ADP® (Nasdaq:ADP), a leading global provider of Human Capital

Management (HCM) solutions, today announced its third quarter

fiscal 2016 financial results. Compared to last year’s third

quarter, revenues grew 7% to $3.2 billion, 9% on a constant dollar

basis. EBIT grew 9% to $806 million, 10% on a constant dollar

basis. EBIT margin increased about 40 basis points in the quarter

to 24.8%. Diluted earnings per share from continuing operations

increased to $1.17, representing growth of 14% on a reported and

constant dollar basis. This growth reflects a lower effective tax

rate and fewer shares outstanding compared with last year’s third

quarter.

Constant dollar, EBIT and EBIT margin are non-GAAP financial

measures. For ADP’s definition of EBIT, see the paragraph “Non-GAAP

Financial Information” at the end of this release. Please refer to

the accompanying financial tables for a reconciliation of non-GAAP

financial measures to their comparable GAAP measures.

“We are seeing continued traction for our technology solutions

and our robust service offerings, as a growing number of clients

adopt new applications or chose our higher-touch HR outsourcing

models,” said Carlos Rodriguez, president and chief executive

officer, ADP. “While sales of additional human capital

management modules that assist with the Affordable Care Act, or

ACA, compliance continue to boost our performance, we are

especially pleased to have seen balanced contributions to growth

from across our HCM portfolio.”

“ADP’s results in the third quarter were solid and reflect

investments we’ve made to support our clients through the first

year of ACA compliance reporting,” said Jan Siegmund, chief

financial officer, ADP. “On a year-to-date basis, we have

made substantial investments in operational resources and

additional selling expenses, and have also continued our

shareholder friendly actions, returning over $1.7 billion in cash

through dividends and share repurchases.”

Third Quarter Fiscal 2016 Segment Results

Employer Services – Employer Services offers a comprehensive

range of HCM and human resources outsourcing solutions.

- Employer Services revenues increased 5% over last year’s third

quarter, 7% on a constant dollar basis.

- The number of employees on ADP clients' payrolls in the United

States increased 2.5% for the third quarter when measured on a

same-store-sales basis for a subset of clients ranging from small

to large businesses.

- Employer Services client revenue retention declined 30 basis

points compared to a year ago.

- Employer Services segment margin decreased approximately 40

basis points compared to last year’s third quarter. This decrease

was primarily driven by the impact of investments made in

operational resources to support new business sold.

PEO Services – PEO Services provides comprehensive employment

administration outsourcing solutions through a co-employment

relationship.

- PEO Services revenues increased 16% compared to last year’s

third quarter.

- PEO Services segment margin increased approximately 50 basis

points over last year’s third quarter, primarily driven by sales

and operational efficiencies.

- Average worksite employees paid by PEO Services increased 14%

for the quarter to approximately 422,000.

Interest on Funds Held for Clients

The safety, liquidity and diversification of ADP clients’ funds

are the foremost objectives of the company’s investment

strategy. Client funds are invested in accordance with ADP’s

prudent and conservative investment guidelines and the credit

quality of the investment portfolio is predominantly AAA/AA.

- For the third quarter, interest on funds held for clients

increased 2% to $103 million from $101 million a year ago.

- Average client funds balances increased 2% in the third quarter

to $26.7 billion compared to $26.2 billion a year ago. On a

constant dollar basis, average client funds balances increased

3%.

- The average interest yield on client funds remained flat in the

third quarter at 1.5% when compared to a year ago.

Fiscal 2016 Outlook

ADP’s fiscal 2016 outlook excludes the impact of the first

quarter gain of $29 million on the sale of the AdvancedMD business

and the second quarter gain of $14 million on the sale of a

building. Adjusted amounts below exclude these two items.

ADP continues to expect growth in worldwide new business

bookings of at least 12% over $1.6 billion sold in fiscal 2015.

Forecasted revenue growth remains unchanged at about 7% or about

9% on a constant dollar basis. This forecast includes an

anticipated negative impact of approximately one percentage point

from the sale of the AdvancedMD business.

ADP now anticipates adjusted diluted earnings per share growth

of about 12% compared with our prior forecast of 11% to 13%

growth. On a constant dollar basis, adjusted diluted earnings

per share is expected to increase about 13%, compared with our

prior forecast of an increase of 12% to 14%.

ADP’s earnings growth forecast still assumes adjusted EBIT

margin expansion of about 50 basis points from 18.8% in fiscal

2015. ADP now anticipates an adjusted effective tax rate of 33.3%

compared to the prior forecasted rate of 33.7%.

Reportable Segments Fiscal 2016 Forecast

- For the Employer Services segment, ADP still anticipates

revenue growth of 4% to 5%. ADP continues to expect about 7%

revenue growth on a constant dollar basis. Employer Services

segment margin is now expected to expand about 50 basis points

compared with our prior forecast of margin expansion of about 75

basis points.

- ADP now expects pays per control to increase 2.5% for the year,

as compared to the prior forecast of 2.0% to 3.0%.

- For the PEO Services segment, ADP now anticipates about 17%

revenue growth compared with our prior forecast of 16% to 18%. ADP

now expects segment margin expansion of up to 75 basis points

compared with our prior forecast of about 50 basis points.

Client Funds Extended Investment Strategy Fiscal 2016

Forecast

The interest assumptions in our forecasts are based on Fed Funds

futures contracts and forward yield curves as of April 26, 2016.

The Fed Funds futures contracts used in the client short and

corporate cash interest income forecasts do not anticipate an

increase in the Fed Funds target rate during the remainder of the

fiscal year. The three-and-a-half and five-year U.S. government

agency rates based on the forward yield curves as of April 26, 2016

were used to forecast new purchase rates for the client and

corporate extended, and client long portfolios, respectively.

