Alliance Pharma PLC Hardman Research: Acquisitions to boost growth

January 11 2018 - 2:15AM

RNS Non-Regulatory

TIDMAPH

Alliance Pharma PLC

11 January 2018

Hardman Research: Acquisitions to boost growth prospects

Acquisitions to boost growth prospects - Alliance Pharma is

continuing with its buy-and-build strategy, having evolved through

35 acquisitions over a period of 20 years into a profitable, cash

generative, specialty pharma business. The company has a mix of

international growth brands - notably Kelo-cote and MacuShield -

and a bedrock of solid local low-growth brands. APH is adding new

products to each of these areas with the recent acquisitions of

Ametop (bedrock) and Vamousse (international growth), both for cash

from the company's existing Revolving Credit Facility, and, given

the good margins, these are expected to be earnings accretive by

the end of the first year of ownership.

Please click here for the full report:

http://hardmanandco.com/docs/default-source/company-docs/alliance-pharma-documents/11.01.18-acquisitions-to-boost-growth-prospects.pdf

To contact us: Contacts: mh@hardmanandco.com

Hardman & Co Dr Martin Hall dmh@hardmanandco.com

35 New Broad Street Dr Dorothea gp@hardmanandco.com

London Hill www.hardmanandco.com

EC2M 1NH Dr Gregoire

Follow us on Twitter @HardmanandCo Pave

+44 20 7194

7622

About Hardman & Co: For the past 20 years Hardman has been

producing specialist research designed to improve investors'

understanding of companies, sectors, industries and investment

securities. Our analysts are highly experienced in their sectors,

and have often been highly rated by professional investors for

their knowledge. Our focus is to raise companies' profiles across

the UK and abroad with outstanding research, investor engagement

programmes and advisory services. Some of our notes have been

commissioned by the company which is the subject of the note; this

is clearly stated in the disclaimer where this is the case.

Hardman Research Ltd, trading as Hardman & Co, is an

appointed representative of Capital Markets Strategy Ltd and is

authorised and regulated by the Financial Conduct Authority; our

FCA registration number is 600843. Hardman Research Ltd is

registered at Companies House with number 8256259.

Our research is provided for the use of the professional

investment community, market counterparties and sophisticated and

high net worth investors as defined in the rules of the regulatory

bodies. It is not intended to be made available to unsophisticated

retail investors. Anyone who is unsure of their categorisation

should consult their professional advisors. This research is

neither an offer, nor a solicitation, to buy or sell any security.

Please read the note for the full disclaimer.

This information is provided by RNS

The company news service from the London Stock Exchange

END

NRAKBLFFVFFLBBX

(END) Dow Jones Newswires

January 11, 2018 02:15 ET (07:15 GMT)

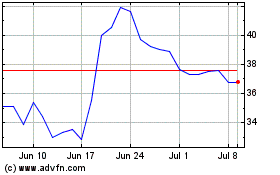

Alliance Pharma (LSE:APH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alliance Pharma (LSE:APH)

Historical Stock Chart

From Apr 2023 to Apr 2024