Ultralife Corporation Reports Third Quarter Results

October 29 2015 - 7:00AM

Ultralife Corporation (NASDAQ:ULBI) reported operating income of

$1.2 million on revenue of $19.0 million for the quarter ended

September 27, 2015. For the third quarter of 2014, the

Company reported an operating loss of $0.1 million on revenue of

$16.1 million.

“Through sustained execution, we delivered another quarter of

profitable growth, steadily building on the revenue gain, margin

expansion and positive EPS we generated for the first half of the

year. On a 19% increase in revenue for the third quarter, we

posted a consolidated gross margin of 31.0%, an operating margin of

6.2% and EPS of $0.07 per share. As a result, on a

year-to-date basis, we have generated $5.3 million more in

operating income on a $10.6 million gain in revenue, clearly

demonstrating our business model operating leverage,” said

Michael D. Popielec, Ultralife's President and Chief Executive

Officer. “With our new products gaining traction and our

opportunity set widening, we firmly believe our plans to produce

revenue and earnings growth for 2015 are within reach.”

Third Quarter 2015 Financial Results

Revenue grew 19%, or $3.0 million, to $19.0 million from $16.1

million for the third quarter of 2014. Battery & Energy

Products sales increased 18% to $16.4 million compared to $13.9

million last year, reflecting higher shipments to both

Government/Defense and commercial customers. Communications

Systems sales were $2.7 million compared to $2.1 million for the

same period last year, an increase of 23%.

Gross profit grew 32% to $5.9 million from $4.5 million for the

third quarter a year ago. As a percentage of revenue, gross

profit increased 310 basis points to 31.0% from 27.9% last year,

primarily reflecting favorable product mix and improved overhead

absorption on higher sales volumes. Battery &

Energy Products’ gross margin was 29.1% compared to 27.4% last

year, an increase of 170 basis points. Communications Systems’

gross margin was 42.4% compared to 31.4% last year, an increase of

1,100 basis points.

Operating expenses were $4.7 million compared to $4.5 million

for the third quarter of 2014, reflecting higher new product

development spending and sales commissions. As a percentage

of revenue, operating expenses improved 350 basis points to 24.8%

compared to 28.3% a year ago.

The combination of increased revenue and improved gross margin

drove a $1.2 million gain in operating income. Operating

income was $1.2 million compared to an operating loss of $0.1

million for the third quarter of 2014. Operating margin was 6.2%

compared to (0.3%) for the year-earlier period.

Net income was $1.0 million, or $0.07 per share, compared to a

net loss of ($0.3) million, or ($0.02) per share, for the third

quarter of 2014.

Share Repurchase Program

During the third quarter Ultralife repurchased 748,582 shares

under its currently authorized 3.4 million share repurchase

program, which will expire April 30, 2016. Since the inception of

the share repurchase program on May 1, 2014, the Company has

repurchased 2,442,191 shares.

About Ultralife Corporation

Ultralife Corporation serves its markets with products and

services ranging from portable power solutions to communications

and electronics systems. Through its engineering and collaborative

approach to problem solving, Ultralife serves government, defense

and commercial customers across the globe.

Headquartered in Newark, New York, the company's business

segments include: Battery & Energy Products and Communications

Systems. Ultralife has operations in North America, Europe and

Asia. For more information, visit www.ultralifecorp.com.

Conference Call Information

Ultralife will hold its third quarter earnings conference call

today at 10:00 AM ET. To participate in the live call, please dial

(800) 915-4836 at least ten minutes before the scheduled start

time, identify yourself and ask for the Ultralife call. A live

webcast of the conference call will be available to investors in

the Events & Presentations section of the Company's website at

http://investor.ultralifecorporation.com. For those who cannot

listen to the live broadcast, a replay of the webcast will be

available shortly after the call at the same location.

This press release may contain forward-looking statements based

on current expectations that involve a number of risks and

uncertainties. The potential risks and uncertainties that could

cause actual results to differ materially include: potential

reductions in U.S. military spending, uncertain global economic

conditions and acceptance of our new products on a global basis.

