TIDMATST

RNS Number : 9276E

Alliance Trust PLC

22 July 2016

Alliance Trust PLC

22 July 2016

Results for six months ended 30 June 2016

Financial Highlights As at 30 As at 31 As at 30

June 2016 Dec 2015 June 2015

Share price 524.0p 517.0p 484.8p

NAV per share 591.4p* 561.1p** 545.9p**

Total dividend 5.65p 12.43*** 5.065p

* Balance sheet value calculated with debt at fair value

** Balance sheet value calculated with debt at par

***Full year dividend for the year ended 31 December 2015

Lord Smith of Kelvin, Chairman of Alliance Trust PLC commented:

"In volatile markets we continue to make good progress against the

initiatives outlined last year to enhance shareholder value. Costs

are coming down, ATI and ATS are making good strides towards

profitability, and a fully non-executive Board is in place. In

addition we announced during the period that the Board has

initiated a strategic review of the Group, encompassing a broad

range of potential courses of action. This review is progressing

well and we will report back on the outcome later in the year.

"Investment performance in the period underperformed the

benchmark, reflecting the turbulent market conditions around the EU

referendum when the Trust's quoted equity portfolio gave up the

outperformance it had recorded over the prior five months. However,

since the period end Alliance Trust's share price has reached new

highs."

Progress Against our Objectives

Improve investment performance

-- Total Shareholder Return (TSR) of 2.6% and Net Asset Value

(NAV) Total Return for the Trust of 6.6%, compared to the MSCI ACWI

benchmark return of 12.0%

-- The underperformance occurred in June, when the quoted equity

holdings gave up the outperformance they had recorded versus the

benchmark over the first five months of the year

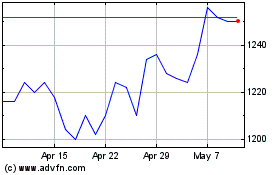

-- Since the period end our share price has risen to a new high of 553p (as of 20th July 2016)

Narrow the discount

-- A period-end discount of 11.4%, compared to 7.9% at the end

of December, at a time of widening discounts for investment trusts

in our peer group

Dividend Progression

-- Second interim dividend of 2.825p declared, bringing the

total to 5.65p for the half year, up from 5.065p a year earlier

Reduce Costs

-- Remain on track to achieve target of an Ongoing Charge Ratio

of 0.45% by end of 2016, one of the lowest in the Global investment

trust sector; with expenses down by 30% to GBP7.7m versus the prior

year

Simplifying the corporate structure

-- The Board now consists solely of non-executive directors,

with independent boards for Alliance Trust Investments and Alliance

Trust Savings

-- Experienced new non-executive, Clare Dobie, appointed to the Board since the AGM

Alliance Trust Investments

-- Alliance Trust Investments (ATI) generated third-party net

inflows of GBP25m, ending the period with assets under management

(AUM) of GBP5.2bn

-- Clear focus on costs and investment proposition which is

accelerating ATI's progress towards profitability

Alliance Trust Savings

-- Assets under administration rose by over 40% and customer

accounts rose by 31%, reflecting the positive impact of the

acquisition of Stocktrade

-- New corporate partnership account won during the period which

will benefit the second half of 2016

-S-

For more information, please contact:

George Renouf

Director of Investor Relations

Alliance Trust PLC

T: 01382 321022

Stephen Malthouse,

Martin Pengelley

Tulchan Communications

T: 020 7353 4200

Alliance Trust PLC Interim Report 2016

Results for 6 months to 30 June 2016

Chairman's Statement

Set out below is a brief summary of the progress we have made

implementing the changes announced in October 2015. These are

intended to enhance shareholder value and better position the Trust

to deliver consistent outperformance in a cost effective manner. I

also provide a brief overview of our investment performance over

the first half of the year.

In the period we have:

-- Implemented changes to the Board, so that it is entirely

non-executive. A new Non-Executive Director, Clare Dobie, was

appointed

-- Signed an Investment Management Agreement with Alliance Trust

Investments to manage our portfolio for a fee of 0.35% of net

assets under management, with a target of outperforming the MSCI

All Country World Index in Sterling (MSCI ACWI) by at least 1% a

year over a three year rolling period

-- Simplified our structure and appointed independent directors

to our subsidiaries, Alliance Trust Investments and Alliance Trust

Savings

-- Focused the portfolio on global equities and reduced the number of non-core investments.

The first half of 2016 has been marked by significant volatility

in markets, particularly around the time of the

EU Referendum. The quoted equity part of the Trust's portfolio

outperformed the MSCI ACWI for the five month period to the end of

May. In June, and following the EU Referendum, this out-performance

was reversed resulting in the equity portfolio returning 9.5% for

the period against the benchmark's 12.0% return. The NAV was also

impacted by a number of other items such as the value of debt and a

pension scheme buy in transaction. The combination of these items

generated the Trust's NAV Total Return of 6.6%, with a Total

Shareholder Return (TSR) at 2.6%. Against this background it should

be noted that since the change in our investment management team in

September 2014, the quoted equity part of the Trust's portfolio has

performed slightly ahead of the MSCI ACWI. In common with many of

our peers, the Trust's share price discount to NAV widened at the

end of the period. Since the period end, after the immediate EU

Referendum volatility, the Company's share price reached a record

high of 553p, with a NAV of 626.2p, at the close on 20 July.

The Trust's expenses have reduced by over 30%, falling to

GBP7.7m from GBP11.1m in the comparable period last year.

The Trust paid an interim dividend of 2.825p per share on 30

June 2016 and will pay a second interim dividend of 2.825p on 30

September 2016 to shareholders on the register on 26 August

2016.

On 30 May, we announced that we had received an unsolicited

approach from RIT Capital Partners PLC for a merger of the two

companies. On 7 June, RIT Capital Partners withdrew its proposal.

We told our shareholders at the time that we would consider any

proposal as part of the Group strategic review that we had already

initiated. This review is ongoing and includes a broad range of

possible courses of action. We are making good progress and intend

to report on the outcome of our review later in the year.

Lord Smith of Kelvin

Chairman

21 July 2016

Company Performance

30 June 31 December 30 June

2016 2015 2015

------------------ -------- ------------ ---------

Share price 524.0p 517.0p 484.8p

------------------ -------- ------------ ---------

Net Asset Value 591.4p* 561.1p** 545.9p**

(NAV) per share

------------------ -------- ------------ ---------

Discount to NAV 11.4% 7.9% 11.2%

------------------ -------- ------------ ---------

*Balance sheet value calculated with debt at fair value.

**Balance sheet value calculated with debt at par.

Portfolio Performance

Contribution Analysis Average Total Contribution

(%) Weight Return to Total

Return

----------------------------- -------- -------- -------------

Equities* 101.5 9.5 9.0

----------------------------- -------- -------- -------------

FX Contracts and

Index Futures N/A N/A -0.2

----------------------------- -------- -------- -------------

Other Investments 2.6 -23.0 -0.7

----------------------------- -------- -------- -------------

Non-core Investments 7.0 0.9 0.0

----------------------------- -------- -------- -------------

Cost of Gearing -12.8 1.1 -0.1

----------------------------- -------- -------- -------------

Cash and Accruals 1.7 N/A 0.1

----------------------------- -------- -------- -------------

Investment Portfolio

Total 100.0 8.1

----------------------------- -------- -------- -------------

Pension Fund Contribution** -0.8

----------------------------- -------- -------- -------------

Fair Value Debt

Adjustment** -0.7

----------------------------- -------- -------- -------------

Buybacks 0.2

----------------------------- -------- -------- -------------

NAV Total Return 6.6

----------------------------- -------- -------- -------------

Management Expenses -0.2

----------------------------- -------- -------- -------------

Effect of Discount -4.0

----------------------------- -------- -------- -------------

Share Price Total

Return 2.6

----------------------------- -------- -------- -------------

MSCI ACWI Total

Return 12.0

----------------------------- -------- -------- -------------

* Includes investments in Funds. **Non-recurring.

