Aéroports de Paris: Q1 2014 consolidated revenue

May 14 2014 - 1:30AM

Traffic growth

(+3.6%) not translated into revenue (-2.4% to €637 million)

due to decrease in de-icing fees and scope effect (mothballing of

cogeneration plant):

-

Continued good dynamics in

traffic (+3.6%) since Q4 2013

-

Aviation:

sustained growth of airport fees (+5.8%, to €206 million) driven by

traffic and tariffs increase, totally offset by the decrease in

ancillary fees (-19.4% to €45 million) linked to low de-icing

activity following an exceptionally mild winter

-

Retail and

services: growth of retail activities (+1.4%, to €85

million) more than offset by the strong decrease in industrial

services (-53.7%, to €13 million) due to the mothballing in April

2013 of the cogeneration plant resulting in a decrease in

electricity sales (-74.0%, to €4 million)

-

Real estate:

impact of the indexation of rents on CCI down by 1.74% as of 1

January 2014

-

Continued control over

operating costs strengthened by a positive effect on margins of no

snowfall

Group revenue by

segment:

In

million of euros

(unless stated otherwise) |

Q1 2014 |

Q1 2013

Pro forma |

2014 / 2013 |

|

Aviation |

376 |

375 |

+0.5% |

| Retail and

services |

224 |

234 |

-4.4% |

| Real

estate |

65 |

66 |

-1.6% |

|

International and airport developments |

16 |

22 |

-26.9% |

| Other

activities |

47 |

47 |

-1.0% |

|

Intersegment eliminations |

(91) |

(91) |

-0.1% |

|

Consolidated revenue |

637 |

653 |

-2.4% |

|

|

|

|

|

Group traffic (in millions of

passengers) |

29 |

27 |

+7.1% |

| Paris

Airports (CDG+ORY) |

20 |

19 |

+3.6% |

| TAV

Airports @ 38% |

8 |

7 |

+15.6% |

|

|

|

|

|

Sales/PAX (€) |

18.0 |

17.8 |

+1.1% |

Augustin de Romanet,

Chairman and Chief Executive Officer of Aéroports de Paris,

said:

"The upturn in traffic observed

since the beginning of the fourth quarter of 2013 continued over

the first quarter of 2014, with a 3.6% growth in passenger traffic

at Paris airports. This growth did not translate into an increase

in consolidated revenue mainly because of an external effect

(decrease in revenue linked to de-icing activities, as a

consequence of an exceptionally mild winter) and a scope effect

(mothballing of cogeneration plant). Beyond revenue, our continued

efforts on control over operating costs and no snowfall had a

positive impact on our margins."

A conference call will be

held today at 9:00, CET

Aéroports de Paris: Q1 2014

consolidated revenue - Financial Release

Aéroports de Paris: Q1 2014 consolidated revenue - Presentation

Aéroports de Paris: Chiffre d'affaires consolidé du T1 2014 -

CP

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Aéroports de Paris via Globenewswire

HUG#1785030

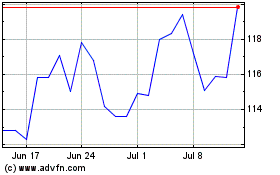

ADP Promesses (EU:ADP)

Historical Stock Chart

From Mar 2024 to Apr 2024

ADP Promesses (EU:ADP)

Historical Stock Chart

From Apr 2023 to Apr 2024