UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) February 19, 2016

TEXAS ROADHOUSE, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

000-50972 |

|

20-1083890 |

|

(State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

|

of incorporation) |

|

File Number) |

|

Identification No.) |

|

6040 Dutchmans Lane, Louisville, KY |

|

40205 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (502) 426-9984

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On February 22, 2016, Texas Roadhouse, Inc. (the “Company”) issued a press release announcing its financial results for the quarter and year ended December 29, 2015. Attached to this Current Report on Form 8-K as Exhibit 99.1 is a copy of the press release.

ITEM 8.01. OTHER EVENTS.

On February 22, 2016, the Company announced its first quarter 2016 cash dividend. The public announcement was made by means of a press release, the text of which is set forth at Exhibit 99.1 hereto.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

(d) EXHIBITS

99.1 Press Release issued by the company on February 22, 2016.

The information in this Current Report on Form 8-K at Item 2.02 and the Exhibit attached hereto shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. Such information will not be incorporated by reference into any registration statement filed by the Company under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated by reference.

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

TEXAS ROADHOUSE, INC. |

|

|

|

|

|

|

|

|

|

Date: February 22, 2016 |

By: |

/s/ Scott M. Colosi |

|

|

|

Scott M. Colosi |

|

|

|

President and Chief Financial Officer |

3

INDEX TO EXHIBITS

|

Exhibit No. |

|

|

|

|

|

|

|

99.1 |

|

Press Release issued by the Company on February 22, 2016. |

4

Exhibit 99.1

Texas Roadhouse, Inc. Announces Fourth Quarter 2015 Results

Increases Quarterly Dividend 12% to $0.19 per Share

LOUISVILLE, KY. (February 22, 2016) — Texas Roadhouse, Inc. (NasdaqGS: TXRH), today announced financial results for the 13 and 52 week periods ended December 29, 2015.

|

|

|

Fourth Quarter |

|

Year to Date |

|

|

($000’s) |

|

2015 |

|

2014 |

|

% Change |

|

2015 |

|

2014 |

|

% Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

|

$ |

454,351 |

|

$ |

404,425 |

|

12 |

|

$ |

1,807,368 |

|

$ |

1,582,148 |

|

14 |

|

|

Income from operations |

|

33,713 |

|

27,043 |

|

25 |

|

144,565 |

|

130,449 |

|

11 |

|

|

Net income |

|

22,982 |

|

18,595 |

|

24 |

|

96,894 |

|

87,022 |

|

11 |

|

|

Diluted EPS |

|

$ |

0.32 |

|

$ |

0.26 |

|

23 |

|

$ |

1.37 |

|

$ |

1.23 |

|

11 |

|

Results for the fourth quarter included the following highlights:

· Comparable restaurant sales growth of 4.5% at company restaurants and 4.0% at franchise restaurants;

· Restaurant margin, as a percentage of restaurant sales, increased 112 basis points to 17.6%, primarily driven by lower other operating costs and lower food costs;

· Diluted earnings per share increased 22.7% to $0.32 from $0.26 in the prior year;

· Seven company-owned Texas Roadhouse restaurants were opened; and,

· The Company repurchased 189,700 shares of its common stock for $6.7 million.

Results for the full year included the following highlights:

· Comparable restaurant sales growth of 7.2% at company restaurants and 6.5% at franchise restaurants;

· Restaurant margin, as a percentage of restaurant sales, decreased 30 basis points to 17.3%. Food cost inflation of approximately 4.9%, driven by beef, more than offset the impact of higher average unit volume;

· Diluted earnings per share increased 11.1% to $1.37 from $1.23 in the prior year;

· 29 company-owned restaurants were opened, including four Bubba’s 33 restaurants; and,

· The Company repurchased 321,789 shares of its common stock for $11.4 million.

Kent Taylor, Chief Executive Officer of Texas Roadhouse, Inc., commented, “We ended the year on a strong note, with double digit revenue and diluted earnings per share growth for both the fourth quarter and the full year. This represents our 24th consecutive quarter of positive comparable restaurant sales growth, which is a testament to our Managing Partners. In addition, our solid balance sheet and healthy cash flow allowed us to open 29 restaurants, while returning $58 million of excess capital to shareholders through quarterly dividend payments and share repurchases throughout the year.”

