Alliance HealthCare Services, Inc. (NASDAQ: AIQ) (the “Company”,

“Alliance”, “we” or “our”), a leading national provider of

outsourced radiology, oncology and interventional services,

announced today the results for the quarter and nine months ended

September 30, 2016.

Third Quarter 2016 Highlights

- The Company reported revenue totaling

$127.1 million for the third quarter, a $6.3 million or 5.2%

increase over the third quarter of last year. On a sequential

basis, revenue increased $1.8 million or 1.4% over second quarter

of 2016.

- The Company generated $35.1 million of

Adjusted EBITDA (as defined below) for the quarter, a $1.3 million

or 3.7% increase over the third quarter of last year. On a

sequential basis, Adjusted EBITDA increased $0.7 million or 1.9%

over second quarter of 2016.

- Net income attributable to Alliance was

$1.4 million for the quarter as compared to $7.2 million in the

third quarter of prior year, which included a one-time non-cash

gain of $10.0 million related to a transaction that occurred during

the third quarter of 2015. Excluding the one-time cash gain on a

tax-affected basis, the net income attributable to Alliance would

have been $1.5 million in 2015 as compared to $1.4 million in the

current quarter.

- GAAP Net Income per Share was $0.12 for

the quarter and Adjusted Net Income per Share (as defined below)

was $0.33.

- The Company continued to generate

strong cash flow, with $24.1 million of quarterly operating cash

flow, compared to $17.0 million in the third quarter of the prior

year.

- Alliance Radiology revenue increased by

2.8% to $88.7 million with strong same-store volume growth of +1.1%

for MRI and +5.3% for PET/CT for the quarter.

- Alliance Oncology revenue increased by

4.1% to $26.3 million for the quarter.

- Alliance Interventional revenue

increased by 28.5% to $11.5 million for the quarter.

- Based on our results thus far this

year, we reaffirmed full-year 2016 guidance for revenue ranging

from $505 million - $535 million and Adjusted EBITDA of $130

million - $150 million.

2016 Financial Results

“Consistent with expectations we outlined on our Q2 earnings

call, the third quarter reflects growth, both sequentially and

year-over-year, across all of the business segments including

Radiology, Oncology and Interventional. Sales, business development

and operational improvements our teams have made, enhance the value

proposition we provide to our customers leading to an improved

competitive position and resulting strong performance in retaining

existing customers and securing new customers,” stated Tom

Tomlinson, Chief Executive Officer and President of Alliance

HealthCare Services. “Our Radiology business delivered another

consecutive quarter of strong same-store growth for MRI and PET/CT

as well as improved performance in customer retention and contract

wins. This marks the tenth consecutive quarter of same-store volume

growth for MRI and seventh consecutive quarter of growth for

PET/CT. Alliance Oncology didn’t complete any new projects in the

quarter, but we expect to be in a position to announce another

significant joint venture before the end of the year.”

Tomlinson continued, “Again, consistent with Q2, in the third

quarter we had some success from initiatives focused on balance

sheet management. We generated strong cash flows, allowing us to

reduce leverage while making necessary investments to support

customer retention and growth. We continue to work with Thai Hot,

our new majority shareholder, to evaluate opportunities to enhance

our long-term growth strategy both domestically and in China. We

are reaffirming full-year 2016 guidance of revenue ranging from

$505 million - $535 million and Adjusted EBITDA of $130 million -

$150 million.”

Revenue for the third quarter of 2016 increased to $127.1

million, compared to $120.8 million in the third quarter of 2015.

This increase was primarily due to an increase in Alliance

Interventional revenue of $2.5 million, in Alliance Radiology

revenue of $2.3 million, and in Oncology revenue of $1.1 million,

when compared to the third quarter of 2015.

Alliance’s Adjusted EBITDA for the third quarter of 2016

increased 3.7% to $35.1 million from $33.9 million in the third

quarter of 2015. The increases were primarily driven by strong

continued same-store volume growth across both Radiology and

Oncology, net new sales and partnerships and our continued

expansion in the Alliance Interventional line of business.

