TIDMAMO

RNS Number : 5756T

Amino Technologies PLC

21 July 2015

21 July 2015

AMINO TECHNOLOGIES PLC

INTERIM RESULTS

FOR THE SIX MONTHS ENDED 31 MAY 2015

CONTINUED OPERATING PROFIT GROWTH AND CASH GENERATION

Amino Technologies plc ('Amino' or the 'Company') (LSE: AMO),

the Cambridge-based leader in digital entertainment solutions for

IPTV, Internet TV and in-home multimedia distribution, announces

unaudited consolidated results for the period ended 31 May

2015.

Financial overview

-- Revenue of GBP17.9m (H1 2014: GBP16.4m) representing y-o-y growth of 9%

-- Gross profit growth 23% to GBP9.1m (H1 2014: GBP7.4m)

-- Gross margin strengthened to 50.8% (H1 2014: 44.9%) reflecting an improved product mix

-- EBITDA before exceptional items grew by 34% to GBP3.9m (H1

2014: GBP2.9m), representing a 4.3% improvement in EBITDA margin

(EBITDA margin 22.0%; H1 2014: 17.7%)

-- Basic earnings per share increased to 5.44p (H1 2014: 3.29p excluding exceptional items)

-- Adjusted operating profit up 56% to GBP2.8m (H1 2014: GBP1.8m) before exceptional items

-- Net cash generated by operating activities up 19% to GBP3.8m (H1 2014: GBP3.2m)

-- Strong net cash balance maintained at GBP17.3m (H1 2014:

GBP19.7m), notwithstanding the acquisition of Booxmedia Oy for

initial cash consideration net of cash acquired of GBP4.5m and an

increase in FY14 dividend of GBP0.7m

-- Interim dividend increased by 10% to 1.265p per share,

payable on 17 September 2015 (H1 2014: 1.15p per share)

Operational highlights:

-- Strong performance in key North American market with take-up of new products

-- New 4K Ultra-HD platform showcased at leading industry trade event

-- Acquisition of Booxmedia Oy, adding the delivery of "TV everywhere" to Amino's offering

-- YouTube certification for new IP device portfolio delivers

new value added content to customers

Post period-end, and as announced separately today, Amino has

conditionally agreed to acquire the entire issued share capital of

Entone Inc. ("Entone") for a total consideration of $73.0 million

(GBP46.7 million) in a transformational acquisition in line with

the Company's strategic goals.

Commenting on today's results and proposed acquisition, Keith

Todd CBE, Non-Executive Chairman said:

"Today's results mark a real turning point for Amino. Following

a significant amount of hard work, and thanks to a clear and well

thought-out strategy, our business has reignited its organic

revenue growth, extended its margins and profitability, and begun

to put in place some very exciting building blocks for the

future.

Our financial strength is allowing us to be bolder in our plans

for growth. Our acquisition of Booxmedia Oy extended our

credibility in customers' eyes as an innovator in the TV space.

Today's proposed acquisition of Entone takes that credibility one

step further still, not only adding excellent product and people to

our offering, but transforming the scale of our business too. We

enter the second half confidently and are excited by the long-term

potential for a bigger, bolder Amino."

For further information please contact:

Amino Technologies plc +44 (0)1954 234100

Keith Todd CBE, Chairman

Donald McGarva, Chief Executive Officer

Julia Hubbard, Chief Financial Officer

FTI Consulting LLP (Financial PR) +44 (0)20 3727 1000

Matt Dixon / Chris Lane / Nicola Krafft / Alex Le May

finnCap Limited (NOMAD and Joint Broker) +44 (0)20 7220 0500

Stuart Andrews / Matt Goode / Carl Holmes - Corporate Finance

Simon Johnson - Corporate Broking

Canaccord Genuity Limited (Financial Adviser and Joint Broker) +44 (0)20 7523 8000

