UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): October 22, 2015

Patterson-UTI Energy, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

0-22664 |

|

75-2504748 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

|

|

|

450 Gears Road, Suite 500, Houston, Texas |

|

|

|

77067 |

|

(Address of principal executive offices) |

|

|

|

(Zip Code) |

Registrant’s telephone number, including area code: 281-765-7100

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Top of the Form

Item 2.02 Results of Operations and Financial Condition.

On October 22, 2015, Patterson-UTI Energy, Inc. (the "Company") announced financial results for the three and nine months ended September 30, 2015. The press release, dated October 22, 2015, is furnished as Exhibit 99.1 to this report and incorporated by reference herein.

The information furnished pursuant to Item 2.02, including Exhibit 99.1 shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, shall not otherwise be subject to the liabilities of that section and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) The following exhibit is furnished herewith:

|

99.1 |

|

Press Release dated October 22, 2015 announcing financial results for the three and nine months ended September 30, 2015. |

Top of the Form

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

Patterson-UTI Energy, Inc. |

|

|

|

|

|

|

|

October 22, 2015 |

|

By: |

|

/s/ John E. Vollmer III |

|

|

|

|

|

Name: John E. Vollmer III |

|

|

|

|

|

Title: Senior Vice President - Corporate Development, Chief Financial Officer and Treasurer |

Top of the Form

Exhibit Index

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

Press Release dated October 22, 2015 announcing financial results for the three and nine months ended September 30, 2015. |

Exhibit 99.1

Contact: Mike Drickamer

Director, Investor Relations

Patterson-UTI Energy, Inc.

(281) 765-7170

Patterson-UTI Energy Reports Financial Results for Three and Nine

Months Ended September 30, 2015

HOUSTON, Texas – October 22, 2015 – PATTERSON-UTI ENERGY, INC. (NASDAQ: PTEN) today reported financial results for the three and nine months ended September 30, 2015. Including the non-cash charges discussed below, the Company reported a net loss of $226 million, or $1.54 per share, for the third quarter of 2015, compared to net income of $16.0 million, or $0.11 per share, for the quarter ended September 30, 2014. Revenues for the third quarter of 2015 were $422 million, compared to $846 million for the third quarter of 2014.

For the nine months ended September 30, 2015, the Company reported a net loss of $236 million, or $1.61 per share, compared to net income of $105 million, or $0.71 per share, for the nine months ended September 30, 2014. Revenues for the nine months ended September 30, 2015, were $1.6 billion, compared to $2.3 billion for the same period in 2014.

The financial results for the three months ended September 30, 2015 include pretax non-cash charges totaling $280 million ($187 million after-tax, or $1.28 per share). These charges include $125 million from the impairment of all goodwill associated with the Company’s pressure pumping business, $131 million from the write-down of drilling equipment primarily related to mechanical rigs and spare rig components, $22.0 million from the write-down of pressure pumping equipment and closed facilities and $1.9 million related to the impairment of certain oil and natural gas properties. For the nine months ended September 30, 2015, the financial results also include pretax charges of $19.8 million related to a legal settlement and the impairment of certain oil and natural gas properties during the first six months of 2015.

Last year’s financial results for the three and nine months ended September 30, 2014, include a pretax non-cash charge of $77.9 million related to the retirement of mechanical rigs and the write-off of excess spare rig components.

Andy Hendricks, Patterson-UTI’s Chief Executive Officer, stated, “During the third quarter, our rig count averaged 105 rigs in the United States and four rigs in Canada, compared to the second quarter average of 122 rigs in the United States and two in Canada. Current commodity prices are, of course, negatively impacting drilling activity. For the month of October, we expect our average rig count will be 92 in the United States and four in Canada.”

Mr. Hendricks added, “We recognized $28.9 million of revenues related to early contract terminations in contract drilling during the third quarter. These early termination revenues positively impacted our total average rig revenue per day of $26,010 by $2,870. Excluding early termination revenue, total average rig revenue per day during the third quarter would have been $23,140, compared to $24,330 per day in the second quarter.

“Total average rig operating costs per day during the third quarter decreased $140 to $13,580 from $13,720 in the second quarter. Excluding the positive impact from early termination revenues in both the second and third quarters, total average rig margin per day was $9,560 during the third quarter, compared to $10,600 during the second quarter.

