TIDMAPH

RNS Number : 7587J

Alliance Pharma PLC

14 September 2016

For immediate release 14 September 2016

ALLIANCE PHARMA PLC

("Alliance" or the "Company")

Interim Results for the six months ended 30 June 2016

Alliance Pharma plc (AIM: APH), the specialty pharmaceutical

company, is pleased to announce its interim results for the six

months ended 30 June 2016.

Highlights:

-- Half year revenue up 104% at GBP46.4m (H1 2015: GBP22.8m)

o Ex-Sinclair products have made an immediate contribution to

our results, in line with our expectations and enabling revenues to

more than double

o Underlying revenue growth of 6% in the original Alliance

portfolio

-- Our largest-selling brand is now the scar reduction product,

Kelo-cote(TM), which achieved H1 sales of GBP4.1m from a widely

spread international base

-- Hydromol(TM), our emollient range, maintained its double

digit growth rate, with H1 sales of GBP3.5m

-- MacuShield(TM), our nutritional supplement product for age

related macular degeneration (AMD), delivered H1 sales of GBP2.0m

(GBP1.4m in the five months after we acquired it in February

2015)

-- Half year EBITDA up 109% at GBP13.2m (H1 2015: GBP6.3m)

-- Half year PBT up 113% at GBP11.7m (H1 2015: GBP5.5m)

-- Basic earnings per share 2.04p (H1 2015: 1.65p)

-- Interim dividend up 10% to 0.403p (H1 2015: 0.366p)

-- Net bank debt GBP79.0m (31 December 2015: GBP71.5m)

o Driven jointly by increases in working capital and Sterling's

weakness

Commenting on the results, Andrew Smith, Alliance Pharma's

Chairman, said:

"Alliance Pharma is a transformed business with sales and

profits in the first half of 2016 having doubled from those of

2015. We are already seeing opportunities to exploit our expanded

international capabilities. We were delighted to announce yesterday

the signing of an EU licensing and distribution agreement for

Diclectin with Duchesnay Inc., which provides the opportunity to

launch this product in a further nine EU territories. This

agreement highlights the potential of our strengthened European

base."

For further information:

+ 44 (0) 1249

Alliance Pharma plc 466966

John Dawson, Chief Executive

Andrew Franklin, Chief Financial

Officer

Sarah Robinson, Company Secretary

+ 44 (0) 20 7466

Buchanan 5000

Mark Court / Sophie Cowles

/ Jane Glover

+ 44 (0) 20 7260

Numis Securities Limited 1000

Nominated Adviser: Michael

Meade / Freddie Barnfield

Corporate Broking: James Black

/ Toby Adcock

Notes to editors:

About Alliance

Alliance, founded in 1998, is an international specialty

pharmaceutical company based in Chippenham, Wiltshire, UK. The

Company has sales in more than 100 countries worldwide via direct

sales, joint ventures and a network of distributors. Alliance has a

strong track record of acquiring the rights to established niche

products and it currently owns or licenses the rights to

approximately 90 pharmaceutical and consumer healthcare products.

The Company continues to explore opportunities to expand its

product portfolio.

Alliance joined the AIM market of the London Stock Exchange in

December 2003 and trades under the symbol APH.

Chairman's and Chief Executive's Statement

Alliance Pharma in 2016 is twice the size that it was in 2015.

We are a transformed business looking forward to greatly increased

opportunities in 2016 and beyond. The integration of the Sinclair

Healthcare Products business acquired in December 2015 has brought

us 27 new products, increasing our portfolio to some 90 products,

and extended our reach from around 40 countries to over 100. We are

now a truly international business, with half of our sales in

markets outside the UK.

The original Alliance products performed strongly in the first

half and the ex-Sinclair products have made an immediate

contribution to our results, in line with our expectations.

Integration of the Sinclair operations is advancing well. We

have maintained the flow of the business and will be independent

from Sinclair in terms of the cash generating activities in Q4 this

year. Other items such as packaging and livery changes that depend

upon regulatory approvals will take up to 18 months to be complete

in all the territories.

