Revenues Rise

9%

Full Year 2017 EPS

Guidance Raised to $5.80-$5.90

American Express Company (NYSE:AXP) today reported

third-quarter net income of $1.4 billion, up 19 percent from $1.1

billion a year ago. Diluted earnings per share was $1.50, up 25

percent from $1.20 a year ago.

(Millions, except percentages and per

share amounts)

Quarters Ended

September 30,

Percentage

Inc/(Dec)

Nine Months Ended

September 30,

Percentage

Inc/(Dec)

2017 2016

2017 2016 Total Revenues Net of

Interest Expense $ 8,436 $ 7,774 9

$ 24,632 $ 24,097 2 Net Income $

1,356 $ 1,142 19 $ 3,933 $ 4,583

(14 ) Earnings Per Common Share – Diluted:

Net Income Attributable to Common

Shareholders1

$ 1.50 $ 1.20 25 $ 4.30 $

4.76 (10 ) Average Diluted Common Shares Outstanding

881 923 (5 ) 892

943 (5 )

Third-quarter consolidated total revenues net of interest

expense were $8.4 billion, up 9 percent from $7.8 billion a year

ago. Excluding the impact of foreign exchange rates, adjusted

revenues net of interest expense grew 8 percent.2 Those increases

primarily reflected higher net interest income and Card Member

spending, partially offset by a lower discount rate.

Consolidated provisions for losses were $769 million, up 53

percent from $504 million a year ago. The rise primarily reflected

continued strong growth in the loan portfolio and an expected

increase in the lending write-off and delinquency rates.

Consolidated expenses were $5.8 billion, up 6 percent from $5.5

billion last year. The current quarter included higher rewards

expenses primarily related to product enhancements and an increase

in Card Member spending, partially offset by lower marketing costs.

Operating expenses were unchanged from a year ago, reflecting lower

technology-related costs, offset by asset impairments and

restructuring and other charges in the company’s U.S. Loyalty

Coalition and Prepaid businesses. Excluding the asset impairments

and other charges in the current year and restructuring charges in

both years, adjusted operating expenses declined 4 percent.3

The effective tax rate for the quarter was 26 percent, down from

34 percent a year ago, primarily due to the realization of certain

foreign tax credits in the current year and the geographic mix of

earnings.

“We are completing a two-year turnaround ahead of plan with

strong revenue and earnings growth across all of our business

segments,” said Kenneth I. Chenault, chairman and chief executive

officer. “We’ve added products and benefits, shown continued

strength in acquiring new customers, and expanded our merchant

network.

“Loan growth continued to be strong and credit metrics were

again in line with our expectations. We’ve contained operating

costs and reallocated a significant part of those savings to fund

many of the initiatives that are now driving growth across the

business. Throughout the turnaround, we’ve dealt effectively with

competitive challenges and redesigned our marketing, customer

service and risk management capabilities for the digital age.

“We’re starting a new chapter from a position of strength. Based

on the momentum in the business, we now expect full year 2017 EPS

of $5.80 to $5.90. That’s up from our earlier outlook of $5.60 to

$5.80.”

Segment Results

U.S. Consumer Services reported third-quarter net income

of $475 million, up 18 percent from $401 million a year ago.

Total revenues net of interest expense were $3.3 billion, up 13

percent from $2.9 billion a year ago. The increase primarily

reflected higher net interest income and Card Member spending.

Provisions for losses totaled $459 million, up 67 percent from

$275 million a year ago. The rise primarily reflected strong growth

in the loan portfolio and an expected increase in the lending

write-off and delinquency rates.

Total expenses were $2.1 billion, up 6 percent from $2.0 billion

a year ago. The current quarter reflected higher rewards expenses

related to product enhancements and an increase in Card Member

spending, partially offset by lower technology-related costs and a

decline in marketing expenses.

The effective tax rate was 32 percent, down from 35 percent a

year ago.

International Consumer and Network Services reported

third-quarter net income of $286 million, up 85 percent from $155

million a year ago.

Total revenues net of interest expense were $1.5 billion, up 7

percent (up 6 percent FX-adjusted2) from $1.4 billion a year ago.

The increase primarily reflected higher Card Member spending and

net interest income.

Provisions for losses totaled $106 million, up 26 percent from

$84 million a year ago. The rise primarily reflected continued

strong growth in the loan portfolio and an expected increase in the

lending write-off rate.

