Today AVANGRID, Inc. (NYSE:AGR) reported consolidated net income

of $120 million, or $0.39 per share, for the second quarter ended

June 30, 2017, compared to $102 million, or $0.33 per share, for

the same period in 2016, a 17% increase in net income. For the

first six months of 2017, consolidated net income was $359 million,

or $1.16 per share, compared to $314 million, or $1.01 per share,

for the first six months of 2016, a 14% increase in net income.

Net income and earnings per share for the second quarter and

first six months of 2017 and 2016 on a U.S. GAAP basis are set

forth below:

Net Income (Loss) - $M Three Months ended

June 30, Six Months ended June 30, $M

2017 2016 '17 vs '16 2017

2016 '17 vs '16 Networks $ 96 $

79 $ 17 $ 268 $ 244 $ 24 Renewables 31 41 (11 ) 100 84 16 Corporate

10 4 6 5 18 (13 ) Gas Storage (16 ) (22 ) 6

(14 ) (32 ) 18

Net Income

$ 120 $ 102 $

18 $ 359 $ 314

$ 45 Earnings (Loss) Per

Share Three Months ended June 30, Six Months

ended June 30, 2017 2016 '17 vs '16

2017 2016 '17 vs '16 Networks $ 0.31 $

0.25 $ 0.06 $ 0.87 $ 0.79 $ 0.08 Renewables 0.10 0.13 (0.03 ) 0.32

0.27 0.05 Corporate 0.03 0.01 0.02 0.02 0.06 (0.04 ) Gas Storage

(0.05 ) (0.07 ) 0.02 (0.05 )

(0.10 ) 0.06

Earnings Per Share

$ 0.39 $ 0.33 $

0.06 $ 1.16 $ 1.01

$ 0.15 Weighted-avg # of Shares

(M): 309.5 309.5 309.5 309.5 Amounts may not add due to rounding

Excluding mark-to-market adjustments in the Renewables segment,

the non-core Gas Storage business and the sale of certain equity

investments in 2016, the non-GAAP consolidated adjusted net income

was $143 million, or $0.46 per share, for the second quarter ended

June 30, 2017, compared to $118 million, or $0.38 per share, for

the same period in 2016, a 21% increase in adjusted net income. For

the first six months of 2017, the non-GAAP consolidated adjusted

net income was $369 million, or $1.19 per share, compared to $322

million, or $1.04 per share, for the same period in 2016, a 15%

increase in adjusted net income. For additional information, see

“Use of Non-GAAP Financial Measures” and “Reconciliation of

Non-GAAP Financial Measures” below.

“We had another quarter of consistent financial results as we

continue to deliver on our 2017 earnings outlook and long-term

growth plans,” said James P. Torgerson, chief executive officer of

AVANGRID. “Earnings once again improved compared to 2016 primarily

due to the implementation of new rate plans and higher wind

production. We are affirming our 2017 adjusted earnings outlook of

$2.10–$2.35 per share and will continue to focus on the execution

of our capital investment plan as well as our Forward 2020

initiatives.”

“Our long-term growth strategy remains on track. We have been

successful in securing power purchase agreements (PPAs) for both

new and existing capacity and recently executed a PPA for 200

mega-watts (MW) to be sourced from a new wind farm in Texas,” added

Torgerson. “Year to date, 401 MW of PPAs for new wind farms have

been secured. We also have been successful in replacing 589 MW of

existing and future merchant capacity with fixed price contracts.

We secured three additional contracts in the second quarter of 2017

increasing our projected contracted capacity to 73% by year end

2017 from 62% in 2016. Additionally, we have executed a 100 MW

repowering PPA in the Midwest, bringing our total repowering for

the year to 122 MW. All of our Renewables projects currently under

construction remain on track for their expected in-service

dates.”