Most of the key positions within the organisation have now been

filled and we are working hard to implement standard ways of

working and to develop a common culture, building on the best of

the two organisations.

Trading performance

In the first half of 2016, sales more than doubled to GBP46.4m

(H1 2015: GBP22.8m). The ex-Sinclair products contributed sales of

GBP20.6m, in line with expectations, while the balance of GBP25.8m

represented over 13% growth in the original Alliance portfolio.

This strong performance reflected 6% underlying growth, augmented

by 7% from one-off events such as the full year effects of products

acquired in 2015 or products with restored availability.

The weakening of Sterling against the Euro and the US Dollar

that developed during the half year had the effect of increasing

sales by 2% when compared to the rates at the start of the year.

The impact to profit before tax is significantly less due to the

benefit to sales being offset by increased costs denominated in

these currencies.

Our three strategic growth brands all performed well. Our

largest-selling brand is now the scar reduction product,

Kelo-cote(TM), which achieved H1 sales of GBP4.1m from a widely

spread international base. Hydromol(TM), our emollient range,

maintained its double digit growth rate, with H1 sales of GBP3.5m

predominantly from the UK. And MacuShield(TM), our nutritional

supplement product for age related macular degeneration (AMD)

delivered H1 sales of GBP2.0m, the majority of which originated

from the UK and Ireland. This compared with GBP1.4m in the five

months after we acquired it in February 2015.

UK

The UK remains our largest territory returning sales of GBP24.0m

(H1 2015: GBP18.3m).

In addition to Hydromol, mentioned above, other notable

achievements included:

The consumer healthcare brands performing well. Ashton &

Parsons Infants' Powders grew by 51% to GBP1.1m in H1 as we

signed-up more national retail chains and supported them with

advertising investment. Brand loyalty is strong and we expect

further growth as awareness of the brand spreads. Additionally,

Anbesol, our treatment for mouth ulcers and teething, had sales of

GBP0.8m in H1, an increase of 10% over the prior year.

In ophthalmology, UK MacuShield sales were GBP1.3m, compared

with GBP1.0m for the first five months of 2015.

We were able to bring our bladder cancer treatment,

ImmuCyst(TM), back to the market in February as our supplier,

Sanofi Pasteur, resumed production after a 3 1/2 -year suspension.

Production remains restricted, so we will not be able to expand our

market share beyond about 25% and we are thus managing sales

carefully to ensure continuity of care to every patient who begins

a course of treatment. Volumes have been building steadily and we

are confident that we will sell all our available supplies,

yielding revenues of around GBP1 million in 2016.

Sales of Forceval capsules continued their strong recovery from

stock-outs, with UK sales up 36% to GBP1.3m in H1 2016.

Western Europe (excl. UK)

Sales for the rest of Western Europe totalled GBP11.7m (H1 2015:

GBP2.3m).

In France sales were GBP4.5m with the largest seller being the

burns treatments Flammazine / Flammacerium at GBP1.4m.

In the Republic of Ireland, sales were GBP2.4m. Nu-Seals

achieved sales of GBP1.1m compared with GBP1.0m in the prior year

as the threat of generic substitution seems to have abated.

Additionally MacuShield performed strongly with sales of GBP0.4m

compared with GBP0.2m in the first five months of 2015.

In the Germany, Austria, Switzerland (DACH) region, sales were

GBP2.0m with the largest product being Flammazine at GBP0.9m.

Spain and Italy recorded sales of GBP1.4m and GBP1.3m

respectively with Aloclair, the mouth ulcer treatment, being the

largest product in each country with sales of GBP0.8m and GBP0.9m

respectively.

International

Total sales outside of Western Europe were GBP10.7m (H1 2015:

GBP2.2m).

Kelo-cote was the largest selling international product

recording sales of GBP3.2m, with GBP0.6m coming from Latin America,

GBP0.9m coming from China and GBP0.8m from Southeast Asia.

Flammazine sold GBP1.1m with GBP0.5m coming from Central and

Eastern Europe (CEE) and GBP0.5m from the Middle East and Africa

(MEA); and Aloclair GBP1.0m with GBP0.5m from CEE. International

sales for Syntometrine were GBP0.7m and the range of child

nutrition products acquired from Sinopharm in China last year

achieved sales of GBP0.4m.