Total expenses were $1.1 billion, down 2 percent (down 3 percent

FX-adjusted2) from a year ago. The decrease primarily reflected

lower marketing and employee compensation expenses, partially

offset by higher rewards costs.

The effective tax rate was 7 percent, down from 25 percent a

year ago, due largely to the realization of certain foreign tax

credits in the current year and the geographic mix of earnings.

Global Commercial Services reported third-quarter net

income of $529 million, up 14 percent from $466 million a year

ago.

Total revenues net of interest expense were $2.6 billion, up 6

percent from $2.4 billion a year ago. The increase primarily

reflected higher Card Member spending and net interest income.

Provisions for losses totaled $194 million, up 45 percent from

$134 million a year ago. The increase primarily reflected strong

growth in the loan portfolio and an expected increase in the

lending write-off rate.

Total expenses were $1.6 billion, up 3 percent from a year ago.

The current quarter reflected higher rewards expenses related to

product enhancements and an increase in Card Member spending,

partially offset by lower technology-related and marketing

expenses.

The effective tax rate was 31 percent, down from 36 percent a

year ago, due largely to the geographic mix of earnings.

Global Merchant Services reported third-quarter net

income of $368 million, up 3 percent from $359 million a year

ago.

Total revenues net of interest expense were $1.2 billion, up 4

percent from $1.1 billion a year ago. The increase primarily

reflected higher Card Member spending, partially offset by a lower

discount rate.

Total expenses were $628 million, up 20 percent from $525

million a year ago. The increase primarily reflected a portion of

the previously-mentioned asset impairments and restructuring and

other charges.

The effective tax rate was 29 percent, down from 37 percent a

year ago, due largely to the realization of certain foreign tax

credits in the current year.

Corporate and Other reported third-quarter net loss of

$302 million compared with net loss of $239 million a year ago,

reflecting a portion of the previously-mentioned asset impairments

and restructuring charges.

About American Express

American Express is a global services company, providing

customers with access to products, insights and experiences that

enrich lives and build business success. Learn more at

americanexpress.com, and connect with us on

facebook.com/americanexpress, instagram.com/americanexpress,

linkedin.com/company/american-express,twitter.com/americanexpress,

and youtube.com/americanexpress.

Key links to products, services and corporate responsibility

information: charge and credit cards, business credit cards, Plenti

rewards program, travel services, gift cards, prepaid cards,

merchant services, Accertify, corporate card, business travel, and

corporate responsibility.

This earnings release should be read in conjunction with the

company’s statistical tables for the third-quarter 2017, available

on the American Express website at

http://ir.americanexpress.com and in a Form 8-K filed

today with the Securities and Exchange Commission.

An investor conference call will be held at 5:00 p.m. (ET) today

to discuss third-quarter earnings results. Live audio and

presentation slides for the investor conference call will be

available to the general public on the above-mentioned American

Express Investor Relations website. A replay of the conference call

will be available later today at the same website address.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This release includes forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995,

which are subject to risks and uncertainties. The forward-looking

statements, which address the Company’s expected business and

financial performance and which include management’s outlook for

2017, among other matters, contain words such as “believe,”

“expect,” “estimate,” “anticipate,” “intend,” “plan,” “aim,”

“will,” “may,” “should,” “could,” “would,” “likely” and similar

expressions. Readers are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

on which they are made. The Company undertakes no obligation to

update or revise any forward-looking statements. Factors that could

cause actual results to differ materially from these

forward-looking statements, include, but are not limited to, the

following:

- the Company’s ability to achieve its

2017 earnings per common share outlook, which will depend in part

on the following: revenues growing consistently with current

expectations, which could be impacted by, among other things, the

factors identified in the subsequent bullet; credit performance

remaining consistent with current expectations; the level of spend

in bonus categories on rewards-based and/or cash-back cards and

redemptions of Card Member rewards and offers; the impact of any

future contingencies, including, but not limited to,

litigation-related settlements, judgments or expenses, the

imposition of fines or civil money penalties, an increase in Card

Member reimbursements, restructurings, impairments and changes in

reserves; the ability to continue to realize benefits from

restructuring actions and operating leverage at levels consistent

with current expectations; the amount the Company spends on Card

Member engagement and the Company’s ability to drive growth from

such investments; changes in interest rates beyond current

expectations (including the impact of hedge ineffectiveness and

deposit rate increases); the impact of regulation and litigation,

which could affect the profitability of the Company’s business

activities, limit the Company’s ability to pursue business

opportunities, require changes to business practices or alter the

Company’s relationships with partners, merchants and Card Members;

the Company’s tax rate remaining in line with current expectations,

which could be impacted by, among other things, the Company’s

geographic mix of income being weighted more to higher tax

jurisdictions than expected, changes in tax laws and regulation and

unfavorable tax audits and other unanticipated tax items;

write-downs of deferred tax assets as a result of tax law or other

changes; the impact of accounting changes and reclassifications;

and the Company’s ability to continue executing its share

repurchase program;