- Interest on funds held for clients is now expected to be about

flat from $378 million in fiscal 2015, compared to the prior

forecast of an increase of up to $5 million. This forecast is based

on anticipated growth in average client funds balances of 3%, to

about $22.4 billion, compared to our prior forecast of 2% to 4%

growth. On a constant dollar basis, average client funds balances

are expected to grow 4%. This forecast assumes an average yield of

1.7%, which is anticipated to be flat compared to fiscal 2015.

- Consistent with the previous forecast, the total contribution

from the client funds extended investment strategy is expected to

be about flat compared to last year.

Investor Webcast Today

ADP will host a conference call for financial analysts today,

Thursday, April 28, 2016 at 8:30 a.m. EDT. The conference call will

be webcast live on ADP’s website at investors.adp.com and will be

available for replay following the call. A slide presentation will

be available shortly before the webcast.

Supplemental financial information including schedules of

quarterly and full year reportable segment revenues and earnings

for fiscal years 2014 and 2015 and the first three quarters of

fiscal 2016, as well as details of the first three quarters of

fiscal 2016 results from the client funds extended investment

strategy, are posted to ADP’s website at investors.adp.com. ADP

news releases, current financial information, SEC filings and

Investor Relations presentations are accessible at the same

website.

Non-GAAP Financial InformationThe company has

presented certain financial data that are considered non-GAAP

financial measures and are reconciled to their comparable GAAP

measures in the accompanying financial tables. The EBIT performance

measures include interest income earned on investments associated

with our client funds extended investment strategy and interest

expense on borrowings related to our client funds extended

investment strategy. ADP believes these amounts to be

fundamental to the underlying operations of our business

model. ADP’s calculation of EBIT may differ from similarly

titled measures used by other companies.

The presentation of growth rates on a constant dollar basis

represent a non-GAAP measure and are calculated by restating

current period results into U.S. dollars using the comparable prior

period’s exchange rates.

About ADP (Nasdaq:ADP)Powerful technology plus

a human touch. Companies of all types and sizes around the

world rely on ADP’s cloud software and expert insights to help

unlock the potential of their people. HR. Talent. Benefits.

Payroll. Compliance. Working together to build a better workforce.

For more information, visit ADP.com.

|

Automatic Data Processing, Inc. and

Subsidiaries |

|

|

Statements of Consolidated Earnings |

|

|

(In millions, except per share amounts) |

|

|

(Unaudited) |

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

|

|

|

March 31, |

|

March 31, |

|

|

|

|

|

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

Revenues,

other than interest on funds held for clients and PEO revenues |

|

$ |

2,283.8 |

|

|

$ |

2,178.3 |

|

|

$ |

6,196.6 |

|

|

$ |

6,003.3 |

|

|

|

|

|

Interest on funds held for clients |

|

|

102.8 |

|

|

|

101.3 |

|

|

|

280.0 |

|

|

|

282.3 |

|

|

|

|

|

PEO revenues (A) |

|

|

862.0 |

|

|

|

744.7 |

|

|

|

2,292.9 |

|

|

|

1,958.4 |

|

|

|

|

|

|

Total

revenues |

|

|

3,248.6 |

|

|

|

3,024.3 |

|

|

|

8,769.5 |

|

|

|

8,244.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

Costs of revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

1,611.6 |

|

|

|

1,482.6 |

|

|

|

4,530.9 |

|

|

|

4,227.6 |

|

|

|

|

|

Systems development & programming costs |

|

|

147.3 |

|

|

|

149.5 |

|

|

|

453.0 |

|

|

|

442.9 |

|

|

|

|

|

Depreciation & amortization |

|

|

53.8 |

|

|

|

52.2 |

|

|

|

157.8 |

|

|

|

155.4 |

|

|

|

|

|

|

Total

costs of revenues |

|

|

1,812.7 |

|

|

|

1,684.3 |

|

|

|

5,141.7 |

|

|

|

4,825.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general & administrative expenses |

|

|

634.4 |

|

|

|

607.2 |

|

|

|

1,866.7 |

|

|

|

1,771.7 |

|

|

|

|

Interest expense |

|

|

16.3 |

|

|

|

0.8 |

|

|

|

38.1 |

|

|

|

4.9 |

|

|

|

|

|

|

Total

expenses |

|

|

2,463.4 |

|

|

|

2,292.3 |

|

|

|

7,046.5 |

|

|

|

6,602.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income, net |

|

|

(9.6 |

) |

|

|

(7.9 |

) |

|

|

(84.7 |

) |

|

|

(47.6 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings from continuing operations before income

taxes |

|

|

794.8 |

|

|

|

739.9 |

|

|

|

1,807.7 |

|

|

|

1,689.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

|

262.3 |

|

|

|

249.6 |

|

|

|

596.3 |

|

|

|

569.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

earnings from continuing operations |

|

$ |

532.5 |

|

|

$ |

490.3 |

|

|

$ |

1,211.4 |

|

|

$ |

1,119.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings from discontinued operations before income taxes |

|

|

— |

|

|

|

0.3 |

|

|

|

(1.4 |

) |

|

|

67.8 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Provision for income taxes |

|

|

— |

|

|

|

1.0 |

|

|

|

(0.5 |

) |

|

|

71.0 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Net

earnings from discontinued operations |

|

$ |

— |

|

|

$ |

(0.7 |

) |

|

$ |

(0.9 |

) |

|

$ |

(3.2 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

earnings |

|

$ |

532.5 |

|

|

$ |

489.6 |

|

|

$ |

1,210.5 |

|

|

$ |

1,116.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share from continuing operations |

|

$ |

1.17 |

|

|

$ |

1.04 |

|

|

$ |

2.64 |

|

|

$ |

2.36 |

|

|

|

|

Basic earnings per share from discontinued operations |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.01 |

) |

|

|

|

Basic earnings per share |

|

$ |

1.17 |

|

|

$ |

1.04 |

|

|

$ |

2.64 |

|

|

$ |

2.35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share from continuing operations |

|

$ |

1.17 |

|

|

$ |

1.03 |

|

|

$ |

2.63 |

|

|

$ |

2.34 |

|

|

|

|

Diluted earnings per share from discontinued operations |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.01 |