Source: Alliance Trust and FactSet

Alliance MSCI All

Trust Country

World Index Stock Total

Quoted Equity Portfolio Sector Sector Allocation Selection Relative

Portfolio

Attribution Return Return Effect Effect Effect

(%)

------------------ ---------- ------------ ------------------ ---------- ---------

Equity Portfolio

Attribution 9.5 12.0 -0.9 -1.6 -2.5

Source: Alliance Trust and FactSet

Shareholder Return

As at 30 June 6 months 1 year 3 years 5 years

2016

------------------- --------- ------- -------- --------

Total Shareholder

Return (TSR) 2.6% 10.9% 32.4% 54.2%

------------------- --------- ------- -------- --------

NAV Total Return 6.6% 10.9% 27.8% 46.1%

------------------- --------- ------- -------- --------

MSCI ACWI 12.0% 13.9% 37.4% 60.4%

------------------- --------- ------- -------- --------

Company Expenses

6 months Year to 6 months

to 31 December to

30 June 2015 30 June

2016 2015

----------------- --------- ------------- ---------

Company Expenses GBP7.7m GBP24.0m GBP11.1m

----------------- --------- ------------- ---------

Investment Management Report

Alliance Trust Investments' mandate is to focus on global quoted

equities and progressively reduce the Trust's non-core

investments.

Summary

Global equity markets endured a volatile six month period

between January and June 2016, yet delivered strong returns, with

the MSCI ACWI in Sterling up 12.0%. Much of this positive return

was due to the depreciation of Sterling over the period. Large-cap

'bond proxy' stocks and other low growth sectors such as utilities

and telecommunications were the main drivers of the performance of

the market.

The UK vote to exit the European Union was the key market driver

in the last week of the six month period. While market reaction has

thus far been confined to weakness in UK domestic and financial

stocks, the risk of a global recession is a key concern heading

into the second half of the year.

Market Review

Global equity markets at the beginning of 2016 were very

volatile. China was the key source of investor concern as pressure

mounted on the world's second largest economy as it continues to

transition away from investment-led growth to consumption-led

growth. This was accompanied by a falling oil price and investor

concern that central banks across the world were running out of

options to battle low growth. The US Federal Reserve had hoped that

the global economy would improve, allowing it to pursue its policy

of normalising US interest rates following its first rate hike in

eight years last December.

Market conditions improved from late February, as Chinese

authorities decided to inject credit into the economy to support

growth; the oil price recovered; and, the US Fed softened its

expectations for interest rate rises over 2016 in the US. However,

the end of June 2016 saw global equity markets sell off

aggressively as the UK electorate voted to leave the EU, which has

created risks to UK, European and global economic stability.

Following the UK's vote to leave the EU, Sterling fell

dramatically, finishing the period at levels not seen since the

1980s. The Bank of England has now shifted from a bias towards

increasing interest rates to a situation in which it may need to

loosen monetary policy. Weak investment and consumption for the

short, and possibly, medium-term are key risks for the UK economy,

which will place further pressure on the currency.

Quoted Equity Portfolio Performance

The Trust's quoted equity portfolio produced a return of 9.5%

for the period against the benchmark's 12.0% return. Much of the

under-performance over the period came during June as the portfolio

was impacted by the dislocation of markets resulting from the EU

Referendum.

The Trust's best performers came from companies associated with

cloud computing. Equinix, a provider of internet related services,

is a key beneficiary of the acceleration of cloud computing

adoption across the enterprise technology landscape. Its

co-location datacentres have become a key hub in the infrastructure

of cloud technology. Accenture, a leading IT service and consulting

firm, has also performed well, as it benefits from the need for

large corporations to integrate the benefits of cloud computing

into its technology infrastructure.

The financial sector was a source of underperformance for the

Trust as two core holdings - Prudential and Legal & General -

performed poorly over the period. Both companies have been hit by

fears around the implications of the EU Referendum, particularly

the risk that higher interest rates and bond yields in the UK are

now many years away. The fund is overweight the UK versus the MSCI

ACWI (16.7% compared to 6.4%), which also pressured performance

over June and in the first six months of the year.

Across the materials, telecoms and utilities sectors the growth

bias of the Trust's process was a headwind during the first half of

the year. With bond yields currently reaching fresh lows and

Chinese authorities pumping large amounts of credit into their

economy, the market rewarded companies with the lowest valuations,

rather than those with the strongest growth and fundamental

tailwinds.

Non-core Investments

During the period it was concluded that, given the prevailing

weakness in oil and gas prices, it was not an appropriate time to

complete the sale of the Trust's mineral rights assets. The Trust

will continue to benefit from the revenue generated by these assets

and the possibility of a sale will be reassessed when energy prices

are more favourable. The Trust's private equity investments have

increased in value since the year end and provided a small positive

contribution to investment returns over the first half of 2016.

EU Referendum Actions

In the period ahead of, and immediately after, the EU Referendum

two hedging positions intended to de-risk the equity portfolio from

market volatility were implemented. Given the risk to the value of

Sterling a three month currency hedge was taken out in March. This

currency position mitigated the equity portfolio's relative

overweight to Sterling compared to the US Dollar, equivalent to

4.8% of the portfolio. As Sterling depreciated over the post EU

Referendum period this position contributed positively to the

Trust's overall performance. This hedge has been rolled over for a

further three months.

The second hedge was a short position on the FTSE 100 future put

in place to protect the Trust's capital in the event of an extreme

market fall-out. The decision was taken to hedge 5% of the

portfolio's UK overweight position relative to the MSCI ACWI. When

combined with the currency hedge, this neutralised the Trust's

overweight position relative to the benchmark. The future position,

a protection against a worst case outcome, was entered as soon as

the leave vote was confirmed on 24 June and was closed on 1 July

when the risk of a disorderly market collapse had abated.

Fortunately, the market regained stability relatively swiftly. This

protection did incur a cost, and the net contribution of these two

measures on the Trust's performance was -0.2%.

Aside from the hedges, the Trust's gearing was reduced by GBP90m

while still maintaining an equity position of at least 100% of net

assets throughout the period.

Investment Outlook

The economic outlook for the second half of 2016 appears unclear

after the EU Referendum vote. The UK economy appears set for at

least a mild recession as investment and consumption freeze up in

the midst of so much uncertainty. The question remains as to

whether this will spill over into Europe and result in a slowdown

across the global economy. The unprecedented nature of the current

situation makes forecasting the impact particularly

challenging.

Political risks abound; from the US presidential election in

November to other important elections and referendums in China,

Germany, France and Italy over the next 18 months. With global

economic growth already fragile, political uncertainty is sure to

be a headwind for equity markets. In this uncertain environment we

believe a defensive portfolio that is invested in companies that

are growing through structural change - rather than those that are

dependent on cyclical tailwinds - will be key to investment

performance.

Alliance Trust Investments

Investment Manager

6 Month Equity Portfolio Sector Attribution to End June 2016

Index: MSCI ACWI in Sterling. Gross value of quoted equities in

portfolio.

Alliance Trust MSCI All Country

World Index

Sector Stock Total

Equity Portfolio Average Portfolio Contribution Average Sector Allocation Selection Relative

to

Attribution Weight Return Equity Weight Return Effect Effect Effect

(%) Return

------------------------ -------- ---------- ------------- ---------- ------- ----------- ---------- ---------

Consumer Discretionary 8.6 0.9 0.0 12.7 5.9 0.2 -0.4 -0.2

Consumer Staples 8.4 20.5 1.8 10.8 20.0 -0.2 0.0 -0.2

Energy 4.9 29.1 1.4 6.5 28.7 -0.2 0.0 -0.2

Financials 23.3 1.9 0.4 20.6 3.3 -0.2 -0.3 -0.5

Health Care 17.4 10.4 1.7 12.3 8.9 -0.2 0.1 -0.1

Industrials 6.9 16.5 1.0 10.4 14.8 -0.1 0.2 0.1

Information

Technology 19.2 10.6 2.1 14.6 10.1 -0.1 0.1 0.0

Materials 4.3 11.4 0.5 4.7 20.9 -0.1 -0.4 -0.5

Telecommunication

Services 3.3 6.2 0.2 4.0 21.1 0.0 -0.5 -0.5

Utilities 3.7 14.1 0.4 3.4 25.3 0.0 -0.4 -0.4

Total 100.0 9.5 9.5 100.0 12.0 -0.9 -1.6 -2.5

------------------------ -------- ---------- ------------- ---------- ------- ----------- ---------- ---------

Source: Alliance Trust and FactSet

Subsidiaries

Our subsidiary businesses, Alliance Trust Investments and

Alliance Trust Savings, are now operating as standalone businesses

and both have seen growth and an increasing level of profitability

during the period.