Simon Bridges / James Craven / Emma Gabriel

About Amino Technologies plc

Amino Technologies plc specialises in the development and

delivery of IPTV and hybrid/OTT solutions. With over five million

devices sold to 850 customers in 85 countries, Amino's

award-winning solutions are deployed by major network operators and

service providers worldwide. Amino Technologies plc is listed on

the AIM market of the London Stock Exchange (AIM: symbol AMO). It

is headquartered near Cambridge, in the UK, with offices in the US

and Finland. For more information, please visit

www.aminocom.com

Chairman's review:

The Company has continued to make strong progress in terms of

financial performance and delivery against its strategic

objectives. Revenue and profit growth experienced during the second

half of 2014 continued in this first half of the year, alongside

good cash generation and margin improvement. In turn, shareholder

returns have again been enhanced in line with our stated

progressive policy of no less than 10% dividend increase a

year.

This strong financial performance was achieved against a

background of considerable and ongoing evolution within the pay-TV

industry where the shift towards "TV everywhere" viewing across

multiple TV, smartphone and tablet screens is accelerating. At the

same time, the timeframe within which new 4K Ultra-HD services are

expected to be deployed by service providers has also shortened

thereby bringing forward Amino's plans to introduce services to

support this exciting new medium and creating fresh demand for

compatible IP devices.

Amino has successfully aligned itself with these shifts in

market dynamics. The Company's heritage and expertise lies in using

IP as a means for delivering entertainment services. To some

extent, the market has now caught up - so much so that IP based

delivery is becoming the de facto pay-TV industry standard. Now,

the acquisitions Amino has undertaken and the product innovations

that are underway are each designed to ensure that the Company

capitalises on this heritage to make good on the new opportunities

that are opening up.

The acquisition of cloud-TV platform provider Booxmedia Oy,

announced in May 2015 is a prime example of this. It is a clear

signal of the Company's intention to extend and enhance its

offering and ensure that the Company is fully aligned with market

changes. This acquisition significantly strengthens Amino's

capabilities in the delivery of "TV everywhere" entertainment to

both existing customers and adjacent markets in mobile, broadcast

and content delivery.

Customers and ecosystem partners have welcomed the move and a

combined sales and marketing programme is underway to introduce

wider solutions-based offerings to the market.

This has been followed by the conditional agreement, post

period-end, to acquire the entire issued capital of Entone Inc, a

provider of broadcast hybrid TV and connected home solutions, for a

total consideration of $73.0 million (GBP46.7 million), and

involving a proposed placing to raise GBP21.0 million. There are

identified synergies between the two companies, with this

transaction further demonstrating Amino's continued focus on

increasing its footprint and scale. The acquisition is expected to

be earnings accretive in the first full year of ownership

(FY2016).

Growth across customers and markets:

The strong momentum seen in the key North American market at the

year-end has continued into 2015. Demand from existing customers

has grown strongly, alongside a number of new contract wins which

further strengthen Amino's position in the tier two and tier three

market.

New products launched into the market have been well-received

with further orders for the Live Advanced Media Platform from an

existing customer and good initial take-up of the A150 IP device,

which was introduced into the market during the period.

Building value around the core product portfolio continues to be

a key focus. The addition of certified YouTube capability alongside

Vudu video-on-demand and the Amino TV Appstore has been well

received by operators seeking to introduce fresh content features

to their offerings.

Progress on the availability of Home Reach has been slower than

expected, although commercial trials are now underway with a

regional operator in North America.

In Latin America, the demand for lower specification products

remains strong with substantial orders received from an existing

customer in Chile. There was also continued progress in the

Argentinian market where Catel, the association representing a new

breed of locally-focused IPTV operators, launched a second phase of

their IPTV deployment using the higher specification A150

device.

As indicated at the year end, Europe remains challenging,

although good progress was made with key customers in the

Netherlands where the A150 continues to be the product of choice

for new deployments.