) |

|

|

|

Diluted earnings per share |

|

$ |

1.17 |

|

|

$ |

1.03 |

|

|

$ |

2.63 |

|

|

$ |

2.33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends declared per common share |

|

$ |

0.530 |

|

|

$ |

0.490 |

|

|

$ |

1.550 |

|

|

$ |

1.460 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Components of Other income, net: |

|

|

|

|

|

|

|

|

|

|

|

Interest income on corporate funds |

|

$ |

(9.7 |

) |

|

$ |

(7.2 |

) |

|

$ |

(45.6 |

) |

|

$ |

(43.9 |

) |

|

|

|

Realized gains on available-for-sale securities |

|

|

(2.0 |

) |

|

|

(1.0 |

) |

|

|

(3.5 |

) |

|

|

(3.6 |

) |

|

|

|

Realized losses on available-for-sale securities |

|

|

2.1 |

|

|

|

0.3 |

|

|

|

7.4 |

|

|

|

1.3 |

|

|

|

|

Gain on sale of notes receivable |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1.4 |

) |

|

|

|

Gain on sale of business |

|

|

— |

|

|

|

— |

|

|

|

(29.1 |

) |

|

|

— |

|

|

|

|

Gain on sale of building |

|

|

— |

|

|

|

— |

|

|

|

(13.9 |

) |

|

|

— |

|

|

|

|

Total other income, net |

|

$ |

(9.6 |

) |

|

$ |

(7.9 |

) |

|

$ |

(84.7 |

) |

|

$ |

(47.6 |

) |

|

| |

|

| (A) Professional Employer Organization (“PEO”) revenues are

net of direct pass-through costs, primarily consisting of payroll

wages and payroll taxes of $8,374.8 million and $7,018.9 million

for the three months ended March 31, 2016 and 2015,

respectively, and $23,613.0 million and $19,972.5 million for the

nine months ended March 31, 2016 and 2015, respectively. |

|

| |

|

| Automatic Data

Processing, Inc. and Subsidiaries |

|

|

|

| Condensed

Consolidated Balance Sheets |

|

|

|

| (In

millions) |

|

|

|

|

(Unaudited) |

|

|

|

|

|

March 31, |

|

June 30, |

|

|

|

2016 |

|

|

|

2015 |

|

| Assets |

|

|

|

| Cash and cash

equivalents/Short-term marketable securities |

$ |

2,965.1 |

|

|

$ |

1,665.9 |

|

| Other

current assets |

|

2,802.4 |

|

|

|

2,278.0 |

|

| Total current assets before funds

held for clients |

|

5,767.5 |

|

|

|

3,943.9 |

|

| Funds

held for clients |

|

41,051.5 |

|

|

|

24,865.3 |

|

| Total current assets |

|

46,819.0 |

|

|

|

28,809.2 |

|

|

|

|

|

|

|

Long-term marketable securities |

|

7.8 |

|

|

|

28.9 |

|

|

Property, plant and equipment, net |

|

668.8 |

|

|

|

672.7 |

|

| Other

non-current assets |

|

3,630.0 |

|

|

|

3,599.7 |

|

| Total assets |

$ |

51,125.6 |

|

|

$ |

33,110.5 |

|

|

|

|

|

|

| Liabilities and

Stockholders' Equity |

|

|

|

| Other

current liabilities |

$ |

2,569.1 |

|

|

$ |

2,463.2 |

|

| Client

funds obligations |

|

40,681.3 |

|

|

|

24,650.5 |

|

| Total current liabilities |

|

43,250.4 |

|

|

|

27,113.7 |

|

|

|

|

|

|

|

Long-term debt |

|

2,007.7 |

|

|

|

9.2 |

|

| Other

non-current liabilities |

|

1,364.3 |

|

|

|

1,179.1 |

|

| Total liabilities |

|

46,622.4 |

|

|

|

28,302.0 |

|

|

|

|

|

|

| Total

stockholders' equity |

|

4,503.2 |

|

|

|

4,808.5 |

|

| Total liabilities and stockholders'