Alliance Trust Investments

During the period, a number of developments have taken place.

These demonstrate the continued positive growth in Alliance Trust

Investments which:

-- increased its assets under management from GBP2.1bn on 31

December 2015 to GBP5.2bn at the end of June 2016

-- had net third party inflows in the period of GBP25m

The Alliance Trust Investments' range of Sustainable Future

equity and fixed income funds (9 OEICs and 1 SICAV) had a

challenging first half of 2016. At the end of May half of these

funds were above the median for 2016 versus their peers however by

June only one fund was above median. The principal impact came in

the last week of June following the UK's vote to leave the EU. The

impact on Sterling hit the UK funds particularly hard, but the

effect of the increased economic uncertainty it precipitated was

felt across the range. The longer-term performance remains strong

across the range over 3 and 5 years. In addition the Monthly Income

Bond Fund continued to deliver an annual income yield of close to

6%.

Alliance Trust Investments is seeing continued interest from

prospective wholesale and institutional clients in its sustainable

investment expertise. A number of initiatives continued to take

place during the period to reduce costs and focus on the clarity of

its investment proposition. These changes are expected to

accelerate its path to profitability.

The Company has made a further investment of GBP2m in the

period. This further investment has not yet been recognised in the

fair value of the business and this remains as stated in our 2015

Annual Report and Accounts as GBP19.8m. The Directors will reassess

the fair value in light of the continuing development of the

business in the second half of the year.

Alliance Trust Savings

During the first half of 2016, Alliance Trust Savings has

focused on three areas:

-- the completion of the acquisition of Stocktrade

-- developing the governance and management of the standalone business

-- continuing the development of an enhanced operating platform for the business

Good progress was made in all three areas, with the Stocktrade

acquisition completed at the end of April, the new Alliance Trust

Savings Board and Executive Committee in place and the new platform

technology launched for new business in the intermediary business

channel.

Assets under administration rose from GBP8.5bn at 31 December

2015 to GBP12bn at 30 June 2016, a rise of 40%. In the same period

the net increase in customer accounts is over 26,000 (31%). This

growth was from the completion of the Stocktrade acquisition and

further organic growth. It has won a new corporate partnership

account which will bring additional business in the second half of

2016.

Alliance Trust Savings has made good progress towards delivering

profitability in 2016. Benefiting from the increased scale from the

Stocktrade acquisition, it achieved a small profit for the first

half of the year.

It is expected that customer numbers will continue to increase,

attracted by:

-- its flat fee structure

-- award winning customer service

-- differentiated proposition, including banking

-- improved functionality with the new technology

The Company has made a further investment of GBP15m in the

period. This further investment has not yet been recognised in the

fair value of the business and this remains as stated in our 2015

Annual Report and Accounts as GBP54.0m. The Directors will reassess

the fair value in light of the continuing development of the

business, embedding Stocktrade and leveraging the enhanced

operating platform in the second half of the year.

Company Portfolio Review

Quoted equity holdings as at 30 June 2016

Stock Country Sector % of Value

of

listing equity GBPm

portfolio

Visa United States Information Technology 3.1 95.0

Pfizer United States Health Care 3.1 93.8

Accenture United States Information Technology 2.9 89.6

CVS Health United States Consumer Staples 2.5 75.7

Amgen United States Health Care 2.5 75.7

Reckitt Benckiser United Kingdom Consumer Staples 2.5 75.2

TJX United States Consumer Discretionary 2.4 72.7

National Grid United Kingdom Utilities 2.4 72.3

American Tower United States Financials 2.4 72.1

Equinix United States Financials 2.3 70.8

Macquarie Infrastructure United States Industrials 2.2 66.9

CSL Australia Health Care 2.2 66.3

Daikin Industries Japan Industrials 2.1 64.8

Blackstone United States Financials 2.0 62.2

Tencent Hong Kong Information Technology 2.0 60.9

Danaher United States Industrials 2.0 60.2

Roche Switzerland Health Care 1.9 58.6

Toronto-Dominion

Bank Canada Financials 1.9 57.7

Wells Fargo United States Financials 1.8 55.3

SS&C Technologies United States Information Technology 1.8 54.2

NASDAQ OMX United States Financials 1.8 53.9

Prudential United Kingdom Financials 1.8 53.8

Walt Disney United States Consumer Discretionary 1.7 52.4

WPP United Kingdom Consumer Discretionary 1.7 52.2

ARM United Kingdom Information Technology 1.7 51.8

Ecolab United States Materials 1.7 50.4

Telecommunication

Vodafone United Kingdom Services 1.6 49.4

Swedbank Sweden Financials 1.6 49.3

Total France Energy 1.6 48.8

Statoil Norway Energy 1.6 48.5

Thermo Fisher

Scientific United States Health Care 1.6 48.4

Linear Technology United States Information Technology 1.6 48.2

Activision Blizzard United States Information Technology 1.5 47.3

Enterprise Products

Partners United States Energy 1.5 47.2

Telecommunication

Deutsche Telekom Germany Services 1.5 45.4

Acuity Brands United States Industrials 1.5 44.9

Johnson Matthey United Kingdom Materials 1.4 44.0

Microsoft United States Information Technology 1.4 42.6

Cadence Design

Systems United States Information Technology 1.4 42.4

Alphabet United States Information Technology 1.4 42.2

Novo Nordisk Denmark Health Care 1.4 41.9

Continental Germany Consumer Discretionary 1.4 41.7

ORIX Japan Financials 1.3 40.1

GlaxoSmithKline United Kingdom Health Care 1.3 39.0

AmBev Brazil Consumer Staples 1.3 38.8

Henkel Germany Consumer Staples 1.3 38.3

Unilever United Kingdom Consumer Staples 1.2 38.1

AmerisourceBergen United States Health Care 1.2 37.4

DNB Norway Financials 1.2 36.9

Dentsu Japan Consumer Discretionary 1.2 36.5

SAP Germany Information Technology 1.2 36.0

Mitsui Fudosan Japan Financials 1.2 35.9

Norsk Hydro Norway Materials 1.1 35.1

Schlumberger United States Energy 1.0 31.3

Legal & General United Kingdom Financials 1.0 30.5

Schneider Electric France Industrials 1.0 29.2

Bangkok Bank Thailand Financials 0.9 28.4

Roper Technologies United States Industrials 0.9 28.2

First Republic

Bank San Francisco United States Financials 0.8 24.1

ENN Energy Hong Kong Utilities 0.6 18.9

Melrose Industries United Kingdom Industrials 0.2 5.0

---------- --------

Total

value 3,054.4

---------- --------

Funds as at 30 June 2016

Alliance Trust Investment Country of Value GBPm

Funds registration

--------------------------------- ---------------- -----------------

Sustainable Future Pan-European

Equity Fund Luxembourg 62.8

Sustainable Future Cautious

Managed Fund United Kingdom 11.0

Sustainable Future Defensive

Managed Fund United Kingdom 11.0

-----------------

Total value 84.8

-----------------

Other investments as at 30 June 2016

Investment Region Value GBPm

------------------- ---------------------------- ------------

Private Equity United Kingdom/Europe/Asia 115.1

Mineral Rights North America 14.8

Alliance Trust

Savings United Kingdom 54.0

Alliance Trust

Investments United Kingdom 19.8

Indirect Property United Kingdom 9.4

Other United Kingdom 2.1

------------

Total value

215.2

------------

Total investments as at 30 June 2016

Investment Value GBPm

------------------- -------------

Quoted equities 3,054.4

Funds 84.8

Other investments 215.2

-------------

Total value

3,354.4

-------------

Source - Alliance Trust

A full portfolio listing, similar to that displayed above, is

available on a monthly basis on our website at

http://investor.alliancetrust.co.uk/ati/investorrelations/list-of-stock-holdings.htm

Risks and Uncertainties

The Company invests in both quoted and unquoted securities, its

subsidiary businesses, other asset classes and financial

instruments in order to achieve its investment objectives. Its

principal risks and uncertainties are therefore:

-- Prudential and Market

-- Operational

-- Strategic

-- Regulatory & Conduct

The Company's Operational and Regulatory & Conduct risks are

now managed by Alliance Trust Investments.