Encouraging progress has been made in the Middle East where

focused sales and marketing activities are now beginning to

generate orders, albeit from a low base. This will continue into

the second half of the year with a focus on developing partnerships

with key regional systems integrators to address new hospitality,

residential compound and digital signage opportunities. A new H150

IP device was launched during the period to address these markets

both regionally and globally.

Focused strategy:

Amino, through its broadened product portfolio, is now better

positioned to capitalise on the opportunities in both its existing

and new markets and the proposed acquisition of Entone further

strengthens this position globally.

TV viewing continues to grow, both in the home, but particularly

away from the home on smartphones and tablets. The challenge for

operators is how to deliver these "TV everywhere" services with a

consistent "look and feel" that retains and enhances their brand.

As we have referenced above, this is the challenge that Booxmedia

Oy, which was acquired just before the period end, is perfectly

placed to solve.

At the same time, operators are also bringing forward their

plans for the deployment of new technologies, such as 4K Ultra-HD

services to meet growing consumer demand for 4K television sets and

the availability of content, albeit primarily from OTT

providers.

In line with this trend, the Company has showcased its new 4K

platform which is based on its widely-deployed Aminet software, to

customers at the major TV Connect industry event in April.

Availability in early 2016 is closely aligned with operator

deployment plans.

Financial progress

A solid sales performance delivered revenue for the period at

GBP17.9m (H1 2014: GBP16.4m).

Gross margins strengthened to 50.8%, an increase of 5.9% against

the prior year, due to improved product mix. Gross profit increased

to GBP9.1m (H1 2014: GBP7.4m).

Operating costs rose to GBP5.2m (H1 2014: GBP4.5m) during the

period. This increase was largely caused by higher R&D costs

for x5x and Live products in H2 2014 following their launch but

also one off legal costs relating to the Booxmedia Oy

acquisition.

EBITDA before exceptional items was GBP3.9m (H1 2014: GBP2.9m)

driven largely by increased gross margin.

Depreciation and amortisation at GBP1.1m is unchanged from the

prior period (H1 2014: GBP1.1m).

Operating profit increased 56% to GBP2.8m (H1 2014: GBP1.8m)

before an exceptional duty rebate of GBP0.7m.

The exceptional duty rebate was the third and final receipt from

the tax authorities in respect of duties paid on previously

recognised international product sales. The first two rebates

totalling GBP1.7m were received during March and April 2013.

The acquisition of Booxmedia Oy during May 2015 resulted in a

cash outflow of GBP4.5m during May 2015. Despite this outflow and

an increase in the final dividend of GBP0.7m, the Company's

continued drive for profitable underlying revenue, tight cost

control and strong working capital management brought further

benefit to the Company's net cash balance, which closed the period

at GBP17.3m (H1 2014: GBP19.7m), a decrease in cash on the 2014

year-end balance of GBP3.5m.

Dividend Policy

The Board is pleased to announce that an interim dividend of

1.265p per share (H1 2014: 1.15p per share) which represents a 10%

increase year on year and is in line with Amino's progressive

dividend policy. This will be payable on 17 September 2015. The

record date for the interim dividend is 4 September 2015 and the

corresponding ex-dividend date is 3 September 2015.

Outlook

Amino has worked hard over the years to ensure it is aligned

with key industry trends and the first half of the current

financial year has seen significant progress towards this goal. The

acquisition of Booxmedia Oy and the proposed acquisition of Entone

mean that Amino will be well positioned globally with a strong

product portfolio to seize these opportunities. Backed by both

strong financial performance and its industry aligned solution

offering, the Board remains confident of meeting market

expectations for the full year, prior to the impact of the

acquisition of Entone.

Consolidated income statement.

