Alexander Mining PLC Placing to raise GBP500k and Warrant Bonus Issue (8939Y)

May 20 2016 - 8:18AM

UK Regulatory

TIDMAXM

RNS Number : 8939Y

Alexander Mining PLC

20 May 2016

20 May 2016

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, IN OR INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH

JURISDICTION.

Alexander Mining plc

("Alexander" or the "Company")

Placing to Raise GBP500,000

The Company is pleased to announce that it has raised GBP500,000

(the "Placing") via Cornhill Capital Limited, acting as placing

agent, through the issue of 500,000,000 new ordinary shares of 0.1p

each (the "Placing Shares") at a price of 0.1p per share (the

"Placing Price") to new and existing shareholders. The net proceeds

of the Placing will be used for general working capital

purposes.

The Board is aware of the impact of dilution of the Placing on

existing shareholders as the Placing Shares will represent

approximately 58% per cent. of the issued share capital of the

Company as enlarged by the Placing Shares (the "Enlarged Share

Capital"). However, the Board believes that the costs of an open

offer or rights issue are such that it is not practicable or cost

effective and cannot be achieved in the timeframe required.

In order to provide existing shareholders with some ability to

subscribe should they so choose on similar terms to the Placing,

the Board proposes subject to regulatory prohibitions relating to

marketing securities in certain jurisdictions, to issue new

warrants ("Warrants") to existing shareholders on the record date

("Qualifying Shareholders") on a pro rata basis of one Warrant for

every four Ordinary Shares ("Qualifying Shares") held (the "Warrant

Bonus Issue"). The Board believes that the Warrant Bonus Issue

should partially alleviate the impact of dilution on Qualifying

Shareholders. Further terms of the proposed Warrant Bonus Issue are

set out below.

Martin Rosser, Chief Executive Officer said: "We are delighted

with the outcome of the Placing and thank the placees for their

support. Importantly, we can now concentrate the Company's efforts

on the commercialisation of its processing technology. With the

proceeds from the Placing, potential cash proceeds from the Warrant

Bonus Issue exercise and also potential revenue from the

commercialisation of our proprietary leaching technologies, the

Company should have adequate working capital for the next 12

months. We remain confident about the prospects for our

technologies; however, given the background of the Company's

directors and senior employees, we are also reviewing several

complementary opportunities of interest in the mining sector."

Warrant Bonus Details

The Board proposes that the Warrants will only be issued to the

existing shareholders of the Company. Accordingly, the record date

for the Warrant Bonus Issue is 4.30 p.m. on 24 May 2016.

One Warrant is proposed to be issued for every four Qualifying

Shares held by eligible shareholders on the record date of the

Bonus Issue (subject to certain regulatory restrictions referred to

below). Based on the current issued share capital of 361,910,288

Ordinary Shares, the Company would therefore issue a maximum of

90,477,572 Warrants. The Warrants would represent approximately

10.5 per cent. of the Enlarged Issued Share Capital prior to

exercise.

The Warrants, which will not be traded on AIM or any other

public markets, will be exercisable in the periods of 15 working

days ending on the following three dates: 20 July 2016; 20 October

2016; and 20 January 2017 (the "Final Exercise Date"). If any of

the Warrants remain unexercised on the Final Exercise Date, they

will expire. The exercise price of the Warrants will be 0.1p, 0.15p

and 0.2p per new Ordinary Share, on each of the exercise dates

respectively.

The instrument constituting the Warrants is expected to contain

other provisions typically found in such instruments, including

those relating to the adjustment of the terms of the Warrants,

protections for holders of Warrants and the procedures for the

modification of the rights of the Warrants. Following the issue of

the warrants, a copy of the instrument constituting them will be

available to download from the Investors section of the Company's

website: www.alexandermining.com.

The Warrants will be subject to eligibility requirements on

issue. Such requirements result from pre-existing securities law

restrictions applicable to certain jurisdictions such as the United

States of America. The Warrant Bonus Issue will not be extended to,

and the Warrants will not be issued to and may not subsequently be

exercisable by, shareholders in a restricted jurisdiction.

Notwithstanding the above, the Company will reserve the right to

permit any shareholder to take up Warrants under the Warrant Bonus

Issue if the Company, in its sole and absolute discretion, is

satisfied that the transaction in question is exempt from, or not

subject to, the applicable restrictive legislation or

regulations.

Qualifying Shareholders who are in any doubt about the

implications of the Bonus Issue on their personal tax position

should consult their professional adviser.

Placing Details

The Placing Shares will rank pari passu with the existing

ordinary shares and an application has been made to the London

Stock Exchange for admission of the Placing Shares to trading on

AIM ("Admission"). Admission is expected to occur at 8.00 a.m. on

25 May 2016.

Alexander has issued a total of 50,000,000 warrants at an

exercise price of 0.1p to Cornhill Capital Limited ("the Broker

Warrants") as part of its remuneration for effecting the Placing.

The Warrants have a five year exercise period.

Total Voting Rights

Following Admission, the Company will have a total of

861,910,288 ordinary shares in issue with each share carrying the

right to one vote. The Company does not hold any shares in

treasury. Therefore, the total number of ordinary shares with

voting rights will be 861,910,288. This figure may be used by

shareholders in the Company as the denominator for the calculations

by which they will determine if they are required to notify their

interest in, or a change in their interest in, the share capital of

the Company under the FCA's Disclosure and Transparency Rules.

Enquiries:

Alexander Mining plc

Martin Rosser Matt Sutcliffe

Chief Executive Officer Executive Chairman

Mobile: +44 (0) 7770 865 Mobile: +44 (0) 7887 930

341 758

Tel: +44 (0) 20 7078 9566

Email: mail@alexandermining.com

Website: www.alexandermining.com

Northland Capital Partners

Limited

Matthew Johnson / Gerry

Beaney

+44 (0) 20 3861 6625

(Corporate Finance)

John Howes / Abigail Wayne

(Corporate Broking)

This information is provided by RNS

The company news service from the London Stock Exchange

END

DRLPGUQGAUPQGPU

(END) Dow Jones Newswires

May 20, 2016 08:18 ET (12:18 GMT)

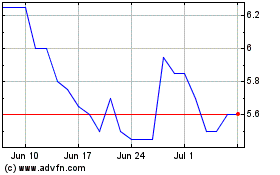

Eenergy (LSE:EAAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

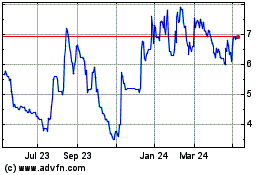

Eenergy (LSE:EAAS)

Historical Stock Chart

From Apr 2023 to Apr 2024