PRINCETON, N.J., Dec. 10 /PRNewswire-FirstCall/ -- AMREP

Corporation (NYSE:AXR) today reported a net loss of $985,000, or

$0.16 per share, for its fiscal 2010 second quarter ended October

31, 2009 compared to net income of $2,895,000, or $0.48 per share,

for its fiscal 2009 second quarter ended October 31, 2008. For the

first six months of fiscal 2010, the Company had a net loss of

$2,041,000, or $0.34 per share, compared to net income of

$2,966,000, or $0.49 per share, for the same period of fiscal 2009.

Revenues were $32,333,000 and $64,790,000 in the second quarter and

first six months of 2010 versus $40,290,000 and $75,860,000 for the

same periods last year. Revenues from land sales at the Company's

AMREP Southwest subsidiary were $1,670,000 and $3,155,000 for the

three and six month periods ended October 31, 2009 compared to

$4,810,000 and $6,073,000 for the same periods of the prior year,

with the results of all periods reflecting a continued softness in

the real estate market in the greater Albuquerque-metro and Rio

Rancho areas that is consistent with the well-publicized problems

of the national homebuilding industry and credit markets. These

decreases in revenues in 2010 primarily reflected the second

quarter 2009 sale of approximately 50 acres of undeveloped land for

$3,849,000 to one purchaser with no similar sale in the first six

months of 2010. The average gross profit percentage on land sales

decreased from 97% and 91% for the second quarter and first six

months of 2009 to 40% and 48% for the same periods in 2010. This

decrease was primarily attributable to a gross profit of $3,825,000

(99%) on the previously mentioned second quarter 2009 sale of

approximately 50 acres of undeveloped land. Revenues, gross profits

and related gross profit percentages from land sales can vary

significantly from period to period as a result of many factors,

including the nature and timing of specific transactions, and prior

results are not necessarily a good indication of what may occur in

future periods. Revenues from the Company's Kable Media Services

operations, including both Fulfillment Services and Newsstand

Distribution Services, decreased from $35,254,000 and $69,277,000

for the second quarter and first six months of 2009 to $30,625,000

and $61,393,000 for the same periods in 2010. Magazine publishers,

who are the principal customers of the Company's Media Services

operations, have continued to suffer from reduced advertising

revenues and lower subscription and newsstand sales during 2010,

which has caused certain publishers to close magazine titles or

seek more favorable terms from Kable or its competitors, all of

which has led to reduced business for the Company's Media Services

operations. Revenues from Kable's Subscription Fulfillment Services

operations decreased from $31,334,000 and $61,176,000 for the

second quarter and first six months of 2009 to $24,230,000 and

$49,357,000 for the same periods of 2010 primarily due to the

industry factors noted above, partly offset by revenue gains from

new and some existing clients. Revenues from Kable's Newsstand

Distribution Services operations increased from $3,096,000 and

$6,451,000 for the second quarter and first six months of 2009 to

$3,595,000 and $6,800,000 for the same periods of 2010 as a result

of changes in product mix and magazine cover price increases. The

net decrease in the combined revenues from Subscription Fulfillment

Services and Newsstand Distribution Services was partly offset by

increased revenues from Kable's Product Fulfillment Services and

Other business segment, which increased from $824,000 and

$1,650,000 for the second quarter and first six months of 2009 to

$2,799,000 and $5,235,000 for the same periods in 2010, reflecting

the inclusion of the revenues of a product repackaging and

fulfillment business and a temporary staffing business that were

acquired in the third quarter of 2009. Kable's operating expenses