“At the end of the third quarter our rig fleet included 160 APEX® rigs. During the fourth quarter we expect to add one additional new APEX® rig under contract to our fleet. We currently have no plans for additional newbuild rigs in 2016.

“As of September 30, 2015, we had term contracts for drilling rigs providing for more than $800 million of future dayrate drilling revenue. Based on contracts currently in place, we expect an average of 71 rigs operating under term contracts during the fourth quarter, and an average of 45 rigs operating under term contracts during 2016.

“We have reduced our mechanical rig fleet to 19 rigs with a combined net book value of $13.1 million. We currently believe there is value to keeping these rigs in our fleet, although we do not expect these rigs to generate meaningful future cash flow.

“In pressure pumping, activity and pricing were lower than we expected during the third quarter. Pressure pumping revenue during the third quarter was $154 million compared to $177 million in the second quarter. Importantly, while pressure pumping Adjusted EBITDA declined in the third quarter to $11.8 million from $29.5 million in the second quarter, we generated positive Adjusted EBITDA,” he concluded.

Mark S. Siegel, Chairman of Patterson-UTI, stated, “Industry conditions remain challenging. Low commodity prices are impacting E&P spending, thereby reducing demand and pricing for drilling and pressure pumping services. We believe that pricing in the pressure

pumping industry has deteriorated to levels that are not sustainable. At current pricing levels, we believe many companies are not generating sufficient cash flow to cover maintenance capital. Under these circumstances, we believe some pressure pumping companies are deferring maintenance, and their equipment is being cannibalized.

“Falling demand and low pricing is leading to a rebalancing in the industry. This rebalancing process in drilling and pressure pumping is painful, but we are well positioned. We have demonstrated our strength in terms of quality equipment, superior execution, and importantly, financial stability,” he concluded.

The Company declared a quarterly dividend on its common stock of $0.10 per share, to be paid on December 24, 2015 to holders of record as of December 10, 2015.

All references to "net income per share" in this press release are diluted earnings per common share as defined within Accounting Standards Codification Topic 260.

The Company's quarterly conference call to discuss the operating results for the quarter ended September 30, 2015 is scheduled for today, October 22, 2015 at 9:00 a.m. Central Time. The dial-in information for participants is 866-841-7265 (Domestic) and 704-908-0463 (International). The Conference ID for both numbers is 14156609. The call is also being webcast and can be accessed through the Investor Relations section at www.patenergy.com. A replay of the conference call will be on the Company’s website for two weeks. A telephonic replay will be available through October 26, 2015 at 855-859-2056 (Domestic) and 404-537-3406 (International) with the Conference ID 14156609.

About Patterson-UTI

Patterson-UTI Energy, Inc. subsidiaries provide onshore contract drilling and pressure pumping services to exploration and production companies in North America. Patterson-UTI Drilling Company LLC and its subsidiaries operate land-based drilling rigs in oil and natural gas producing regions of the continental United States and western Canada. Universal Pressure Pumping, Inc. and Universal Well Services, Inc. provide pressure pumping services primarily in Texas and the Appalachian region.

Location information about the Company’s drilling rigs and their individual inventories is available through the Company’s website at www.patenergy.com.

Statements made in this press release which state the Company's or management's intentions, beliefs, expectations or predictions for the future are forward-looking statements. It is important to note that actual results could differ materially from those discussed in such forward-looking statements. Important factors that could cause actual results to differ materially include, but are not limited to, volatility in customer spending and in oil and natural gas prices, which could adversely affect demand for our services and their associated effect on rates, utilization, margins and planned capital expenditures; global economic conditions; excess availability of land drilling rigs and pressure pumping equipment, including as a result of reactivation or construction; equipment specialization and new technologies; adverse industry conditions; adverse credit and equity market conditions; difficulty in building and deploying new equipment; difficulty in integrating acquisitions; shortages, delays in delivery and interruptions of supply of equipment, supplies and materials; weather; loss of, or reduction in business with, key customers; liabilities from operations; ability to effectively identify and enter new markets; governmental regulation; ability to realize backlog; and ability to retain management and field personnel. Additional information concerning factors that could cause actual results to differ materially from those in the forward-looking statements is contained from time to time in the Company's SEC filings, which may be obtained by contacting the Company or the SEC. These filings are also available through the Company's web site at http://www.patenergy.com or through the SEC's Electronic Data Gathering and Analysis Retrieval System (EDGAR) at http://www.sec.gov. We undertake no obligation to publicly update or revise any forward-looking statement.