equity |

$ |

51,125.6 |

|

|

$ |

33,110.5 |

|

|

|

|

|

|

| |

| Automatic Data

Processing, Inc. and Subsidiaries |

|

|

|

|

| Condensed

Statements of Consolidated Cash Flows |

|

|

|

|

| (In

millions) |

|

|

|

|

|

(Unaudited) |

Nine Months Ended |

|

|

|

March 31, |

|

|

|

|

2016 |

|

|

|

2015 |

|

|

| Cash Flows from

Operating Activities: |

|

|

|

|

| Net

earnings |

$ |

1,210.5 |

|

|

$ |

1,116.3 |

|

|

|

Adjustments to reconcile net earnings to cash flows provided by

operating activities |

|

377.3 |

|

|

|

313.6 |

|

|

| Changes

in operating assets and liabilities, net of effects from

acquisitions and divestitures of businesses |

|

(387.0 |

) |

|

|

(189.1 |

) |

|

| Proceeds

from the sale of notes receivable |

|

— |

|

|

|

226.7 |

|

|

|

Operating activities of discontinued operations |

|

— |

|

|

|

(3.3 |

) |

|

| Net cash flows

provided by operating activities |

|

1,200.8 |

|

|

|

1,464.2 |

|

|

|

|

|

|

|

|

| Cash Flows from

Investing Activities: |

|

|

|

|

|

Purchases and proceeds from corporate and client funds marketable

securities |

|

(179.7 |

) |

|

|

(748.7 |

) |

|

| Net

increase in restricted cash and cash equivalents held to satisfy

client funds obligations |

|

(15,969.9 |

) |

|

|

(7,133.3 |

) |

|

| Capital

expenditures |

|

(127.6 |

) |

|

|

(107.5 |

) |

|

|

Additions to intangibles |

|

(160.1 |

) |

|

|

(131.6 |

) |

|

| Dividend

received from CDK Global, Inc., net of cash retained |

|

— |

|

|

|

645.0 |

|

|

| Other

investing activities |

|

177.9 |

|

|

|

15.5 |

|

|

|

Investing activities of discontinued operations |

|

— |

|

|

|

(15.9 |

) |

|

| Net cash flows

used in investing activities |

|

(16,259.4 |

) |

|

|

(7,476.5 |

) |

|

|

|

|

|

|

|

| Cash Flows from

Financing Activities: |

|

|

|

|

| Net

increase in client funds obligations |

|

16,098.1 |

|

|

|

9,811.3 |

|

|

| Net

proceeds from debt issuance |

|

1,998.3 |

|

|

|

— |

|

|

|

Repurchases of common stock |

|

(1,091.0 |

) |

|

|

(1,127.7 |

) |

|

|

Dividends paid |

|

(701.2 |

) |

|

|

(696.2 |

) |

|

| Net

repayments of commercial paper borrowings |

|

— |

|

|

|

(2,173.0 |

) |

|

| Other

financing activities |

|

62.0 |

|

|

|

133.9 |

|

|

|

Financing activities of discontinued operations |

|

— |

|

|

|

1.5 |

|

|

| Net cash flows

provided by financing activities |

|

16,366.2 |

|

|

|

5,949.8 |

|

|

|

|

|

|

|

|

| Effect

of exchange rate changes on cash and cash equivalents |

|

(5.5 |

) |

|

|

(112.5 |

) |

|

|

|

|

|

|

|

| Net

change in cash and cash equivalents |

|

1,302.1 |

|

|

|

(175.0 |

) |

|

|

|

|

|

|

|

| Cash and

cash equivalents, beginning of period |

|

1,639.3 |

|

|

|

1,983.6 |

|

|

| Cash and

cash equivalents, end of period |

|

2,941.4 |

|

|

|

1,808.6 |

|

|

| Less

cash and cash equivalents of discontinued operations, end of

period |

|

— |

|

|

|

2.9 |

|

|

| Cash and

cash equivalents of continuing operations, end of period |

$ |

2,941.4 |

|

|

$ |

1,805.7 |

|

|

| |

|

|

|

|

|

Supplemental disclosures of cash flow information: |

|

|

|

|

| Cash

paid for interest |

$ |

34.0 |

|

|

$ |

4.4 |

|

|

| Cash

paid for income taxes, net of income tax refunds |

$ |

420.3 |

|

|

$ |

546.0 |

|

|

| |

|

|

|

|

| Automatic Data

Processing, Inc. and Subsidiaries |

|

|

|

|

|

|

|

|

| Other Selected

Financial Data |

|

|

|

|

|

|

|

|

| (Dollars in

millions, except per share amounts) |

|

|

|

|

|

|

|

|

|

(Unaudited) |

Three Months Ended |

|

% Change |

|

|

|

March 31, |

|

As |

|

Constant |

|

|

|

|

2016 |

|

|

|

2015 |

|

|

Reported |

|

Dollar Basis |

|

| Revenues from

continuing operations |

|

|

|

|

|

|

|

|

| Employer Services |

$ |

2,576.7 |

|

|

$ |

2,446.4 |

|

|

|

5 |

% |

|

|

7 |

% |

|

| PEO Services |

|

866.3 |

|

|

|

748.5 |

|

|

|

16 |

% |

|

|

16 |

% |

|

| Other |

|

(194.4 |

) |

|

|

(170.6 |

) |

|

n/m |

|

n/m |

|

| Total revenues from continuing

operations |

$ |

3,248.6 |

|

|

$ |

3,024.3 |

|

|

|

7 |

% |

|

|

9 |

% |

|

|

|

|

|

|

|

|

|

|

|

| Segment earnings from

continuing operations |

|

|

|

|

|

|

|

|

| Employer Services |

$ |

971.4 |

|

|

$ |

931.3 |

|

|

|

4 |

% |

|

|

5 |

% |

|

| PEO Services |

|

97.9 |

|

|

|

80.5 |

|

|

|

22 |

% |

|

|

22 |

% |

|

| Other |

|

(274.5 |

) |

|

|

(271.9 |

) |

|

n/m |

|

n/m |

|

| Total pretax earnings from

continuing operations |

$ |

794.8 |

|

|

$ |

739.9 |

|

|

|

7 |

% |

|

|

8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

|

|

March 31, |

|

|

|

|

|

| Segment margin |

|

2016 |

|

|

|

2015 |

|

|

Change |

|

|

|

| Employer Services |

|

37.7 |

% |

|

|

38.1 |

% |

|

|

(0.4 |

)% |

|

|

|

| PEO Services |

|

11.3 |

% |

|

|

10.8 |

% |

|

|

0.5 |

% |

|

|

|

| Other |

n/m |

|

n/m |

|

n/m |

|

|

|

| Total pretax margin |

|

24.5 |

% |

|

|

24.5 |

% |

|

|

— |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

% Change |

|

|

|

March 31, |

|

As |

|

Constant |

|

|

|

|

2016 |

|

|

|

2015 |

|

|

Reported |

|

Dollar Basis |

|

| Segment revenues from

continuing operations |

|

|

|

|

|

|

|

|

| Employer Services |

$ |

6,920.1 |

|

|

$ |

6,660.0 |

|

|

|

4 |

% |

|

|

7 |

% |

|

| PEO Services |

|

2,305.2 |

|

|

|

1,969.2 |

|

|

|

17 |

% |

|

|

17 |

% |

|

| Other |

|

(455.8 |

) |

|

|

(385.2 |

) |

|

n/m |

|

n/m |

|

| Total revenues from continuing

operations |

$ |

8,769.5 |

|

|

$ |

8,244.0 |

|

|

|

6 |

% |

|