Alliance’s net income, computed in accordance with GAAP, totaled

$1.4 million in the third quarter of 2016 compared to $7.2 million

in the third quarter of 2015. The $5.8 million decline is largely

due to the net impact of a $10.0 million non-cash gain in the third

quarter of 2015 which did not re-occur in 2016. Excluding the

one-time cash gain on a tax-affected basis, the net income

attributable to Alliance would have been $1.5 million in 2015 as

compared to $1.4 million in the current quarter.

Net income per share on a diluted basis, computed in accordance

with GAAP, was $0.12 per share in the third quarter of 2016

compared to $0.67 per share for same quarter of 2015. The $0.55 per

share decline is largely due to the net impact of $0.53 in earnings

per share generated from one-time tax-affected non-cash gains in

the third quarter of 2015 relating to a transaction which did not

re-occur in 2016.

Net income per share on a diluted basis was impacted by net

charges (benefits) of $0.21 in the third quarter of 2016 and

$(0.33) in the third quarter of 2015 due to severance and related

costs, restructuring charges, transaction costs, shareholder

transaction costs, deferred financing costs in connection with

shareholder transaction, impairment charges, legal matters expense,

net, changes in fair value of contingent consideration related to

acquisitions, other non-cash charges (gains), non-cash gain on step

acquisition, and differences in the GAAP income tax rate from our

historical income tax rate of 42.5%. Excluding these charges

(benefits), adjusted net income per diluted share – non-GAAP was

$0.33 for the third quarter 2016 and $0.34 for the same quarter of

2015.

Cash flows provided by operating activities totaled $24.1

million in the third quarter of 2016, compared to $17.0 million in

the third quarter of 2015. In the third quarter of 2016, total

capital expenditures, including cash paid for equipment purchases

and deposits on equipment and capital leases, totaled $13.3 million

compared to $16.1 million in the third quarter of 2015.

Alliance’s gross debt, defined as total long-term debt

(including current maturities but excluding the impact of deferred

financing costs), decreased $17.2 million to $560.5 million at

September 30, 2016 from $577.7 million at December 31, 2015.

Alliance’s net debt, defined as total long-term debt (including

current maturities but excluding the impact of deferred financing

costs) less cash and cash equivalents, increased $1.3 million to

$540.9 million at September 30, 2016 from $539.6 million at

December 31, 2015. Cash and cash equivalents were $19.6 million at

September 30, 2016 and $38.1 million at December 31, 2015.

Alliance’s total debt, as defined above, divided by the last

twelve months Consolidated Adjusted EBITDA was 4.13x for the twelve

month period ended September 30, 2016, compared to 4.15x for the

quarter ended June 30, 2016 and 4.10x for the year ended December

31, 2015. Alliance’s net debt, as defined above, divided by the

last twelve months Consolidated Adjusted EBITDA was 3.99x for the

twelve month period ended September 30, 2016, compared to 3.83x for

the year ended December 31, 2015.

Full Year 2016 Guidance

Alliance’s full year 2016 guidance ranges are as follows:

Ranges (dollars in millions) Revenue

$505 - $535 Adjusted EBITDA $130 - $150 Capital expenditures $75 -

$90 Maintenance $45 - $55 Growth $30 - $35

Decrease/(increase) in long-term debt, net

of the change in cash and cash equivalents (before investments in

acquisitions), before growth capital expenditures or “free cash

flow before growth capital expenditures”

$20 - $40

Decrease/(increase) in long-term debt, net

of the change in cash and cash equivalents (before investments in

acquisitions), after growth capital expenditures or “free cash flow

after growth capital expenditures”

($15) - ($25)

Third Quarter 2016 Earnings Conference Call

Investors and all others are invited to listen to a conference

call discussing third quarter 2016 results. The conference call is

scheduled for Thursday, November 3, 2016 at 5 p.m. Eastern Time.

Additionally, a live webcast of the call will be available on the

Company’s website at www.alliancehealthcareservices-us.com. Click

on “About Us,” then, “Investor Relations.” You will find the Audio

Presentation in the “News & Events” section. A replay of the

webcast will be available on the Company’s website until December

3, 2016.