Taylor continued, “We have assembled a substantial pipeline of new locations and are on track to open approximately 30 company restaurants this year. Our top-line momentum has continued into 2016 and we are pleased to have seen continued traffic growth during the first seven weeks of the year. Looking ahead, we will stay focused on solidifying our long-term brand position and capitalizing on our growth potential.”

2016 Outlook

The Company reported that comparable restaurant sales growth of at company restaurants for the first seven weeks of its first quarter of fiscal 2016 was approximately 4.4% compared to the prior year period.

Management updated the following expectations for 2016:

· Approximately 30 company restaurant openings, including approximately seven Bubba’s 33 restaurants;

· 1.0% to 2.0% food cost deflation;

· An income tax rate of approximately 30.0%; and,

· Total capital expenditures of $165.0 million to $175.0 million.

Management reiterated the expectation of positive comparable restaurant sales growth for 2016.

Cash Dividend Payment

On February 19, 2016, the Company’s Board of Directors authorized the payment of a quarterly cash dividend of $0.19 per share of common stock. This payment, which will be distributed on April 1, 2016 to shareholders of record at the close of business on March 16, 2016, represents a 12% increase from the cash dividend of $0.17 per share of common stock declared during each quarter of 2015 and represents our fifth consecutive year of dividend payments.

Conference Call

The Company is hosting a conference call today, February 22, 2016 at 5:00 p.m. Eastern Time to discuss these results. The dial-in number is (877) 874-1571 or (719) 325-4839 for international calls. A replay of the call will be available for one week following the conference call. To access the replay, please dial (877) 870-5176 or (858) 384-5517 for international calls, and use 1297446 as the pass code. There will be a simultaneous Web cast conducted at www.texasroadhouse.com.

About the Company

Texas Roadhouse is a casual dining concept that first opened in 1993 and today operates over 485 restaurants system-wide in 49 states and four foreign countries. For more information, please visit the Company’s Web site at www.texasroadhouse.com.

Forward-looking Statements

Certain statements in this release that are not historical facts, including, without limitation, those relating to our anticipated financial performance, are forward-looking statements that involve risks and uncertainties. Such statements are based upon the current beliefs and expectations of the management of the Company. Actual results may vary materially from those contained in forward-looking statements based on a number of factors including, without limitation, the actual number of restaurants opening; the sales at these and our other company and franchise restaurants; changes in restaurant development or operating costs, such as food and labor; our ability to acquire franchise restaurants; our ability to integrate the franchise restaurants we acquire or other concepts we develop; our ability to continue to generate the necessary cash flows to fund our new restaurant growth, continue our share repurchase program and pay a quarterly cash dividend; strength of consumer spending; pending or future legal claims; breaches of security; conditions beyond our control such as weather, natural disasters, disease outbreaks, epidemics or pandemics impacting our customers or food supplies; food safety and food borne illness concerns; acts of war or terrorism and other factors disclosed from time to time in our filings with the U.S. Securities and Exchange Commission. Investors should take such risks into account when making investment decisions. Shareholders and other readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. We undertake no obligation to update any forward-looking statements.

# # #

Contacts:

Investor Relations

Tonya Robinson

(502) 515-7269

Media

Travis Doster

(502) 638-5457

Texas Roadhouse, Inc. and Subsidiaries

Condensed Consolidated Statements of Income

(in thousands, except per share data)

(unaudited)

|

|

|

13 Weeks Ended |

|

52 Weeks Ended |

|

|

|

|

December 29,

2015 |

|

December 30,

2014 |

|

December 29,

2015 |

|

December 30,

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

Restaurant sales |

|

$ |

450,529 |

|

$ |

400,790 |

|

$ |

1,791,446 |

|

$ |

1,568,556 |

|

|

Franchise royalties and fees |

|

3,822 |

|

3,635 |

|

15,922 |

|

13,592 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

|

454,351 |

|

404,425 |

|

1,807,368 |

|

1,582,148 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

Restaurant operating costs (excluding depreciation and amortization shown separately below): |