These risks, and the way in which they are managed, are

described in more detail within the Risk section on pages 18 and 19

of the Company's Annual Report and Accounts for the year ended 31

December 2015, which is available on the Company's website at

www.alliancetrust.co.uk.

Although the outcome of the referendum on the UK's membership of

the EU may provide additional risk from a market perspective we do

not expect our principal risks to change for the remainder of the

financial year.

Related Party Transactions

The nature of related party transactions has not changed

significantly from those described in the Company's Report and

Accounts for the year ended 31 December 2015. With effect from 1

January 2016 staff contracts have been transferred to Alliance

Trust Investments and Alliance Trust Savings. Alliance Trust

Investments was appointed alternative investment fund manager with

responsibility for portfolio investment for the Trust on 3 February

2016. In the period the Company subscribed to additional capital in

Alliance Trust Savings and Alliance Trust Investments as disclosed

on page 6. There were no transactions with related parties during

the six months ended 30 June 2016 which have a material effect on

the results or the financial position of the Company or of the

Group.

Defined Benefit Pension Scheme

In May 2016 the Board decided to inject GBP19.2m into its closed

defined benefit pension scheme to fund the purchase of an annuity

policy with Legal & General to match the scheme's liabilities

to its members. The annuity was purchased by the Trustees of the

Alliance Trust Companies' Pension Scheme on 31 May 2016, prior to

the fall in bond yields that followed the EU referendum vote. This

has removed volatility and risk from the Company balance sheet but

has impacted Total Return in the period by -0.8%.

Buybacks and Discount

In the first half of 2016 the sector average discount widened as

market and economic concerns undermined investor confidence. The

Company discount closed the period at 11.4% compared to 7.9% at 31

December 2015.

During the period the Company bought back and cancelled

11,365,096 shares. This represents 2.2% of the Company's share

capital. On 7 June, the Company announced that it had suspended its

share buybacks until it had concluded its strategic review. No

shares are held in Treasury. The weighted average discount of these

buybacks was 10.2%.

Going Concern Statement

The factors impacting on Going Concern are set out in detail on

page 33 of the Company's Annual Report and Accounts for the year

ended 31 December 2015.

As at 30 June 2016 there have been no significant changes to

these factors. The Directors, who have reviewed budgets, forecasts

and sensitivities, consider that the Group has adequate financial

resources to enable it to continue in operational existence for the

foreseeable future. Accordingly, the Directors believe it is

appropriate to continue to adopt the going concern basis for

preparing the financial statements.

Responsibility Statement

We confirm that to the best of our knowledge:

-- The condensed set of financial statements have been prepared

in accordance with IAS 34 "Interim Financial Reporting" as adopted

by the EU;

-- The interim management report includes a fair review of the information required by:

(a) DTR 4.2.7R of the Disclosure and Transparency Rules, being

an indication of important events that have occurred during the

first six months of the financial year and their impact on the

condensed set of financial statements, and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

(b) DTR 4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the first six

months of the current financial year and that have materially

affected the financial position or performance of the entity during

that period, and any changes in the related party transactions

described in the last annual report that could do so.

Signed on behalf of the Board

Lord Smith of

Kelvin

Chairman

21 July 2016

Financial Statements

Consolidated income statement (unaudited) for the

period ended 30 June 2016

------------------------------------------------------------------------------------------------------------------

Year to

6 months to 6 months to 31 Dec 2015

30 June 2016 30 June 2015 (audited)

--------------------- ---- --------------------------- --------------------------- ---------------------------

GBP000 Note Revenue Capital Total Revenue Capital Total Revenue Capital Total

--------------------- ---- ------- -------- -------- -------- ------- -------- -------- ------- --------

Revenue

Income 3 50,779 -- 50,779 63,378 -- 63,378 114,386 - 114,386

Profit on fair

value designated

investments -- 190,968 190,968 -- 375 375 -- 85,137 85,137

Profit on investment

property -- - - -- - - -- 720 720

Loss on fair

value of debt -- (21,670) (21,670) -- - - -- - -

--------------------- ---- ------- -------- -------- -------- ------- -------- -------- ------- --------

Total Revenue 50,779 169,298 220,077 63,378 375 63,753 114,386 85,857 200,243

Administrative

expenses (3,866) (3,825) (7,691) (21,508) (709) (22,217) (44,460) (1,585) (46,045)

Finance costs 4 (1,381) (2,762) (4,143) (1,964) (2,465) (4,429) (3,972) (5,281) (9,253)

Gain on revaluation

of office premises -- - - -- - - -- 175 175

Foreign exchange

gains/(losses) -- 4,691 4,691 -- (460) (460) -- (84) (84)

--------------------- ---- ------- -------- -------- -------- ------- -------- -------- ------- --------

Profit/(Loss)

before tax 45,532 167,402 212,934 39,906 (3,259) 36,647 65,954 79,082 145,036

Tax 5 (3,211) - (3,211) (3,444) - (3,444) (5,362) - (5,362)

--------------------- ---- ------- -------- -------- -------- ------- -------- -------- ------- --------

Profit/(Loss)

for the period/year 42,321 167,402 209,723 36,462 (3,259) 33,203 60,592 79,082 139,674

--------------------- ---- ------- -------- -------- -------- ------- -------- -------- ------- --------

All profit/(loss) for the period/year is attributable to equity

holders of the parent.

Earnings per share attributable to equity holders of the

parent

Basic (p per

share) 78.20 32.42 40.62 6.61 (0.59) 6.02 11.05 14.42 25.47

Diluted (p per

share) 78.18 32.37 40.55 6.60 (0.59) 6.01 11.03 14.39 25.42

Consolidated statement of comprehensive income (unaudited)

Year to

6 months to 6 months to 31 Dec 2015

30 June 2016 30 June 2015 (audited)

--------------------- ---- --------------------------- ------------------------ -------------------------

GBP000 Note Revenue Capital Total Revenue Capital Total Revenue Capital Total

--------------------- ---- ------- -------- -------- ------- ------- ------ ------- ------- -------

Profit/(Loss)

for the period/year 42,321 167,402 209,723 36,462 (3,259) 33,203 60,592 79,082 139,674

--------------------- ---- ------- -------- -------- ------- ------- ------ ------- ------- -------

Items that will

not be reclassified

subsequently

to profit or

loss:

Defined benefit

plan net actuarial

(loss)/gain 8 - (26,112) (26,112) - 4,492 4,492 - (22) (22)

Retirement benefit

obligations

deferred tax - - - - - - - (96) (96)

--------------------- ---- ------- -------- -------- ------- ------- ------ ------- ------- -------

Other comprehensive

(loss)/gain - (26,112) (26,112) - 4,492 4,492 - (118) (118)

--------------------- ---- ------- -------- -------- ------- ------- ------ ------- ------- -------

Total comprehensive

income for the

period/year 42,321 141,290 183,611 36,462 1,233 37,695 60,592 78,964 139,556

--------------------- ---- ------- -------- -------- ------- ------- ------ ------- ------- -------

All total comprehensive income for the period/year is

attributable to equity holders of the parent.