The Company cautions investors not to place undue reliance on

forward-looking statements, which reflect the Company's analysis

only as of today's date. The Company undertakes no obligation to

publicly update forward-looking statements to reflect subsequent

events or circumstances. Further information on these factors and

other factors that could affect Ultralife's financial results is

included in Ultralife's Securities and Exchange Commission (SEC)

filings, including the latest Annual Report on Form 10-K.

| ULTRALIFE CORPORATION AND

SUBSIDIARIES |

| CONSOLIDATED BALANCE

SHEETS(Dollars in Thousands) |

| (unaudited) |

|

|

|

|

|

| ASSETS |

| |

September 27, |

|

December 31, |

| |

|

2015 |

|

|

|

2014 |

|

| Current

assets: |

|

|

|

| Cash and cash

equivalents |

$ |

14,728 |

|

|

$ |

17,866 |

|

| Trade accounts

receivable, net |

|

11,242 |

|

|

|

11,295 |

|

| Inventories, net |

|

23,352 |

|

|

|

26,086 |

|

| Prepaid expenses and

other current assets |

|

2,226 |

|

|

|

1,603 |

|

| Total current

assets |

|

51,548 |

|

|

|

56,850 |

|

| Property,

equipment and improvements, net |

|

9,191 |

|

|

|

9,812 |

|

| Goodwill,

intangibles and other assets |

|

20,613 |

|

|

|

20,980 |

|

| Total assets |

$ |

81,352 |

|

|

$ |

87,642 |

|

| |

|

|

|

| LIABILITIES AND SHAREHOLDERS'

EQUITY |

| Current

liabilities: |

|

|

|

| Accounts payable |

$ |

6,766 |

|

|

$ |

6,996 |

|

| Accrued compensation

and related benefits |

|

2,398 |

|

|

|

1,725 |

|

| Accrued expenses and

other current liabilities |

|

2,334 |

|

|

|

2,490 |

|

| Total current

liabilities |

|

11,498 |

|

|

|

11,211 |

|

| Deferred

income taxes and other non-current liabilities |

|

4,679 |

|

|

|

4,518 |

|

| Total liabilities |

|

16,177 |

|

|

|

15,729 |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

|

Shareholders' equity: |

|

|

|

| Common stock |

|

1,899 |

|

|

|

1,894 |

|

| Capital in excess of

par value |

|

176,402 |

|

|

|

175,940 |

|

| Accumulated

deficit |

|

(94,553 |

) |

|

|

(96,920 |

) |

| Accumulated other

comprehensive loss |

|

(750 |

) |

|

|

(467 |

) |

| Treasury stock |

|

(17,686 |

) |

|

|

(8,420 |

) |

| Total Ultralife

equity |

|

65,312 |

|

|

|

72,027 |

|

|

Noncontrolling interest |

|

(137 |

) |

|

|

(114 |

) |

| Total shareholders’