The conference call can be accessed at 877.638.4550

(International callers can dial 973.582.2737). Interested parties

should call at least five minutes prior to the call to register. A

telephone replay will be available until January 3, 2017. The

telephone replay can be accessed by calling 800.585.8367. The

conference call identification number is 9264474.

Definition of Non-GAAP Measures

Adjusted EBITDA and Adjusted Net Income Per Share are not

measures of financial performance under generally accepted

accounting principles in the United States (“GAAP”).

For a more detailed discussion of these non-GAAP financial

measures and a reconciliation to the most directly comparable GAAP

financial measure, see the section entitled “Non-GAAP Measures”

included in the tables following this release.

About Alliance HealthCare Services

Alliance HealthCare Services (NASDAQ: AIQ) is a leading national

provider of outsourced healthcare services to hospitals and

providers. We also operate freestanding outpatient radiology,

oncology and interventional services clinics, and Ambulatory

Surgical Centers (“ASC”) that are not owned by hospitals or

providers. Diagnostic radiology services are delivered through the

Radiology Division (Alliance HealthCare Radiology), radiation

oncology services are delivered through the Oncology Division

(Alliance Oncology), and interventional and pain management

services are delivered through the Interventional Division

(Alliance Interventional). Alliance is the nation’s largest

provider of advanced diagnostic mobile imaging services, an

industry-leading operator of fixed-site imaging centers, and a

leading provider of stereotactic radiosurgery nationwide. As of

September 30, 2016, Alliance operated 619 diagnostic radiology and

radiation therapy systems, including 112 fixed-site radiology

centers across the country, and 32 radiation therapy centers and

SRS facilities. With a strategy of partnering with hospitals,

health systems and physician practices, Alliance provides quality

clinical services for over 1,000 hospitals and other healthcare

partners in 45 states, where approximately 2,400 Alliance Team

Members are committed to providing exceptional patient care and

exceeding customer expectations. For more information, visit

www.alliancehealthcareservices-us.com.

Forward-Looking Statements

This press release contains forward-looking statements relating

to future events, including statements related to the Company’s

long-term growth strategy and efforts to diversify its business

model, the Company’s plans to expand its Interventional Division,

both organically and through one or more acquisitions, the

Company’s expectations regarding growth across the Company’s

divisions, the expansion of its service footprint and revenue

growth, maximizing shareholder value, and the Company’s Full Year

2016 Guidance, including its forecasts of revenue, Adjusted EBITDA,

capital expenditures, and increase in long-term debt. In this

context, forward-looking statements often address the Company’s

expected future business and financial results and often contain

words such as “expects,” “anticipates,” “intends,” “plans,”

“believes,” “seeks” or “will.” Forward-looking statements by their

nature address matters that are uncertain and subject to risks.

Such uncertainties and risks include: changes in the preliminary

financial results and estimates due to the restatement or review of

the Company’s financial statements; the nature, timing and amount

of any restatement or other adjustments; the Company’s ability to

make timely filings of its required periodic reports under the

Securities Exchange Act of 1934; issues relating to the Company’s

ability to maintain effective internal control over financial

reporting and disclosure controls and procedures; the Company’s

high degree of leverage and its ability to service its debt;

factors affecting the Company’s leverage, including interest rates;

the risk that the counterparties to the Company’s interest rate

swap agreements fail to satisfy their obligations under these

agreements; the Company’s ability to obtain financing; the effect

of operating and financial restrictions in the Company’s debt

instruments; the Company’s ability to comply with reporting

obligations and other covenants under the Company’s debt

instruments, the failure of which could cause the debt to become

due; the accuracy of the Company’s estimates regarding its capital

requirements; the effect of intense levels of competition and

overcapacity in the Company’s industry; changes in the methods of

third party reimbursements for diagnostic imaging and radiation

oncology services; fluctuations or unpredictability of the

Company’s revenues, including as a result of seasonality; changes

in the healthcare regulatory environment; the Company’s ability to

keep pace with technological developments within its industry; the

growth or lack thereof in the market for radiology, oncology,

interventional and other services; the disruptive effect of

hurricanes and other natural disasters; adverse changes in general

domestic and worldwide economic conditions and instability and

disruption of credit and equity markets; difficulties the Company

may face in connection with recent, pending or future acquisitions,

including unexpected costs or liabilities resulting from the

acquisitions, diversion of management’s attention from the

operation of the Company’s business, costs, delays and impediments

to completing the acquisitions, and risks associated with

integration of the acquisitions; and other risks and uncertainties

identified in the Risk Factors section of the Company’s Form 10-K

for the year ended December 31, 2015, filed with the Securities and

Exchange Commission (the “SEC”), as may be modified or supplemented

by our subsequent filings with the SEC. These uncertainties may

cause actual future results or outcomes to differ materially from

those expressed in the Company’s forward-looking statements.

Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date hereof.

The Company does not undertake to update its forward-looking

statements except as required under the federal securities

laws.

ALLIANCE HEALTHCARE SERVICES, INC. CONDENSED

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE

INCOME (Unaudited) (in thousands, except per share

amounts) Three Months Ended September

30, Nine Months Ended September 30, 2016

2015 2016 2015 Revenues $ 127,121 $

120,784 $ 376,162 $ 348,717 Costs and expenses:

Cost of revenues, excluding depreciation

and amortization

71,132 67,057 211,985 196,428 Selling, general and administrative

expenses 23,061 24,543 71,501 66,298 Transaction costs 138 432 986

1,964 Shareholder transaction costs 1,009 — 3,516 — Severance and

related costs 762 277 3,186 731 Impairment charges — 71 — 6,817

Depreciation expense 13,899 12,247 40,677 35,952 Amortization

expense 2,556 2,377 7,493 6,907 Interest expense, net 9,072 6,660

25,439 19,582 Other income, net (1,915 ) (10,451 )

(6,249 ) (10,324 ) Total costs and expenses

119,714 103,213 358,534 324,355

Income before income taxes, earnings from

unconsolidated investees, and noncontrolling interest

7,407 17,571 17,628 24,362 Income tax expense 1,862 5,098 3,137

5,304 Earnings from unconsolidated investees (282 )

(592 ) (927 ) (3,047 ) Net income 5,827 13,065 15,418

22,105 Less: Net income attributable to noncontrolling interest

(4,469 ) (5,861 ) (12,791 ) (15,111 )

Net income attributable to Alliance HealthCare Services, Inc. $

1,358 $ 7,204 $ 2,627 $ 6,994 Comprehensive income (loss),

net of taxes: Net income 5,827 13,065 15,418 22,105 Unrealized gain

(loss) on hedging transactions, net of taxes 24 (8 ) (18 ) (149 )

Reclassification adjustment for losses

included in net income, net of taxes

148 — 236 — Total comprehensive income,

net of taxes 5,999 13,057 15,636 21,956

Comprehensive income attributable to

noncontrolling interest

(4,469 ) (5,861 ) (12,791 ) (15,111 )

Comprehensive income attributable to

Alliance HealthCare Services, Inc.

$ 1,530 $ 7,196 $ 2,845 $ 6,845 Income per common share

attributable to Alliance HealthCare Services, Inc.: Basic $ 0.12 $

0.67 $ 0.24 $ 0.65 Diluted $ 0.12 $ 0.67 $ 0.24 $ 0.65

Weighted average number of shares of

common stock and common stock equivalents:

Basic 10,888 10,716 10,850 10,715 Diluted 10,963 10,815 10,953

10,832

ALLIANCE HEALTHCARE SERVICES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands)

September 30, December 31,

2016 2015 (unaudited) (audited)

ASSETS Current assets: Cash and cash equivalents $ 19,608 $

38,070 Accounts receivable, net of allowance for doubtful accounts

74,605 73,208 Prepaid expenses 12,939 13,463 Other receivables

3,408 3,206 Total current assets 110,560 127,947

Plant, property and equipment, net 206,596 177,188 Goodwill 105,239

102,782 Other intangible assets, net 162,326 162,923 Other assets

22,794 32,820 Total assets $ 607,515 $ 603,660

LIABILITIES AND STOCKHOLDERS’ DEFICIT Current liabilities:

