TIDMAEX

RNS Number : 1413W

Aminex PLC

25 April 2016

25 April 2016

FINAL RESULTS for year ended 31 december 2015, ANNUAL REPORT

and NOTICE OF MEETING

Aminex PLC ('Aminex' or the 'Company') is pleased to announce

its final results for the year ended 31 December 2015 and the 2015

Annual Report is available on the Company's website,

www.aminex-plc.com, and may be viewed by clicking on the following

link:

http://www.rns-pdf.londonstockexchange.com/rns/1413W_-2016-4-24.pdf

HIGHLIGHTS

During 2015:

-- Gas Sales Agreement signed effective 31 December 2015

-- Sale of 6.5% interest in Kiliwani North to Solo Oil for $3.5 million

-- Regional gas pipeline completed with sales line connected to Kiliwani North

-- Drilling and development plan moving forward for Ruvuma

-- Planning for Ntorya-1 recompletion and Ntorya-2 appraisal drilling, expected during 2016

-- Nyuni Area deep water potential reassessed

-- Technical team strengthened

-- Ongoing restructuring and cost monitoring

Looking ahead:

-- 2016 will be the year when Aminex begins to reap rewards from

a decade of exploration and development in Tanzania with first

production from Kiliwani North, booking its first reserves in

country.

-- In a difficult market favourable opportunities may present

themselves and the Company is actively engaged in looking for

production and development led opportunities.

The Annual General Meeting of the Company will be held at 11:00

am on 18 May 2016 at:

The Building

Centre

26 Store Street

London WC1E

7BT

The Notice of Annual General Meeting, including the Form of

Proxy, is also be available on the Company's website, together with

a copy of the Company's Memorandum and Articles of Association with

amendments arising primarily from the Companies Act 2014, which are

being proposed as resolutions at the Meeting. Details of the

amendments are provided in the Notice of Annual General

Meeting.

Paper copies of the Annual Report, the Notice of Annual General

Meeting and the Form of Proxy are being mailed to those

shareholders who have elected to receive paper copies.

In accordance with Irish Listing Rule 6.6.1 and UKLA Listing

Rule 9.6.1, a copy of the Annual Report has been submitted to the

Irish Stock Exchange and to the UK's National Storage Mechanism. It

will shortly be available at:

Company Announcements

Office

Irish Stock Exchange

28 Anglesea Street

Dublin 2

Ireland

and at:

www.morningstar.co.uk/uk/NSM

For further information:

Aminex PLC +44 20 7291 3100

Jay Bhattacherjee, Chief

Executive Officer

Max Williams, Chief

Financial Officer

Corporate Brokers

Shore Capital Stockbrokers,

Jerry Keen +44 20 7408 4090

Davy, Brian Garrahy +353 1 679 6363

Camarco +44 20 3757 4980

Billy Clegg

Gordon Poole

Chairman's Statement

Dear Shareholder

Herewith are Aminex's results for the year ended 31 December

2015. The Group made a loss for the financial year of $3.78 million

(2014: $7.01 million).

During the year Aminex negotiated a long-awaited gas sales

agreement for the Kiliwani North field and completed a partial

disposal of its interest in the field which enabled it to retire a

portion of its corporate debt. It also converted an Egyptian

carried working interest into a royalty arrangement. The

transaction for the Egyptian asset has transformed a potential work

obligation into a potential future revenue stream. As the Board has

previously stated that it does not intend to commit further funds

to its Moldova asset in the near term, Aminex's activities are now

exclusively concentrated on its Tanzanian gas projects, all of

which it operates. The Company is consequently not directly

affected by the current slump in world oil prices as it will be

producing gas at a pre-agreed price for power generation.

This time last year I forecast that Aminex would be producing

Tanzanian gas in 2015 but events outside the control of the Company

prevented this from occurring. However, since the year end we have

signed a formal Gas Sales Agreement with the Tanzania Petroleum

Development Corporation ('TPDC') and, at the time of writing,

Kiliwani North gas is producing commissioning gas.

Our next step will be to build on our earlier success in the

Ruvuma area with follow-up drilling this year. We expect to spud a

new well, Ntorya-2, to offset and appraise the Ntorya-1 discovery

during the course of this summer with an additional well, Ntorya-3,

also being planned to test the main channel system. Once Ntorya-2

has been drilled, Aminex expects to apply for a development licence

for the prospect, opening the way for the Company to produce from

not one but two separate Tanzanian fields in the foreseeable

future.