decreased by $3,962,000 and $6,177,000 for the second quarter and

first six months of 2010 compared to the same periods in 2009,

primarily attributable to lower payroll and benefits costs and, to

a lesser extent, efficiencies related to the ongoing project to

consolidate the Subscription Fulfillment Services business from

three locations in Colorado, Florida and Illinois into one existing

location at Palm Coast, Florida. AMREP Southwest has a loan

agreement with a bank that matures on December 17, 2009. The lender

has issued a commitment letter that would replace the existing

facility. The replacement facility would mature in 364 days and,

among other provisions, would reduce the amount that may be

borrowed under the facility from the current balance outstanding of

$24,000,000 to $22,500,000. AMREP Southwest is considering the

terms of the replacement facility proposed in the lender's

commitment letter and no replacement loan agreement has as yet been

entered into. The lender has not extended the maturity date of the

existing facility and if it does not do so, but demands repayment

of amounts due under that facility, AMREP Southwest would not have

sufficient funds to satisfy such demand. AMREP Corporation's AMREP

Southwest Inc. subsidiary is a major landholder and leading

developer of real estate in New Mexico, and its Kable Media

Services, Inc. subsidiary distributes magazines to wholesalers and

provides subscription fulfillment and related services to

publishers and others. The quarterly results should be considered

in conjunction with the Company's audited financial statements for

fiscal 2009, which are included in the Company's 2009 Annual Report

on Form 10-K filed with the Securities and Exchange Commission.

Attachment 1 AMREP Corporation and Subsidiaries Financial

Highlights (Unaudited) Three Months Ended October 31,

------------------------------ 2009 2008 ---- ---- Revenues

$32,333,000 $40,290,000 Net income (loss) $(985,000) $2,895,000

Earnings (loss) per share - Basic and Diluted $(0.16) $0.48

Weighted average number of common shares outstanding 5,996,000

5,996,000 Six Months Ended October 31, ----------------------------

2009 2008 ---- ---- Revenues $64,790,000 $75,860,000 Net income

(loss) $(2,041,000) $2,966,000 Earnings (loss) per share - Basic

and Diluted $(0.34) $0.49 Weighted average number of common shares

outstanding 5,996,000 5,996,000 Attachment 2 The Company's land

sales in Rio Rancho, New Mexico were as follows (dollar amounts in

thousands): 2009 2008 -------------------------

------------------------- Revenues Revenues Acres Revenues Per Acre

Acres Revenues Per Acre Sold (in 000s) (in 000s) Sold (in 000s) (in

000s) ------ -------- -------- ----- -------- -------- Three months

ended October 31: Developed Residential 2.4 $775 $323 0.4 $86 $244

Commercial 1.7 895 526 - - - --- --- --- --- --- --- Total

Developed 4.1 1,670 407 0.4 86 244 Undeveloped - - - 87.1 4,724 54

--- --- --- ---- ----- --- Total 4.1 $1,670 $407 87.5 $4,810 $55

--- ------ ---- ---- ------ --- Six months ended October 31:

Developed Residential 5.2 $1,445 $278 1.8 $428 $238 Commercial 1.7

895 526 1.0 126 126 --- --- --- --- --- --- Total Developed 6.9

2,340 339 2.8 554 198 Undeveloped 26.0 815 31 131.9 5,519 42 ----

--- --- ----- ----- --- Total 32.9 $3,155 $96 134.7 $6,073 $45 ----

------ --- ----- ------ --- The Company offers for sale developed

and undeveloped land in Rio Rancho from a number of different

projects, and selling prices may vary from project to project and

within projects depending on location, the stage of development and

other factors. DATASOURCE: AMREP Corporation CONTACT: Peter M.

Pizza, Vice President and Chief Financial Officer, AMREP

Corporation, +1-609-716-8210 Web Site: http://www.amrepcorp.com/

Copyright

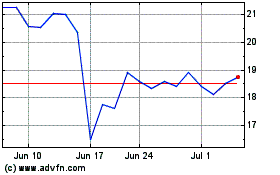

AMREP (NYSE:AXR)

Historical Stock Chart

From Aug 2024 to Sep 2024

AMREP (NYSE:AXR)

Historical Stock Chart

From Sep 2023 to Sep 2024