- the ability of the Company to grow

revenues net of interest expense, which could be impacted by, among

other things, weakening economic conditions in the United States or

internationally, a decline in consumer confidence impacting the

willingness and ability of Card Members to sustain and grow

spending, continued growth of Card Member loans, a greater erosion

of the average discount rate than expected, the strengthening of

the U.S. dollar, a greater impact on discount revenue from cash

back and cobrand partner and client incentive payments, more

cautious spending by large and global corporate Card Members, the

willingness of Card Members to pay higher card fees, and lower

spending on new cards acquired than estimated; and will depend on

factors such as the Company’s success in addressing competitive

pressures and implementing its strategies and business initiatives,

including growing profitable spending from existing and new Card

Members, increasing penetration among middle market and small

business clients, expanding the Company’s international footprint

and increasing merchant acceptance;

- changes in the substantial and

increasing worldwide competition in the payments industry,

including competitive pressure that may impact the prices charged

to merchants that accept American Express cards, competition for

cobrand relationships and the success of marketing, promotion or

rewards programs;

- the Company’s rewards expense and cost

of Card Member services growing inconsistently from expectations,

which will depend in part on Card Member behavior as it relates to

their spending patterns and actual usage and redemption of rewards,

as well as the degree of interest of Card Members in the value

proposition offered by the Company; increasing competition, which

could result in greater rewards offerings; the Company’s ability to

enhance card products and services to make them attractive to Card

Members; and the amount the Company spends on the promotion of

enhanced services and rewards categories and the success of such

promotion;

- the actual amount to be spent on

marketing and promotion, which will be based in part on

management’s assessment of competitive opportunities; overall

business performance and changes in macroeconomic conditions; the

actual amount of advertising and Card Member acquisition costs;

competitive pressures that may require additional expenditures; the

Company’s ability to continue to shift Card Member acquisition to

digital channels; contractual obligations with business partners

and other fixed costs and prior commitments; management’s ability

to identify attractive investment opportunities and make such

investments, which could be impacted by business, regulatory or

legal complexities; and the Company’s ability to realize

efficiencies, optimize investment spending and control expenses to

fund such spending;

- the ability of the Company to reduce

its overall cost base by $1 billion on a run rate basis by the end

of 2017, which will depend in part on the timing and financial

impact of reengineering plans, which could be impacted by factors

such as the Company’s inability to mitigate the operational and

other risks posed by potential staff reductions, the Company’s

inability to develop and implement technology resources to realize

cost savings and underestimating hiring and other employee needs;

the ability of the Company to reduce annual operating expenses,

which could be impacted by, among other things, the factors

identified below; the ability of the Company to optimize marketing

and promotion expenses, which could be impacted by the factors

identified in the preceding bullet;

- the ability to reduce annual operating

expenses, which could be impacted by the need to increase

significant categories of operating expenses, such as consulting or

professional fees, including as a result of increased litigation,

compliance or regulatory-related costs or fraud costs; the ability

of the Company to develop, implement and achieve substantial

benefits from reengineering plans; higher than expected employee

levels; the impact of changes in foreign currency exchange rates on

costs; the payment of civil money penalties, disgorgement,

restitution, non-income tax assessments and litigation-related

settlements; impairments of goodwill or other assets; management’s

decision to increase or decrease spending in such areas as

technology, business and product development and sales forces;

greater than expected inflation; the Company’s ability to balance

expense control and investments in the business; the impact of

accounting changes and reclassifications; and the level of M&A

activity and related expenses;

- the Company’s delinquency and write-off

rates and growth of provisions for losses being higher than current

expectations, which will depend in part on changes in the level of

loan balances and delinquencies, mix of loan balances, loans and

receivables related to new Card Members and other borrowers

performing as expected, credit performance of new and enhanced

lending products, unemployment rates, the volume of bankruptcies

and recoveries of previously written-off loans;

