Emirates Airline Chief Warns of Brexit Impact on Europe

June 03 2016 - 4:30AM

Dow Jones News

DUBLIN—Emirates Airline President Tim Clark said a British exit

from the European Union could send the European single currency

into "free fall."

While most European airline executives have focused on the

ramifications on the U.K. economy from a vote to leave, Mr. Clark

said "my concern is what would happen not so much to the U.K., but

the rest of the European Union."

The U.K. is set to vote on June 23 in a referendum on whether to

remain in the EU or exit.

Mr. Clark said a British exit could compound economic woes in

continental Europe, potentially depressing demand and undermining

the value of the euro.

"Europe will be shocked and stunned by what happens," he said at

the sidelines of the annual meeting of International Air Transport

Association.

Potential instability and volatility triggered by a so-called

Brexit are a big concern for airlines, Mr. Clark said.

Michael O'Leary, Chief Executive of Europe's biggest budget

airline Ryanair Holdings PLC as been lobbying for the U.K. to

remain in the European trade group. He has said an exit could slow

economic growth and make the U.K. less attractive for future

investments.

As for the U.S. presidential election, Mr. Clark said he viewed

the possibility of a victory by Donald Trump, the presumptive

Republican Party nominee, as good news for the dollar even though

demand in the U.S. could soften in the run-up to the vote.

A Trump presidency could boost the dollar and would "strengthen

the economy in many ways." Mr. Clark said he viewed Mr. Trump as "a

man of business" despite the heated rhetoric during the

campaign.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

June 03, 2016 04:15 ET (08:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

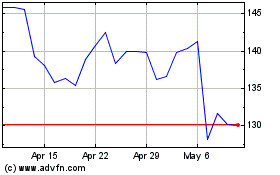

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

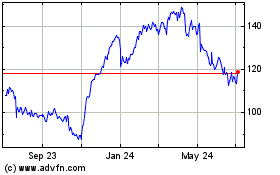

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Apr 2023 to Apr 2024