equity |

|

65,175 |

|

|

|

71,913 |

|

| |

|

|

|

| Total liabilities and

shareholders' equity |

$ |

81,352 |

|

|

$ |

87,642 |

|

| |

|

|

|

| |

| ULTRALIFE

CORPORATION AND SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

| (In

Thousands except per share amounts) |

|

(unaudited) |

| |

|

|

|

| |

Three month

periods ended |

|

Nine month

periods ended |

| |

September

27, |

|

September

28, |

|

September

27, |

|

September

28, |

| |

|

2015 |

|

|

|

2014 |

|

|

|

2015 |

|

|

|

2014 |

|

| Revenues: |

|

|

|

|

|

|

|

| Battery & energy products |

$ |

16,390 |

|

|

$ |

13,913 |

|

|

$ |

48,638 |

|

|

$ |

40,000 |

|

| Communication systems |

|

2,654 |

|

|

|

2,149 |

|

|

|

8,538 |

|

|

|

6,546 |

|

| Total

revenues |

|

19,044 |

|

|

|

16,062 |

|

|

$ |

57,176 |

|

|

$ |

46,546 |

|

| |

|

|

|

|

|

|

|

| Cost of products sold: |

|

|

|

|

|

|

|

| Battery & energy products |

|

11,616 |

|

|

|

10,100 |

|

|

|

34,538 |

|

|

|

29,510 |

|

| Communication systems |

|

1,528 |

|

|

|

1,476 |

|

|

|

4,872 |

|

|

|

4,003 |

|

| Total cost of products

sold |

|

13,144 |

|

|

|

11,576 |

|

|

|

39,410 |

|

|

|

33,513 |

|

| |

|

|

|

|

|

|

|

| Gross profit |

|

5,900 |

|

|

|

4,486 |

|

|

|

17,766 |

|

|

|

13,033 |

|

| |

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

| Research and development |

|

1,224 |

|

|

|

1,014 |

|

|

|

3,917 |

|

|

|

4,010 |

|

| Selling, general and

administrative |

|

3,503 |

|

|

|

3,527 |

|

|

|

11,037 |

|

|

|

11,498 |

|

| Total operating expenses |

|

4,727 |

|

|

|

4,541 |

|

|

|

14,954 |

|

|

|

15,508 |

|

| |

|

|

|

|

|

|

|

| Operating income (loss) |

|

1,173 |

|

|

|

(55 |

) |

|

|

2,812 |

|

|

|

(2,475 |

) |

| |

|

|

|

|

|

|

|

| Other (expense) income: |

|

|

|

|

|

|

|

| Interest income |

|

- |

|

|

|

3 |

|

|

|

2 |

|

|

|

12 |

|

| Interest and financing expense |

|

(65 |

) |

|

|

(56 |

) |

|

|

(197 |

) |

|

|

(153 |

) |

| Miscellaneous |

|

70 |

|

|

|

(158 |

) |

|

|

39 |

|

|

|

(128 |

) |

| Income (loss) from continuing operations

before income taxes |

|

1,178 |

|

|

|

(266 |

) |

|

|

2,656 |

|

|

|

(2,744 |

) |

| Income tax provision |

|

130 |

|

|

|

60 |

|

|

|

312 |

|

|

|

177 |

|

| |

|

|

|

|

|

|

|

| Net income (loss) from continuing

operations |

|

1,048 |

|

|

|

(326 |

) |

|

|

2,344 |

|

|

|

(2,921 |

) |

| Loss from discontinued operations, net of

tax |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(61 |

) |

| |

|

|

|

|

|

|

|

| Net income (loss) |

|

1,048 |

|

|

|

(326 |

) |

|

|

2,344 |

|

|

|

(2,982 |

) |

| Net (income) loss attributable to noncontrolling

interest |

|

(1 |

) |

|

|

3 |

|

|

|

23 |

|

|

|

13 |

|

| |

|

|

|

|

|

|

|

| Net income (loss) attributable to

Ultralife |

$ |

1,047 |

|

|

$ |

(323 |

) |

|

$ |

2,367 |

|

|

$ |

(2,969 |

) |

| |

|

|

|

|

|

|

|

| Net income (loss) per share attributable

to Ultralife common shareholders – basic: |

|

|

|

|

|

|

|

| Continuing operations |

$ |

.07 |

|

|

$ |

(.02 |

) |

|

$ |

.14 |

|

|

$ |

(.17 |

) |

| Discontinued operations |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(.00 |

) |

| Total |

$ |

.07 |

|

|

$ |

(.02 |

) |

|

$ |

.14 |

|

|

$ |

(.17 |

) |

| |

|

|

|

|

|

|

|

| Net income per share attributable to

Ultralife common shareholders – diluted: |

|

|

|

|

|

|

|

| Continuing operations |

$ |

.07 |

|

|

|

|

$ |

.14 |

|

|

|

| Discontinued operations |

|

- |

|

|

|

|

|

- |

|

|

|

| Total |

$ |

.07 |

|

|

|

|

$ |

.14 |

|

|

|

| |

|

|

|

|

|

|

|

| Weighted average shares outstanding –

basic |

|

15,633 |

|

|

|

17,490 |

|

|

|

16,503 |

|

|

|

17,510 |

|

| Weighted average shares outstanding –

diluted |

|

15,740 |

|

|

|

|

|

16,550 |

|

|

|

Company Contact:

Ultralife Corporation

Philip A. Fain

(315) 332-7100

pfain@ulbi.com

Investor Relations Contact:

LHA

Jody Burfening

(212) 838-3777

jburfening@lhai.com

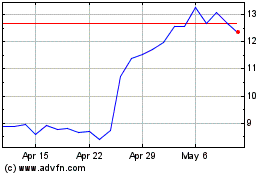

Ultralife (NASDAQ:ULBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

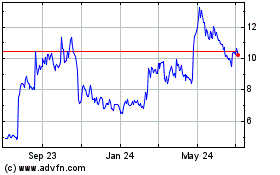

Ultralife (NASDAQ:ULBI)

Historical Stock Chart

From Apr 2023 to Apr 2024