For the six months ended 31 May 2015

Six months Six months Year ended

ended ended 30 November

31 May 31 May 2014

Notes 2015 2014 Audited

Unaudited Unaudited

GBP000s GBP000s GBP000s

Revenue 3 17,935 16,412 36,190

Cost of sales (8,822) (9,046) (19,417)

---------- ---------- ------------

Gross profit 9,113 7,366 16,773

Other income 744 -

Operating expenses (6,276) (5,591) (12,815)

---------- ---------- ------------

Operating profit 3,581 1,775 3,958

Analysed as:

Gross profit 9,113 7,366 16,773

Selling, general and administrative

expenses (2,911) (2,664) (5,365)

Research and development

expenses (2,265) (1,803) (4,689)

---------- ---------- ------------

EBITDA before exceptional

items 3,937 2,899 6,719

Depreciation (75) (67) (141)

Amortisation (1,025) (1,057) (2,468)

---------- ---------- ------------

Operating profit before

exceptional items 2,837 1,775 4,110

Restructuring 4 - - (152)

---------- ---------- ------------

Operating profit after

restructuring 1,775 3,958

Exceptional income - duties

refund 4 744 - -

---------- ---------- ------------

Operating profit 3,581 1,775 3,958

------------------------------------ ------- ---------- ---------- ------------

Finance expense - - -

Finance income 27 18 87

---------- ---------- ------------

Net finance income 27 18 87

Profit before corporation

tax 3,608 1,793 4,045

Corporation tax (charge)/credit (13) (44) 29

---------- ---------- ------------

Profit for the period from

continuing operations attributable

to equity holders 3,595 1,749 4,074

---------- ---------- ------------

Basic earnings per 1p ordinary

share 5 6.85p 3.29p 7.68p

Diluted earnings per 1p

ordinary share 5 6.84p 3.24p 7.57p

Basic earnings per 1p ordinary

share (excluding exceptional

items) 5 5.44p 3.29p 7.97p

Diluted earnings per 1p

ordinary share (excluding

exceptional items) 5 5.43p 3.24p 7.85p

The accompanying notes are an integral part of these

interim financial statements.

Consolidated statement of comprehensive income

For the six months ended 31 May 2015

Six months Six months Year ended

ended ended 30 November

31 May 31 May 2014

2015 2014 Audited

Unaudited Unaudited

GBP000s GBP000s GBP000s

Profit for the period 3,595 1,749 4,074

---------- ---------- ------------

Foreign exchange difference

arising on consolidation 11 (11) (14)

---------- ---------- ------------

Other comprehensive income/(expense) 11 (11) (14)

---------- ---------- ------------

Total comprehensive income

for the period 3,606 1,738 4,060

---------- ---------- ------------

The accompanying notes are an integral part of these interim

financial statements.

Consolidated Balance Sheet

As at 31 May 2015

As at As at As at

31 May 31 May 30 November

2015 2014 2014

Unaudited Unaudited Audited

Notes

Assets GBP000s GBP000s GBP000s

Non-current assets

Property, plant and equipment 388 456 439

Intangible assets 6 11,231 4,330 3,717

Deferred income tax assets 560 560 560

Other receivables 162 162 162

---------- ---------- ------------

12,341 5,508 4,878

---------- ---------- ------------

Current assets

Inventories 1,303 2,192 2,262

Trade and other receivables 9,419 6,479 6,903

Cash and cash equivalents 17,298 19,703 20,758

---------- ---------- ------------

28,020 28,374 29,923

---------- ---------- ------------

Total assets 40,361 33,882 34,801

---------- ---------- ------------

Capital and reserves attributable

to equity holders of the

business

Called-up share capital 583 579 579

Share premium 605 126 126

Capital redemption reserve 6 6 6

Foreign exchange reserves 595 586 584

Other reserves 16,389 16,389 16,389

Retained earnings 10,280 7,717 8,113

---------- ---------- ------------

Total equity 28,458 25,403 25,797

---------- ---------- ------------

Liabilities

Current liabilities

Trade and other payables 11,367 8,479 9,000

Derivative financial instruments - - 4

------ ------ ------

11,367 8,479 9,004

Non-current liabilities

Deferred tax liability 536 - -

------ ------ ------

536 - -

Total liabilities 11,903 8,479 9,004

------ ------ ------

Total equity and liabilities 40,361 33,882 34,801

------ ------ ------

The interim financial statements on pages 8 to 14 were approved

by the Board of directors on 20 July 2015 and were signed on its

behalf by:

