). At constant rates of exchange, the increase

was 9.9%. As previously reported, growth includes income

attributable to multi-year reinsurance contracts, and adjusting for

the premium attributable to future years, growth at constant rates

of exchange was 7.9%.

Average renewal rates were down 3.5% (30 September 2013: flat)

and the renewal retention ratio was healthy at 85.5% (30 September

2013: 86.5%).

Following the changes made to outwards reinsurance at the start

of the year, net written premium increased by 8.8%.

Premium income by division is analysed in the table below.

Gross Renewal Renewal Gross Renewal Renewal

written rate written rate

premium change premium change

to 30 to to 30 to

Sept Sept

2014

GBP million 30 Sept retention 2013 30 Sept retention

ratio 2013 ratio

to to

2014 30 Sept GBP million % 30 Sept

% 2014 2013

% %

Amlin London 1,076.6 (5.3) 85.6 985.3 (0.8) 86.4

Amlin UK 257.4 2.9 78.8 269.6 4.2 86.2

Amlin Bermuda 340.2 (8.3) 85.1 331.3 (3.1) 83.3

Amlin Re Europe 242.5 (0.9) 92.3 196.3 2.4 90.3

Amlin Europe 371.4 (0.3) 86.6 413.2 0.1 88.0

Total / average 2,288.1 (3.5) 85.5 2,195.7 (0.1) 86.5

Note: Gross written premium by division is shown excluding the

impact of intra-group transactions.

The underwriting environment has become more challenging in

property catastrophe reinsurance. However, Amlin's strong client

proposition, enhanced by Leadenhall Capital Partners, has enabled

Amlin to achieve modest growth of 5.3% with a focus on those areas

where pricing meets hurdle rates of return. The average renewal

rate decrease was 8.2%.

Other reinsurance classes have not experienced the same degree

of pressure and Amlin Re Europe has continued to develop

positively, adding GBP41.1 million of new business for the nine

months period, mostly from growth in non-catastrophe lines, which

achieved an average rate increase of 0.3%. In addition, Amlin

Bermuda added GBP16.8 million of new proportional reinsurance

business.

In our UK commercial business, UK fleet motor rates have

continued to rise, with an average increase of 5.7% in the first

nine months. Most other UK commercial classes have had more modest

increases.

Rates for Amlin London's Property & Casualty business

declined by 1.2%. However, new income of GBP64.5 million was added

across classes. Renewal rates for Amlin's London Marine &

Aviation business decreased by an average of 3.9%, with the energy

class experiencing a rate reduction of 8.9%.

Continental European insurance markets remain competitive but

rates have been stable.

Outwards reinsurance

Reinsurance expenditure in the nine months to 30 September 2014

was GBP273.1 million, representing 11.9% of gross written premium

(30 September 2013: GBP343.5 million and 15.6%). As previously

reported, the reduction reflects the closure of Special Purpose

Syndicate 6106, which accounted for GBP34.2 million of reinsurance

expenditure in the prior period, together with improved

retrocessional purchase, with lower rates and greater cover

available on attractive terms. In addition, outwards reinsurance

expenditure for insurance classes has been reduced. With the

assistance of more sophisticated modelling, the Group decided to

internalise a proportion of a number of programmes.

Claims and reserves

There were no major catastrophe losses in the third quarter. The

largest loss events in the year to date remain the European

hailstorms and Nebraska tornado, both in June. Claims estimates for

both these events have increased in the quarter, by GBP7.7 million

to GBP32.9 million and GBP6.1 million to GBP29.8 million

respectively.

Smaller catastrophe and large risk losses in the quarter, the

most significant of which resulted from the terrorist attacks at

Tripoli Airport, amounted to GBP33.4 million, bringing the nine

month total to GBP59.9 million.

Claims reserves for prior years have continued to run-off

positively with releases in the first nine months totalling GBP63.6

million (30 September 2013: GBP79.3 million). Releases in the third

quarter of GBP23.5 million were predominantly due to positive

claims development in Amlin London and Amlin Europe.

Investment returns and foreign exchange

The investment return for the nine month period was 1.8%, with

average funds under management of GBP4.3 billion. During the period

bonds - duration returned 1.4%, bonds - absolute return 1.5%, cash

and cash equivalents 0.4%, equities 2.6% and property 5.8%.

The asset allocation (based on allocations to sub-advisors) at

30 September 2014 was 20% bonds - duration, 54% bonds - absolute

return, 6% cash and cash equivalents, 14% equities and 6%

property.

The strengthening of the US dollar during the third quarter

generated GBP28.0 million of foreignexchange gains on translation

of foreign operations (net of designated hedges) through reserves,

partially reversing previous translation losses.

Other developments

On 24 October, Amlin announced that it had increased its

existing interest in Leadenhall Capital Partners (LCP) from 40% to

75%. The remaining 25% interest will continue to be held by the

individual partners of LCP. The current management team of John

Wells (Chairman) and Luca Albertini (CEO and CIO) will remain in

their existing roles. The team manages $1.8 billion (as at

September 2014) of assets across three separate funds and managed

accounts.

LCP provides asset management solutions to institutional clients

in the (re)insurance-linked securities (ILS) market. ILS has grown

materially over recent years, particularly in reinsurance, and

Amlin is one of only a few (re)insurers to have an aligned business

in this area. Significant synergies have already been developed

between LCP and Amlin's reinsurance business, and the increased

stake provides both businesses with a valuable strategic

advantage.

On 1 September, Amlin reorganised its client facing operations

into three global strategic business units: Reinsurance, Marine and

Aviation and Property and Casualty. This will allow an even greater

focus on clients' needs and relationships and is expected to

enhance our long term growth potential through a globally

co-ordinated market approach. At the same time, the Group

consolidated Amlin's claims and business support functions to

improve service to our clients. In addition, the changes will

increase efficiency and scalability over the medium term.

On 21 August, Amlin appointed Oliver Peterken as an Independent

Non-Executive Director.

Charles Philipps, Amlin's Chief Executive, commented: "We are

pleased with our progress to date in 2014 and are confident that we

can continue to deliver healthy returns for shareholders. Against a

backdrop of intensifying competition as a result of increasing

industry capital, we have successfully maintained underwriting

discipline while making good progress in building a more

diversified business which is better suited to meeting the

challenges of the current environment."

Enquiries:

Charles Philipps, Chief Executive,

Amlin plc 0207 746 1000

Richard Hextall, Chief Finance & Operations

Officer, Amlin plc 0207 746 1000

Analysts and Investors

Julianne Jessup, Global Head of Investor

& Media Relations, Amlin plc 0207 746 1961

Media

Ed Berry, FTI Consulting 0203 727 1046

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSGMMMMGRZGDZZ

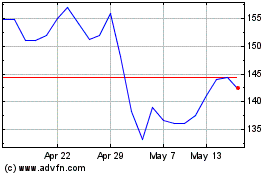

Aston Martin Lagonda Glo... (LSE:AML)

Historical Stock Chart

From Aug 2024 to Sep 2024

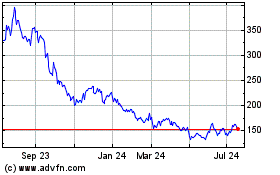

Aston Martin Lagonda Glo... (LSE:AML)

Historical Stock Chart

From Sep 2023 to Sep 2024