Accounts payable $ 29,982 $ 20,796 Accrued compensation and related

expenses 23,334 19,933 Accrued interest payable 3,254 3,323 Current

portion of long-term debt 18,124 17,732 Current portion of

obligations under capital leases 3,321 2,674 Other accrued

liabilities 28,397 36,453 Total current liabilities

106,412 100,911 Long-term debt, net of current portion and deferred

financing costs 498,885 540,353 Obligations under capital leases,

net of current portion 13,541 10,332 Deferred income taxes 26,098

23,020 Other liabilities 7,526 6,664 Total

liabilities 652,462 681,280 Stockholders’ deficit: Common

stock 109 108 Treasury stock (3,138 ) (3,138 ) Additional paid-in

capital 60,815 29,297 Accumulated comprehensive loss (293 ) (511 )

Accumulated deficit (195,766 ) (198,393 )

Total stockholders’ deficit attributable

to Alliance HealthCare Services, Inc.

(138,273 ) (172,637 ) Noncontrolling interest 93,326

95,017 Total stockholders’ deficit (44,947 ) (77,620

) Total liabilities and stockholders’ deficit $ 607,515 $ 603,660

ALLIANCE HEALTHCARE SERVICES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited) (in thousands) Nine

Months Ended September 30, 2016 2015

Operating activities: Net income $ 15,418 $ 22,105

Adjustments to reconcile net income to net cash provided by

operating activities: Provision for doubtful accounts 1,663 2,373

Share-based payment 2,187 1,242 Depreciation and amortization

48,170 42,859 Amortization of deferred financing costs 5,690 2,602

Accretion of discount on long-term debt 383 357 Adjustment of

derivatives to fair value 520 100 Distributions from unconsolidated

investees 955 3,332 Earnings from unconsolidated investees (927 )

(3,047 ) Deferred income taxes 2,413 4,043 Gain on sale of assets

(1,279 ) (685 ) Changes in fair value of contingent consideration

related to acquisitions (4,640 ) — Non-cash gain on step

acquisition — (9,950 ) Other non-cash gain (248 ) — Gain on

acquisition — (209 ) Impairment charges — 6,817 Excess tax benefit

from share-based payment arrangements (87 ) 5 Changes in operating

assets and liabilities, net of the effects of acquisitions:

Accounts receivable (2,787 ) (2,674 ) Prepaid expenses 220 (1,106 )

Other receivables 1,392 451 Other assets 279 1,488 Accounts payable

8,026 (363 ) Accrued compensation and related expenses 3,401 (968 )

Accrued interest payable (69 ) 116 Income taxes payable 551 55

Other accrued liabilities 864 (4,248 ) Net cash

provided by operating activities 82,095 64,695

Investing activities: Equipment purchases (52,977 ) (39,382

) Increase in deposits on equipment (8,122 ) (13,024 )

Acquisitions, net of cash received (6,659 ) (22,657 ) Proceeds from

sale of assets 1,663 868 Net cash used in investing

activities (66,095 ) (74,195 )

ALLIANCE HEALTHCARE SERVICES, INC. CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (continued) (Unaudited) (in

thousands) Nine Months Ended September 30,

2016 2015 Financing activities:

Principal payments on equipment debt and capital lease obligations

(12,437 ) (6,664 ) Proceeds from equipment debt 11,793 23,295

Principal payments on term loan facility (3,900 ) (8,651 ) Proceeds

from term loan facility — 29,850 Principal payments on revolving

loan facility (45,000 ) (28,000 ) Proceeds from revolving loan

facility 29,000 26,000 Payments of debt issuance costs and deferred

financing costs (25,493 ) (801 ) Distributions to noncontrolling

interest in subsidiaries (18,045 ) (13,734 ) Contributions from

noncontrolling interest in subsidiaries 1,113 — Excess tax benefit

from share-based payment arrangements 87 (5 ) Issuance of common

stock 1 — Proceeds from exercise of stock options 614 25 Settlement

of contingent consideration related to acquisitions (825 ) —

Proceeds from shareholder transaction 28,630 — Net

cash (used in) provided by financing activities (34,462 )