|

8 |

% |

|

|

|

|

|

|

|

|

|

|

|

| Segment earnings from

continuing operations |

|

|

|

|

|

|

|

|

| Employer Services |

$ |

2,195.7 |

|

|

$ |

2,135.6 |

|

|

|

3 |

% |

|

|

4 |

% |

|

| PEO Services |

|

280.2 |

|

|

|

226.2 |

|

|

|

24 |

% |

|

|

24 |

% |

|

| Other |

|

(668.2 |

) |

|

|

(672.7 |

) |

|

n/m |

|

n/m |

|

| Total pretax earnings from

continuing operations |

$ |

1,807.7 |

|

|

$ |

1,689.1 |

|

|

|

7 |

% |

|

|

8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

|

|

|

|

|

|

March 31, |

|

|

|

|

|

| Segment margin |

|

2016 |

|

|

|

2015 |

|

|

Change |

|

|

|

| Employer Services |

|

31.7 |

% |

|

|

32.1 |

% |

|

|

(0.3 |

)% |

|

|

|

| PEO Services |

|

12.2 |

% |

|

|

11.5 |

% |

|

|

0.7 |

% |

|

|

|

| Other |

n/m |

|

n/m |

|

n/m |

|

|

|

| Total pretax margin |

|

20.6 |

% |

|

|

20.5 |

% |

|

|

0.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

% Change |

|

|

|

March 31, |

|

As |

|

Constant |

|

| Earnings per share

information: |

|

2016 |

|

|

|

2015 |

|

|

Reported |

|

Dollar Basis |

|

| Net

earnings from continuing operations |

$ |

532.5 |

|

|

$ |

490.3 |

|

|

|

9 |

% |

|

|

9 |

% |

|

| Net

earnings |

$ |

532.5 |

|

|

$ |

489.6 |

|

|

|

9 |

% |

|

|

9 |

% |

|

|

|

|

|

|

|

|

|

|

|

| Basic

weighted average shares outstanding |

|

454.4 |

|

|

|

470.3 |

|

|

|

(3 |

)% |

|

|

n/a |

|

| Basic

earnings per share from continuing operations |

$ |

1.17 |

|

|

$ |

1.04 |

|

|

|

13 |

% |

|

|

13 |

% |

|

| Basic

earnings per share |

$ |

1.17 |

|

|

$ |

1.04 |

|

|

|

13 |

% |

|

|

13 |

% |

|

|

|

|

|

|

|

|

|

|

|

| Diluted

weighted average shares outstanding |

|

456.9 |

|

|

|

474.0 |

|

|

|

(4 |

)% |

|

|

n/a |

|

| Diluted

earnings per share from continuing operations |

$ |

1.17 |

|

|

$ |

1.03 |

|

|

|

14 |

% |

|

|

14 |

% |

|

| Diluted

earnings per share |

$ |

1.17 |

|

|

$ |

1.03 |

|

|

|

14 |

% |

|

|

14 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

% Change |

|

|

|

March 31, |

|

As |

|

Constant |

|

| Earnings per share

information: |

|

2016 |

|

|

|

2015 |

|

|

Reported |

|

Dollar Basis |

|

| Net

earnings from continuing operations |

$ |

1,211.4 |

|

|

$ |

1,119.5 |

|

|

|

8 |

% |

|

|

10 |

% |

|

| Net

earnings |

$ |

1,210.5 |

|

|

$ |

1,116.3 |

|

|

|

8 |

% |

|

|

10 |

% |

|

|

|

|

|

|

|

|

|

|

|

| Basic

weighted average shares outstanding |

|

458.2 |

|

|

|

475.1 |

|

|

|

(4 |

)% |

|

|

n/a |

|

| Basic

earnings per share from continuing operations |

$ |

2.64 |

|

|

$ |

2.36 |

|

|

|

12 |

% |

|

|

14 |

% |

|

| Basic

earnings per share |

$ |

2.64 |

|

|

$ |

2.35 |

|

|

|

12 |

% |

|

|

14 |

% |

|

|

|

|

|

|

|

|

|

|

|

| Diluted

weighted average shares outstanding |

|

460.6 |

|

|

|

478.3 |

|

|

|

(4 |

)% |

|

|

n/a |

|

| Diluted

earnings per share from continuing operations |

$ |

2.63 |

|

|

$ |

2.34 |

|

|

|

12 |

% |

|

|

14 |

% |

|

| Diluted

earnings per share |

$ |

2.63 |

|

|

$ |

2.33 |

|

|

|

13 |

% |

|

|

14 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

|

|

March 31, |

|

|

|

|

|

| Key Statistics: |

|

2016 |

|

|

|

2015 |

|

|

|

|

|

|

| Internal

revenue growth: |

|

|

|

|

|

|

|

|

| Employer Services |

|

5 |

% |

|

|

5 |

% |

|

|

|

|

|

| PEO Services |

|

16 |

% |

|

|

15 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Internal

revenue growth - Constant Dollar Basis: |

|

|

|

|

|

|

|

|

| Employer Services |

|

7 |

% |

|

|

8 |

% |

|

|

|

|

|

| PEO Services |

|

16 |

% |

|

|

15 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Employer

Services: |

|

|

|

|

|

|

|

|

| Change in pays per control -

U.S. |

|

2.5 |

% |

|

|

3.1 |

% |

|

|

|

|

|

| Change in client revenue retention

percentage - worldwide |

(0.3) pts |

|

(0.7) pts |

|

|

|

|

|

| Employer Services/PEO new business

bookings growth - worldwide |

|

13 |

% |

|

|

6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PEO

Services: |

|

|

|

|

|

|

|

|

| Paid PEO worksite employees at end

of period |

|

420,000 |

|

|

|

371,000 |

|

|

|

|

|

|

| Average paid PEO worksite employees

during the period |

|

422,000 |

|

|

|

369,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

|

|

|

|

|

|

March 31, |

|

|

|

|

|

| Key Statistics: |

|

2016 |

|

|

|

2015 |

|

|

|

|

|

|

| Internal

revenue growth: |

|

|

|

|

|

|

|

|

| Employer Services |

|

4 |

% |

|

|

5 |

% |

|

|

|

|

|

| PEO Services |

|

17 |

% |

|

|

17 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Internal

revenue growth - Constant Dollar Basis: |

|

|

|

|

|

|

|

|

| Employer Services |

|

7 |

% |

|

|

7 |

% |

|

|

|

|

|

| PEO Services |

|

17 |

% |

|

|

17 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Employer

Services: |

|

|

|

|

|

|

|

|

| Change in pays per control -

U.S. |

|

2.4 |

% |

|

|

3.0 |

% |

|

|

|

|

|

| Change in client revenue retention

percentage - worldwide |

(1.0) pt |

|

0.1 pt |

|

|

|

|

|

| Employer Services/PEO new business

bookings growth - worldwide |

|

14 |

% |

|

|

11 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PEO

Services: |

|

|

|

|

|

|

|

|

| Paid PEO worksite employees at end

of period |

|

420,000 |

|

|

|

371,000 |

|

|

|

|

|

|

| Average paid PEO worksite employees

during the period |

|

405,000 |

|

|

|

356,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Automatic Data Processing, Inc. and