Financial performance

Pre-tax profits more than doubled to GBP11.7m (H1 2015:

GBP5.5m). This was a particularly encouraging result in the first

period following the acquisition of the Sinclair products.

Gross margin was 56.0%, resulting in gross profit of GBP26.0m

(H1 2015: GBP13.8m, 60.5%). This lower gross margin percentage is

in line with our expectations as the Sinclair business has a

slightly lower average gross margin than our original Alliance

business. We expect average margin for the combined business to be

in the range 55%-60% going forward.

Operating costs for the half year totalled GBP13.4m compared

with GBP7.7m in the first half of 2015. Marketing investment was

mainly directed at Kelo-cote, Hydromol, MacuShield, Diclectin,

Ashton & Parsons, the re-introduction of ImmuCyst and the

Flamma franchise. Transition costs, including interim staff,

totalled GBP1.3m. Whilst there have been transition costs

associated with the integration of the Sinclair acquisition that

will not recur in 2017, they will be compensated by the full year

effect of employees recruited during this year.

Earnings before interest, taxes, depreciation and amortisation

(EBITDA), defined as Operating Profit (incl. share of Joint Venture

profit) less Depreciation and Amortisation, was GBP13.2m (H1 2015:

GBP6.3m). This represents 28.5% of sales, placing us close to the

top of our 25-30% target range.

Alliance remains a strongly cash-generative business. However,

cash generation in the short term has been constrained by an

increase in working capital from the balance of trade debtors and

creditors associated with the acquisition of the Sinclair products.

Working capital, with the exception of inventory, was not purchased

as part of the Sinclair acquisition and we have therefore seen a

build-up in H1 that we expect to now stabilise. Despite this, cash

flow from Operating Activities in the first half increased to

GBP4.2m (H1 2015: GBP2.8m).

Net debt rose to GBP79.0m from GBP71.5m at the end of 2015. The

increase was partly due to increases in working capital levels and

partly due to Sterling's weakness following the EU referendum, as

approximately half our debt is denominated in Euros and US Dollars.

At constant exchange rates, the 2016 half year figure would have

been approximately GBP75.8m. The movement in foreign denominated

loans and subsidiaries is largely accounted for within equity,

therefore there is minimal P&L impact from the exchange rate

movement on our loans.

The bank debt/EBITDA ratio remained stable over the period,

being 2.8 times at the end of the first half and also 2.8 times at

the end of 2015 (both including historic Sinclair pro forma

EBITDA). The ratio at half year was adversely impacted by

Sterling's weakness on net debt and the increase in working

capital. From the second half of 2016 onwards we expect to reduce

this figure progressively as cash generation increases and working

capital stabilises.

At the end of the period we had unused bank facilities of

GBP20.5m. This gives us ample headroom to finance bolt-on additions

if attractive opportunities arise.

Dividend

In line with our progressive dividend policy, and given the

strong progress made in the first half of 2016, we are making an

interim payment of 0.403p per ordinary share (H1 2015: 0.366p).

This represents an increase of 10% on last year's figure while

maintaining dividend cover at more than 3 times earnings.

The interim dividend will be paid on 12 January 2017 to

shareholders on the register on 23 December 2016.

Strategy

Our strategy is to build our portfolio by acquiring products

that are already established in their market or by in-licensing

already-developed products for launch. We deploy our capital to

grow our cash generating portfolio, leaving activities such as

manufacturing, storage and logistics to be outsourced to leading

specialist organisations in these fields.

In building our portfolio we balance two elements: the first

being brands with growth potential in which we invest and the

second being well-established niche brands that will maintain their

sales for many years with little or no promotion, thus providing a

cash generating "bedrock" that feeds the growth activities. By

balancing the two elements, we can invest in targeted marketing to

grow sales while maintaining good cash generation and

profitability.