21,315 Net (decrease) increase in cash and cash equivalents

(18,462 ) 11,815 Cash and cash equivalents, beginning of period

38,070 33,033 Cash and cash equivalents, end of

period $ 19,608

$ 44,848

Supplemental disclosure of cash flow

information: Interest paid $ 19,100 $ 16,973 Income taxes paid,

net of refunds 102 327

Supplemental disclosure of non-cash

investing and financing activities: Capital lease obligations

related to the purchase of equipment 1,499 1,294 Equipment

purchases in accounts payable and accrued equipment (2,491 ) 2,417

Noncontrolling interest assumed in connection with acquisitions

2,948 30,417 Fair value of contingent consideration related to

acquisitions 420 — Extinguishment of note receivable — 3,071

Transfer of equity investment as consideration in step acquisition

— 690 Transfer of equipment as consideration in step acquisition —

477 Transfer of fair value of equity investment in step acquisition

— 13,645

ALLIANCE HEALTHCARE SERVICES,

INC.NON-GAAP MEASURES(in thousands)

Adjusted EBITDA and Adjusted Net Income Per Share (the “Non-GAAP

Measures”) are not measures of financial performance under

generally accepted accounting principles in the U.S., or

“GAAP.”

Adjusted EBITDA, as defined by the Company’s management, is

consistent with the definition in the Company’s Credit Agreement

and represents net income (loss) before: income tax (benefit)

expense, interest expense, net, depreciation expense, amortization

expense, non-cash share-based payment, severance and related costs,

net income attributable to noncontrolling interest, restructuring

charges, transaction costs, shareholder transaction costs, non-cash

impairment charges, legal matters expense, net, changes in fair

value of contingent consideration related to acquisitions, non-cash

gain on step acquisition and other non-cash charges, net, which

include non-cash gain on sales of equipment. The components used to

reconcile Net Income (Loss) to Adjusted EBITDA are consistent with

our historical presentation of Adjusted EBITDA.

Adjusted Net Income Per Share, as defined by the Company’s

management, represents net income (loss) before: severance and

related charges, restructuring charges, transaction costs,

shareholder transaction costs, deferred financing costs in

connection with shareholder transaction, impairment charges, legal

matters expenses, net, changes in fair value of contingent

consideration related to acquisitions, other non-cash charges

(gains), non-cash gain on step acquisition, and differences in the

GAAP income tax rate compared to our historical income tax rate.

The components used to reconcile net income (loss) per share to

Adjusted Net Income Per Share are consistent with our historical

presentation of Adjusted Net Income Per Share.

Management uses the Non-GAAP Measures, and believes they are

useful measures for investors, for a variety of reasons. Management

regularly communicates the results of its Non-GAAP Measures and

management’s interpretation of such results to its board of

directors. Management also compares the Company’s results of its

Non-GAAP Measures against internal targets as a key factor in

determining cash incentive compensation for executives and other

employees, largely because management feels that these measures are

indicative of how our radiology, oncology and interventional

services businesses are performing and are being managed. The

diagnostic imaging and radiation oncology industry continues to

experience significant consolidation. These activities have led to

significant charges to earnings, such as those resulting from

acquisition costs, and to significant variations among companies

with respect to capital structures and cost of capital (which

affect interest expense) and differences in taxation and book

depreciation of facilities and equipment (which affect relative

depreciation expense), including significant differences in the

depreciable lives of similar assets among various companies. In

addition, management believes that because of the variety of equity

awards used by companies, the varying methodologies for determining

non-cash share-based compensation expense among companies and from

period to period, and the subjective assumptions involved in that

determination, excluding non-cash share-based compensation from

Adjusted EBITDA enhances company-to-company comparisons over

multiple fiscal periods and enhances the Company’s ability to

analyze the performance of its radiology, oncology and

interventional services businesses.

In the future, the Company expects that it may incur expenses

similar to the excluded items discussed above. Accordingly, the

exclusion of these and other similar items in the Company’s

non-GAAP presentation should not be interpreted as implying that

these items are non-recurring, infrequent or unusual. The Non-GAAP

Measures have certain limitations as analytical financial measures,

which management compensates for by relying on the Company’s GAAP

results to evaluate its operating performance and by considering

independently the economic effects of the items that are or are not

reflected in the Non-GAAP Measures. Management also compensates for

these limitations by providing GAAP-based disclosures concerning

the excluded items in the Company’s financial disclosures. As a

result of these limitations and because the Non-GAAP Measures may

not be directly comparable to similarly titled measures reported by

other companies, however, the Non-GAAP Measures should not be

considered as an alternative to the most directly comparable GAAP

measure, or as an alternative to any other GAAP measure of

operating performance.