PATTERSON-UTI ENERGY, INC.

Condensed Consolidated Statements of Operations

(unaudited, in thousands, except per share data)

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

|

September 30, |

|

|

September 30, |

|

|

|

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

|

REVENUES |

|

$ |

422,251 |

|

|

$ |

845,628 |

|

|

$ |

1,552,711 |

|

|

$ |

2,281,072 |

|

|

COSTS AND EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direct operating costs |

|

|

277,834 |

|

|

|

562,486 |

|

|

|

1,005,550 |

|

|

|

1,516,794 |

|

|

Depreciation, depletion, amortization and impairment |

|

|

332,151 |

|

|

|

237,825 |

|

|

|

689,457 |

|

|

|

538,573 |

|

|

Impairment of goodwill |

|

|

124,561 |

|

|

|

— |

|

|

|

124,561 |

|

|

|

— |

|

|

Selling, general and administrative |

|

|

18,582 |

|

|

|

18,896 |

|

|

|

70,595 |

|

|

|

58,117 |

|

|

Net gain on asset disposals |

|

|

(1,362 |

) |

|

|

(3,870 |

) |

|

|

(7,276 |

) |

|

|

(8,705 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total costs and expenses |

|

|

751,766 |

|

|

|

815,337 |

|

|

|

1,882,887 |

|

|

|

2,104,779 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING INCOME (LOSS) |

|

|

(329,515 |

) |

|

|

30,291 |

|

|

|

(330,176 |

) |

|

|

176,293 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

323 |

|

|

|

234 |

|

|

|

924 |

|

|

|

618 |

|

|

Interest expense |

|

|

(9,254 |

) |

|

|

(6,993 |

) |

|

|

(27,044 |

) |

|

|

(21,430 |

) |

|

Other |

|

|

16 |

|

|

|

— |

|

|

|

16 |

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total other expense |

|

|

(8,915 |

) |

|

|

(6,759 |

) |

|

|

(26,104 |

) |

|

|

(20,809 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME (LOSS) BEFORE INCOME TAXES |

|

|

(338,430 |

) |

|

|

23,532 |

|

|

|

(356,280 |

) |

|

|

155,484 |

|

|

INCOME TAX EXPENSE (BENEFIT) |

|

|

(112,452 |

) |

|

|

7,556 |

|

|

|

(120,452 |

) |

|

|

50,403 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS) |

|

$ |

(225,978 |

) |

|

$ |

15,976 |

|

|

$ |

(235,828 |

) |

|

$ |

105,081 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS) PER COMMON SHARE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(1.54 |

) |

|

$ |

0.11 |

|

|

$ |

(1.61 |

) |

|

$ |

0.72 |

|

|

Diluted |

|

$ |

(1.54 |

) |

|

$ |

0.11 |

|

|

$ |

(1.61 |

) |

|

$ |

0.71 |

|

|

WEIGHTED AVERAGE NUMBER OF COMMON

SHARES OUTSTANDING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

145,662 |

|

|

|

144,798 |

|

|

|

145,317 |

|

|

|

143,778 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted |

|

|

145,662 |

|

|

|

146,991 |

|

|

|

145,317 |

|

|

|

146,101 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH DIVIDENDS PER COMMON SHARE |

|

$ |

0.10 |

|

|

$ |

0.10 |

|

|

$ |

0.30 |

|

|

$ |

0.30 |

|

PATTERSON-UTI ENERGY, INC.

Additional Financial and Operating Data

(unaudited, dollars in thousands)

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

|

September 30, |

|

|

September 30, |

|

|

|

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

|

Contract Drilling: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

261,817 |

|

|

$ |

482,212 |

|

|

$ |

951,616 |

|

|

$ |

1,346,698 |

|

|

Direct operating costs |

|

$ |

136,718 |

|

|

$ |

278,195 |

|

|

$ |

503,376 |

|

|

$ |

784,572 |

|

|

Margin (1) |

|

$ |

125,099 |

|

|

$ |

204,017 |

|

|

$ |

448,240 |

|

|

$ |

562,126 |

|

|

Selling, general and administrative |

|

$ |

1,599 |

|

|

$ |

1,213 |

|

|

$ |

16,717 |

|

|

$ |

4,452 |

|

|

Depreciation, amortization and impairment |

|

$ |

254,756 |

|

|

$ |

190,657 |

|

|

$ |

497,215 |

|

|

$ |

408,833 |

|

|

Operating income |

|

$ |

(131,256 |

) |

|

$ |

12,147 |

|

|

$ |

(65,692 |

) |

|

$ |

148,841 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating days – United States |