Donald McGarva Julia Hubbard

Director Director

The accompanying notes are an integral part of these interim

financial statements

Consolidated Cash Flow Statement

As at 31 May 2015

Six months Six months Year

ended 31 ended 31 to 30

May May 2014 November

2015 Unaudited 2014

Notes Unaudited Audited

GBP000s GBP000s GBP000s

Cash flows from operating

activities

Cash generated from operations 7 3,799 3,223 6,447

Corporation tax (paid)/received (13) (44) 35

---------- ---------- ---------

Net cash generated from

operating activities 3,786 3,179 6,482

---------- ---------- ---------

Cash flows from investing

activities

Expenditure on intangible

assets (1,139) (1,575) (2,373)

Purchase of property, plant

and equipment (34) (40) (114)

Proceeds on disposal of

property, plant and equipment - 2 2

Interest received 27 18 87

Acquisition of subsidiary (4,512) - -

---------- ---------- ---------

Net cash used in investing

activities (5,658) (1,595) (2,398)

---------- ---------- ---------

Cash flows from financing

activities

Proceeds from exercise

of employee share options 567 27 96

Share repurchase - - (1,429)

Dividends paid (2,043) (1,302) (1,914)

---------- ---------- ---------

Net cash used in financing

activities (1,476) (1,275) (3,247)

---------- ---------- ---------

Net increase in cash and

cash equivalents (3,348) 309 837

Cash and cash equivalents

at start of the period 20,758 19,521 19,521

Effects of exchange rate

fluctuations on cash held (112) (127) 400

---------- ---------- ---------

Cash and cash equivalents

at end of period 17,298 19,703 20,758

---------- ---------- ---------

Consolidated Statement of changes in equity

Share Share Other Foreign Capital Profit Total

capital premium reserves exchange redemption and

reserve reserve loss

account

GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s

Shareholders' equity

at 30 November 2013

(audited) 579 126 16,389 598 6 7,224 24,922

--------------------------------- --------- --------- ---------- ---------- ------------ --------- --------

Comprehensive income

Profit for the period - - - - - 1,749 1,749

Other comprehensive

income - - - (11) - - (11)

--------------------------------- --------- --------- ---------- ---------- ------------ --------- --------

Total comprehensive

income for the period

attributable to equity

holders - - - (11) - 1,749 1,738

--------------------------------- --------- --------- ---------- ---------- ------------ --------- --------

Share option compensation

charge - - - - - 18 18

Movement on EBT reserves - - - - - 27 27

Dividends paid - - - - - (1,302) (1,302)

--------------------------------- --------- --------- ---------- ---------- ------------ --------- --------

Total transactions with

owners - - - - - (1,257) (1,257)

--------------------------------- --------- --------- ---------- ---------- ------------ --------- --------

Total movement in shareholders'

equity - - - (11) - 492 481

--------------------------------- --------- --------- ---------- ---------- ------------ --------- --------

At 31 May 2014 (unaudited) 579 126 16,389 586 6 7,717 25,403

--------------------------------- --------- --------- ---------- ---------- ------------ --------- --------

Comprehensive income

Profit for the period - - - - - 2,325 2,325

Other comprehensive

income - - - (3) - - (3)

--------------------------------- --------- --------- ---------- ---------- ------------ --------- --------

Total comprehensive

income for the period

attributable to equity

holders - - - (3) - 2,325 2,322

--------------------------------- --------- --------- ---------- ---------- ------------ --------- --------

Share option compensation

charge - - - - - 44 44

Movement on EBT reserves - - - - - 69 69

Purchase of own shares - - - - - (1,429) (1,429)

Dividends paid - - - - - (612) (612)

