Starbucks Tempers Revenue Forecast -- Update

January 26 2017 - 6:49PM

Dow Jones News

By Julie Jargon

Starbucks Corp. says it has become a victim of the success of

its mobile order app.

The coffee chain created the app to reduce long lines at the

cash register, but Starbucks Operating Chief Kevin Johnson said

Thursday the lines have just shifted to the pickup counter.

"The success of mobile order-and-pay has created a new

challenge," Mr. Johnson said in an interview.

Mr. Johnson, who will become chief executive in April when

Howard Schultz steps down to focus on building high-end Starbucks

stores, said long waits have driven away some potential customers.

The number of transactions in the company's fiscal first quarter

were down as a result.

Starbucks posted a 3% increase in U.S. same-store sales growth

in the quarter ended Jan. 1, but analysts were expecting 4% growth.

It marks the company's fifth consecutive quarter of missed

expectations for same-store sales in the U.S., its largest market.

Growth came from a 5% increase in the price of an average purchase,

offset by a 2% decline in transactions.

U.S. sales have slowed repeatedly in recent quarters. Starbucks

previously blamed the economy. The company has said it would return

to its historic same-store sales growth rate of 5% in the U.S.,

though it hasn't said when.

Mobile order-and-pay represented 7% of U.S. company-operated

transactions in the quarter, up from 3% in the prior year. The

number of its highest-volume stores for mobile order-and-pay, where

orders placed via the app account for more than 20% of transactions

during peak hours, doubled to 1,200 stores over the prior

quarter.

Mr. Johnson said the company plans to fix the problem with

better signage, text messages telling customers when their orders

are ready, and the deploying of employees to hand off mobile

orders.

Starbucks lowered its revenue forecast for the year while

posting revenue for the latest quarter below expectations. Shares,

up 5.3% this year through Thursday's close, fell 4.4% after hours

to $55.90.

The company expects revenue growth for 2017 of 8% to 10%,

compared with prior guidance for double-digit growth. Starbucks

backed its guidance for earnings of $2.12 to $2.14 a share.

Starbucks earned $751.8 million, or 51 cents a share, up from

$687.6 million, or 46 cents, the year before. Excluding certain

items, profit rose to 52 cents a share from 46 cents a share a year

earlier.

Revenue rose 6.7% to $5.73 billion. Analysts surveyed by Thomson

Reuters had forecast earnings of 52 cents on $5.85 billion in

sales.

Starbucks reported that global same-store sales rose 3% in the

quarter. Same-store sales in Europe, Middle East and Africa

declined 1% from the year-ago period. The company said that number

only includes company-owned Starbucks and that many stores in that

market have become licensed by other operators and aren't counted

in that result.

China and the Asia Pacific region posted a 5% same-store sales

increase. China, expected to overtake the U.S. as the chain's

largest market, posted a 6% increase in same-store sales.

--Anne Steele contributed to this article.

Write to Julie Jargon at julie.jargon@wsj.com

(END) Dow Jones Newswires

January 26, 2017 18:34 ET (23:34 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

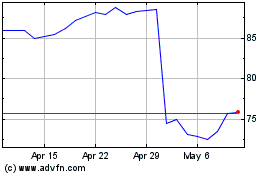

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

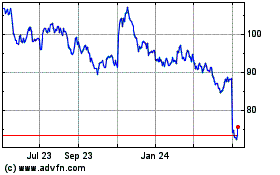

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Apr 2023 to Apr 2024