“And lastly, later this month we plan to bid multiple

transmission and/or renewables solutions in the Clean Energy RFP

issued by Massachusetts Electric Distribution Companies and the

Department of Energy Resources for 9.45 terawatt hours of clean

energy power by 2022 and will also look to participate in the

recently opened offshore RFP with responses due at the end of this

year. In May, Avangrid Renewables formed a strategic partnership

with Copenhagen Infrastructure Partners to jointly develop a large

scale wind project off the coast of Massachusetts, acquiring a 50

percent ownership interest in Vineyard Wind,” added Torgerson.

“This partnership, along with our family of companies’ extensive

offshore wind experience, demonstrates our strong commitment to

execute our growth strategy and expand both our onshore and

offshore renewables portfolio across the U.S.”

Avangrid Networks

Avangrid Networks earned $96 million, or $0.31 per share, in the

second quarter of 2017, compared to $79 million, or $0.25 per

share, in the second quarter of 2016. For the first six months of

2017, Avangrid Networks earned $268 million, or $0.87 per share,

compared to $244 million, or $0.79 per share, for the first six

months of 2016. Year-to-date 2016 earnings include interest expense

in the amount of $7.2 million (pre-tax), or $0.02 per share,

related to $450 million of UIL Holdings Corporation debt. This debt

which was moved from Avangrid Networks to Corporate at the end of

2016 and does not have an impact on consolidated results. Earnings

for the second quarter and first six months of 2017 compared to

2016 benefitted primarily from the implementation of new rate plans

and lower interest expense with the transfer of the UIL Holdings

Corporation debt to Corporate, which was partially offset by

expected earnings sharing related to the first rate year of the

rate settlement in New York. Adjusted net income increased by 21%

and 9% for the second quarter and first six months of 2017,

compared to 2016, respectively.

Avangrid Renewables

Avangrid Renewables earned $31 million, or $0.10 per share, in

the second quarter of 2017, compared to $41 million, or $0.13 per

share, for the same period in 2016. For the first six months of

2017, Avangrid Renewables earned $100 million, or $0.32 per share,

compared to $84 million, or $0.27 per share, for the first six

months of 2016. Second quarter and year-to-date 2016 earnings

include a minor gain on the sale of an equity method investment.

Earnings for the second quarter of 2017 compared to 2016 decreased

due to negative mark-to-market, partially offset by improved wind

production, although below normal, primarily from the inclusion of

the 208 MW Amazon Wind Farm U.S. East. Earnings for the first six

months of 2017 compared to 2016 benefitted from improved wind

production and a lower effective tax rate. Excluding mark-to-market

and the minor gain on the sale of an equity method investment in

2016, adjusted net income increased by 7% and 26% for the second

quarter and first six months of 2017, compared to 2016,

respectively.

Corporate

Corporate produced net income of $10 million, or $0.03 per

share, in the second quarter of 2017, compared to net income of $4

million, or $0.01 per share, in the second quarter of 2016. For the

first six months of 2017, Corporate had net income of $5 million,

or $0.02 per share, compared to net income $18 million, or $0.06

per share, for the first six months of 2016. Year-to-date results

for 2017 reflect an increase in interest expense compared to

year-to-date 2016 due to the transfer of UIL Holdings Corporation

debt described above and year-to-date results for 2016 include the

gain from the sale in Iroquois of $19 million, or $0.06 per

share.

Gas Storage

Gas Storage incurred a net loss of $16 million, or $0.05 per

share, in the second quarter of 2017, compared to a net loss of $22

million, or $0.07 per share, for the same period in 2016. For the

first six months of 2017, Gas Storage incurred a net loss of $14

million, or $0.05 per share, compared to a net loss of $32 million,

or $0.10 per share, for the first six months of 2016.

Outlook

Avangrid affirms its adjusted consolidated earnings outlook for

2017 of $2.10-$2.35 per share. Details of the earnings components

are summarized as follows.