Consolidated statement of changes in equity (unaudited)

for the period ended 30 June 2016

-----------------------------------------------------------------------------------

Year to

6 months 6 months 31 Dec

to to 2015

30 June 30 June

GBP000 2016 2015 (audited)

---------------------------------------------- ---------- ---------- -----------

Called up share capital

At 1 January 13,160 13,835 13,835

Own shares purchased and

cancelled in the period/year (285) (27) (675)

---------------------------------------------- ---------- ---------- -----------

At 30 June / 31 December 12,875 13,808 13,160

---------------------------------------------- ---------- ---------- -----------

Capital reserves

At 1 January 2,169,142 2,233,915 2,233,915

Profit/(Loss) for the period/year 167,402 (3,259) 79,082

Defined benefit plan actuarial

(loss)/gain (26,112) 4,492 (118)

Own shares purchased and

cancelled in the period/year (56,171) (5,110) (136,479)

Share based payments 223 1,017 521

Dividends paid - - (7,779)

---------------------------------------------- ---------- ---------- -----------

At 30 June / 31 December 2,254,484 2,231,055 2,169,142

---------------------------------------------- ---------- ---------- -----------

Merger reserve

---------------------------------------------- ---------- ---------- -----------

At 1 January, 30 June and

31 December 645,335 645,335 645,335

---------------------------------------------- ---------- ---------- -----------

Capital redemption reserve

At 1 January 5,838 5,163 5,163

Own shares purchased and

cancelled in the period/year 285 27 675

---------------------------------------------- ---------- ---------- -----------

At 30 June / 31 December 6,123 5,190 5,838

---------------------------------------------- ---------- ---------- -----------

Revenue reserve

At 1 January 112,565 120,916 120,916

Profit for the period/year 42,321 36,462 60,592

Dividends (32,001) (41,552) (68,982)

Unclaimed dividends (redistributed)/returned (2) - 39

---------------------------------------------- ---------- ---------- -----------

At 30 June / 31 December 122,883 115,826 112,565

---------------------------------------------- ---------- ---------- -----------

Total equity

---------------------------------------------- ---------- ---------- -----------

At 1 January 2,946,040 3,019,164 3,019,164

---------------------------------------------- ---------- ---------- -----------

At 30 June / 31 December 3,041,700 3,011,214 2,946,040

---------------------------------------------- ---------- ---------- -----------

Consolidated balance sheet (unaudited) as at 30 June

2016

----------------------------------------------------------------------------------

30 June 30 June 31 Dec

GBP000 Note 2016 2015 2015 (audited)

--------------------------------- ----- ---------- ---------- ----------------

Non--current assets

Investments held at fair

value 10 3,343,938 3,408,527 3,307,397

Investment property held

at fair value - 4,830 -

Property, plant and equipment:

Office premises 4,540 4,365 4,540

Other fixed assets 29 352 299

Intangible assets - 1,012 917

Pension scheme surplus 8 235 11,299 6,882

Deferred tax asset 1,238 1,039 1,238

--------------------------------- ----- ---------- ---------- ----------------

3,349,980 3,431,424 3,321,273

Current assets

Outstanding settlements

and other receivables 43,366 23,282 12,125

Recoverable overseas tax 2,754 1,244 1,483

Cash and cash equivalents 42,817 33,505 25,153

--------------------------------- ----- ---------- ---------- ----------------

88,937 58,031 38,761

Total assets 3,438,917 3,489,455 3,360,034

Current liabilities

Outstanding settlements

and other payables (70,222) (10,265) (17,570)

Tax payable (3,991) (3,991) (3,991)

Bank loans 13 (200,000) (362,000) (290,000)

--------------------------------- ----- ---------- ---------- ----------------

(274,213) (376,256) (311,561)

Total assets less current

liabilities 3,164,704 3,113,199 3,048,473

Non--current liabilities

Unsecured fixed rate loan

notes (121,670) (100,000) (100,000)

Deferred tax liability (1,238) (1,039) (1,238)

Amounts payable under

long term Investment Incentive

Plan (96) (946) (1,195)

(123,004) (101,985) (102,433)

Net assets 3,041,700 3,011,214 2,946,040

Equity

Share capital 14 12,875 13,808 13,160

Capital reserve 2,254,484 2,231,055 2,169,142

Merger reserve 645,335 645,335 645,335

Capital redemption reserve 6,123 5,190 5,838

Revenue reserve 122,883 115,826 112,565

Total Equity 3,041,700 3,011,214 2,946,040

All net assets are attributable to the equity holders of the

parent.

Net asset value per ordinary share attributable to equity

holders of the parent

Basic (GBP) 9 GBP5.91 GBP5.46 GBP5.61

Diluted (GBP) 9 GBP5.91 GBP5.45 GBP5.60

Consolidated cash flow (unaudited) for the period

ended 30 June 2016

------------------------------------------------------------------------------------

Year to

6 months 6 months 31 Dec

to to 2015

30 June 30 June

GBP000 2016 2015 (audited)

---------------------------------------------- ---------- ---------- ------------

Cash flows from operating activities

Profit before tax 212,934 36,647 145,036

Adjustments for:

Gains on investments (190,968) (375) (85,857)

Loss on fair value of debt 21,670 - -

Foreign exchange (gain)/loss (4,691) 460 84

Depreciation (122) 118 193

Amortisation of intangibles - 165 329

Gain on revaluation of offices

premises - - (175)

Share based payment expense 223 1,017 521

Interest 4,143 4,429 9,253

Movement in pension scheme

surplus (19,465) (1,610) (1,707)

Operating cash flows before

movements in working capital 23,724 40,851 67,677

(Increase)/Decrease in receivables (4,720) (7,796) 3,367

(Decrease)/Increase in payables (7,771) 3,311 10,067

---------------------------------------------- ---------- ---------- ------------

Net cash inflow from operating

activities before income taxes 11,233 36,366 81,111

Taxes paid (4,482) (3,693) (5,948)

---------------------------------------------- ---------- ---------- ------------

Net cash inflow from operating

activities 6,751 32,673 75,163

Cash flows from investing activities

Proceeds on disposal at fair

value of investments through

profit and loss 586,168 691,897 1,325,859

Purchase of investments at

fair value through profit and

loss (398,933) (765,105) (1,206,841)

Disposal/(Purchase) of plant

and equipment 389 (3) (25)

Disposal/(Purchase) of other

intangible assets 920 (142) (214)

Net cash inflow/(outflow) from

investing activities 188,544 (73,353) 118,779

Cash flows from financing activities

Dividends paid -- Equity (32,001) (41,552) (76,761)

Unclaimed dividends (redistributed)/returned (2) - 39

Purchase of own shares (56,171) (5,110) (136,479)

Bank loans and unsecured fixed

rate loan notes raised - 82,000 10,000

Repayment of borrowing (90,000) - -

Interest payable (4,148) (4,795) (9,606)

Net cash (outflow)/inflow from

financing activities (182,322) 30,543 (212,807)

Net increase/(decrease) in

cash and cash equivalents 12,973 (10,137) (18,865)

Cash and cash equivalents at

beginning of period/year 25,153 44,102 44,102

Effect of foreign exchange

rate changes 4,691 (460) (84)

---------------------------------------------- ---------- ---------- ------------

Cash and cash equivalents at

the end of period/year 42,817 33,505 25,153

1 General Information

The information contained in this report for the period ended 30

June 2016 does not constitute statutory accounts as defined in

section 434 of the Companies Act 2006. A copy of the statutory

accounts for the year ended 31 December 2015 has been delivered to

the Registrar of Companies. The auditor's report on those financial

statements was prepared under s495 and s496 of the Companies Act

2006. The report was not qualified, did not contain an emphasis of

matter paragraph and did not contain statements under section

498(2) or (3) of the Companies Act.

The interim results are unaudited. They should not be taken as a

guide to the full year and do not constitute the statutory

accounts.

2 Accounting Policies

Basis of preparation

The annual financial statements were prepared using accounting

policies consistent with International Financial Reporting

Standards (IFRS) as adopted by the EU. The condensed set of

financial statements included in this half yearly financial report

have been prepared in accordance with IAS 34 'Interim Financial

Reporting', as adopted by the EU.

Going concern

The Directors have a reasonable expectation that the Company and

Group have sufficient resources to continue in operational

existence for the foreseeable future. Accordingly the financial

statements have been prepared on a going concern basis.

Segmental reporting

The Group has identified a single operating segment, the

investment trust, which aims to maximise shareholders returns. As

such no segmental information has been included in these financial

statements.