Under our long-established 'buy and build' strategy we

supplement organic growth with acquisitions that allow us to

accelerate expansion and adjust the balance of our portfolio. The

Sinclair transaction in December 2015 was our 31st and largest-ever

acquisition. We made no acquisitions in H1 2016.

The Sinclair business brought us brands in both the 'growth' and

'bedrock' categories, leaving the balance broadly unchanged. Since

the acquisition we have been refining our strategies for individual

brands, to determine which products and which markets will be the

focus of our marketing investment.

Sinclair has greatly expanded our international footprint -

lifting non-UK sales from about 19% of turnover to approximately

50%, giving us a market presence in some 60 additional countries

and giving us critical mass in the major EU territories. This

creates new opportunities to broaden the marketing and distribution

of brands - although careful analysis and planning is necessary, as

a successful niche brand from one country may face a very different

competitive landscape in other markets. Our greater scale and

footprint also bring strategic advantages. Alliance is now a

credible candidate for larger and more complex acquisitions in a

wider range of territories; and we are also well placed to broaden

the scope of existing agreements, as indicated by yesterday's

announcement to acquire the licensing and distribution rights to

Diclectin in a further nine EU countries

We continue to make good progress towards UK registration for

Diclectin. This well-established product, which has been a

routinely used treatment in Canada for over 30 years for nausea and

vomiting of pregnancy. In the United States, it was licensed by the

FDA in 2013 under the name Diclegis with a Category A safety rating

for drugs used during pregnancy, and has performed strongly since

launch. We expect UK registration next year, enabling us to begin

sales in the second half.

In the meantime, in the UK consumer health market, we are

preparing to relaunch Lypsyl in the second half of this year. We

have re-engineered the product and upgraded the pack design to

enhance its shelf presence. The lip balm market is a crowded one,

but Lypsyl still enjoys high consumer awareness - the trademark was

first registered 125 years ago - and we are confident that this

rejuvenated brand can reclaim a strong position.

The significantly greater scale of our business has highlighted

the need for investment in a new enterprise resource planning (ERP)

system to manage the enlarged portfolio and facilitate further

expansion in the future. We will start this project in early 2017

once the majority of the Sinclair integration has completed.

Team

Prior to the acquisition of the Sinclair products, we had

fine-tuned the leadership of the major functions within the

business and also had in place Country Managers for France and

Germany. This greatly facilitated our absorption of the Sinclair

products business. As part of the Sinclair transaction, Dario

Opiparo transferred to us as Country Manager for Italy. We promoted

Steve Lobb to Head of UK & Ireland; Alex Duggan to Head of

Strategy for our Global Consumer Brands; and Karim Husny to be Head

of our International Business. Thus we have been able to hit the

ground running in taking over the new business that effectively

doubled the size of our operation. To complement the foregoing, we

have appointed Luis Silva as Country Manager for Spain, Roger Lim

as Regional Business Manager for Southeast Asia and we expect to

appoint a new head of our enlarged China business in the near

future. We thus have in place senior managers who can provide

market insight and knowledge across all our geographic

interests.

Charity

We continue to donate products regularly to International Health

Partners, which distributes medicines to doctors in the world's

neediest areas. We also support employee fundraising for local

causes including Wiltshire Air Ambulance and national charities

such as British Heart Foundation and The Alzheimer's Society.

Outlook

We are confident in the outlook for Alliance. We are putting

together a high calibre team within an efficient organisation using

class-leading systems to support further profitable transformation

over the next few years. In addition we will be investing in

Diclectin to provide a new platform for future growth.

In terms of the business environment, it is still too early to

assess the long-term impact of the UK's decision to renegotiate its

relationship with the European Union, which is reported will take

considerable time. However, with operations in France, Germany,

Italy and Spain, we do not expect market access to be a problem -

and all our licences are held within individual member states.

For the rest of this year, our focus will be on assimilating the

ex-Sinclair business and beginning to exploit the opportunities it

opens up for us. We do not anticipate any further substantial

acquisitions in the very near term, but remain alert to bolt-on

opportunities that add value. As we move through into next year, we

will be looking for the kind of product acquisitions and

in-licensing deals across Europe, such as Diclectin, that might not

have been open to us before. The past six months have begun the

transformation of Alliance, and we are encouraged by its progress

so far.