Past months have not been easy in our sector in general but

Aminex has successfully weathered many storms in the past and we

expect to do so in the future. Tough times can present openings for

flexible, smaller companies which are not always available when the

markets are strong and when larger players are ready to pay very

high prices for assets. Aminex's management team is ever vigilant

for such opportunities.

May I express your Board's appreciation for the continuing

support we have received. Perseverance and patience usually pay in

the long run and we are grateful to those who have stayed with us.

This year's AGM will be held in London on 18 May and we hope to

meet as many of you as possible on that occasion.

Yours sincerely,

Brian Hall

Chairman

Chief Executive's Review

Aminex has now become an African producer for the first time and

this will transform the Group. The team continues to explore and

maximise the prospectivity of the Group's assets in preparation for

production and the development of the onshore Ruvuma Basin, where

the Company has an existing discovery.

Tanzania

The major new regional gas pipeline developed by the Tanzania

Petroleum Development Corporation ('TPDC') was under construction

throughout 2015 and is now receiving Kiliwani North commissioning

gas. The pipeline provides a commercialisation route for Kiliwani

North gas and opens up the potential for commercialisation of the

Company's Ntorya discovery and any other discoveries which may be

made in the Company's onshore Ruvuma Basin acreage.

Kiliwani North is being used to commission the Songo Songo Gas

Processing Plant and, once commercial rates have been established,

is expected to produce initially at a rate of 25-30 MMcfd. The

Company will sell gas directly at wellhead for a price of $3.07 per

MCF and will be paid in US Dollars with payment guarantees in

place.

During 2015 the Company completed a new seismic programme in the

vicinity of its Ntorya-1 discovery on the Ruvuma PSA acreage. The

programme was designed to identify the channel fairway associated

with the Tertiary and Cretaceous reservoirs where Ntorya-1 tested

gas at 20 MMcfd with 139 barrels of associated condensate. The

seismic programme was completed on time and within budget. The

Company currently has an obligation to drill a minimum of four

exploration wells by the end of 2016 but is in discussions with the

TPDC to focus resources on the development of Ntorya with a view to

accelerating the supply of gas into the new regional pipeline

system. Should the Company have success in its appraisal and

development drilling programme in the Ruvuma Basin, any further gas

discovered can be commercialised through the new pipeline.

At the Nyuni Area PSA, the Company will focus exploration

activity on the deep water sector of the licence. The Tanzanian

authorities have agreed to replace a commitment to acquire 2D

seismic in the shallow zones with 3D seismic in the deep water

sector. This will enable the acquisition of up to 700 square

kilometres of new 3D seismic in the deep water. As part of this

approval, a two-well commitment due to be carried out in 2015 has

been deferred into the next exploration phase which expires in

October 2019.

Other assets

Since 2014, the Aminex Board has sought to focus the Group's

resources on its key production, development and appraisal assets

in Tanzania by reducing commitments in other regions. In 2015, the

Group converted its interest in the West Esh el Mallaha-2

('WEEM-2') concession in Egypt to a 1% gross overriding royalty in

the South Malak-2 discovery, thereby eliminating future capital

expenditure in a small non-operated interest. The Group's interest

in Moldova does not give rise to any capital commitments. In the

current low oil price environment the Company has decided to impair

the carrying value of the Moldova interest.

Evaluation of New Opportunities

The Company's management and technical team continue to evaluate

and analyse new production-led business opportunities with the aim

of creating a larger and stronger base for its activities,

balancing risk against opportunity.

Looking Forward

This is a very promising time for the Company. Its first

commercial production from Kiliwani North will help meet the

Group's ongoing overhead expenses, which continue to be monitored

closely, and assist with further debt retirement. The planned

appraisal of the Ntorya discovery offers considerable growth

potential for the Group. After drilling the Ntorya-2 appraisal

well, Aminex plans to apply for a licence to fast-track development

of the Ntorya field so as to monetise gas discoveries through the

new gas infrastructure. Aminex is also in discussions with the TPDC

to identify opportunities for an early production system from

Ntorya-1 and Ntorya-2.

I would like to thank our staff and all those that have been

associated with the Company's progress for their consistent hard

work and our shareholders for their continued support.