- the Company’s ability to execute

against its lending strategy to grow loans, which may be affected

by increasing competition, brand perceptions and reputation, the

Company’s ability to manage risk in a growing Card Member loan

portfolio, and the behavior of Card Members and their actual

spending and borrowing patterns, which in turn may be driven by the

Company’s ability to issue new and enhanced card products, offer

attractive non-card lending products, capture a greater share of

existing Card Members’ spending and borrowings, reduce Card Member

attrition and attract new customers;

- the growth in net interest income

slowing more than expected, which will be impacted by the growth

and mix of Card Member and other loans, which will depend in part

on the factors identified in the preceding bullet, and the

Company’s net interest yield on Card Member loans, which will be

influenced by, among other things, interest rates, changes in

consumer behavior that affect loan balances, such as paydown rates,

the Company’s Card Member acquisition strategy, product mix, cost

of funds, credit actions, including line size and other adjustments

to credit availability, potential pricing changes and deposit

rates, which could be impacted by, among other things, the factors

identified in the subsequent bullet;

- the Company’s deposit rates increasing

faster or slower than current expectations due to changes in the

Company’s funding mix, market pressures, regulatory constraints or

changes in benchmark interest rates, which could affect the

Company’s net interest yield and funding costs;

- the possibility that the Company will

not execute on its plans to significantly increase merchant

coverage, which will depend in part on the success of OptBlue

merchant acquirers in signing merchants to accept American Express,

which could be impacted by the pricing set by the merchant

acquirers, the value proposition offered to small merchants and the

efforts of OptBlue merchant acquirers to sign merchants for

American Express acceptance, as well as the awareness and

willingness of Card Members to use American Express cards at small

merchants and of those merchants to accept American Express

cards;

- the ability of the Company to capture

commercial spending, which will depend in part on the willingness

and ability of companies to use credit and charge cards for

procurement and other business expenditures, perceived or actual

difficulties and costs related to setting up card-based B2B payment

platforms, the ability of the Company to offer attractive value

propositions and card products to potential customers, competition,

the Company’s ability to enhance and expand its payment solutions,

and the effectiveness of the Company’s marketing and promotion of

its corporate payment solutions and small business card products to

potential customers;

- the ability of the Company to grow

internationally, including the growth of international proprietary

and GNS billed business, which could be impacted by regulation and

business practices, such as those capping interchange or other

fees, favoring local competitors or prohibiting or limiting foreign

ownership of certain businesses; the Company’s ability to partner

with additional GNS issuers as a result of regulation or otherwise

and the success of GNS partners in acquiring Card Members and/or

merchants; political or economic instability, which could affect

lending and other commercial activities; the Company’s ability to

tailor products and services to make them attractive to local

customers; and competitors with more scale and experience and more

established relationships with relevant customers, regulators and

industry participants;

- the Company’s ability to attract and

retain Card Members, including within the premium space, which will

be impacted in part by competition, brand perceptions (including

perceptions related to merchant coverage) and reputation and the

ability of the Company to develop and market value propositions

that appeal to Card Members and new customers and offer attractive

services and rewards programs, which will depend in part on ongoing

investment in marketing and promotion expenses, new product

innovation and development, Card Member acquisition efforts and

enrollment processes, including through digital channels, and

infrastructure to support new products, services and benefits;

- the ability of the Company to maintain

and expand its presence in the digital payments space, which will

depend on the Company’s success in evolving its products and

processes for the digital environment, offering attractive value

propositions to Card Members to incentivize the use of and enhance

satisfaction with the Company’s digital channels and the Company’s

products as a means of payment through online and mobile channels,

building partnerships and executing programs with other companies,

and utilizing digital capabilities that can be leveraged for future

growth;

- the ability of the Company to innovate

and introduce new network features and offer expanded products and

services to GNS partners, which will depend in part on the ability

of the Company to update its systems and platforms, the amount the

Company invests in the network, and technological developments

relating to fraud protection support, marketing insights and

digital connections;

- the erosion of the average discount

rate by a greater amount than anticipated, including as a result of

a greater shift of existing merchants into the OptBlue program,

changes in the mix of spending by location and industry, merchant

negotiations (including merchant incentives, concessions and

volume-related pricing discounts), competition, pricing regulation

(including regulation of competitors’ interchange rates in the

European Union and elsewhere) and other factors;

- changes affecting the ability or desire

of the Company to return capital to shareholders through dividends

and share repurchases, which will depend on factors such as

approval of the Company’s capital plans by its primary regulators,

the amount the Company spends on acquisitions of companies and the

Company’s results of operations and capital needs and economic

environment in any given period;