|

|

9,702 |

|

|

|

19,197 |

|

|

|

35,593 |

|

|

|

54,818 |

|

|

Operating days – Canada |

|

|

365 |

|

|

|

887 |

|

|

|

1,205 |

|

|

|

2,043 |

|

|

Operating days – Total |

|

|

10,067 |

|

|

|

20,084 |

|

|

|

36,798 |

|

|

|

56,861 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average revenue per operating day – United States |

|

$ |

25.99 |

|

|

$ |

23.76 |

|

|

$ |

25.88 |

|

|

$ |

23.43 |

|

|

Average direct operating costs per operating day – United States |

|

$ |

13.38 |

|

|

$ |

13.66 |

|

|

$ |

13.46 |

|

|

$ |

13.58 |

|

|

Average margin per operating day – United States (1) |

|

$ |

12.60 |

|

|

$ |

10.10 |

|

|

$ |

12.41 |

|

|

$ |

9.85 |

|

|

Average rigs operating – United States |

|

|

105 |

|

|

|

209 |

|

|

|

130 |

|

|

|

201 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average revenue per operating day – Canada |

|

$ |

26.60 |

|

|

$ |

29.44 |

|

|

$ |

25.40 |

|

|

$ |

30.50 |

|

|

Average direct operating costs per operating day – Canada |

|

$ |

18.86 |

|

|

$ |

17.93 |

|

|

$ |

20.03 |

|

|

$ |

19.75 |

|

|

Average margin per operating day – Canada (1) |

|

$ |

7.74 |

|

|

$ |

11.51 |

|

|

$ |

5.36 |

|

|

$ |

10.74 |

|

|

Average rigs operating – Canada |

|

|

4 |

|

|

|

10 |

|

|

|

4 |

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average revenue per operating day – Total |

|

$ |

26.01 |

|

|

$ |

24.01 |

|

|

$ |

25.86 |

|

|

$ |

23.68 |

|

|

Average direct operating costs per operating day – Total |

|

$ |

13.58 |

|

|

$ |

13.85 |

|

|

$ |

13.68 |

|

|

$ |

13.80 |

|

|

Average margin per operating day – Total (1) |

|

$ |

12.43 |

|

|

$ |

10.16 |

|

|

$ |

12.18 |

|

|

$ |

9.89 |

|

|

Average rigs operating – Total |

|

|

109 |

|

|

|

218 |

|

|

|

135 |

|

|

|

208 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

$ |

111,514 |

|

|

$ |

209,769 |

|

|

$ |

422,876 |

|

|

$ |

546,609 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pressure Pumping: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

154,407 |

|

|

$ |

348,692 |

|

|

$ |

580,752 |

|

|

$ |

895,530 |

|

|

Direct operating costs |

|

$ |

138,597 |

|

|

$ |

281,016 |

|

|

$ |

494,078 |

|

|

$ |

722,801 |

|

|

Margin (2) |

|

$ |

15,810 |

|

|

$ |

67,676 |

|

|

$ |

86,674 |

|

|

$ |

172,729 |

|

|

Selling, general and administrative |

|

$ |

4,019 |

|

|

$ |

4,881 |

|

|

$ |

13,463 |

|

|

$ |

14,816 |

|

|

Depreciation, amortization and impairment |

|

$ |

70,694 |

|

|

$ |

37,587 |

|

|

$ |

165,874 |

|

|

$ |

106,252 |

|

|

Impairment of goodwill |

|

$ |

124,561 |

|

|

$ |

— |

|

|

$ |

124,561 |

|

|

$ |

— |

|

|

Operating income (loss) |

|

$ |

(183,464 |

) |

|

$ |

25,208 |

|

|

$ |

(217,224 |

) |

|

$ |

51,661 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fracturing jobs |

|

|

137 |

|

|

|

358 |

|

|

|

501 |

|

|

|

872 |

|

|

Other jobs |

|

|

517 |

|

|

|

1,228 |

|

|

|

1,670 |

|

|

|

3,166 |

|

|

Total jobs |

|

|

654 |

|

|

|

1,586 |

|

|

|

2,171 |

|

|

|

4,038 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average revenue per fracturing job |