Application of accounting policies

The same accounting policies, presentations and methods of

computation are followed in these financial statements as were

applied in the Group's last annual audited financial statements

with the exception of the following changes that have been made to

the basis of accounting estimates:

-- From 1 January 2016 the Company attributes indirect

expenditure one third to revenue and two thirds to capital costs.

In prior periods the Company allocated all indirect expenditure

against revenue profits save that two thirds of the costs of bank

indebtedness, an indirect cost, were allocated against capital

profits save for the costs associated with seeding the fixed income

bond fund which was all charged to revenue. This is consistent with

the Statement of Recommended Practice ('SORP') "Financial

Statements of Investment Trust Companies and Venture Capital

Trusts" for investment trusts issued by the Association of

Investment Companies ('AIC') in November 2014 which states that

either a proportion of all indirect expenditure or no indirect

expenditure is allocated against capital profits.

-- From the 1 June 2016 the unsecured fixed rate loan notes are

recognised at fair value. In prior periods they have been included

at par value.

Group Consolidation

The Company qualifies as an investment entity under IFRS 10

meeting all the key characteristics and as such is no longer

required to consolidate its subsidiaries on a line by line basis,

but instead recognise them as investments at fair value through the

income statement.

The 'Consolidated Group', represents the results of the Company

('Alliance Trust PLC') and Alliance Trust Services Limited

('ATSL'). ATSL is required to be consolidated as it provides

services that relate directly to the investment activities of the

Company however it is not itself an investment entity.

The investment mandate of the Company was awarded to Alliance

Trust Investments ('ATI') in February. The primary objective of ATI

however remains to grow its third party asset management business,

with the Company being one client and as such we consider it would

not be appropriate to consolidate ATI as at 30 June 2016.

All other subsidiaries within the Group are valued at fair value

through the income statement as they do not provide services that

relate directly to the investment activities of the Company or they

are themselves regarded as an investment entity.

The same accounting policies, presentations and methods of

computation are followed in these financial statements as were

applied in the Group's last annual audited financial

statements.

3 Revenue

6 months 6 months

to to

30 June 30 June Year to

GBP000 2016 2015 31 Dec 2015

----------------------- --------- ---------- -------------

Deposit interest 3 5 17

Dividend income* 49,950 50,076 88,247

Mineral rights income 826 1,928 3,311

Property rental income - 230 565

Recharged costs** - 11,139 22,027

Other income - - 219

----------------------- --------- ---------- -------------

Total revenue 50,779 63,378 114,386

* Designated at fair value through profit and loss on initial

recognition

** ATSL acted as a paymaster company and as such staff costs and

all indirect costs for the two trading business, Alliance Trust

Savings Limited ('ATS') and Alliance Trust Investments Limited

('ATI'), were included within income and expenses in the

Consolidated Income Statement as these are recharged by ATSL in the

results to 31 December 2015 and to 30 June 2015. From 1 January

2016 staff costs and indirect costs were paid directly by the two

trading businesses and as such were not recharged through ATSL.

4 Finance Costs

6 months to 6 months to Year to 31 Dec

30 June 2016 30 June 2015 2015

--------------- ----------------------- ----------------------- -----------------------

GBP000 Revenue Capital Total Revenue Capital Total Revenue Capital Total

--------------- ------- ------- ----- ------- ------- ----- ------- ------- -----

Bank loans

and unsecured

fixed rate

loan notes 1,381 2,762 4,143 1,964 2,465 4,429 3,972 5,281 9,253

Total finance

costs 1,381 2,762 4,143 1,964 2,465 4,429 3,972 5,281 9,253

Finance costs include interest of GBP2.2m (GBP1.7m at 30 June

2015 and GBP4.3m at 31 December 2015) on the GBP100m 4.28%

unsecured fixed rate loan notes which were drawn down in July 2014

for 15 years.

5 Taxation

UK corporation tax for the period to 30 June 2016 is charged at

20.0% (20.3% for the period to 30 June 2015) of the estimated

taxable profits for the period. A reduction in the main rate of UK

corporation tax to 20.0% was substantively enacted in April 2016.

Taxation levied by other jurisdictions is calculated at the rates

prevailing in those jurisdictions, such taxation mainly comprises

withholding taxes levied on the investment returns generated on

foreign investments such as overseas dividend income.

6 Dividends

6 months 6 months

to to Year to

30 June 30 June 31 Dec

GBP000 2016 2015 2015

---------------------------------- -------- -------- -------

Fourth interim dividend for the

year ended 31 December 2014 of

2.4585p per share - 13,555* 13,555*

First interim dividend for the

year ended 31 December 2015 of

2.5325p per share - 13,961 13,962

Second interim dividend for the

year ended 31 December 2015 of

2.5325p per share - - 13,965

Third interim dividend for the

year ended 31 December 2015 of

2.5325p per share - - 13,464

Fourth interim dividend for the

year ended 31 December 2015 of

3.3725p per share 17,473* - -

First interim dividend for the

year ended 31 December 2016 of

2.825p per share 14,528 - -

---------------------------------- -------- -------- -------

32,001 27,516 54,946

Special dividend for the year

ended 31 December 2014 of 2.546p

per share - 14,036* 14,036*

Special dividend for the year

ended 31 December 2015 of 1.463p

per share - - 7,779

---------------------------------- -------- -------- -------

32,001 41,552 76,761

---------------------------------- -------- -------- -------

*Dividends for the year ended 31 December 2015 have been

adjusted to reflect share buybacks and changes in shares held by

the Trustee of the Employee Benefit Trust.

7 Earnings Per Share

From continuing operations

The calculation of the basic and diluted earnings per share is

based on the following data:

6 months to 6 months to Year to 31 Dec

30 June 2016 30 June 2015 2015

-------------------- ------------------------- ------------------------ -------------------------

GBP000 Revenue Capital Total Revenue Capital Total Revenue Capital Total

-------------------- ------- ------- ------- ------- ------- ------ ------- ------- -------

Ordinary shares

Earnings for

the purposes

of basic earnings

per share being

net profit

attributable

to equity holders

of the parent 42,321 167,402 209,723 36,462 (3,259) 33,203 60,592 79,082 139,674

Number of shares

Weighted average

number of ordinary

shares for

the purposes

of basic earnings

per share 516,332,453 551,532,534 548,480,531

Weighted average

number of ordinary

shares for

the purposes

of diluted

earnings per

share 517,100,606 552,517,817 549,465,141

The weighted average number of ordinary shares is arrived at by

excluding 698,062 (886,173 at 30 June 2015 and 886,173 at 31

December 2015) ordinary shares acquired by the Trustee of the

Employee Benefit Trust with funds provided by the Company.

IAS 33.41 requires that shares should only be treated as

dilutive if they decrease earnings per share or increase the loss

per share. The earnings per share figures on the income statement

reflect this.

8 Pension Schemes

The Group sponsors two pension arrangements.

The Alliance Trust Companies' Pension Fund ('the Scheme') is a

funded defined benefit pension scheme which closed to future

accrual on 2 April 2011. In November 2015, following the

announcement of changes made to the management of Alliance Trust

PLC, the Trustees requested that Alliance Trust PLC consider

funding the Scheme to allow them to secure the benefits of the

members with an insurance company. The Board of Alliance Trust PLC,

after a tender exercise had been carried out by the Trustees,

approved in May 2016 additional funding to allow the Trustees to

enter into an agreement with Legal and General Assurance Society

Limited for a policy to secure all of the benefits of the members.

The Trustees entered into such an Agreement effective 31 May

2016.

Employees are entitled to receive contributions into their own

Self Invested Personal Pension ('SIPP') provided by ATS.

Defined Benefit Scheme

The net actuarial loss made in the period and recognised in the

Consolidated Statement of Comprehensive Income was GBP26,112,000

(30 June 2015 net actuarial gain of GBP4,492,000 and 31 December

2015 net actuarial loss of GBP22,000) calculated by a qualified

independent actuary.

