Amended Tender Offer Statement by Issuer (sc To-i/a)

July 20 2016 - 4:25PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

(Amendment No. 2)

(Rule 13e-4)

Tender Offer Statement under Section

14(d)(1) or 13(e)(1) of the Securities

Exchange Act of 1934

AUDIOCODES LTD.

(Name of Subject Company (Issuer))

AUDIOCODES LTD.

(Name of Filing Person (Offeror))

ORDINARY SHARES, PAR VALUE NIS 0.01

PER SHARE

(Title of Class of Securities)

M15342104

(CUSIP Number of Class of Securities)

Itamar Rosen, Adv.

Chief Legal Officer and Company Secretary

AudioCodes Ltd.

1 Hayarden Street

Airport City, Lod, 7019900, Israel

Telephone: (972) 3-976-4000

Facsimile: (972)

3-976-4044

(Name, address and telephone numbers of

person authorized to receive

notices and communications on behalf of

filing persons)

With copies to:

|

Neil Gold, Esq.

Manuel G. Rivera, Esq.

Norton Rose Fulbright US LLP

666 Fifth Avenue

New York, New York 10103

Telephone: (212) 318-3000

Facsimile: (212) 318-3400

|

Aaron M. Lampert, Adv.

Goldfarb Seligman & Co.

98 Yigal Alon Street

Tel Aviv 67897, Israel

Telephone: (972) 3- 608-9999

Facsimile: (972) 3- 608-9909

|

CALCULATION OF FILING FEE

|

Transaction Valuation

*

|

Amount of Filing Fee

*

|

|

$13,050,000

|

$1,314.14

|

|

*

|

The amount of the filing

fee, calculated in accordance with Rule 0-11 of the Securities Exchange Act of 1934, as amended, equals $100.70 per million of

the transaction valuation.

|

|

x

|

Check the box if any

part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously

paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

Amount Previously Paid: $1,314.14

|

Filing Party: Audio Codes Ltd.

|

|

Form or Registration No.: 005-59711

|

Date Filed: June 16, 2016

|

|

o

|

Check the box if the filing relates solely to preliminary communications made before the

commencement of a tender offer.

|

Check the appropriate boxes below to designate

any transaction to which the statement relates:

|

o

|

third-party tender offer subject to Rule 14d-1

|

|

x

|

issuer tender offer subject to Rule 13e-4

|

|

o

|

going-private transaction subject to Rule 13e-3

|

|

o

|

amendment to Schedule 13D under Rule 13d-2

|

Check the following

box if the filing is a final amendment reporting the results of the tender offer:

x

If applicable, check the appropriate box(es)

below to designate the appropriate rule provision(s) relied upon:

|

o

|

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

|

|

o

|

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

|

This Amendment No.

2 (this “Amendment No. 2”) supplements and amends the Tender Offer Statement on Schedule TO originally filed by AudioCodes

Ltd., a company incorporated under the laws of the State of Israel (“AudioCodes”), with the Securities and Exchange

Commission (the “SEC”) on June 16, 2016, pursuant to Rule 13e-4 under the Securities Exchange Act of 1934, as amended

(the “Exchange Act”) (as previously amended and supplemented by Amendment No. 1 thereto filed with the SEC on June

21, 2016, the “Schedule TO”) relating to the AudioCodes’ offer (the “Offer”) to purchase up to 3,000,000

ordinary shares of AudioCodes, nominal (par) value NIS 0.01 per share (the “Shares”), at a price of $4.35 per Share,

net to the seller in cash, less any applicable withholding taxes, and without interest.

This Amendment No.

2 is being filed solely to report the results of the Offer.

Pursuant to Rule 12b-15

under the Exchange Act, this Amendment No. 2 supplements and amends only Items 4, 11 and 12 of the Schedule TO, and unaffected

items and exhibits in the Schedule TO are not included herein. This Amendment No. 2 should be read in conjunction with the Schedule

TO and the related exhibits included therein, including the Offer to Purchase.

|

|

ITEM 4.

|

TERMS OF THE TRANSACTION.

|

Item 4 of the Schedule

TO is hereby amended and supplemented by adding the following information to the end thereof:

The Offer expired

at 10:00 a.m., New York time, or 5:00 p.m., Israel time, on Wednesday, July 20, 2016. AudioCodes accepted for purchase

3,000,000 Shares, at a total cost to AudioCodes of $13,050,000, excluding fees and expenses related to the Offer. Because

more than 3,000,000 Shares were properly tendered and not properly withdrawn, the Offer was oversubscribed by 2,254,186

Shares. Therefore, pursuant to the terms of the Offer, Shares have been accepted for purchase on a pro rata basis. The final

proration factor for the Offer is approximately 57.1%. AudioCodes will promptly return to tendering shareholders any Shares

tendered and not accepted for purchase due to the oversubscription of the Offer.

|

|

ITEM 11.

|

ADDITIONAL INFORMATION.

|

Item 11 of Schedule

TO is hereby amended and supplemented by adding the following information to the end thereof:

On July 20, 2016, AudioCodes

issued a press release announcing the final results of the Offer, which expired at 10:00 a.m., New York time, or 5:00 p.m., Israel

time, on Wednesday, July 20, 2016. A copy of such press release is filed as Exhibit (a)(5)(D) to this Schedule TO and is incorporated

herein by reference.

