Alumasc Group PLC Interim Management Statement (6449V)

October 30 2014 - 3:00AM

UK Regulatory

TIDMALU

RNS Number : 6449V

Alumasc Group PLC

30 October 2014

Thursday 30 October 2014

THE ALUMASC GROUP PLC ("ALUMASC" OR THE "GROUP")

INTERIM MANAGEMENT STATEMENT

Alumasc, the premium building and engineering products company,

is publishing its first interim management statement for the year

ending 30 June 2015 covering the period from 1 July 2014 to date,

ahead of its Annual General Meeting being held in London at 10.30am

today.

Overall, trading to date has been in line with the Board's

expectations. Group revenues from continuing operations(1) are

ahead of prior year to date levels by some 5%, with Building

Products divisional revenues up by 9% and Engineering Products

divisional revenues lower by 10%. Cash generation remains strong

and the group's overall cash flow performance is in line with our

expectation.

The Building Products division continues to benefit from

improving market demand, the introduction of new products and

steady export market penetration. Our roofing and walling

businesses, in particular, have had a much better than expected

start to the year, building on the positive ongoing momentum in our

rainwater, drainage and house building products businesses. In view

of these trends, the Board anticipates that the Building Products

divisional performance for the full financial year will be stronger

than envisaged at the beginning of the year.

In the Engineering Products division, Alumasc Precision

Components (APC) has continued to operate at broadly EBITDA

break-even from lower sales, reflecting the managed exit from loss

making work over the last year and cost saving initiatives.

Recently, we were informed by a European customer that replacement

work on a new engine variant will not be awarded to APC and

negotiations to settle the final account are ongoing. Meanwhile,

Dyson Diecastings continues to trade in line with expectations.

Therefore, whilst still relatively early in the financial year,

the Board remains positive on prospects for the year as a whole in

view of the encouraging start from the majority of our

businesses.

As part of its strategic review announced in September, the

Board has concluded that APC, which competes in a global market

supplying large international OEMs, no longer fits Alumasc's growth

strategy. Therefore we are in the early stages of exploring

opportunities to sell the business. Dyson Diecastings, which

remains a strong business operating independently from APC, will be

unaffected.

This strategic decision will enable Alumasc to focus its

management and financial resources on accelerating the growth and

development of the group's successful building products activities,

with the objective of creating better value for shareholders in the

medium term.

Note 1: Revenues from continuing operations in both the current

and prior year have been adjusted to exclude Pendock, the non-core

building products business sold by Alumasc on 30 September

2014.

END

Enquiries:

The Alumasc Group plc:

Paul Hooper (Group Chief Executive) Tel: 01536 383821

Andrew Magson (Group Finance Director) Tel: 01536 383844

Glenmill Partners Limited:

Simon Bloomfield Tel: 07771 758517

This Interim Management Statement has been drawn up and

presented for the purposes of complying with English law. Any

liability arising out of or in connection with this Interim

Management Statement will also be determined in accordance with

English law.

This Interim Management Statement may contain 'forward-looking

statements'. By their nature, forward-looking statements involve

risk and uncertainty because they relate to future events and

circumstances. Many of these risks and uncertainties relate to

factors beyond The Alumasc Group's control or which cannot be

estimated precisely, such as future market conditions and the

behaviour of the market participants. Actual outcomes and results

may therefore differ materially from any outcomes or results

expressed or implied by any such forward-looking statements.

Nothing in this Interim Management Statement is intended to be a

profit forecast.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSQKLFLZBFZFBV

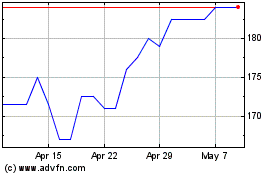

Alumasc (LSE:ALU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alumasc (LSE:ALU)

Historical Stock Chart

From Apr 2023 to Apr 2024