Subsidiaries |

|

|

Other Selected Financial Data, Continued |

|

|

(Dollars in millions, except per share amounts or where

otherwise stated) |

|

|

(Unaudited) |

|

|

|

|

|

|

| |

Three Months Ended |

|

|

|

|

|

|

|

March 31, |

|

|

|

|

|

|

|

|

2016 |

|

|

|

2015 |

|

|

Change |

|

% Change |

|

| Average

investment balances at cost (in billions): |

|

|

|

|

|

|

|

|

| Corporate, other than corporate

extended |

$ |

2.8 |

|

|

$ |

1.8 |

|

|

$ |

1.0 |

|

|

|

56 |

% |

|

| Corporate extended |

|

1.4 |

|

|

|

1.1 |

|

|

|

0.3 |

|

|

|

27 |

% |

|

| Total corporate |

|

4.2 |

|

|

|

2.9 |

|

|

|

1.3 |

|

|

|

45 |

% |

|

| Funds held for clients |

|

26.7 |

|

|

|

26.2 |

|

|

|

0.5 |

|

|

|

2 |

% |

|

| Total |

$ |

30.8 |

|

|

$ |

29.1 |

|

|

$ |

1.8 |

|

|

|

6 |

% |

|

|

|

|

|

|

|

|

|

|

|

| Average

interest rates earned exclusive of realized losses (gains) on: |

|

|

|

|

|

|

|

|

| Corporate, other than corporate

extended |

|

0.6 |

% |

|

|

0.6 |

% |

|

|

|

|

|

| Corporate extended |

|

1.6 |

% |

|

|

1.6 |

% |

|

|

|

|

|

| Total corporate |

|

0.9 |

% |

|

|

1.0 |

% |

|

|

|

|

|

| Funds held for clients |

|

1.5 |

% |

|

|

1.5 |

% |

|

|

|

|

|

| Total |

|

1.5 |

% |

|

|

1.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

unrealized gain position at end of period |

$ |

371.1 |

|

|

$ |

376.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average

short-term financing (in billions): |

|

|

|

|

|

|

|

|

| U.S. commercial paper

borrowings |

$ |

1.3 |

|

|

$ |

1.0 |

|

|

|

|

|

|

| U.S. & Canadian reverse

repurchase agreement borrowings |

|

0.1 |

|

|

|

0.1 |

|

|

|

|

|

|

|

|

$ |

1.4 |

|

|

$ |

1.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average

interest rates paid on: |

|

|

|

|

|

|

|

|

| U.S. commercial paper

borrowings |

|

0.4 |

% |

|

|

0.1 |

% |

|

|

|

|

|

| U.S. & Canadian reverse

repurchase agreement borrowings |

|

0.5 |

% |

|

|

0.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest

on funds held for clients |

$ |

102.8 |

|

|

$ |

101.3 |

|

|

$ |

1.5 |

|

|

|

2 |

% |

|

|

Corporate extended interest income (C) |

|

5.6 |

|

|

|

4.4 |

|

|

|

1.1 |

|

|

|

26 |

% |

|

|

Corporate interest expense-short-term financing (C) |

|

(1.4 |

) |

|

|

(0.5 |

) |

|

|

(0.9 |

) |

|

|

(172 |

)% |

|

|

|

$ |

107.0 |

|

|

$ |

105.3 |

|

|

$ |

1.8 |

|

|

|

2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

|

|

|

|

|

|

March 31, |

|

|

|

|

|

|

|

|

2016 |

|

|

|

2015 |

|

|

Change |

|

% Change |

|

| Average

investment balances at cost (in billions): |

|

|

|

|

|

|

|

|

| Corporate, other than corporate

extended |

$ |

2.4 |

|

|

$ |

1.9 |

|

|

$ |

0.6 |

|

|

|

30 |

% |

|

| Corporate extended |

|

3.0 |

|

|

|

2.8 |

|

|

|

0.2 |

|

|

|

7 |

% |

|

| Total corporate |

|

5.4 |

|

|

|

4.7 |

|

|

|

0.8 |

|

|

|

16 |

% |

|

| Funds held for clients |

|

22.2 |

|

|

|

21.5 |

|

|

|

0.6 |

|

|

|

3 |

% |

|

| Total |

$ |

27.6 |

|

|

$ |

26.2 |

|

|

$ |

1.4 |

|

|

|

5 |

% |

|

|

|

|

|

|

|

|

|

|

|

| Average

interest rates earned exclusive of realized losses (gains) on: |

|

|

|

|

|

|

|

|

| Corporate, other than corporate

extended |

|

0.5 |

% |

|

|

0.6 |

% |

|

|

|

|

|

| Corporate extended |

|

1.6 |

% |

|

|

1.7 |

% |

|

|

|

|

|

| Total corporate |

|

1.1 |

% |

|

|

1.3 |

% |

|

|

|

|

|

| Funds held for clients |

|

1.7 |

% |

|

|

1.7 |

% |

|

|

|

|

|

| Total |

|

1.6 |

% |

|

|

1.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

unrealized gain position at end of period |

$ |

371.1 |

|

|

$ |

376.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average

short-term financing (in billions): |

|

|

|

|

|

|

|

|

| U.S. commercial paper

borrowings |

$ |

2.7 |

|

|

$ |

2.4 |

|

|

|

|

|

|

| U.S. & Canadian reverse

repurchase agreement borrowings |

|

0.3 |

|

|

|

0.4 |

|

|

|

|

|

|

|

|

$ |

3.0 |

|

|

$ |

2.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average

interest rates paid on: |

|

|

|

|

|

|

|

|

| U.S. commercial paper

borrowings |

|

0.2 |

% |

|

|

0.1 |

% |

|

|

|

|

|

| U.S. & Canadian reverse

repurchase agreement borrowings |

|

0.4 |

% |

|

|

0.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest

on funds held for clients |

$ |

280.0 |

|

|

$ |

282.3 |

|

|

$ |

(2.3 |

) |

|

|

(1 |

)% |

|

|

Corporate extended interest income (C) |