Unaudited Consolidated Income Statement

For the six months ended 30 June 2016

Unaudited Unaudited

Six months Six months

ended ended

30 June 30 June

2016 2015

Total Total

Note GBP 000s GBP 000s

---------------------------- ---- ------------ ------------

Revenue 46,372 22,795

Cost of sales (20,392) (8,996)

---------------------------- ---- ------------ ------------

Gross profit 25,980 13,799

---------------------------- ---- ------------ ------------

Operating expenses

Administration and

marketing expense (12,862) (7,232)

Amortisation of intangible

assets (84) (99)

Share-based employee

remuneration (404) (385)

(13,350) (7,716)

---------------------------- ---- ------------ ------------

Operating profit 12,630 6,083

Share of joint venture

profits 343 26

Operating profit including

share of joint venture

profits 12,973 6,109

Finance Costs

Interest payable and

similar charges 4 (1,660) (722)

Interest income 4 54 35

Other finance income 4 375 102

(1,231) (585)

---------------------------- ---- ------------ ------------

Profit on ordinary

activities before taxation 11,742 5,524

Taxation 5 (2,169) (1,152)

---------------------------- ---- ------------ ------------

Profit for the year

attributable to equity

shareholders 9,573 4,372

---------------------------- ---- ------------ ------------

Earnings per share

Basic (pence) 9 2.04 1.65

Diluted (pence) 9 2.02 1.64

---------------------------- ---- ------------ ------------

Unaudited Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2016

Unaudited

Unaudited Six months

Six months ended

ended 30 June

30 June 2016 2015

GBP 000s GBP 000s

Profit for the period 9,573 4,372

Other items recognised

directly in equity:

Items that may be reclassified

to profit or loss:

Interest rate swaps - cash

flow hedge (509) 80

Deferred tax on interest

rate swaps 102 (16)

Foreign exchange translation

differences 1,129 (3)

Total comprehensive income

for the period 10,295 4,433

---------------------------------- --------------- ------------

Unaudited Consolidated Balance Sheet

As at 30 June 2016

Unaudited Audited

30 June 31 December

2016 2015

Note GBP000s GBP000s

----------------------------- ---- --------- ------------

Assets

Non-current assets

Intangible assets 6 266,830 259,945

Property, plant and

equipment 1,182 1,013

Joint Venture investment 1,808 1,465

Joint Venture receivable 1,462 1,462

Deferred tax asset 520 418

Other non-current

assets 328 122

272,130 264,425

Current assets

Inventories 16,216 12,910

Trade and other receivables 7 22,718 11,630

Cash and cash equivalents 3,936 3,229

42,870 27,769

Total assets 315,000 292,194

----------------------------- ---- --------- ------------

Equity

Ordinary share capital 4,684 4,682

Share premium account 108,332 108,308

Share option reserve 3,014 2,610

Reverse takeover reserve (329) (329)

Other reserve (505) (98)

Translation reserve 1,161 32

Retained earnings 51,659 47,237

----------------------------- ---- --------- ------------

Total equity 168,016 162,442

Liabilities

Non-current liabilities

Long term financial

liabilities 11 59,380 58,968

Other liabilities 114 1,496

Deferred tax liability 39,519 37,413

Derivative financial

instruments 630 120

----------------------------- ---- --------- ------------

99,643 97,997

Current liabilities

Cash and cash equivalents 2,300 31

Financial liabilities 11 21,269 15,776

Corporation tax 2,022 2,075

Trade and other payables 8 21,750 13,873

47,341 31,755

Total liabilities 146,984 129,752

Total equity and liabilities 315,000 292,194

----------------------------- ---- --------- ------------

Unaudited Consolidated Statement of Cash Flows

For the six months ended 30 June 2016

Unaudited Unaudited

Six months Six months

ended ended

30 June 30 June

2016 2015

GBP 000s GBP 000s

Operating activities

Result for the period

before tax 11,742 5,524

Interest payable 1,660 722

Interest receivable (54) (35)