---------------------------------

Total transactions with

owners - - - - - (1,928) (1,928)

--------------------------------- --------- --------- ---------- ---------- ------------ --------- --------

Total movement in shareholders'

equity - - - (3) - 397 394

--------------------------------- --------- --------- ---------- ---------- ------------ --------- --------

Shareholders' equity

at 30 November 2014

(audited) 579 126 16,389 584 6 8,113 25,797

--------------------------------- --------- --------- ---------- ---------- ------------ --------- --------

Comprehensive income

Profit for the period - - - - - 3,595 3,595

Other comprehensive

income - - - 11 - - 11

--------------------------------- --------- --------- ---------- ---------- ------------ --------- --------

Total comprehensive

income for the period

attributable to equity

holders - - - 11 - 3,595 3,606

--------------------------------- --------- --------- ---------- ---------- ------------ --------- --------

Share option compensation

charge - - - - - 48 48

Movement on EBT reserves - - - - - 567 567

Issue of new shares 4 479 - - - - 483

Dividends paid - - - - - (2,043) (2,043)

--------------------------------- --------- --------- ---------- ---------- ------------ --------- --------

Total transactions with

owners 4 479 - - - (1,428) (945)

--------------------------------- --------- --------- ---------- ---------- ------------ --------- --------

Total movement in shareholders'

equity 4 479 - 11 - 2,167 2,661

--------------------------------- --------- --------- ---------- ---------- ------------ --------- --------

At 31 May 2015 (unaudited) 583 605 16,389 595 6 10,280 28,458

--------------------------------- --------- --------- ---------- ---------- ------------ --------- --------

Notes to the interim financial statements

Six months ended 31 May 2015

1 General information

Amino Technologies plc ('the Company') and its subsidiaries

(together 'the Group') specialises in IPTV software technologies

and hardware platforms that enable delivery of digital programming

and interactivity over IP networks, including the internet.

The Company is a public limited company which is listed on the

AIM market of the London Stock Exchange and is incorporated and

domiciled in the UK.

2 Basis of preparation

The financial information has been prepared in accordance with

all relevant International Financial Reporting Standards ("IFRS")

and International Financial Reporting Interpretations Committee

("IFRIC") interpretations that had been published by 31 May 2015 as

endorsed by the European Union (EU). The accounting policies

adopted are consistent with those of the financial statements for

the year ended 30 November 2014, as described in those financial

statements. In preparing these interim financial statements the

Board has not sought to adopt IAS 34 "Interim financial

reporting".

The figures for the six-month periods ended 31 May 2015 and 31

May 2014 have not been audited. The figures for the year ended 30

November 2014 have been extracted from, but do not constitute, the

consolidated financial statements of Amino Technologies plc for

that year. Those financial statements have been delivered to the

Registrar of Companies and included an auditors' report, which was

unqualified and did not contain a statement under Section 498(2) or

Section 498(3) Companies Act 2006.

3 Revenue

The Group has only one operating segment, being the development

and sale of broadband network software and systems. All revenues,

costs, assets and liabilities relate to this segment.

The geographical analysis of revenue is as follows:

Six months Six months Year to

ended ended 30 November

31 May 31 May 2014

2015 2014 Audited

Unaudited Unaudited

GBP000s GBP000s GBP000s

USA 9,262 7,338 16,176

Canada 1,439 511 1,369

---------- ---------- ------------

10,701 7,849 17,545

Serbia 38 3,168 3,585

Netherlands 2,327 1,753 5,459

Rest of the World 4,869 3,642 9,601

---------- ---------- ------------

17,935 16,412 36,190

---------- ---------- ------------

4 Exceptional items

During the six months ending 31 May 2015, the Company received a

final rebate of GBP743,565 in respect of duties paid on previously

recognised international product sales.

No exceptional items were disclosed in the financial statements

for the prior period.