Jay Bhattacherjee

Chief Executive

Group Income Statement

(MORE TO FOLLOW) Dow Jones Newswires

April 25, 2016 02:00 ET (06:00 GMT)

for the year ended 31 December 2015

2015 2015 2014 2014

US$'000 US$'000 US$'000 US$'000

Continuing operations

Revenue 350 444

Cost of sales (341) (412)

--------- ---------

Gross profit 9 32

Administrative expenses (1,615) (2,795)

Depreciation of other assets (15) (9)

--------- ---------

(1,630) (2,804)

--------- ---------

Loss from operating activities

before other items (1,621) (2,772)

Gain on disposal of development 1,772 -

asset

Reduction in fair value of (968) -

other receivables

Impairment provision against (353) -

exploration and

evaluation assets

Impairment provision against

assets held for sale (850) (622)

Impairment loss on available

for sale assets (68) (243)

Loss on disposal of available (7) -

for sale assets

--------- ---------

Loss from operating activities (2,095) (3,637)

Finance income 3 11

Finance costs (1,686) (2,239)

--------- ---------

Loss before tax (3,778) (5,865)

Income tax expense - -

--------- ---------

Loss from continuing operations (3,778) (5,865)

Discontinued operations

Loss from discontinued operations - (1,143)

--------- ---------

Loss for the financial year

attributable to equity holders

of the Company (3,778) (7,008)

--------- ---------

Basic and diluted loss per

Ordinary Share (in US cents) (0.20) (0.41)

--------- ---------

Basic and diluted loss per

Ordinary Share (in US cents)

- continuing operations (0.20) (0.34)

--------- ---------

Group Statement of Other Comprehensive Income

for the year ended 31 December 2015

2015 2014

US$'000 US$'000

Loss for the financial year (3,778) (7,008)

Other comprehensive income:

Items that are or maybe reclassified

to profit or loss:

Currency translation differences (293) (19)

--------- ---------

Total comprehensive income for

the financial year attributable

to equity holders of the Company (4,071) (7,027)

--------- ---------

Group and Company Balance Sheets

at 31 December 2015

Group Company

2015 2014 2015 2014

US$'000 US$'000 US$'000 US$'000

ASSETS

Exploration and evaluation

assets 79,864 78,734 - -

Property, plant and

equipment 12,416 13,510 - -

Investments in subsidiary

undertakings - - 5,207 6,603

Amounts due from subsidiary

undertakings - - 93,960 95,012

Available for sale

assets 22 107 22 107

Trade and other receivables 1,950 2,800 1,950 2,800

--------- --------- --------- ---------

Total non-current

assets 94,252 95,151 101,139 104,522

--------- --------- --------- ---------

Assets held for sale - 850 - -

Trade and other receivables 606 1,217 52 313

Amounts due from subsidiary

undertakings - - 660 1,363

Cash and cash equivalents 2,128 1,765 429 617

--------- --------- --------- ---------

Total current assets 2,734 3,832 1,141 2,293

--------- --------- --------- ---------

Total assets 96,986 98,983 102,280 106,815

--------- --------- --------- ---------

LIABILITIES

Current liabilities

Loans and borrowings (8,559) (10,218) (8,559) (10,218)

Trade and other payables (3,103) (1,863) (53) (51)

--------- --------- --------- ---------

Total current liabilities (11,662) (12,081) (8,612) (10,269)

--------- --------- --------- ---------

Non-current liabilities

Decommissioning provision (448) (425) - -

--------- --------- --------- ---------

Total non-current

liabilities (448) (425) - -

--------- --------- --------- ---------

Total liabilities (12,110) (12,506) (8,612) (10,269)

--------- --------- --------- ---------

NET ASSETS 84,876 86,477 93,668 96,546

--------- --------- --------- ---------

Equity

Issued capital 67,192 67,094 67,192 67,094

Share premium 96,036 93,505 96,036 93,505

Capital conversion

reserve fund 234 234 234 234

Share option reserve 3,683 3,891 3,683 3,891

Share warrant reserve 3,054 3,031 3,054 3,031

Foreign currency translation

reserve (1,459) (1,166) - -

Retained earnings (83,864) (80,112) (76,531) (71,209)

--------- --------- --------- ---------

84,876 86,477 93,668 96,546

--------- --------- --------- ---------

Group Statement of Changes in Equity

for the year ended 31 December 2015

Attributable to equity shareholders of

the Company

Share Share Capital Share Fair Foreign Retained Total

capital premium conversion option value currency earnings US$'000

US$'000 US$'000 reserve reserve warrant translation US$'000

fund US$'000 reserve reserve

US$'000 US$'000 US$'000

At 1 January

2014 65,629 79,431 234 3,891 2,535 (1,147) (73,104) 77,469

Transactions

with shareholders

recognised directly

in equity

Shares issued 1,465 14,074 - - (211) - - 15,328

Share warrants

granted - - - - 707 - - 707

Comprehensive

income:

Currency translation

differences - - - - - (19) - (19)

Loss for the

financial year - - - - - - (7,008) (7,008)

--------- --------- ------------ --------- --------- ------------- ---------- ---------

At 1 January

2015 67,094 93,505 234 3,891 3,031 (1,166) (80,112) 86,477

Transactions

with shareholders

recognised directly

in equity

Shares issued 98 2,531 - - - - (182) 2,447

Share option

reserve adjustment - - - (208) - - 208 -

Share warrants

granted - - - - 23 - - 23

Comprehensive

income:

Currency translation

differences - - - - - (293) - (293)

Loss for the

(MORE TO FOLLOW) Dow Jones Newswires

April 25, 2016 02:00 ET (06:00 GMT)

financial year - - - - - - (3,778) (3,778)

--------- --------- ------------ --------- --------- ------------- ---------- ---------

At 31 December

2015 67,192 96,036 234 3,683 3,054 (1,459) (83,864) 84,876

--------- --------- ------------ --------- --------- ------------- ---------- ---------

Group and Company Statements of Cashflows

for the year ended 31 December 2015

Group Company

2015 2014 2015 2014

US$'000 US$'000 US$'000 US$'000

Operating activities

Loss for the financial year (3,778) (7,008) (5,378) (8,616)

Depletion, depreciation and

decommissioning 15 92 - -

Impairment provision against

assets held for sale 850 872 - -

Impairment provision against 353 - - -

exploration and evaluation

assets

Provision against doubtful

debts - - - 15

Finance income (3) (11) (3) (11)

Finance costs 1,686 2,295 1,643 2,200

Gain on disposal of development (1,772) - - -

asset

Loss on disposal of available

for sale assets 7 - 7 -

Reduction in value of trade

receivables 968 - 968 -

Loss on disposal of subsidiary

undertaking - 368 - (1,769)

Impairment of available for

sale assets 68 243 85 243

Impairment provision against

intercompany loans - - 928 6,945

Impairment provision against

investment in subsidiary undertakings - - 1,397 463

Decrease in trade and other

receivables 493 1,507 136 67

Increase/(decrease) in trade

and other payables 177 (625) 3 404

--------- --------- --------- ---------

Net cash absorbed by operations (936) (2,267) (184) (59)

Interest paid (1,563) (1,179) (1,563) (1,179)

--------- --------- --------- ---------

Net cash outflows from operating

activities (2,499) (3,446) (1,747) (1,238)

--------- --------- --------- ---------

Investing activities

Proceeds from sale of development 3,325 - - -

asset

Proceeds from disposal of available 10 - - -

for sale assets

Acquisition of property, plant

and equipment (204) (234) - -

Expenditure on exploration

and evaluation assets (1,001) (7,053) - -

Decrease/(increase) in amounts

due from subsidiary undertakings - - 827 (10,468)

Loss on disposal of subsidiary

undertaking - - - (66)

Cost of disposal of subsidiary

undertaking - (368) - (368)

Interest received 3 11 3 11

--------- --------- --------- ---------

Net cash from/(used in) investing

activities 2,133 (7,644) 830 (10,891)

--------- --------- --------- ---------

Financing activities

Proceeds from issue of share

capital 2,629 14,907 2,629 14,907

Payment of transaction expenses (182 (2,205) (182) (2,205)

Loans repaid (1,718) (13) (1,718) -

--------- --------- --------- ---------

Net cash inflows from financing

activities 729 12,689 729 12,702

--------- --------- --------- ---------

Net increase/(decrease) in

cash and cash equivalents 363 1,599 (188) 573

Cash and cash equivalents at

1 January 1,765 166 617 44

Cash and cash equivalents at

31 December 2,128 1,765 429 617

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR BZLFLQZFEBBX

(END) Dow Jones Newswires

April 25, 2016 02:00 ET (06:00 GMT)

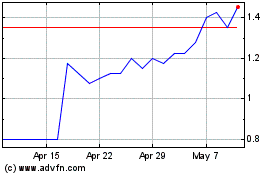

Aminex (LSE:AEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aminex (LSE:AEX)

Historical Stock Chart

From Apr 2023 to Apr 2024