- uncertainty relating to the ultimate

outcome of the antitrust lawsuit filed against the Company by the

U.S. Department of Justice and certain state attorneys general,

including the review of the case by the U.S. Supreme Court and the

impact on existing private merchant cases and potentially

additional litigation and/or arbitrations;

- legal and regulatory developments,

including with regard to broad payment system regulatory regimes,

actions by the CFPB and other regulators and the stricter

regulation of financial institutions, which could require the

Company to make fundamental changes to many of its business

practices, including our ability to continue certain GNS and other

partnerships; exert further pressure on the average discount rate

and GNS volumes; result in increased costs related to regulatory

oversight, litigation-related settlements, judgments or expenses,

restitution to Card Members or the imposition of fines or civil

money penalties; materially affect capital or liquidity

requirements, results of operations, or ability to pay dividends or

repurchase of stock; or result in harm to the American Express

brand; and

- factors beyond the Company’s control

such as changes in global economic and business conditions,

consumer and business spending, the availability and cost of

capital, unemployment rates, geopolitical conditions (including

potential impacts resulting from the U.S. Administration and the

proposed exit of the U.K. from the European Union), foreign

currency rates and interest rates, as well as fire, power loss,

disruptions in telecommunications, severe weather conditions,

natural disasters (including further impacts from the recent

hurricanes in Texas, Florida and Puerto Rico), health pandemics,

terrorism, cyber attacks or fraud, any of which could significantly

affect demand for and spending on American Express cards,

delinquency rates, loan balances and other aspects of the Company

and its results of operations or disrupt the Company’s global

network systems and ability to process transactions.

A further description of these uncertainties and other risks can

be found in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2016, the Company’s Quarterly Reports on Form

10-Q for the quarters ended March 31 and June 30, 2017 and the

Company’s other reports filed with the Securities and Exchange

Commission.

American Express Company (Preliminary)

Appendix I Reconciliations of

Adjustments (Millions, except percentages and where indicated)

YOY % Change Q3'17 Q3'16

Adjusted

Operating Expenses

Operating expenses (A) $ 2,763 $

2,761 - U.S. Loyalty Coalition and Prepaid charges

(pre-tax) (B) (155 ) Q3'16 Restructuring

charge (pre-tax) (44 ) Adjusted

Operating Expenses $ 2,608 $ 2,717

(4 )

(A) Operating expenses represent salaries and employee benefits,

professional services, occupancy and equipment, communications, and

other, net.(B) Includes asset impairments and restructuring and

other charges.

1 Represents net income less (i) earnings allocated to

participating share awards of $11 million and $9 million for the

three months ended September 30, 2017 and 2016, respectively, and

$32 million and $37 million for the nine months ended September 30,

2017 and 2016, respectively, and (ii) dividends on preferred shares

of $21 million for both the three months ended September 30, 2017

and 2016, and $61 million for both the nine months ended September

30, 2017 and 2016.

2 As reported in this release, FX-adjusted information assumes a

constant exchange rate between the periods being compared for

purposes of currency translations into U.S. dollars (i.e., assumes

the foreign exchange rates used to determine results for the three

months ended September 30, 2017 apply to the period(s) against

which such results are being compared). Management believes the

presentation of information on an FX-adjusted basis is helpful to

investors by making it easier to compare the company’s performance

in one period to that of another period without the variability

caused by fluctuations in currency exchange rates.

3 Operating expenses represent salaries and employee benefits,

professional services, occupancy and equipment, communications, and

other, net. Adjusted operating expenses is a non-GAAP measure.

Management believes adjusted operating expenses is a useful metric

for evaluating the company’s ongoing performance and cost reduction

efforts. See Appendix I for a reconciliation to operating expenses

on a GAAP basis.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171018006426/en/

Media:Marina H. Norville,

+1.212.640.2832marina.h.norville@aexp.comORInvestors/Analysts:Toby

Willard, +1.212.640.5574sherwood.s.willardjr@aexp.comorShreya

Patel, +1.212.640.5574shreya.patel@aexp.com

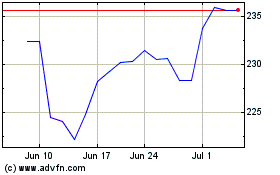

American Express (NYSE:AXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

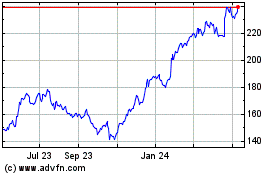

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2023 to Apr 2024