Certain actuarial assumptions have been used to arrive at the

retirement benefit scheme surplus of GBP0.2m as at 30 June 2016 (30

June 2015 surplus of GBP11.3m and 31 December 2015 surplus of

GBP6.9m). The change in the period is due to the purchase of the

bulk annuity policy with Legal and General, which means the assets

now match the liabilities of the Scheme, with the exception of the

amount held in the bank account. The actuarial assumptions are set

out in the following table:

30 June 30 June 31 Dec

2016 2015 2015

----------------------------------- -------- -------- -------

% per % per % per

annum annum annum

----------------------------------- -------- -------- -------

Retail Price Index Inflation 3.30 3.15 3.50

Consumer Price Index Inflation 2.40 2.25 2.60

Rate of discount 3.25 3.40 3.80

Allowance for pension in payment

increases of RPI (subject to

a maximum increase of 5% p.a) 3.20 3.05 3.35

Allowance for revaluation of

deferred pensions of CPI (subject

to a maximum increase of 5% p.a) 2.40 2.25 2.20

9 Net Asset Value Per Ordinary Share

The calculation of the net asset value per ordinary share is

based on the following:

30 June 30 June 31 Dec

2016 2015 2015

---------------------------------- ----------- ----------- -----------

Equity shareholder funds (GBP000) 3,041,700 3,011,214 2,946,040

Number of shares at period

end -- Basic 514,277,739 551,447,973 525,454,724

Number of shares at period

end -- Diluted 514,975,801 552,334,146 526,340,897

The number of ordinary shares has been reduced by 698,062

(886,173 at 30 June 2015 and 886,173 at 31 December 2015) ordinary

shares held by the Trustee of the Employee Benefit Trust in order

to arrive at the Basic figures above.

10 Hierarchical valuation of financial instruments

The Group refines and modifies its valuation techniques as

markets develop. While the Group believes its valuation techniques

to be appropriate and consistent with other market participants,

the use of different methodologies or assumptions could result in

different estimates of fair value at the balance sheet date.

Financial instruments excludes the Investment Property.

The table below analyses financial instruments carried at fair

value, by valuation method. The different levels have been defined

as follows:

Level 1 - Quoted prices (unadjusted) in active markets for

identical assets or liabilities

Level 2 - Inputs other than quoted prices included within level

1 that are observable for the asset or liability, either directly

(that is, as prices) or indirectly (that is, derived from

prices)

Level 3 - Inputs for the asset or liability that are not based

on observable market data (that is, unobservable inputs)

The following table analyses the fair value measurements for the

Group's assets and liabilities measured by the level in the fair

value hierarchy in which the fair value measurement is categorised

at 30 June 2016. All fair value measurements disclosed are

recurring fair value measurements.

Group valuation hierarchy fair value through profit and loss

As at 30 June 2016

Level Level Level

GBP000 1 2 3 Total

--------------------------- --------- ----- ------- ---------

Listed investments 3,124,036 - - 3,124,036

Foreign exchange contracts - 4,690 - 4,690

Unlisted investments

Private Equity - - 124,500 124,500

Alliance Trust Savings - - 54,000 54,000

Alliance Trust Investments - - 19,800 19,800

Alliance Trust Finance - - 720 720

Mineral rights - - 14,778 14,778

Other - - 1,414 1,414

--------------------------- --------- ----- ------- ---------

3,124,036 4,690 215,212 3,343,938

As at 30 June 2015

Level Level Level

GBP000 1 2 3 Total

--------------------------- --------- ------ -------- ----------

Listed investments 3,176,679 - - 3,176,679

Foreign exchange contracts - (5) - (5)

Unlisted investments

Private Equity - - 132,898 132,898

Alliance Trust Savings - - 31,573 31,573

Alliance Trust Investments - - 24,269 24,269

Alliance Trust Finance - - 8,871 8,871

Mineral rights - - 33,087 33,087

Other - - 1,155 1,155

--------------------------- --------- ------ -------- ----------

3,176,679 (5) 231,853 3,408,527

As at 31 Dec 2015

Level Level Level

GBP000 1 2 3 Total

--------------------------- --------- ------ -------- ----------

Listed investments 3,088,881 - - 3,088,881

Unlisted investments

Private Equity - - 125,254 125,254

Alliance Trust Savings - - 54,000 54,000

Alliance Trust Investments - - 19,800 19,800

Alliance Trust Finance - - 720 720

Mineral rights - - 17,535 17,535

Other - - 1,207 1,207

--------------------------- --------- ------ -------- ----------

3,088,881 - 218,516 3,307,397

There have been no transfers of recurring measurements during

the year between Levels 1, 2 and 3.

Fair Value Assets in Level 1

The quoted market price used for financial investments held by

the group is the current bid price. These investments are included

within Level 1 and comprise of equities, bonds and exchange traded

derivatives.

Fair Value Assets in Level 2

The fair value of financial instruments that are not traded in

an active market (for example, over--the--counter derivatives) is

determined by using valuation techniques. These valuation

techniques maximise the use of observable market data where it is

available and with minimal reliance on entity specific

estimates.

Fair Value Assets in Level 3

Level 3, excluding the valuations of the subsidiaries, are

reviewed at least annually by the Valuation Committee who are

assigned responsibility by the Board of Alliance Trust PLC. The

valuations of the subsidiaries are approved at least annually by

the Audit Committee and then recommended to the Valuation

Committee. The Valuation Committee considers the appropriateness of

the valuation models and inputs used in accordance with the Group's

valuation policy. The Valuation Committee will determine the

appropriateness of any valuation of the underlying assets.

The following table shows the reconciliation from the beginning

balances to the ending balances for fair value measurement in Level

3 of the fair value hierarchy.

Group

------------------------------------ -----------------------------

June

GBP000 June 16 15 Dec 15

------------------------------------ -------- --------- --------

Balance at 1 January 218,516 232,531 232,531

Net loss from financial instruments

at fair value through profit or

loss (15,043) (2,390) (16,556)

Purchases at cost 17,817 9,519 42,908

Sales proceeds (9,187) (10,085) (38,175)

Realised gain/(loss) on sale 3,109 2,278 (2,192)

Balance at 30 June / 31 December 215,212 231,853 218,516

Investments in subsidiary companies (Level 3) are valued in the

Company's accounts at GBP168.0m (GBP170.6m at 30 June 2015 and

GBP173.0m at 31 December 2015) being the Directors' estimate of

their fair value, using the guidelines and methodologies on

valuation published by the International Private Equity and Venture

Capital Board. This includes ATS at GBP54.0m (GBP31.6m at 30 June

2015 and GBP54.0m at 31 December 2015), ATI at GBP19.8m (GBP24.3m

at 30 June 2015 and GBP19.8m at 31 December 2015) and ATF GBP0.7m

(GBP8.9m at 30 June 2015 and GBP0.7m at 31 December 2015). This

represents the Directors' view of the amount for which the

subsidiaries could be exchanged between knowledgeable willing

parties in an arm's length transaction. This does not assume that

the underlying business is saleable at the reporting date or that

the Company currently has any intention to sell the subsidiary

business in the future. The Directors have used several valuation

methodologies as prescribed in the guidelines to arrive at their

best estimate of fair value, including discounted cash flow

calculations, revenue and earnings multiples and recent market

transactions where available.

The following key assumptions are relevant to the fair valuation

of our investment in our subsidiary companies, and are consistent

with prior years. The multiples applied in valuing our subsidiaries

are derived from comparable companies sourced from market data.

-- ATS -- This is valued as a trading business. For the fair

valuation of ATS as at 31 December 2015 the Board used an external

valuation. A discounted cash flow, revenue multiple and an earnings

before interest, tax, depreciation and amortisation multiple

approach were used for comparative purposes. No change has been

made to the fair valuation as at 30 June 2016.

-- ATI -- This is valued as a trading business. A discounted

cashflow, revenue multiple and an earnings before interest, tax

depreciation and amortisation multiple valuation approach was

adopted as at 31 December 2015. No change has been made to the fair

valuation as at 30 June 2016.

The fair value of both ATS and ATI are as stated in the 2015

Annual Report and Accounts. These have been reassessed by the

Directors and are still regarded as best estimation of the fair

value for financial reporting purposes as at 30 June 2016. The

Directors will review the fair value on an ongoing basis and will

reassess the fair value in light of progress in the new business

integration and operating platform with specific respect to ATS and

in respect of delivery of business plans and profitability for both

companies, prior to the financial year end.