Other finance costs (375) (102)

Depreciation of property,

plant and equipment 181 136

Amortisation of intangible

assets 84 99

Share-based employee

remuneration 404 385

Change in inventories (3,306) (1,369)

Change in investments (343) (26)

Change in trade and

other receivables (11,088) (768)

Change in trade and

other payables 7,429 (815)

Tax paid (2,101) (964)

Cash flows from operating

activities 4,233 2,787

------------ ------------

Investing activities

Interest received 54 35

Payment of deferred

consideration (4,503) -

Development costs

capitalised (46) (7)

Purchase of property,

plant and equipment (325) (248)

Purchase of other

intangible assets - (6,500)

Purchase of other

non-current assets (203) -

Net cash used in investing

activities (5,023) (6,720)

------------ ------------

Financing activities

Interest paid and

similar charges (1,353) (588)

Loan issue costs (280) -

Proceeds from exercise

of share options 26 97

Dividend paid (1,714) (880)

Receipt from borrowings 4,500 5,500

Repayment of borrowings (3,000) (1,500)

Net cash used in financing

activities (1,821) 2,629

------------ ------------

Net movement in cash

and cash equivalents (2,611) (1,304)

Cash and cash equivalents

at beginning of period 3,198 1,020

Effects of exchange

rate movements 1,049 (27)

Cash and cash equivalents

at end of period 1,636 (311)

============ ============

Unaudited Consolidated Statement of Changes in Equity

For the six months ended 30 June 2016

Ordinary Share Share Reverse Translation

Share Premium Option takeover Other Reserve Retained Total

capital account reserve reserve reserve earnings equity

GBP GBP GBP GBP GBP GBP GBP

000s 000s 000s 000s 000s 000s 000s GBP 000s

Balance 1

January

2015

(audited) 2,641 29,388 1,995 (329) (103) - 37,188 70,780

--------------- --------- -------- -------- --------- -------- ------------------------- --------- --------

Issue of

shares 3 94 - - - - - 97

Dividend

payable/paid - - - - - - (2,643) (2,643)

Share options

charge - - 385 - - - - 385

--------------- --------- -------- -------- --------- -------- ------------------------- --------- --------

Transactions

with owners 3 94 385 - - - (2,643) (2,161)

--------------- --------- -------- -------- --------- -------- ------------------------- --------- --------

Profit for the

period - - - - - - 4,372 4,372

Other

comprehensive

income

Interest rate

swaps - cash

flow hedge - - - - 80 - - 80

Deferred tax

on interest

rate swaps - - - - (16) - - (16)

Foreign

exchange

translation

differences - - - - - - (3) (3)

Total

comprehensive

income for

the

period - - - - 64 - 4,369 4,433

Balance 30

June

2015

(unaudited) 2,644 29,482 2,380 (329) (39) - 38,914 73,052

--------------- --------- -------- -------- --------- -------- ------------------------- --------- --------

Balance 1

January

2016

(audited) 4,682 108,308 2,610 (329) (98) 32 47,237 162,442

--------------- --------- -------- -------- --------- -------- ------------------------- --------- --------

Issue of

shares 2 24 - - - - - 26

Dividend

payable/paid - - - - - - (5,151) (5,151)

Share options

charge - - 404 - - - - 404

--------------- --------- -------- -------- --------- -------- ------------------------- --------- --------

Transactions

with owners 2 24 404 - - - (5,151) (4,721)

Profit for the

period - - - - - - 9,573 9,573

Other

comprehensive

income

Interest rate

swaps - cash

flow hedge - - - - (509) - - (509)

Deferred tax

on interest

rate swaps - - - - 102 - - 102

Foreign

exchange

translation

differences - - - - - 1,129 - 1,129

Total

comprehensive

income for

the

period - - - - (407) 1,129 9,573 10,295

Balance 30

June

2016

(unaudited) 4,684 108,332 3,014 (329) (505) 1,161 51,659 168,016

--------------- --------- -------- -------- --------- -------- ------------------------- --------- --------

Notes to the Half Yearly Report

For the six months ended 30 June 2016

1. Nature of operations

Alliance Pharma plc ("the company") and its subsidiaries

(together "the Group") acquire, market and distribute

pharmaceutical products. The company is a public limited company

incorporated and domiciled in England. The address of its

registered office is Avonbridge House, Bath Road, Chippenham,

Wiltshire, SN15 2BB.