Outlook -

Estimated EPS(1)

As of July 19, 2017 Networks $1.66 - $1.74

Renewables(2) $0.50 - $0.65 Corporate $(0.08) - $(0.05) Adjusted

EPS(3) $2.10 - $2.35 Amounts may not add due to rounding;

Estimates are not expected to be additive. (1) Assumes approx.

309.5 million shares outstanding (2) Includes the assumption of the

purchase of 49.5% of the El Cabo wind project by JV partner (3)

Excludes non-core Gas Storage and Renewables mark-to-market

Primary outlook assumptions include:

- Full year NYSEG, RG&E and

UI-Distribution rates

- Further integration & best

practices

- Normal wind

- Full year Renewables extension of wind

assets useful life

- Full year Amazon Wind Farm U.S.

East

- Additional Wind projects by

year-end

- Excludes non-core Gas Storage and

Renewables mark-to-market

Although it is not included in our 2017 adjusted consolidated

earnings outlook, the Gas Storage business is projected to earn

$(0.12)-$(0.08) per share in 2017.

Webcast

Avangrid will webcast an audio-only financial presentation in

conjunction with releasing second quarter 2017 earnings today

beginning at 10:00 A.M. Eastern time. The webcast will feature a

presentation from Avangrid’s CEO, James P. Torgerson and other

members of the executive team, and can be accessed through the

Investor Relations’ section of Avangrid’s website at

http://www.Avangrid.com.

Avangrid, Inc. (NYSE: AGR) is a diversified energy and utility

company with more than $31 billion in assets and operations in 27

states. The company owns regulated utilities and electricity

generation assets through two primary lines of business, Avangrid

Networks and Avangrid Renewables. Avangrid Networks is comprised of

eight electric and natural gas utilities, serving approximately 3.2

million customers in New York and New England. Avangrid Renewables

operates 6.6 gigawatts of electricity capacity, primarily through

wind power, in 23 states across the United States. Avangrid employs

approximately 6,800 people. For more information, visit

www.avangrid.com.

Forward Looking Statements

Certain statements in this presentation may relate to our future

business and financial performance and future events or

developments involving us and our subsidiaries that are not purely

historical and may constitute “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements may be identified by the use of

forward-looking terms such as “may,” “will,” “should,” “can,”

“expects,” “believes,” “anticipates,” “intends,” “plans,”

“estimates,” “projects,” “assumes,” “guides,” “targets,”

“forecasts,” “is confident that” and “seeks” or the negative of

such terms or other variations on such terms or comparable

terminology. Such forward looking statements include, but are not

limited to, statements about our plans, objectives and intentions,

outlooks or expectations for earnings, revenues, expenses or other

future financial or business performance, strategies or

expectations, or the impact of legal or regulatory matters on our

business, results of operations or financial condition. Such

statements are based upon the current beliefs and expectations of

our management and are subject to significant risks and

uncertainties that could cause actual outcomes and results to

differ materially. Important factors that could cause actual

results to differ materially from those indicated by such

forward-looking statements include, without limitation, the risks

and uncertainties set forth under the section entitled “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” in our Annual Report on Form

10-K for the year ended December 31, 2016 and our Quarterly Report

on Form 10-Q for the three months ended March 31, 2017, which is on

file with the Securities and Exchange Commission (SEC) and

available on our investor relations website at www.Avangrid.com and

on the SEC website at www.sec.gov. Additional information will also

be set forth in subsequent filings with the SEC. You should

consider these factors carefully in evaluating forward-looking

statements. Should one or more of these risks or uncertainties

materialize, or should any of the underlying assumptions prove

incorrect, actual results may vary in material respects from those

expressed or implied by these forward-looking statements. You

should not place undue reliance on these forward-looking

statements. We do not undertake any obligation to update or revise

any forward-looking statements to reflect events or circumstances

after the date of this presentation whether as a result of new

information, future events or otherwise, except as may be required

under applicable securities laws.

