TIDMAIEA

RNS Number : 5902A

Airea PLC

21 February 2014

AIREA plc

Interim Results for the Six Months Ended 31 December 2013

Review of Operations

Introduction

The six months to December 2013 have been a challenging period

for Airea plc as we continue to reshape the business towards our

goal of sustainable profitable growth against a backdrop of ongoing

hostile market conditions. We stated in the annual report that we

could not see any reliable signs of an upturn in market conditions

and this continued to be the case throughout the period. Whilst we

discerned some marginal improvement in demand for our residential

carpet range in the final quarter of the calendar year, this was

patchy and volatile. Demand in the contract flooring market

remained weak as the non-residential construction sector continued

to be subdued. Our revenue reflected this general market picture

and was further impacted by timing issues on larger contracts and

stocking deals.

Against this back-ground of weak demand, the business has

demonstrated financial resilience. Margin improvement, resulting

from the work done on product engineering and price management, and

a lower cost base kept the business in profit and we have

maintained the financial headroom to allow us to operate debt

free.

We continue to make good progress in strengthening the product

portfolio and a number of important product launches were

successfully completed in the first half from which we can expect

to see sales in future periods. New wool mix collections extolling

the virtues of wool over synthetic materials, emphasising the

superior lasting appearance, resilience, cleaning properties and

allergy benefits have been welcomed by retailers. Our carpet tile

collection has been strengthened in the medium price sector and we

have re-launched our best selling product with enhanced design

options at a very competitive price point.

Group results

Revenue for the period was GBP11.6m (2012: GBP13.5m). The

operating profit was GBP222,000 (2012: GBP359,000). After charging

pension related finance costs of GBP200,000 (2012: GBP89,000) and

incorporating the appropriate tax charge the net profit for the

period was GBP16,000 (2012: GBP176,000). Basic earnings per share

were 0.03p (2012: 0.38p).

The change in operating profit resulted from a combination of

reduced sales volumes improved margins and a lower cost base. The

increase in pension related finance costs arises from the new

approach to calculating and presenting the net interest expense on

the net defined liability introduced by a revision to the

appropriate accounting standard. The notional interest is now

calculated as a single net figure, based on the discount rate that

is used to measure the defined benefit obligation. As a consequence

the long term expected return on the plan assets actually held is

no longer used. In common with many other entities, this results in

a lower reported net profit. It does not reflect any real

deterioration in the underlying pension funding level.

Operating cash flows before movements in working capital were

GBP599,000 (2012: GBP929,000). Working capital increased by

GBP373,000 (2012: reduction GBP1,355,000) due to timing of payments

to suppliers. Contributions to the defined benefit pension scheme

were GBP200,000 (2011: GBP217,000) in line with the agreement

reached with the scheme trustees following the last triennial

valuation as at 1(st) July 2011. Capital expenditure of GBP113,000

(2012: GBP134,000) was focussed on essential replacements and

productivity improvements.

Current trading and future prospects

Despite the generally more optimistic tone concerning the wider

economy we have not seen this work through into the particular

sectors in which we operate. The residential carpet market has yet

to see any sustained improvement from an increase in activity in

the housing market, and demand remains volatile. On the contract

flooring side, the dearth of development activity over the last six

years in commercial construction and now the cut backs in public

sector investment has led to challenging market conditions with

intensified competition for the available business. However, the

products we have launched in the first half of our financial year,

combined with the work we have been doing in reshaping the

salesforce, puts us in a stronger competitive position and we

continue to demonstrate our financial resilience. Given the current

trading position, and the ongoing need to carefully husband our

financial resources, the board has decided not to make a dividend

payment at the interim stage.

Enquiries:

Neil Rylance 01924 266561

Chief Executive Officer

Roger Salt 01924 266561

Group Finance Director

Richard Lindley 0113 388 4789

N+1 Singer

Consolidated Income Statement

6 months ended 31st December

2013

Unaudited Unaudited Audited

6 months 6 months year ended

ended ended

31st December 31st December 30th June

2013 2012 2013

GBP000 GBP000 GBP000

Revenue 11,555 13,521 25,049

Operating costs (11,333) (13,162) (24,340)

Operating profit after

exceptional items 222 359 709

Finance income 2 - 2

Finance costs (200) (89) (178)

-------------- -------------- ------------

Profit before taxation 24 270 533

Taxation (8) (94) (90)

--------------

Profit for the period 16 176 443

============== ============== ============

Earnings per share (basic

and diluted) 0.03p 0.38p 0.96p

All amounts relate to continuing

operations

Consolidated Statement of Comprehensive

Income

6 months ended 31st December

2013

Unaudited Unaudited Audited

6 months 6 months year ended

ended ended

31st December 31st December 30th June

2013 2012 2013

GBP000 GBP000 GBP000

Profit attributable to

shareholders of the group 16 176 443

Actuarial losses recognised

in the pension scheme - - 2,350

Related deferred taxation - - (797)