The company is listed on the London Stock Exchange, Alternative

Investment Market (AIM).

2. General information

The information in these financial statements does not

constitute statutory accounts as defined in section 434 of the

Companies Act 2006 and is un-audited. These financial statements

have been prepared in accordance with the AIM rules, and IAS 34 has

not been adopted. A copy of the Group's statutory accounts for the

period ended 31 December 2015, prepared under International

Financial Reporting Standards as adopted by the European Union, has

been delivered to the Registrar of Companies. The auditors' report

on those accounts was unqualified and did not contain statements

under section 498(2) or section 498(3) of the Companies Act

2006.

This interim financial report for the six month period ended 30

June 2016 (including comparatives for the six months ended 30 June

2015) was approved by the Board of Directors on 13 September

2016.

The current rate of cash generation by the Group comfortably

exceeds the capital and debt servicing needs of the business

(though there cannot, of course, be absolute certainty that the

rate of cash generation will be maintained). The Board remains

confident that all the bank covenants will continue to be met for

at least the next 12 months. The Group has a GBP5m Working Capital

Facility of which GBP2.2m is undrawn at the balance sheet date and

which the Board believes should comfortably satisfy the Group's

working capital needs for at least the next 12 months.

3. Accounting policies

The same accounting policies and methods of computation are

followed in the interim financial report as published by the

company in its 31 December 2015 Annual Report. The Annual report is

available on the company's website alliancepharmaceuticals.com.

4. Finance Costs

Unaudited

Unaudited Six months

Six months ended

ended 30 June 2015

30 June

2016 2015

GBP000s GBP000s

------------------------------- ----------- -------------

Interest payable

and similar charges

On loans and overdrafts (1,397) (536)

Amortised finance

issue costs (177) (52)

Notional interest (86) (134)

------------------------------- ----------- -------------

(1,660) (722)

Interest income 54 35

Other finance income

Foreign exchange

movements 375 102

375 102

------------------------------- ----------- -------------

Finance costs - net (1,231) (585)

=============================== =========== =============

Notional interest relates to the unwinding of the deferred

consideration on the MacuVision acquisition.

Notes to the Half Yearly Report (continued)

For the six months ended 30 June 2016

5. Taxation

Analysis of charge in period.

Unaudited Unaudited

Six months Six months

ended ended

30 June 30 June

2016 2015

GBP 000s GBP 000s

United Kingdom corporation

tax at 20%/20.5%

In respect of current

period 2,046 920

Current tax 2,046 920

Deferred tax 123 232

----------------------------

Taxation 2,169 1,152

============================ ============= =============

6. Intangible assets

Technical

know-how,

trademarks

and distribution Development

Goodwill rights costs Total

GBP 000s GBP 000s GBP 000s GBP 000s

Cost

At 1 January

2016 (audited) 26,035 237,324 438 263,797

Additions - - 47 47

Exchange adjustments - 6,922 - 6,922

At 30 June 2016

(unaudited) 26,035 244,246 485 270,766

---------------------- -------- ----------------- ----------- --------

Amortisation

At 1 January

2016 (audited) - 3,852 - 3,852

Amortisation

for the period - 84 - 84

At 30 June 2016

(unaudited) - 3,936 - 3,936

---------------------- -------- ----------------- ----------- --------

Net book amount

At 30 June 2016

(unaudited) 26,035 240,310 485 266,830

---------------------- -------- ----------------- ----------- --------

At 1 January

2016 (audited) 26,035 233,472 438 259,945

---------------------- -------- ----------------- ----------- --------

Notes to the Half Yearly Report (continued)