|

$ |

1,081.14 |

|

|

$ |

913.88 |

|

|

$ |

1,108.22 |

|

|

$ |

960.55 |

|

|

Average revenue per other job |

|

$ |

12.17 |

|

|

$ |

17.53 |

|

|

$ |

15.29 |

|

|

$ |

18.30 |

|

|

Average revenue per total job |

|

$ |

236.10 |

|

|

$ |

219.86 |

|

|

$ |

267.50 |

|

|

$ |

221.78 |

|

|

Average costs per total job |

|

$ |

211.92 |

|

|

$ |

177.19 |

|

|

$ |

227.58 |

|

|

$ |

179.00 |

|

|

Average margin per total job (2) |

|

$ |

24.17 |

|

|

$ |

42.67 |

|

|

$ |

39.92 |

|

|

$ |

42.78 |

|

|

Margin as a percentage of revenues (2) |

|

|

10.2 |

% |

|

|

19.4 |

% |

|

|

14.9 |

% |

|

|

19.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures and acquisitions |

|

$ |

29,409 |

|

|

$ |

65,620 |

|

|

$ |

169,228 |

|

|

$ |

198,103 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil and Natural Gas Production and Exploration: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues – Oil |

|

$ |

5,278 |

|

|

$ |

13,299 |

|

|

$ |

18,233 |

|

|

$ |

34,377 |

|

|

Revenues – Natural gas and liquids |

|

$ |

749 |

|

|

$ |

1,425 |

|

|

$ |

2,110 |

|

|

$ |

4,467 |

|

|

Revenues – Total |

|

$ |

6,027 |

|

|

$ |

14,724 |

|

|

$ |

20,343 |

|

|

$ |

38,844 |

|

|

Direct operating costs |

|

$ |

2,519 |

|

|

$ |

3,275 |

|

|

$ |

8,096 |

|

|

$ |

9,421 |

|

|

Margin (3) |

|

$ |

3,508 |

|

|

$ |

11,449 |

|

|

$ |

12,247 |

|

|

$ |

29,423 |

|

|

Depletion |

|

$ |

3,434 |

|

|

$ |

6,218 |

|

|

$ |

12,941 |

|

|

$ |

16,026 |

|

|

Impairment of oil and natural gas properties |

|

$ |

1,898 |

|

|

$ |

2,229 |

|

|

$ |

9,323 |

|

|

$ |

4,060 |

|

|

Operating income (loss) |

|

$ |

(1,824 |

) |

|

$ |

3,002 |

|

|

$ |

(10,017 |

) |

|

$ |

9,337 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

$ |

2,890 |

|

|

$ |

9,489 |

|

|

$ |

14,094 |

|

|

$ |

26,915 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate and Other: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

$ |

12,964 |

|

|

$ |

12,802 |

|

|

$ |

40,415 |

|

|

$ |

38,849 |

|

|

Depreciation |

|

$ |

1,369 |

|

|

$ |

1,134 |

|

|

$ |

4,104 |

|

|

$ |

3,402 |

|

|

Net gain on asset disposals |

|

$ |

(1,362 |

) |

|

$ |

(3,870 |

) |

|

$ |

(7,276 |

) |

|

$ |

(8,705 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

$ |

774 |

|

|

$ |

875 |

|

|

$ |

2,022 |

|

|

$ |

2,164 |

|

|

Total capital expenditures and acquisitions |

|

$ |

144,587 |

|

|

$ |

285,753 |

|

|

$ |

608,220 |

|

|

$ |

773,791 |

|

|

|

(1) |

For Contract Drilling, margin is defined as revenues less direct operating costs and excludes depreciation, amortization and impairment and selling, general and administrative expenses. Average margin per operating day is defined as margin divided by operating days. |

|

|

(2) |

For Pressure Pumping, margin is defined as revenues less direct operating costs and excludes depreciation, amortization and impairment and selling, general and administrative expenses. Total average margin per job is defined as margin divided by total jobs. Margin as a percentage of revenues is defined as margin divided by revenues. |

|

|

(3) |

For Oil and Natural Gas Production and Exploration, margin is defined as revenues less direct operating costs and excludes depletion and impairment. |