Mineral rights are carried at fair value and are valued in the

Company's accounts at GBP14.8m (GBP33.1m at 30 June 2015, GBP17.5m

at 31 December 2015) being the Directors' estimate of their fair

value, using the guidelines and methodologies on valuation

published by the Oklahoma Tax Commission and for non--producing

properties, the Lierle US Price Report.

The table below details how an increase or decrease in the input

variables would impact the valuation disclosed for the relevant

Level 3 assets.

Fair

Value

at Input Change in

GBP000 June Valuation Unobservable sensitivity valuation

Investment 2016 Method inputs Input +/- +/-

------------------- ------ ------------------- ------------------- ----- ------------ ---------------

Average of

discounted

cash flow

methodology

Alliance and comparable DCF Discount

Trust Savings 54,000 trading multiples. rate 13.2% 1% 6,000/(6,000)

------------------- ----- ------------ ---------------

AUA Growth 1 1 12,000/(12,000)

------------------- ----- ------------ ---------------

EBITDA multiple 1 1 6,300/(6,300)

------------------- ----- ------------ ---------------

Average of

discounted

cash flow

methodology

Alliance and comparable DCF Discount

Trust Investments 19,800 trading multiples. rate 15% 1% (600)/600

------------------- ----- ------------ ---------------

Revenue

multiple 2 1 6,000/(6,000)

------------------- ----- ------------ ---------------

EBITDA multiple 6 1 470/(470)

------------------- ----- ------------ ---------------

Oklahoma Tax

Commission

multiples

and Lierle

US Price report Revenue

(for non producing multiple

Mineral Rights 14,778 properties). - gas 7 1 1,100/(1,100)

------------------- ------------------- ----- ------------ ---------------

Revenue

multiple

- oil 4 1 800/(800)

------------------- ------------------- ----- ------------ ---------------

Revenue

multiple

- 4 1 400/(400)

products/condensate

------------------- ----- ------------ ---------------

Average

bonus 1 0.5 1,000/(1,000)

multiple

non producing

------------------- ------ ------------------- ------------------- ----- ------------ ---------------

The change in valuation disclosed in the above table shows the

direction an increase or decrease in the respective input variables

would have on the valuation result. For ATS, an increase in the

assets under administration (AUA) growth multiple and EBITDA

multiple or a decrease in the discount rate would lead to an

increase in the estimated value. For ATI, an increase in the

revenue and EBITDA multiple or a decrease in the discount rate

would lead to an increase in the estimated value. For mineral

rights, an increase in the revenue multiple and average bonus

multiple would lead to an increase in the estimated value.

Private equity investments, both fund--to--fund and direct

included under Level 3, are valued in accordance with the

International Private Equity and Venture Capital Valuation

Guidelines issued in December 2012. Unlisted investments in private

equity are stated at the valuation as determined by the Valuation

Committee based on information provided by the General Partner. The

General Partner's policy in valuing unlisted investments is to

carry them at fair value. The General Partner will generally rely

on the fund's investment manager's fair value at the last reported

period, rolled forward for any cashflows. However, if the General

Partner does not feel the manager is reflecting a fair value they

will select a valuation methodology that is most appropriate for

the particular investments in that fund and generate a fair value.

In those circumstances the General Partner believes the most

appropriate methodologies to use to value the underlying

investments in the portfolio are: Price of a recent investment,

Multiples, Net assets, and Industry valuation benchmarks. An entity

is not required to create quantitative information to comply with

this disclosure requirement if quantitative unobservable inputs are

not developed by the entity when measuring fair value (for example,

when an entity uses prices from prior transactions or third--party

pricing information without adjustment). Alliance Trust PLC

receives information from the General Partner on the underlying

investments which is subsequently reviewed by the Valuation

Committee. Where Alliance Trust PLC does not feel that the

valuation is appropriate, an adjustment will be made.

The Company's unsecured fixed rate loan notes are initially

recognised at a carrying value equivalent to the proceeds received

net of issue costs associated with the borrowings. After initial

recognition, unsecured fixed rate loan notes are subsequently

measured at amortised cost using the effective interest rate

method. The effective rate of interest is 4.30%.

No interrelationships between unobservable inputs used in the

above valuations of Level 3 investments have been identified.

11 Financial Commitments

As at 30 June 2016 the Group and Company had financial

commitments, which have not been accrued, totaling GBP26m (GBP42m

at 30 June 2015 and GBP44m at 31 December 2015). Of this amount

GBP26m (GBP42m at 30 June 2015 and GBP44m at 31 December 2015) was

in respect of uncalled subscriptions in investments structured as

limited partnerships all of which relates to investments in our

private equity portfolio. This is the maximum amount that the

Company may be required to invest. These limited partnership

commitments may be called at any time up to an agreed contractual

date. The Company may choose not to fulfil individual commitments

but may suffer a penalty should it do so, the terms of which vary

between investments.

The Company has provided letters of support in connection with

funding made available to certain of its subsidiaries, including

ATS and ATI, confirming ongoing support for at least 12 months from

the date the annual financial statements were signed, to make

sufficient funds available if needed to enable them to continue

trading, meet commitments and not to seek repayment of any amounts

outstanding.

On 25 March 2011 the Company granted a floating charge of up to

GBP30m over its listed investments to the Trustees of the Alliance

Trust Companies Pension Fund.

12 Share Based Payments

The Group operates two share based payment schemes. Full details

of these schemes (LTIP and AESOP) are disclosed in the December

2015 Annual Report and financial statements and the basis of

measuring fair value is consistent with that disclosed therein.

Long Term Incentive Plan ('LTIP')

The disclosure in this note relates to the 2014 and 2015 plans;

no awards have been granted for a 2016 scheme. As of 1 January

2016, employee contracts have been transferred to ATI and ATS and

as such no ongoing remuneration costs are incurred by the Company.

However, the Company will continue to incur some costs in relation

to the 2014 and 2015 plans through to vesting dates for previous

Company employees. The actual pay out values are to be recognised

in the Company accounts at the respective plan vesting dates and

are contingent on the performance of the business in accordance

with the performance measures in the plan rules.

In the period ended 30 June 2016 no Company shares were

purchased (98,002 at 30 June 2015 and 31 December 2015) at a price

of GBP Nil (GBP5.10 at 30 June 2015 and 31 December 2015) per

share. Matching awards of up to Nil (317,880 at 30 June 2015 and 31

December 2015) shares, and performance awards of up to Nil (552,263

at 30 June 2015 and 31 December 2015) shares were granted.

Matching awards and performance awards made during the period

were valued at GBPNil (GBP588,000 at 30 June 2015 and at 31

December 2015) and GBPNil (GBP1,022,000 at 30 June 2015 and at 31

December 2015) respectively. The fair value of the awards was

calculated using a binomial methodology.

The cumulative charge to the income statement during the period

for the 2014 and 2015 LTIP awards was GBP213,000 (GBP452,000 at 30

June 2015 and GBP52,000 at 31 December 2015) for the Group.

These costs are adjusted if certain vesting conditions are not

met, for example if a participant leaves before the end of the

three year (2014 scheme) and five year (2015 scheme) vesting

period.

13 Bank loans and unsecured fixed rate loan notes

As at As at As at

30 June 30 June 31 Dec

GBP000 2016 2015 2015

------------------------------------ --------- --------- --------

Bank loans repayable within

one year 200,000 362,000 290,000

------------------------------------ --------- --------- --------

Analysis of borrowings by currency:

Bank loans -- Sterling 200,000 362,000 290,000

The weighted average % interest

rates payable:

Bank loans 1.24% 1.39% 1.33%

The Directors' estimate of

the fair value of the borrowings:

Bank loans 200,000 362,000 290,000

Unsecured fixed rate loan notes 121,670 100,000 100,000

------------------------------------ --------- --------- --------

The effective interest rates

payable:

Unsecured fixed rate loan notes 4.30% 4.30% 4.30%

GBP100m of unsecured fixed rate loan notes were drawn down in

July 2014, over 15 years at 4.28%. Up until 31 December 2015, these

were accounted for at par. With effect from 1 June 2016 these are