Use of Non-GAAP Financial Measures

To supplement our consolidated financial statements presented in

accordance with U.S. GAAP, Avangrid considers certain non-GAAP

financial measures that are not prepared in accordance with U.S.

GAAP, including adjusted net income and adjusted earnings per

share. The non-GAAP financial measures we use are specific to

Avangrid and the non-GAAP financial measures of other companies may

not be calculated in the same manner. We use these non-GAAP

financial measures, in addition to U.S. GAAP measures, to establish

operating budgets and operational goals to manage and monitor our

business, evaluate our operating and financial performance and to

compare such performance to prior periods and to the performance of

our competitors. We believe that presenting such non-GAAP financial

measures is useful because such measures can be used to analyze and

compare profitability between companies and industries because it

eliminates the impact of financing and certain non-cash charges as

well as allow for an evaluation of Avangrid with a focus on the

performance of its core operations. In addition, we present

non-GAAP financial measures because we believe that they and other

similar measures are widely used by certain investors, securities

analysts and other interested parties as supplemental measures of

performance.

We provide adjusted net income and adjusted earnings per share,

which are adjusted to reflect the effect of mark-to-market changes

in the fair value of derivative instruments used by Avangrid to

economically hedge market price fluctuations in related underlying

physical transactions for the purchase and sale of electricity,

adjustments for the non-core Gas Storage business, for which we are

exploring strategic options, and the impairment of certain

investments and excludes the sale of certain equity investments. We

believe adjusted net income is useful in understanding and

evaluating actual and projected financial performance and

contribution of Avangrid core lines of business and to more fully

compare and explain our results. The most directly comparable U.S.

GAAP measure to adjusted net income is net income. We also provide

adjusted earnings per share, which is adjusted net income converted

to an earnings per share amount.

The use of non-GAAP financial measures is not intended to be

considered in isolation or as a substitute for, or superior to,

Avangrid’s U.S. GAAP financial information, and investors are

cautioned that the non-GAAP financial measures are limited in their

usefulness, may be unique to Avangrid, and should be considered

only as a supplement to Avangrid’s U.S. GAAP financial measures.

The non-GAAP financial measures may not be comparable to other

similarly titled measures of other companies and have limitations

as analytical tools. Non-GAAP financial measures are not primary

measurements of our performance under U.S. GAAP and should not be

considered as alternatives to operating income, net income or any

other performance measures determined in accordance with U.S.

GAAP.

Avangrid, Inc. Condensed Consolidated Statements

of Income (In Millions except per share amounts)

(Unaudited) Three Months ended

Six Months ended June 30, June 30, ($M)

2017 2016 2017 2016 Operating

Revenues $ 1,331 $ 1,439

$ 3,089 $ 3,109

Operating Expenses Purchased power, natural gas and fuel

used 242 221 707 649 Operations and maintenance 522 558 1,073 1,109

Depreciation and amortization 206 213 403 418 Taxes other than

income taxes 138 125 285

262

Total Operating Expenses

1,108 1,117 2,468

2,438 Operating Income

223 322 621

671 Other Income and (Expense) Other

income 8 20 21 69 Earnings from equity method investments 1 - 3 2

Interest expense, net of capitalization (68 ) (68 )

(139 ) (152 )

Income Before Income Tax

164 274 506

590 Income tax expense 44

172 147 276

Net Income

$ 120 $ 102 $

359 $ 314

Earnings per Common Share, Basic: $

0.39 $ 0.33 $ 1.16

$ 1.01 Earnings per Common Share,

Diluted:

$ 0.39 $ 0.33

$ 1.16 $ 1.01

Weighted-average Number of Common Shares Outstanding (M): Basic

309.5 309.5 309.5 309.5 Diluted 309.8 309.7 309.8 309.7

Amounts may not add due to rounding

Operating revenues and income tax expense

for the three and six month periods ended June 30, 2016 include

increases for unfunded future income taxes that were adjusted in

the amount of $126 million to reflect the change from a flow

through to normalization method following the approval of the Joint

Proposal by the NYPSC. This item does not impact net income for the

periods.