|

36.4 |

|

|

|

35.7 |

|

|

|

0.6 |

|

|

|

2 |

% |

|

|

Corporate interest expense-short-term financing (C) |

|

(5.0 |

) |

|

|

(3.9 |

) |

|

|

(1.2 |

) |

|

|

(30 |

)% |

|

|

|

$ |

311.3 |

|

|

$ |

314.2 |

|

|

$ |

(2.8 |

) |

|

|

(1 |

)% |

|

|

|

|

|

|

|

|

|

|

|

| (C) While “Corporate extended interest income” and “Corporate

interest expense-short-term financing” are non-GAAP measures,

management believes this information is beneficial to reviewing the

financial statements of ADP. Management believes this information

is beneficial as it allows the reader to understand the extended

investment strategy for ADP's client funds assets, corporate

investments and short-term borrowings. A reconciliation of

the non-GAAP measures to GAAP measures is as follows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

|

|

March 31, |

|

|

|

|

|

|

|

|

2016 |

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate extended interest income |

$ |

5.6 |

|

|

$ |

4.4 |

|

|

|

|

|

|

| All

other interest income |

|

4.1 |

|

|

|

2.7 |

|

|

|

|

|

|

| Total interest income on corporate

funds |

$ |

9.7 |

|

|

$ |

7.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate interest expense - short-term financing |

$ |

1.4 |

|

|

$ |

0.5 |

|

|

|

|

|

|

| All

other interest expense |

|

14.9 |

|

|

|

0.3 |

|

|

|

|

|

|

| Total interest expense |

$ |

16.3 |

|

|

$ |

0.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

|

|

|

|

|

|

March 31, |

|

|

|

|

|

|

|

|

2016 |

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate extended interest income |

$ |

36.4 |

|

|

$ |

35.7 |

|

|

|

|

|

|

| All

other interest income |

|

9.1 |

|

|

|

8.1 |

|

|

|

|

|

|

| Total interest income on corporate

funds |

$ |

45.6 |

|

|

$ |

43.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate interest expense - short-term financing |

$ |

5.0 |

|

|

$ |

3.9 |

|

|

|

|

|

|

| All

other interest expense |

|

33.1 |

|

|

|

1.1 |

|

|

|

|

|

|

| Total interest expense |

$ |

38.1 |

|

|

$ |

4.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Automatic Data Processing, Inc. and

Subsidiaries |

|

|

|

Consolidated Statement of Adjusted / Non-GAAP Financial

Information |

|

|

|

(in millions, except per share amounts) |

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Within the tables above and below, we use the term "constant

dollar basis" so that certain financial measures can be viewed

without the impact of foreign currency fluctuations to facilitate

period-to-period comparisons of business performance. The

financial results on a "constant dollar basis" are determined by

calculating the current year result using foreign exchange rates

consistent with the prior year. We believe "constant dollar

basis" provides information that isolates the actual growth of our

operations. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| The following table reconciles our reported results to

earnings from continuing operations before interest and income

taxes (“EBIT”), which excludes certain interest amounts. The

EBIT performance measure includes interest income earned on

investments associated with our client funds extended investment

strategy and interest expense on borrowings related to our client

funds extended investment strategy. We believe these amounts

to be fundamental to the underlying operations of our business

model. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

Nine Months Ended |

|

|

|

|

|

|

|

|

March 31, |

|

% Change |

|

March 31, |

|

% Change |

|

|

|

|

|

2016 |

|

|

|

2015 |

|

|

As Reported |

|

Constant Dollar Basis |

|

|

2016 |

|

|

|

2015 |

|

|

As Reported |

|

Constant Dollar Basis |

|

| Earnings

from continuing operations before income taxes |

|

$ |

794.8 |

|

|

$ |

739.9 |

|

|

|

7 |

% |

|

|

8 |

% |

|

$ |

1,807.7 |

|

|

$ |

1,689.1 |

|

|

|

7 |

% |

|

|

8 |

% |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

14.9 |

|

|

|

0.3 |

|

|

|

|

|

|

|

33.1 |

|

|

|

1.1 |

|

|

|

|

|

|

| Interest income |

|

|

(4.1 |

) |

|

|

(2.7 |

) |

|

|

|

|

|

|

(9.1 |

) |

|

|

(8.1 |

) |

|

|

|

|

|

|

EBIT |

|

$ |

805.6 |

|

|

$ |

737.5 |

|

|

|

9 |

% |

|

|

10 |

% |

|

$ |

1,831.7 |

|

|

$ |

1,682.1 |

|

|

|

9 |

% |

|

|

10 |

% |

|

| EBIT

Margin |

|

|

24.8 |

% |

|

|

24.4 |

% |

|

|

|

|

|

|

20.9 |

% |

|

|

20.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Additionally, the following table reconciles EBIT and other