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

159,301 |

|

143,592 |

|

644,001 |

|

553,144 |

|

|

Labor |

|

131,517 |

|

116,744 |

|

524,203 |

|

459,119 |

|

|

Rent |

|

9,741 |

|

8,624 |

|

37,183 |

|

33,174 |

|

|

Other operating |

|

70,773 |

|

65,848 |

|

275,296 |

|

246,339 |

|

|

Pre-opening |

|

4,640 |

|

5,775 |

|

19,116 |

|

18,452 |

|

|

Depreciation and amortization |

|

18,700 |

|

15,497 |

|

69,694 |

|

59,179 |

|

|

Impairment and closure |

|

974 |

|

626 |

|

974 |

|

636 |

|

|

General and administrative |

|

24,992 |

|

20,676 |

|

92,336 |

|

81,656 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total costs and expenses |

|

420,638 |

|

377,382 |

|

1,662,803 |

|

1,451,699 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations |

|

33,713 |

|

27,043 |

|

144,565 |

|

130,449 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

479 |

|

520 |

|

1,959 |

|

2,084 |

|

|

Equity income from investments in unconsolidated affiliates |

|

353 |

|

627 |

|

1,641 |

|

1,602 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before taxes |

|

33,587 |

|

27,150 |

|

144,247 |

|

129,967 |

|

|

Provision for income taxes |

|

9,567 |

|

7,528 |

|

42,986 |

|

38,990 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income including noncontrolling interests |

|

$ |

24,020 |

|

$ |

19,622 |

|

$ |

101,261 |

|

$ |

90,977 |

|

|

Less: Net income attributable to noncontrolling interests |

|

1,038 |

|

1,027 |

|

4,367 |

|

3,955 |

|

|

Net income attributable to Texas Roadhouse, Inc. and subsidiaries |

|

$ |

22,982 |

|

$ |

18,595 |

|

$ |

96,894 |

|

$ |

87,022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per common share attributable to Texas Roadhouse, Inc. and subsidiaries: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.33 |

|

$ |

0.27 |

|

$ |

1.38 |

|

$ |

1.25 |

|

|

Diluted |

|

$ |

0.32 |

|

$ |

0.26 |

|

$ |

1.37 |

|

$ |

1.23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

70,143 |

|

69,500 |

|

70,032 |

|

69,719 |

|

|

Diluted |

|

70,865 |

|

70,359 |

|

70,747 |

|

70,608 |

|

Texas Roadhouse, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(in thousands)

(unaudited)

|

|

|

December 29, 2015 |

|

December 30, 2014 |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

59,334 |

|

$ |

86,122 |

|

|

Other current assets |

|

74,479 |

|

61,604 |

|

|

Property and equipment, net |

|

751,288 |

|

649,637 |

|

|

Goodwill |

|

116,571 |

|

116,571 |

|

|

Intangible assets, net |

|

4,827 |

|

6,203 |

|

|

Other assets |

|

26,207 |

|

23,005 |

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

1,032,706 |

|

$ |

943,142 |

|

|

|

|

|

|

|

|

|

Current maturities of long-term debt |

|

144 |

|

129 |

|

|

Other current liabilities |

|

256,498 |

|

215,842 |

|

|

Long-term debt, excluding current maturities |

|

25,550 |

|

50,693 |

|

|

Other liabilities |

|

73,332 |

|

61,522 |

|

|

Texas Roadhouse, Inc. and subsidiaries stockholders’ equity |

|

669,662 |

|

607,892 |

|

|

Noncontrolling interests |

|

7,520 |

|

7,064 |

|

|

|

|

|

|

|

|

|

Total liabilities and equity |

|

$ |

1,032,706 |

|

$ |

943,142 |

|

Texas Roadhouse, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(in thousands)

(unaudited)

|

|

|

52 Weeks Ended |

|

|

|

|

December 29, 2015 |

|

December 30, 2014 |

|

|

|

|

|

|

|

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net income including noncontrolling interests |

|

$ |

101,261 |

|

$ |

90,977 |

|

|

Adjustments to reconcile net income to net cash provided by operating activities |