Item 12 of Schedule

TO is hereby amended and supplemented as follows:

|

NO.

|

|

DESCRIPTION

|

|

|

|

|

|

(a)(1)(A)+

|

|

Offer to Purchase, dated June 16, 2016.

|

|

(a)(1)(B)+

|

|

Letter of Transmittal (including Substitute Form W-9 and Guidelines and Declaration of Status for Israeli Income Tax Purposes).

|

|

(a)(1)(C)+

|

|

Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees (updated to include new e-mail and fax delivery instructions to the information agent for the Offer).

|

|

(a)(1)(D)+

|

|

Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees.

|

|

(a)(1)(E)+

|

|

Substitute Form W-9 and Guidelines for Certification of Taxpayer Identification Number.

|

|

(a)(1)(F)+

|

|

Declaration Form (Declaration of Status for Israeli Income Tax Purposes).

|

|

(a)(5)(A)+

|

|

Text of Press Release issued by AudioCodes on June 16, 2016.

|

|

(a)(5)(B)+

|

|

Forms of Acceptance Notice and Share Transfer Deed filed with the Israeli Securities Authority on June 16, 2016.*

|

|

(a)(5)(C)+

|

|

Summary of Procedures to Tender Shares, posted on AudioCodes’ website on June 21, 2016.

|

|

(a)(5)(D)

|

|

Text of Press Release issued by AudioCodes on July 20, 2016.

|

|

(d)(1)

|

|

AudioCodes Ltd. 2008 Equity Incentive Plan (incorporated herein by reference to Exhibit 4.41 to the Company’s Annual Report on Form 20-F for the fiscal year ended December 31, 2008 filed on June 30, 2009 (File No. 000-30070)).

|

|

(d)(2)

|

|

Amendment to AudioCodes Ltd. 2008 Equity Incentive Plan (incorporated herein by reference to Exhibit 4.2 to the Company’s Registration Statement on Form S-8 (No. 333-170676) filed on November 18, 2010).

|

|

(d)(3)

|

|

Amendment No. 2 to AudioCodes Ltd. 2008 Equity Incentive Plan (incorporated herein by reference to Exhibit 4.3 to the Company’s Registration Statement on Form S-8 (No. 333-190437) filed on June 7, 2013).

|

|

(d)(4)

|

|

Amendment No. 3 to AudioCodes Ltd. 2008 Equity Incentive Plan (incorporated herein by reference to Exhibit 4.4 to the Company’s Registration Statement on Form S-8 (No. 333-210438) filed on March 29, 2016).

|

________________________

+Previously filed.

*English translation from Hebrew.

SIGNATURE

After due inquiry and

to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

AUDIOCODES LTD.

|

|

|

|

|

|

|

|

|

By:

|

/s/Shabtai Adlersberg

|

|

|

|

Name: Shabtai Adlersberg

|

|

|

|

Title: President and Chief Executive Officer

|

Dated: July 20, 2016

EXHIBIT INDEX

|

NO.

|

|

DESCRIPTION

|

|

|

|

|

|

(a)(1)(A)+

|

|

Offer to Purchase, dated June 16, 2016.

|

|

(a)(1)(B)+

|

|

Letter of Transmittal (including Substitute Form W-9 and Guidelines and Declaration of Status for Israeli Income Tax Purposes).

|

|

(a)(1)(C)+

|

|

Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees (updated to include new e-mail and fax delivery instructions to the information agent for the Offer).

|

|

(a)(1)(D)+

|

|

Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees.

|

|

(a)(1)(E)+

|

|

Substitute Form W-9 and Guidelines for Certification of Taxpayer Identification Number.

|

|

(a)(1)(F)+

|

|

Declaration Form (Declaration of Status for Israeli Income Tax Purposes).

|

|

(a)(5)(A)+

|

|

Text of Press Release issued by AudioCodes on June 16, 2016.

|

|

(a)(5)(B)+

|

|

Forms of Acceptance Notice and Share Transfer Deed filed with the Israeli Securities Authority on June 16, 2016.*

|

|

(a)(5)(C)+

|

|

Summary of Procedures to Tender Shares, posted on AudioCodes’ website on June 21, 2016.

|

|

(a)(5)(D)

|

|

Text of Press Release issued by AudioCodes on July 20, 2016.

|

|

(d)(1)

|

|

AudioCodes Ltd. 2008 Equity Incentive Plan (incorporated herein by reference to Exhibit 4.41 to the Company’s Annual Report on Form 20-F for the fiscal year ended December 31, 2008 filed on June 30, 2009 (File No. 000-30070)).

|

|

(d)(2)

|

|

Amendment to AudioCodes Ltd. 2008 Equity Incentive Plan (incorporated herein by reference to Exhibit 4.2 to the Company’s Registration Statement on Form S-8 (No. 333-170676) filed on November 18, 2010).

|

|

(d)(3)

|

|

Amendment No. 2 to AudioCodes Ltd. 2008 Equity Incentive Plan (incorporated herein by reference to Exhibit 4.3 to the Company’s Registration Statement on Form S-8 (No. 333-190437) filed on June 7, 2013).

|

|

(d)(4)

|

|

Amendment No. 3 to AudioCodes Ltd. 2008 Equity Incentive Plan (incorporated herein by reference to Exhibit 4.4 to the Company’s Registration Statement on Form S-8 (No. 333-210438) filed on March 29, 2016).

|

________________________

+Previously filed.

*English translation from Hebrew.

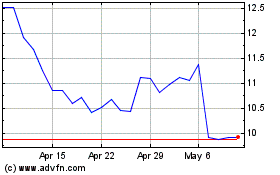

AudioCodes (NASDAQ:AUDC)

Historical Stock Chart

From Mar 2024 to Apr 2024

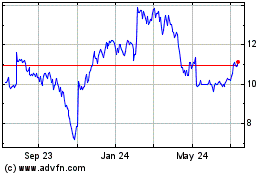

AudioCodes (NASDAQ:AUDC)

Historical Stock Chart

From Apr 2023 to Apr 2024