Avangrid, Inc. Condensed Consolidated

Balance Sheets (Unaudited) June 30,

December 31, ($M) 2017 2016

ASSETS Current assets $ 1,921 $ 2,252 Net property, plant

& equipment in service 20,419 20,077 Total property, plant

& equipment 22,290 21,548 Regulatory assets 3,013 3,091

Goodwill 3,124 3,124 Other assets 1,126 1,294

Total Assets $ 31,474 $

31,309 LIABILITIES AND EQUITY Current

liabilities 2,461 2,712 Regulatory liabilities 2,310 2,318 Other

non-current liabilities 6,689 6,647 Non-current debt 4,773

4,510

Total Liabilities

16,233 16,187 EQUITY

Common stock 3 3 Additional paid-in-capital 13,655 13,653 Treasury

stock (8 ) (5 ) Retained earnings 1,639 1,544 Accumulated other

comprehensive loss (62 ) (86 )

Total Stockholders'

Equity 15,227 15,109

Noncontrolling interests 14 13

Total Equity

15,241 15,122 Total

Liabilities & Equity $ 31,474 $

31,309 Amounts may not add due to rounding

Avangrid, Inc. Condensed Consolidated

Statement of Cash Flows (Unaudited) Six

Months Ended June 30, $M 2017

2016 Cash Flow from Operating Activities:

Net income

$ 359 $ 314 Net Cash

Provided by Operating Activities 925

906 Cash Flow from Investing

Activities: Capital expenditures (1,069 ) (674 ) Contributions

in aid of construction 21 41 Proceeds from sale of property, plant

and equipment 3 43 Proceeds from sale of equity method and other

investment 5 57 Receipts from affiliates — 2 Cash distribution from

equity method investments 2 2 Other investments and equity method

investments, net (7 ) (8 )

Net Cash Used in

Investing Activities (1,045 )

(537 ) Cash Flow from Financing Activities:

Non-current note issuance 294 — Repayments of non-current debt (23

) (45 ) Receipts (repayments) of other short-term debt, net 158

(160 ) Payments on tax equity financing arrangements (60 ) (53 )

Repayments of capital leases (31 ) (4 ) Repurchase of common stock

(3 ) (4 ) Issuance of common stock (1 ) (2 ) Dividends paid

(268 ) (134 )

Net Cash Provided by (Used in) Financing

Activities 66 (402 )

Net Decrease in Cash, Cash Equivalents and Restricted Cash

(54 ) (33 ) Cash, Cash

Equivalents and Restricted Cash, beginning of period

96 434 Cash, Cash Equivalents

and Restricted Cash, end of period $ 42

$ 401 Amounts may not add due to

rounding

Reconciliation of

Non-GAAP Financial Measures

Avangrid, Inc. Reconciliation of Non-GAAP Adjusted

Net Income (Loss) - $M (Unaudited)

Three Months ended June 30, Six Months ended June

30, 2017 2016 '17 vs '16

2017 2016 '17 vs '16

Networks $ 96 $ 79 $ 17 $ 268 $ 244 $ 24 Renewables 31 41 (11 ) 100

84 16 Corporate 10 4 6 5 18 (13 ) Gas Storage (16 )

(22 ) 6 (14 ) (32 ) 18

Net Income $ 120 $ 102 $

18 $ 359 $ 314 $

45 Adjustments: Sale of equity method investment - (3 ) 3 -

(36 ) 36 Impairment of investment - - - - 3 (3 ) Mark-to-market

adjustments - Renewables 11 (7 ) 19 (6 ) (8 ) 2 Income tax impact

of adjustments* (4 ) 4 (8 ) 2 17 (15 ) Gas Storage, net of tax

16 22 (6 ) 14

32 (18 )

Adjusted Net Income $

143 $ 118 $

25 $ 369 $

322 $ 48 * 2017:

Income tax impact of adjustments: $2M from MtM

adjustment-Renewables. * 2016: Income tax impact of

adjustments: $14M from sale of equity method investment- Corporate,

$(1)M on impairment of investment - Networks, $1M from sale of

other investment and $3M from MtM adjustments - Renewables.