|

|

|

|

|

|

Depreciation and amortization |

|

69,694 |

|

59,179 |

|

|

Share-based compensation expense |

|

22,825 |

|

14,883 |

|

|

Other noncash adjustments |

|

5,697 |

|

4,078 |

|

|

Change in working capital |

|

28,464 |

|

22,596 |

|

|

Net cash provided by operating activities |

|

227,941 |

|

191,713 |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

Capital expenditures - property and equipment |

|

(173,475 |

) |

(125,445 |

) |

|

Proceeds from sale of property and equipment, including insurance proceeds |

|

272 |

|

1,205 |

|

|

Net cash used in investing activities |

|

(173,203 |

) |

(124,240 |

) |

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

Repayments of revolving credit facility |

|

(25,000 |

) |

— |

|

|

Repurchase shares of common stock |

|

(11,397 |

) |

(42,744 |

) |

|

Dividends paid |

|

(46,176 |

) |

(31,333 |

) |

|

Other financing activities |

|

1,047 |

|

(2,148 |

) |

|

Net cash used in financing activities |

|

(81,526 |

) |

(76,225 |

) |

|

|

|

|

|

|

|

|

Net decrease in cash and cash equivalents |

|

(26,788 |

) |

(8,752 |

) |

|

Cash and cash equivalents - beginning of period |

|

86,122 |

|

94,874 |

|

|

Cash and cash equivalents - end of period |

|

$ |

59,334 |

|

$ |

86,122 |

|

Texas Roadhouse, Inc. and Subsidiaries

Supplemental Financial and Operating Information

($ amounts in thousands, except weekly sales by group)

(unaudited)

|

|

|

Fourth Quarter |

|

Change |

|

Year to Date |

|

Change |

|

|

|

|

2015 |

|

2014 |

|

vs LY |

|

2015 |

|

2014 |

|

vs LY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restaurant openings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company - Texas Roadhouse |

|

7 |

|

7 |

|

0 |

|

24 |

|

22 |

|

2 |

|

|

Company - Bubba’s 33 |

|

0 |

|

2 |

|

(2 |

) |

4 |

|

2 |

|

2 |

|

|

Company - Other |

|

0 |

|

1 |

|

(1 |

) |

1 |

|

1 |

|

0 |

|

|

Franchise - Texas Roadhouse |

|

1 |

|

5 |

|

(4 |

) |

3 |

|

6 |

|

(3 |

) |

|

Total |

|

8 |

|

15 |

|

(7 |

) |

32 |

|

31 |

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restaurant acquisitions/dispositions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company - Texas Roadhouse |

|

0 |

|

1 |

|

(1 |

) |

0 |

|

1 |

|

(1 |

) |

|

Company - Bubba’s 33 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

|

Company - Other |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

|

Franchise - Texas Roadhouse |

|

0 |

|

(1 |

) |

1 |

|

0 |

|

(1 |

) |

1 |

|

|

Total |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restaurants open at the end of the quarter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company - Texas Roadhouse |

|

392 |

|

368 |

|

24 |

|

|

|

|

|

|

|

|

Company - Bubba’s 33 |

|

7 |

|

3 |

|

4 |

|

|

|

|

|

|

|

|

Company - Other |

|

2 |

|

1 |

|

1 |

|

|

|

|

|

|

|

|

Franchise - Texas Roadhouse |

|

82 |

|

79 |

|

3 |

|

|

|

|

|

|

|

|

Total |

|

483 |

|

451 |

|

32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company-owned restaurants |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restaurant sales |

|

$ |

450,529 |

|

$ |

400,790 |

|

12.4 |

% |

$ |

1,791,446 |

|

$ |

1,568,556 |

|

14.2 |

% |

|

Store weeks |

|

5,186 |

|

4,766 |

|

8.8 |

% |

20,020 |

|

18,565 |

|

7.8 |

% |

|

Comparable restaurant sales growth (1) |

|

4.5 |

% |

7.0 |

% |

|

|

7.2 |

% |

4.7 |

% |

|

|

|

Texas Roadhouse restaurants only: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comparable restaurant sales growth (1) |

|

4.5 |

% |

7.0 |

% |

|

|

7.2 |

% |

4.7 |

% |

|

|

|

Average unit volume (2) |

|

$ |

1,130 |

|

$ |

1,083 |

|

4.3 |

% |

$ |

4,664 |

|

$ |

4,351 |

|

7.2 |

% |

|

Weekly sales by group: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comparable restaurants (352 units) |

|

$ |

87,038 |

|

|

|

|

|

|

|

|

|

|

|

|

Average unit volume restaurants (18 units) (3) |

|

$ |

84,218 |

|

|

|

|

|

|

|

|

|

|

|

|

Restaurants less than 6 months old (22 units) |

|

$ |

94,410 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restaurant operating costs (as a % of restaurant sales) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

