By Mia Lamar

A little-known Singapore hedge fund run by a former professor

and an ex-actuary is quietly earning some of the world's top

returns with a sometimes stomach-churning strategy that piles on

risk.

Quantedge Capital Pte Ltd's hedge fund has gained 40% after fees

this year as of June, making it the second-best-performing fund in

2016 in a ranking of more than 350 hedge funds that HSBC Holdings

PLC compiles and sends to clients.

The fund gained an estimated 12% in June alone, according to a

letter sent to investors and seen by The Wall Street Journal.

Bond-related investments led the June gain, offsetting losses on

stocks as markets "swung wildly" following Britain's decision to

leave the European Union, the letter said.

In an emailed response to questions, the fund said that holding

riskier longer-term bonds while betting against short-term bonds--a

"term premium" strategy that tends to rise in times of market

distress--has been among its profitable bets this year.

Over the long term, which is how many investors evaluate funds,

the $1.3 billion fund has produced an average annualized return of

27% since inception, far more than similar hedge funds. Quantedge

started trading in late 2006 with $3 million, according to

marketing documents seen by the Journal.

The fund's nearly decadelong history makes it one of the

longest-running--and most successful--"risk premia" investors, an

approach that has been the focus of an increasing number of new

fund offerings.

Thierry Roncalli, head of quantitative research at Société

Générale's Lyxor Asset Management unit, said this type of strategy

appeals to sophisticated, long-term investors looking to earn a

return in an era of low interest rates and low expected returns on

traditional assets.

"You have to take some risk. This is not a magic formula," Mr.

Roncalli said. "It would be very interesting if we found a

portfolio which is well rewarded and has limited risk."

Unlike stock or bond funds that build portfolios around a

specific class of assets, such funds build portfolios around

specific risks, such as owning illiquid, harder-to-trade stocks

versus easier-to-trade stocks, or owning riskier long-term debt

versus short-term debt.

Such strategies seek to profit by collecting the excess

returns--or risk premia--that are typically expected from riskier

bets to compensate investors for the greater chance of losses.

Quantedge has a sprawling portfolio compared to many similar

investors, using automated computer programs to shift between some

combination of over 100 such positions at any time in everything

from commodity to bond markets, the fund said in its emailed

response.

For the term premium strategy, for example, the fund may short,

or bet against, three-month Treasury bills while going long, or

betting on gains, for 10-year Treasury notes.

The approach takes a page from the endowment model of investing

made famous by Yale University, which also seeks to profit over the

long run with a high stake in riskier investments.

Quantedge adds a tweak that can be dangerous. Many investors

raise and reduce risk in their portfolios as they change their

positions. That helps them to avoid sharp, sudden losses in times

of market fear but can also mean they are slower to profit when

markets rebound.

Quantedge, by comparison, maintains a common measure of risk

known as annualized volatility at a constant and abnormally high

level of 30%, two to three times that sought by similar hedge

funds, according to investors.

That produces a higher chance for the fund to notch

above-average gains. It also raises the likelihood of a big loss,

and some investors say that the risk of investing in a

high-volatility fund like Quantedge is that losses get so high that

an investor pulls out of the fund at a big loss.

Earlier in its history, its risk target was even higher at 40%

annualized volatility, according to a 2012 marketing document seen

by the Journal.

"Our investment goal is to compound capital aggressively over

the long term at a level of volatility that our investors can

tolerate," the fund said in its emailed response.

AQR Capital Management LLC--founded by former University of

Chicago finance researchers--and Two Sigma Advisers LLC are among

firms that have rolled out new funds focused specifically on

reaping rewards from risk premia.

The outsize returns set the firm apart in a hedge-fund industry

that has struggled for several years with lackluster performance.

Since Quantedge started trading in October 2006, hedge funds

globally have produced an average annualized return of 3.61% as of

the end of June, according to data provided by fund tracker HFR

Inc.

Similar quantitative funds have produced an average annualized

return of 5% over the same period, according to HFR.

The firm doesn't boast the Wall Street background typical of

many hedge funds. One founder, Chua Choong Tze, previously worked

as a finance professor in Singapore. The other, Leow Kah Shin,

worked as an actuary in Bermuda, according to marketing

documents.

Quantedge's rich returns have come with some bumpy rides. This

was in display during last summer's global market selloff, when the

fund plunged 8.9% in June, and an additional 16% in August.

In an August letter to investors seen by the Journal, the fund

called its performance during the global market rout

"disappointing."

"To our longtime investors, who have been through a few

up-and-down cycles with us, you know this is business as usual," it

wrote. "...Our investment model delivers high returns over time, at

the cost of unpleasant bumps along the way."

Write to Mia Lamar at mia.lamar@wsj.com

(END) Dow Jones Newswires

July 20, 2016 05:53 ET (09:53 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

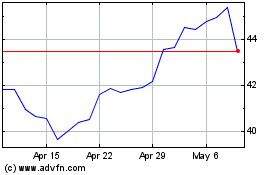

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

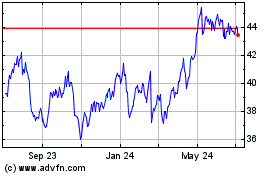

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024