5 Earnings per share

Six months Six months Year to

ended 31 ended 31 30 November

May May 2014

2015 2014 Audited

Unaudited Unaudited

GBP000s GBP000s GBP000s

Profit attributable to

shareholders 3,595 1,749 4,074

---------- ---------- ------------

Profit attributable to

shareholders excluding

exceptional items 2,851 1,749 4,074

---------- ---------- ------------

Number Number Number

Weighted average number

of shares (Basic) 52,453,196 53,128,260 57,893,052

---------- ---------- ------------

Weighted average number

of shares (Diluted) 52,561,432 54,038,981 57,893,052

---------- ---------- ------------

The calculation of basic earnings per share is based on profit

after taxation and the weighted average number of ordinary shares

of 1p each in issue during the period, as adjusted for shares held

by an Employee Benefit Trust and held by the Company in

treasury.

The profit attributable to shareholders excluding exceptional

items is derived by adding back the exceptional items disclosed in

note 4 to the profit attributable to ordinary shareholders.

For diluted earnings per share, the weighted average number of

ordinary shares in issue is adjusted to assume conversion of all

dilutive potential ordinary share options. The Group has only one

category of dilutive potential ordinary share options: those share

options where the vesting conditions have not yet been met.

6 Intangible Assets

Goodwill IPR Software Development Total

licenses costs

GBP000s GBP000s GBP000s GBP000s GBP000s

Cost at 30 November

2013 (audited) 4,138 291 1,960 12,496 18,885

Additions - - - 1,575 1,575

----------------------------- --------- -------- ---------- ------------ --------

Costs at 31 May 2014

(unaudited) 4,138 291 1,960 14,071 20,460

Additions - - 64 734 798

Derecognised - - - (5,016) (5,016)

----------------------------- --------- -------- ---------- ------------ --------

Cost at 30 November

2014 (audited) 4,138 291 2,024 9,789 16,242

Additions - - 23 1,116 1,139

Acquired on acquisition

of subsidiary 4,720 588 - 2,092 7,400

----------------------------- --------- -------- ---------- ------------ --------

Costs at 31 May 2015

(unaudited) 8,858 879 2,047 12,997 24,781

----------------------------- --------- -------- ---------- ------------ --------

Amortisation at 30 November

2013 (audited) 4,138 291 1,950 8,694 15,073

Charge for the period - - 4 1,053 1,057

----------------------------- --------- -------- ---------- ------------ --------

Amortisation at 31 May

2014 (unaudited) 4,138 291 1,954 9,747 16,130

Charge for the period - - 14 1,397 1,411

Derecognised - - - (5,016) (5,016)

----------------------------- --------- -------- ---------- ------------ --------

Amortisation at 30 November

2014 (audited) 4,138 291 1,968 6,128 12,525

Charge for the period - - 15 1,010 1,025

-----------------------------

Amortisation at 31 May

2015 (unaudited) 4,138 291 1,983 7,138 13,550

----------------------------- --------- -------- ---------- ------------ --------

Net book amount

----------------------------- --------- -------- ---------- ------------ --------

At 31 May 2015 (unaudited) 4,720 588 64 5,859 11,231

----------------------------- --------- -------- ---------- ------------ --------

At 31 May 2014 (unaudited) - - 6 4,324 4,330

At 30 November 2014

(audited) - - 56 3,661 3,717

----------------------------- --------- -------- ---------- ------------ --------

7 Cash generated from operations

Six months Six months Year to

ended ended 30

31 May 31 May 2014 November

2015 Unaudited 2014

Unaudited Audited

GBP000s GBP000s GBP000s

Operating profit before

exceptional items 2,837 1,775 4,110

Restructuring costs - - (152)

Duties rebate 744 - -

---------- ------------ ---------

Operating profit 3,581 1,775 3,958

Amortisation charge 1,025 1,057 2,468

Depreciation charge 75 69 141

Loss/(gain) on disposal

of property, plant &

equipment 10 (2) 17

Share-based payment charge 48 18 62

Loss on derivative financial

instruments (4) - 4

Exchange differences 124 116 (415)

Decrease in inventories 959 345 275

(Increase) in trade and

other receivables (2,069) (1,126) (1,660)

Increase in trade and

other payables 50 971 1,597

---------- ------------ ---------

Cash generated from operations 3,799 3,223 6,447

8 Acquisition of a subsidiary

On 19 May 2015, the Group acquired 99.9% of the issued share

capital of Booxmedia Oy, obtaining control of Booxmedia Oy.