35.4 |

% |

35.8 |

% |

(47 |

)bps |

35.9 |

% |

35.3 |

% |

68 |

bps |

|

Labor |

|

29.2 |

% |

29.1 |

% |

6 |

bps |

29.3 |

% |

29.3 |

% |

(1 |

)bps |

|

Rent |

|

2.2 |

% |

2.2 |

% |

1 |

bps |

2.1 |

% |

2.1 |

% |

(4 |

)bps |

|

Other operating |

|

15.7 |

% |

16.4 |

% |

(72 |

)bps |

15.4 |

% |

15.7 |

% |

(34 |

)bps |

|

Total |

|

82.4 |

% |

83.5 |

% |

(112 |

)bps |

82.7 |

% |

82.4 |

% |

30 |

bps |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restaurant margin (4) |

|

17.6 |

% |

16.5 |

% |

112 |

bps |

17.3 |

% |

17.6 |

% |

(30 |

)bps |

|

Restaurant margin ($ in thousands) |

|

$ |

79,196 |

|

$ |

65,982 |

|

20.0 |

% |

$ |

310,762 |

|

$ |

276,782 |

|

12.3 |

% |

|

Restaurant margin $/Store week |

|

$ |

15,272 |

|

$ |

13,844 |

|

10.3 |

% |

$ |

15,523 |

|

$ |

14,909 |

|

4.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Franchise-owned restaurants |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Franchise royalties and fees |

|

$ |

3,822 |

|

$ |

3,635 |

|

5.1 |

% |

$ |

15,922 |

|

$ |

13,592 |

|

17.1 |

% |

|

Store weeks |

|

1,062 |

|

998 |

|

6.4 |

% |

4,174 |

|

3,910 |

|

6.8 |

% |

|

Comparable restaurant sales growth (1) |

|

4.0 |

% |

5.7 |

% |

|

|

6.5 |

% |

4.9 |

% |

|

|

|

Average unit volume (2) |

|

$ |

1,202 |

|

$ |

1,175 |

|

2.3 |

% |

$ |

5,029 |

|

$ |

4,639 |

|

8.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pre-opening expense |

|

$ |

4,640 |

|

$ |

5,775 |

|

(19.7 |

)% |

$ |

19,116 |

|

$ |

18,452 |

|

3.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

$ |

18,700 |

|

$ |

15,497 |

|

20.7 |

% |

$ |

69,694 |

|

$ |

59,179 |

|

17.8 |

% |

|

As a % of revenue |

|

4.1 |

% |

3.8 |

% |

28 |

bps |

3.9 |

% |

3.7 |

% |

12 |

bps |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative expenses |

|

$ |

24,992 |

|

$ |

20,676 |

|

20.9 |

% |

$ |

92,336 |

|

$ |

81,656 |

|

13.1 |

% |

|

As a % of revenue |

|

5.5 |

% |

5.1 |

% |

39 |

bps |

5.1 |

% |

5.2 |

% |

(5 |

)bps |

(1) Comparable restaurant sales growth reflects the change in year-over-year sales for restaurants open a full 18 months before the beginning of the period measured, excluding sales from restaurants closed during the period.

(2) Average unit volume includes sales from Texas Roadhouse restaurants open for a full six months before the beginning of the period measured, excluding sales from restaurants closed during the period.

(3) Average unit volume restaurants include Texas Roadhouse restaurants open a full six to 18 months before the beginning of the period measured.

(4) Restaurant margin represents restaurant sales less cost of sales, labor, rent and other operating costs (as a percentage of restaurant sales). Restaurant margin is widely regarded in the restaurant industry as a useful metric by which to evaluate restaurant-level operating efficiency and performance. Restaurant margin is not a measurement determined in accordance with GAAP and should not be considered in isolation, or as an alternative, to income from operations or other similarly titled measures of other companies.

Amounts may not foot due to rounding.

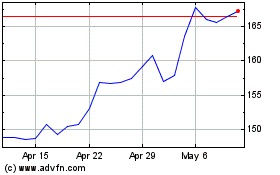

Texas Roadhouse (NASDAQ:TXRH)

Historical Stock Chart

From Mar 2024 to Apr 2024

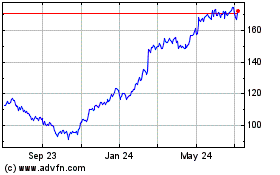

Texas Roadhouse (NASDAQ:TXRH)

Historical Stock Chart

From Apr 2023 to Apr 2024