The calculation of Adjusted EBITDA is shown below:

Three Months EndedSeptember

30,

Nine Months EndedSeptember

30,

TwelveMonthsEndedSeptember30,

2016 2015 2016 2015

2016 Net income attributable to Alliance HealthCare

Services, Inc. $ 1,358 $ 7,204 $ 2,627 $ 6,994 $ 2,375 Income tax

expense 1,862 5,098 3,137 5,304 4,369 Interest expense, net 9,072

6,660 25,439 19,582 32,098 Depreciation expense 13,899 12,247

40,677 35,952 13,825 Amortization expense 2,556 2,377 7,493 6,907

49,181

Share-based payment (included in selling,

general and administrative expenses)

407 423 2,650 1,242 3,109 Severance and related costs 762 277 3,186

731 3,775

Net income attributable to noncontrolling

interest

4,469 5,861 12,791 15,111 18,053 Restructuring charges 284 216

1,635 707 2,255 Transaction costs 138 432 986 1,964 2,318

Shareholder transaction costs 1,009 — 3,516 — 5,369 Impairment

charges — 71 — 6,817 -

Legal matters expense, net (included in

selling, general and administrative expenses)

(88 ) 2,924 106 5,827 1,194

Changes in fair value of contingent

consideration related to acquisitions

(1,000 ) — (4,640 ) — (4,640 )

Other non-cash charges, net (included in

other income, net)

385 22 324 805 635

Non-cash gain on step acquisition

(included in other income, net)

— (9,950 ) — (9,950 ) (722 )

Adjusted EBITDA $ 35,113 $ 33,862 $ 99,927 $ 97,993 $ 133,194

The leverage ratio calculations as of September 30, 2016, are

shown below:

Consolidated Total debt $ 560,537 Less: Cash

and cash equivalents (19,608 ) Net debt $ 540,929 Last 12

months Adjusted EBITDA 133,194

Pro-forma acquisitions in the last 12

month period (1)

2,523 Last 12 months Consolidated Adjusted EBITDA $ 135,717

Total leverage ratio 4.13 x Net leverage ratio 3.99 x

_______________(1) Gives pro-forma effect to acquisitions

occurring during the last twelve months pursuant to the terms of

the Credit Agreement.

The reconciliation of income per diluted share – GAAP to

adjusted net income per diluted share – non-GAAP is shown

below:

Three Months EndedSeptember

30,

Nine Months EndedSeptember

30,

2016 2015 2016 2015

Income per diluted share - GAAP $ 0.12 $ 0.67 $ 0.24 $ 0.65

Reconciling charges (benefits) to arrive at Adjusted net income per

diluted share - non-GAAP: Severance and related charges, net of

taxes 0.04 0.01 0.17 0.04 Restructuring charges, net of taxes 0.01

0.01 0.09 0.04 Transaction costs, net of taxes 0.01 0.02 0.05 0.10

Shareholder transaction costs, net of taxes 0.05 — 0.18 —

Deferred financing costs in connection

with shareholder transaction, net of taxes

0.10 — 0.19 — Impairment charges, net of taxes — — — 0.36 Legal

matters expense, net, net of taxes — 0.16 0.01 0.31

Changes in fair value of contingent

consideration related to acquisitions, net of taxes

(0.05 ) — (0.24 ) — Other non-cash charges (gains), net of taxes

0.01 — (0.01 ) — Non-cash gain on step acquisition, net of taxes —

(0.53 ) — (0.53 )

GAAP income tax rate compared to our

historical income tax rate

0.04 — 0.06 0.01 Total reconciling

charges (benefits) 0.21 (0.33 ) 0.50

0.33 Adjusted net income per diluted share- non-GAAP $ 0.33 $ 0.34

$ 0.74 $ 0.98

The reconciliation from net income to Adjusted EBITDA for the

2016 guidance range is shown below (in millions):