Total comprehensive income/(loss)

for the period 16 176 1,996

============== ============== ============

Consolidated Balance Sheet

as at 31st December 2013 Unaudited Unaudited Audited

31st December 31st December 30th June

2013 2012 2013

GBP000 GBP000 GBP000

Non-current assets

Property, plant and equipment 6,165 6,872 6,428

Deferred tax asset 1,476 2,495 1,476

7,641 9,367 7,904

-------------- -------------- ------------

Current assets

Inventories 8,723 7,501 8,874

Trade and other receivables 3,205 3,467 4,331

Cash and cash equivalents 2,406 3,090 2,747

-------------- -------------- ------------

14,334 14,058 15,952

-------------- -------------- ------------

Total assets 21,975 23,425 23,856

-------------- -------------- ------------

Current liabilities

Trade and other payables (3,797) (4,368) (5,440)

Non-current liabilities

Pension deficit (5,668) (8,129) (5,668)

Deferred tax (41) (41) (41)

(5,709) (8,170) (5,709)

-------------- -------------- ------------

Total liabilities (9,506) (12,538) (11,149)

-------------- -------------- ------------

12,469 10,887 12,707

============== ============== ============

Equity

Called up share capital 11,561 11,561 11,561

Share premium account 504 504 504

Capital redemption reserve 2,395 2,395 2,395

Share option reserve - 16 -

Retained earnings (1,991) (3,589) (1,753)

12,469 10,887 12,707

============== ============== ============

Consolidated Cash Flow

Statement

6 months ended 31st December Unaudited Unaudited Audited

2013

6 months 6 months year ended

ended ended

31st December 31st December 30th June

2013 2012 2013

GBP000 GBP000 GBP000

Operating activities

Profit attributable to

shareholders of the group 16 176 443

Tax charged 8 94 90

Finance costs 198 89 176

Depreciation 377 570 1,137

-------------- -------------- ------------

Operating cash flows before

movements in working capital 599 929 1,846

(Increase)/decrease in

working capital (373) 1,355 416

Contributions to defined

benefit pension scheme (200) (217) (415)

-------------- -------------- ------------

Cash generated from operations 26 2,067 1,847

-------------- -------------- ------------

Investing activities

Purchase of property, plant

and equipment (113) (134) (257)

-------------- -------------- ------------

Financing activities

Equity dividends paid (254) (185) (185)

-------------- -------------- ------------

Net (decrease)/increase

in cash and cash equivalents (341) 1,748 1,405

Cash and cash equivalents

at start of period 2,747 1,342 1,342

Cash and cash equivalents

at end of period 2,406 3,090 2,747

============== ============== ============

Consolidated Statement of Changes in

Equity

6 months ended 31st December

2013

Share capital Share premium Capital Share Retained Total

account redemption option Earnings equity

reserve reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1st July 2012 11,561 504 2,395 16 (3,580) 10,896

Profit attributable to

shareholders of the group - - - - 176 176

Dividend paid - - - - (185) (185)

-------------- -------------- ------------ --------- ----------

At 1st January 2013 11,561 504 2,395 16 (3,589) 10,887

Profit attributable to

shareholders of the group - - - - 267 267

Other comprehensive income

for the period - - - - 1,553 1,553

Reserve transfer relating

to share based payment - - - (16) 16 -

At 1st July 2013 11,561 504 2,395 - (1,753) 12,707

Profit attributable to

shareholders of the group - - - - 16 16

Dividend paid - - - - (254) (254)

At 31st December 2013 11,561 504 2,395 - (1,991) 12,469

============== ============== ============ ========= ========== ========

Note

BASIS OF PREPARATION AND ACCOUNTING

POLICIES

The financial information for the six month periods ended 31(st) December

2013 and 31(st) December 2012 has not been audited and does not constitute

full financial statements within the meaning of Section 434 of the Companies

Act 2006.

The financial information relating to the year ended 30th June 2013 does

not constitute full financial statements within the meaning of Section

434 of the Companies Act 2006. This information is based on the group's

statutory accounts for that period. The statutory accounts were prepared

in accordance with International Financial Reporting Standards as adopted

by the European Union ("IFRS") and received an unqualified audit report

and did not contain statements under Section 498(2) or (3) of the Companies

Act 2006. These financial statements have been filed with the Registrar

of Companies.

These interim financial statements have been prepared using the recognition

and measurement principles of International Financial Reporting Standards

as adopted by the European Union ("IFRS"). The accounting policies used

are the same as those used in preparing the financial statements for the

year ended 30th June 2013. These policies are set out in the annual report

and accounts for the year ended 30th June 2013. The interim and annual

reports are available on the company's website at www.aireaplc.co.uk.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR MMGZZNGLGDZM

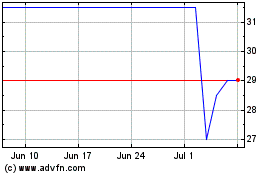

Airea (LSE:AIEA)

Historical Stock Chart

From Mar 2024 to Apr 2024

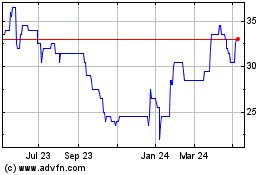

Airea (LSE:AIEA)

Historical Stock Chart

From Apr 2023 to Apr 2024