Non-GAAP Adjusted Net Income (Loss) - $M Three

Months ended June 30, Six Months ended June 30,

Adjusted 2017 Adjusted 2016

Adjusted'17 vs '16

Adjusted 2017 Adjusted 2016

Adjusted '17vs '16

Networks $ 96 $ 79 $ 17 $ 268 $ 246 $ 22 Renewables 38 35 3 97 77

20 Corporate 10 4 6

5 (1 ) 6

Adjusted Net

Income $ 143 $ 118

25 $ 369 $

322 48

Avangrid, Inc. Reconciliation of Adjusted Non-GAAP

Earnings (Loss) Per Share (EPS) (Unaudited)

Three Months ended June 30, Six Months ended June 30,

2017 2016 '17 vs '16 2017 2016

'17 vs '16 Networks $ 0.31 $ 0.25 $ 0.06 $ 0.87 $

0.79 $ 0.08 Renewables 0.10 0.13 (0.03 ) 0.32 0.27 0.05 Corporate

0.03 0.01 0.02 0.02 0.06 (0.04 ) Gas Storage (0.05 )

(0.07 ) 0.02 (0.05 ) (0.10 )

0.06

Earnings Per Share $ 0.39 $

0.33 $ 0.06 $ 1.16 $

1.01 $ 0.15 Adjustments: Sale of equity method

investment - (0.01 ) 0.01 - (0.12 ) 0.12 Impairment of investment -

- - - 0.01 (0.01 ) Mark-to-market adjustments - Renewables 0.04

(0.02 ) 0.06 (0.02 ) (0.03 ) 0.01 Income tax impact of adjustments*

(0.01 ) 0.01 (0.03 ) 0.01 0.06 (0.05 ) Gas Storage, net of tax

0.05 0.07 (0.02 ) 0.05

0.10 (0.06 )

Adjusted Earnings Per

Share $ 0.46 $ 0.38

$ 0.08 $ 1.19 $

1.04 $ 0.15

Weighted-avg # of Shares (M): 309.5 309.5 309.5 309.5 Amounts may

not add due to rounding * 2017: EPS Income tax impact of

adjustments: $0.01 from MtM adjustment - Renewables. * 2016: EPS

Income tax impact of adjustments: $0.05 from sale of equity method

investment - Corporate and $0.01 from MtM adjustment - Renewables.

Non-GAAP Adjusted Earnings (Loss) Per Share

Three Months ended June 30, Six Months ended June 30,

Adjusted 2017 Adjusted 2016

Adjusted'17 vs '16

Adjusted 2017 Adjusted 2016

Adjusted '17vs '16

Networks $ 0.31 $ 0.26 $ 0.05 $ 0.87 $ 0.79 $ 0.07 Renewables 0.12

0.11 0.01 0.31 0.25 0.06 Corporate 0.03 0.01

0.02 0.02 (0.00 )

0.02

Adjusted Earnings Per Share $ 0.46

$ 0.38 $ 0.08

$ 1.19 $ 1.04 $

0.15 Weighted-avg # of Shares (M): 309.5 309.5

309.5 309.5 Amounts may not add due to rounding

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170719005289/en/

AVANGRID, Inc.Analysts:Patricia Cosgel,

203-499-2624orMedia:Michael West Jr., 203-499-3858

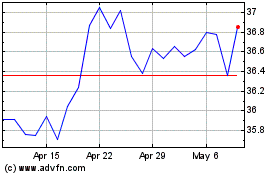

Avangrid (NYSE:AGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Avangrid (NYSE:AGR)

Historical Stock Chart

From Apr 2023 to Apr 2024