Aminex PLC PART DISPOSAL AND FARM OUT OF TANZANIAN ASSETS (2197G)

November 19 2015 - 2:00AM

UK Regulatory

TIDMAEX

RNS Number : 2197G

Aminex PLC

19 November 2015

Aminex plc

("Aminex" or "the Company")

PART DISPOSAL AND FARM OUT OF TANZANIAN ASSETS

Landmark transaction strengthens balance sheet, accelerates work

programme and meets stated corporate strategy

Aminex is pleased to announce that it has reached an agreement

with Bowleven plc ("Bowleven"), the AIM listed oil and gas company,

for part disposal and farm out of its Tanzanian assets (the

"Bowleven Agreement"). Terms of the Bowleven Agreement include the

disposal by Aminex of a 25% interest in the Kiliwani North

Development Licence ("KNDL") and farming into the Ruvuma PSA,

including the Ntorya appraisal programme, for a 50% gross interest.

Under an inter-conditional agreement with its existing joint

venture partner Solo Oil plc ("Solo"), the farm out terms for the

Ruvuma PSA will be shared proportionately by Aminex and Solo (the

"Solo Agreement").

KEY TRANSACTIONAL POINTS - GROSS OFFER TERMS:

-- Cash consideration of $8.5 million

-- Shares in Bowleven to the value of $5 million with a 9 month lock-up period

-- Net carry of $10 million on all Ruvuma PSA activity, enabling a multi well programme

-- A cash bonus of $0.5 million on the completion of drilling of the Ntorya-2 well

-- A bonus of $4 million, to be settled in cash or shares at

Bowleven's option, payable on achieving commercial production from

the Ruvuma PSA for a minimum of 30 days

KEY POINTS FOR AMINEX:

-- Balance sheet strengthened with outstanding debt substantially reduced

-- Operations in Ruvuma PSA accelerated

-- Aminex will remain the operator of all its assets in Tanzania

Under the Solo Agreement, Solo will receive a 25% share of the

net carry of $10 million and will be entitled to 25% of the

contingent bonuses. The net effective value to Aminex of the

transaction will be $24.375 million.

The combined transaction is conditional upon, amongst other

things, the execution of formal agreements with Bowleven and Solo,

and Aminex shareholder approval. The Bowleven Agreement will have

an effective date of 1 January 2016. Both the sale of an interest

in the KNDL and the farm-out transaction for interests in the

Ruvuma PSA are subject to approval from the Tanzanian authorities

and, where applicable, to partner pre-emption rights which must be

exercised within 30 days, in absence of which they will lapse.

The completion of the proposed transactions with Bowleven and

Solo will enable Aminex to reduce its outstanding corporate debt

substantially, delivering on its 2015 stated objective. Aminex will

remain the operator of all its assets in Tanzania following close

of the transaction and is in discussions with Solo and Bowleven to

accelerate the work programme at Ruvuma. The Company will announce

an updated work programme once concluded. In addition, the holding

in Bowleven shares will give Aminex shareholders an exposure to

Bowleven's drilling and development programme for 2016 in

Cameroon.

Following the completion of the combined transactions and with

cash expected to be generated from KNDL soon, the Board considers

the Company to be well placed to identify other production and

development opportunities in line with the Company's longer-term

strategy.

On completion of the transactions, Aminex will retain an

operated 30.575% interest in KNDL and an operated 37.5% interest in

the Ruvuma PSA. Shareholders are reminded that Solo retains its

option to purchase a further 6.5% stake in KNDL (before TPDC

back-in) on the terms previously advised to shareholders.

Aminex Chief Executive Jay Bhattacherjee commented:

"Today's disposal and farm out is a landmark transaction for the

Company and I am delighted to welcome Bowleven as a joint venture

partner. Bowleven has built an enviable position in Cameroon and

has a strong technical team who share the same ideology as us and

we feel will strengthen the prospects of development."

- Ends -

For further information:

Aminex PLC +44 20 7291 3100

Jay Bhattacherjee, Chief

Executive Officer

Max Williams, Chief Financial

Officer

www.aminex-plc.com

Corporate Brokers

Shore Capital Stockbrokers-Jerry

Keen +44 20 7408 4090

Davy Corporate Finance-Brian

Garrahy +35 3 1679 7788

GMP Securities Europe

LLP-Rob Collins +44 20 7647 2816

Yellow Jersey PR (Financial

PR) +44 7768 537 739

Dominic Barretto

Aidan Stanley

This information is provided by RNS

The company news service from the London Stock Exchange

END

DISKMMMMNRGGKZM

(END) Dow Jones Newswires

November 19, 2015 02:00 ET (07:00 GMT)

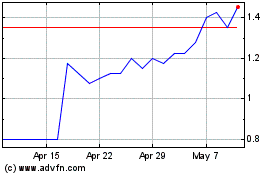

Aminex (LSE:AEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aminex (LSE:AEX)

Historical Stock Chart

From Apr 2023 to Apr 2024