Booxmedia Oy is a Software-as-a-Service cloud TV platform provider.

Booxmedia Oy was acquired to enhance Amino's offering by adding a

field-proven and scalable cloud-based platform which can enable the

delivery of "TV everywhere" entertainment to a full range of IP

connected devices to align the Company with the industry shift

towards "TV everywhere" viewing.

The remaining 0.1% share capital was acquired on 1 July

2015.

The amounts recognised in respect of the identifiable assets

acquired and liabilities assumed are as set out in the table

below.

Book Fair Fair value

value value

adjustment

GBP000s

Financial assets 929 - 929

Inventory - - -

Property, plant and equipment - - -

Identifiable intangible assets - 2,680 2,680

Financial liabilities (248) (536) (784)

Contingent liability - - -

--------------------------------------- ------ ----------- ----------

Total identifiable assets 681 2,144 2,825

Goodwill 4,720

--------------------------------------- ------ ----------- ----------

Total consideration 7,545

--------------------------------------- ------ ----------- ----------

Satisfied by:

Cash 4,993

Equity instruments (360,845

ordinary shares of Amino Technologies

plc) 483

Contingent and deferred consideration

arrangements 2,069

--------------------------------------- ------ ----------- ----------

Total consideration transferred 7,545

--------------------------------------- ------ ----------- ----------

Net cash outflow arising on

acquisition

Cash consideration 4,993

Less: cash and cash equivalent

balances acquired (481)

4,512

----------

The fair value of the financial assets includes trade

receivables with a fair value of GBP181k and a gross contractual

value of GBP181k. The best estimate at acquisition date of the

contract cash flows not to be collected is GBPnil.

The goodwill of GBP4,720k arising from the acquisition consists

of expected growth in the sale of "TV everywhere" services as the

industry shifts away from the current connected home focus. The

acquisition of Booxmedia will expand Amino's addressable market to

include mobile operators, OTT providers, media companies and

broadcasters. None of the goodwill is expected to be deductible for

income tax purposes.

The fair value of the 360,845 ordinary shares issued as part of

the consideration paid for Booxmedia Oy (GBP483k) was determined on

by reference to the average of the middle market share price on

each of the five business days preceding the second business day

before completion.

The contingent consideration arrangement requires Booxmedia Oy

to achieve certain revenue targets over a three year period. The

potential undiscounted amount of all future payments that Amino

Technologies plc could be required to make under the contingent

consideration arrangement is GBP2,069k.

The fair value of the contingent consideration arrangement of

GBP2,069k was estimated by applying the exchange rate at completion

to the gross expected payments.

Booxmedia Oy contributed GBP77k revenue and GBP0k to the Group's

profit for the period between the date of acquisition and the

balance sheet date.

If the acquisition of Booxmedia Oy had been completed on the

first day of the financial year, group revenues for the period

would have been GBP18,452k and group profit would have been

GBP3,709k.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SEAFUSFISELW

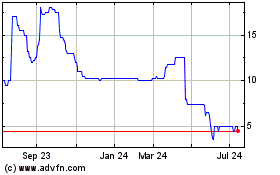

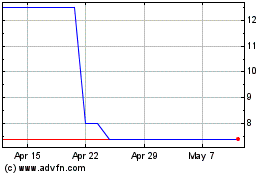

Aferian (LSE:AFRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aferian (LSE:AFRN)

Historical Stock Chart

From Apr 2023 to Apr 2024