2016 Full Year Guidance Range Net

income $ 7 $ 12 Income tax expense 5 9

Interest expense and other, net;

depreciation expense; amortization expense; share-based payment and

other expenses; noncontrolling interest in subsidiaries

118 129 Adjusted EBITDA $ 130 $ 150

ALLIANCE HEALTHCARE SERVICES, INC. SELECTED STATISTICAL

INFORMATION

Three Months EndedSeptember

30,

2016 2015 MRI Average number of

total systems 280.1 264.1 Average number of scan-based systems

219.1 209.8 Scans per system per day (scan-based systems) 9.17 9.09

Total number of scan-based MRI scans 136,147 132,962 Price per scan

$ 311.51 $ 311.16 Scan-based MRI revenue (in millions) $ 42.4 $

41.4 Non-scan-based MRI revenue (in millions) 7.5 6.2

Total MRI revenue (in millions) $ 49.9 $ 47.6

PET/CT Average

number of total systems 119.9 116.2 Average number of scan-based

systems 111.7 108.4 Scans per system per day 5.49 5.38 Total number

of PET/CT scans 34,548 35,501 Price per scan $ 888.71 $ 879.72

Total PET and PET/CT revenue (in millions) $ 31.9 $ 32.3

Oncology Linear accelerator treatments 23,109 21,118

Stereotactic radiosurgery patients 909 901 Total Oncology revenue

(in millions) $ 26.3 $ 25.2

Interventional Visits 57,784

37,390 Total interventional revenue (in millions) $ 11.5 $ 9.0

Revenue breakdown (in millions) MRI revenue $ 49.9 $ 47.6

PET/CT revenue 31.9 32.3 Other radiology revenue 6.9

6.5 Radiology revenue 88.7 86.4 Oncology revenue 26.3 25.2

Interventional revenue 11.5 9.0 Corporate / Other 0.6

0.2 Total revenues $ 127.1 $ 120.8

Total fixed-site revenue (in

millions) 27.7 28.1

ALLIANCE HEALTHCARE SERVICES,

INC.SELECTED STATISTICAL INFORMATIONRADIOLOGY AND

ONCOLOGY DIVISION SAME-STORE VOLUME

The Company utilizes same-store volume growth as a historical

statistical measure of the MRI and PET/CT imaging procedure, linear

accelerator (“Linac”) treatment and stereotactic radiosurgery

(“SRS”) case growth at its customers in a specified period on a

year-over-year basis. Same-store volume growth is calculated by

comparing the cumulative scan, treatment or case volume at all

locations in the current year quarter to the same quarter in the

prior year. The group of customers whose volume is included in the

scan, treatment or case volume totals includes only those that

received service from Alliance for the full quarter in each of the

comparison periods. A positive percentage represents growth over

the prior year quarter and a negative percentage represents a

decline over the prior year quarter. Alliance measures each of its

major radiology and oncology modalities, MRI, PET/CT, Linac and

SRS, separately.

The Radiology Division same-store volume growth for the last

four calendar quarters ended September 30, 2016 is as follows:

Same-Store Volume MRI

PET/CT

2016

Third Quarter 1.1 % 5.3 % Second Quarter 2.0 % 5.8 %

First Quarter 6.6 % 9.3 %

2015

Fourth Quarter 3.6 % 8.6 %

The Oncology Division same-store volume growth/(decline) for the

last four calendar quarters ended September 30, 2016 is as

follows:

Same-Store Volume Linac

SRS

2016

Third Quarter 5.7 % (4.6) % Second Quarter (1.1 )%

(0.2) % First Quarter 5.6 % 9.0 %

2015

Fourth Quarter (6.4) % 3.9 %

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161103006878/en/

Alliance HealthCare Services, Inc.Rhonda Longmore-Grund,

949-242-5300Executive Vice PresidentChief Financial Officer

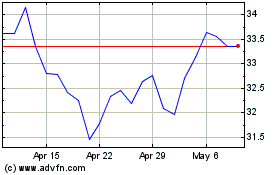

Global X Funds Global X ... (NASDAQ:AIQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Global X Funds Global X ... (NASDAQ:AIQ)

Historical Stock Chart

From Apr 2023 to Apr 2024