financial results to adjusted results that exclude the gain on the

sale of the AdvancedMD ("AMD") business and the gain on sale of a

building in the nine months ended March 31, 2016. We use

these adjusted results, among other measures, to evaluate our

operating performance in the absence of certain items and for

planning and forecasting of future periods. We believe

that EBIT, adjusted EBIT, adjusted provision for income

taxes, adjusted net earnings from continuing operations, adjusted

diluted earnings per share ("EPS") from continuing operations, and

adjusted EBIT margin provide relevant and useful information as

these measures allow investors to assess our performance in a

manner similar to the method used by management and improves our

ability to understand and assess our operating performance against

prior periods. Since these measures are not measures of

performance calculated in accordance to accounting principles

generally accepted in the United States of America (“U.S. GAAP”),

they should not be considered in isolation from, or as substitute

for, earnings from continuing operations before income taxes,

provision for income taxes, net earnings from continuing

operations, and diluted EPS from continuing operations, and they

may not be comparable to similarly titled measures used by other

companies. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

% Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

2016 |

|

|

|

2015 |

|

|

As Reported |

|

Constant Dollar Basis |

|

|

|

|

|

|

|

|

|

|

EBIT |

|

$ |

1,831.7 |

|

|

$ |

1,682.1 |

|

|

|

9 |

% |

|

|

10 |

% |

|

|

|

|

|

|

|

|

|

| Gain on sale of building |

|

|

(13.9 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gain on sale of AMD |

|

|

(29.1 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted

EBIT |

|

$ |

1,788.7 |

|

|

$ |

1,682.1 |

|

|

|

6 |

% |

|

|

8 |

% |

|

|

|

|

|

|

|

|

|

| Adjusted

EBIT Margin |

|

|

20.4 |

% |

|

|

20.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

$ |

596.3 |

|

|

$ |

569.6 |

|

|

|

5 |

% |

|

|

6 |

% |

|

|

|

|

|

|

|

|

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gain on sale of building |

|

|

(5.3 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gain on sale of AMD |

|

|

(7.3 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted

provision for income taxes |

|

$ |

583.7 |

|

|

$ |

569.6 |

|

|

|

2 |

% |

|

|

4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

earnings from continuing operations |

|

$ |

1,211.4 |

|

|

$ |

1,119.5 |

|

|

|

8 |

% |

|

|

10 |

% |

|

|

|

|

|

|

|

|

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gain on sale of building |

|

|

(13.9 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gain on sale of AMD |

|

|

(29.1 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Provision for income taxes on gain

on sale of building |

|

|

5.3 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Provision for income taxes on gain

on sale of AMD |

|

|

7.3 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted

net earnings from continuing operations |

|

$ |

1,181.0 |

|

|

$ |

1,119.5 |

|

|

|

5 |

% |

|

|

7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted

earnings per share from continuing operations |

|

$ |

2.63 |

|

|

$ |

2.34 |

|

|

|

12 |

% |

|

|

14 |

% |

|

|

|

|

|

|

|

|

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gain on sale of building |

|

|

(0.02 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gain on sale of AMD |

|

|

(0.05 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted

diluted earnings per share from continuing operations |

|

$ |

2.56 |

|

|

$ |

2.34 |

|

|

|

9 |

% |

|

|

11 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Safe Harbor Statement

This document and other written or oral statements made from

time to time by ADP may contain “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. Statements that are not historical in nature and which may be

identified by the use of words like “expects,” “assumes,”

“projects,” “anticipates,” “estimates,” “we believe,” “could” and

other words of similar meaning, are forward-looking statements.

These statements are based on management’s expectations and

assumptions and are subject to risks and uncertainties that may

cause actual results to differ materially from those expressed.

Factors that could cause actual results to differ materially from

those contemplated by the forward-looking statements include: ADP's

success in obtaining and retaining clients, and selling additional

services to clients; the pricing of products and services;

compliance with existing or new legislation or regulations; changes

in, or interpretations of, existing legislation or regulations;

overall market, political and economic conditions, including

interest rate and foreign currency trends; competitive conditions;

our ability to maintain our current credit rating and the impact on

our funding costs and profitability; security or privacy breaches,

fraudulent acts, and system interruptions and failures; employment

and wage levels; changes in technology; availability of skilled

technical associates; and the impact of new acquisitions and

divestitures. ADP disclaims any obligation to update any

forward-looking statements, whether as a result of new information,

future events or otherwise. These risks and uncertainties, along

with the risk factors discussed under “Item 1A. - Risk Factors” in

our Annual Report on Form 10-K for the fiscal year ended June 30,

2015 should be considered in evaluating any forward-looking

statements contained herein.

ADP and the ADP logo are registered trademarks of ADP, LLC. ADP

A more human resource. is a service mark of ADP, LLC. All other

marks are the property of their respective owners. Copyright © 2016

ADP, LLC. All rights reserved.

ADP-Investor Relations

Investor Relations Contacts:

Sara Grilliot

973.974.7834

Sara.Grilliot@ADP.com

Byron Stephen

973.974.7896

Byron.Stephen@ADP.com

Media Contact:

Andy Hilton

973.974.4462

Andy.Hilton@ADP.com

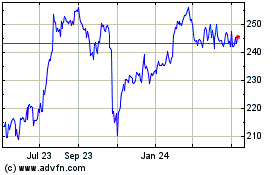

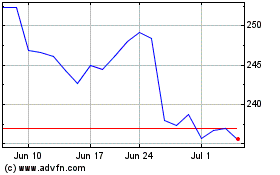

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Apr 2023 to Apr 2024