For the six months ended 30 June 2016

7. Trade and other receivables

Unaudited Audited

30 June 31 December

2016 2015

GBP 000s GBP 000s

Trade receivables 19,597 8,783

Other receivables 352 1,062

Prepayments and

accrued income 1,710 525

Amounts owed by

Joint Venture 1,059 1,260

22,718 11,630

=========== ==============

8. Trade and other payables

Unaudited Audited

30 June 31 December

2016 2015

GBP 000s GBP 000s

Trade payables 5,829 1,153

Other taxes and

social security

costs 1,173 905

Accruals and deferred

income 6,489 5,663

Other payables 1,262 728

Deferred consideration 2,184 5,026

Amounts due to Joint

Ventures 1,375 398

Dividend payable 3,438 -

----------- --------------

21,750 13,873

=========== ==============

Notes to the Half Yearly Report (continued)

For the six months ended 30 June 2016

9. Earnings per share (EPS)

Basic EPS is calculated by dividing the earnings attributable to

ordinary shareholders by the weighted average number of ordinary

shares outstanding during the year. For diluted EPS, the weighted

average number of ordinary shares in issue is adjusted to assume

conversion of all dilutive potential ordinary shares.

A reconciliation of the weighted average number of ordinary

shares used in the measures is given below:

Six months Six months

ended ended

30 June 30 June

2016 2015

Weighted Weighted

average average

number number

of shares of shares

000s 000s

----------------- ----------- -----------

For basic EPS 468,297 264,216

Share options 6,329 3,097

For diluted EPS 474,626 267,313

----------------- ----------- -----------

Six months Six months

to to

30 June 30 June

2016 2015

GBP 000s GBP 000s

-------------------- ----------- -----------

Earnings for basic

and diluted EPS 9,573 4,372

-------------------- ----------- -----------

The resulting EPS measures are:

Six months Six months

to to

30 June 30 June

2016 2015

Pence Pence

Basic EPS 2.04 1.65

------------- ----------- -----------

Diluted EPS 2.02 1.64

------------- ----------- -----------

Notes to the Half Yearly Report (continued)

For the six months ended 30 June 2016

10. Dividends

Six months Six months

ended ended

30 June 2016 30 June 2015

GBP

Pence/share 000s Pence/share GBP000s

Amounts recognised

as distributions

to owners in the

year

Interim dividend

for the prior financial

year 0.366 1,714 0.333 880

0.734 3,438

--------------------

Final dividend for

the prior financial

year 0.667 1,763

------------------------------ ----------- ----- -------------------- -----

5,152 2,643

------------------------------ ----------- ----- -------------------- -----

The final dividend for the prior financial year was approved by

the Board of Directors on 31 March 2016 and subsequently by the

shareholders at the Annual General Meeting on 25 May 2016. This

dividend has been included as a liability as at 30 June 2016, in

accordance with IAS 10 Events After the Balance Sheet Date, and was

paid on 13 July 2016 to shareholders who were on the register of

members at 17 June 2016.

11. Borrowings

Movements in borrowings are analysed as follows:

Six months

ended

30 June

2016

GBP 000s

At 1 January 2016 (audited) 74,744

------------------------------------- ------------------------------

Repayment of borrowings (3,000)

Revolving Credit Facility

drawdown 4,500

Amortisation of prepaid arrangement

fees 176

Additional prepaid arrangement

fee (280)

Exchange movements 4,509

------------------------------------- ------------------------------

At 30 June 2016 (unaudited) 80,649

===================================== ==============================

The carrying amount of the group's borrowings are denominated in

the following currencies:

Unaudited Audited

30 June 31 December

2016 2015

GBP 000s GBP 000s

GBP 38,581 37,185

USD 27,068 24,324

EUR 15,000 13,235

80,649 74,744

=========== ==============

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LFFFLAIIVLIR

(END) Dow Jones Newswires

September 14, 2016 02:00 ET (06:00 GMT)

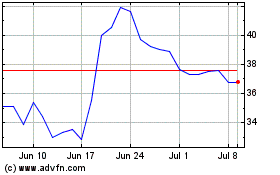

Alliance Pharma (LSE:APH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alliance Pharma (LSE:APH)

Historical Stock Chart

From Apr 2023 to Apr 2024