|

|

|

September 30, |

|

|

December 31, |

|

|

Selected Balance Sheet Data (unaudited, dollars in thousands): |

|

2015 |

|

|

2014 |

|

|

Cash and cash equivalents |

|

$ |

76,465 |

|

|

$ |

43,012 |

|

|

Current assets |

|

$ |

505,741 |

|

|

$ |

909,092 |

|

|

Current liabilities |

|

$ |

396,077 |

|

|

$ |

568,404 |

|

|

Working capital |

|

$ |

109,664 |

|

|

$ |

340,688 |

|

|

Current portion of long-term debt |

|

$ |

50,000 |

|

|

$ |

12,500 |

|

|

Borrowings under revolving credit facility |

|

$ |

— |

|

|

$ |

303,000 |

|

|

Other long-term debt |

|

$ |

815,000 |

|

|

$ |

670,000 |

|

PATTERSON-UTI ENERGY, INC.

Non-U.S. GAAP Financial Measures

(unaudited, dollars in thousands)

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

|

September 30, |

|

|

September 30, |

|

|

|

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

|

Adjusted Earnings Before Interest, Taxes, Depreciation

and Amortization (Adjusted EBITDA)(1): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

(225,978 |

) |

|

$ |

15,976 |

|

|

$ |

(235,828 |

) |

|

$ |

105,081 |

|

|

Income tax expense (benefit) |

|

|

(112,452 |

) |

|

|

7,556 |

|

|

|

(120,452 |

) |

|

|

50,403 |

|

|

Net interest expense |

|

|

8,931 |

|

|

|

6,759 |

|

|

|

26,120 |

|

|

|

20,812 |

|

|

Depreciation, depletion, amortization and impairment |

|

|

332,151 |

|

|

|

237,825 |

|

|

|

689,457 |

|

|

|

538,573 |

|

|

Impairment of goodwill |

|

|

124,561 |

|

|

|

— |

|

|

|

124,561 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

$ |

127,213 |

|

|

$ |

268,116 |

|

|

$ |

483,858 |

|

|

$ |

714,869 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

|

$ |

422,251 |

|

|

$ |

845,628 |

|

|

$ |

1,552,711 |

|

|

$ |

2,281,072 |

|

|

Adjusted EBITDA margin |

|

|

30.1 |

% |

|

|

31.7 |

% |

|

|

31.2 |

% |

|

|

31.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA by operating segment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contract drilling |

|

$ |

123,500 |

|

|

$ |

202,804 |

|

|

$ |

431,523 |

|

|

$ |

557,674 |

|

|

Pressure pumping |

|

|

11,791 |

|

|

|

62,795 |

|

|

|

73,211 |

|

|

|

157,913 |

|

|

Oil and natural gas |

|

|

3,508 |

|

|

|

11,449 |

|

|

|

12,247 |

|

|

|

29,423 |

|

|

Corporate and other |

|

|

(11,586 |

) |

|

|

(8,932 |

) |

|

|

(33,123 |

) |

|

|

(30,141 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Adjusted EBITDA |

|

$ |

127,213 |

|

|

$ |

268,116 |

|

|

$ |

483,858 |

|

|

$ |

714,869 |

|

|

|

(1) |

Adjusted EBITDA is not defined by accounting principles generally accepted in the United States of America (“U.S. GAAP”). We present Adjusted EBITDA (a non-U.S. GAAP measure) because we believe it provides additional information with respect to both the performance of our fundamental business activities and our ability to meet our capital expenditures and working capital requirements. Adjusted EBITDA should not be construed as an alternative to the U.S. GAAP measures of net income (loss) or operating cash flow. |

Patterson-UTI Energy, Inc.

Impact of Non-Cash Charges

Three Months Ended September 30, 2015

(unaudited, dollars in thousands, except per share amounts)

|

|

|

|

|

|

|

Impairment of goodwill |

|

$ |

(124,561 |

) |

|

Write-down of drilling equipment |

|

|

(131,062 |

) |

|

Write-down of pressure pumping equipment and closed facilities |

|

|

(22,048 |

) |

|

Impairment of oil and natural gas properties |

|

|

(1,898 |

) |

|

Total non-cash charges before income taxes |

|

$ |

(279,569 |

) |

|

|

|

|

|

|

|

Effective tax rate |

|

|

33.2 |

% |

|

|

|

|

|

|

|

After-tax amount |

|

$ |

(186,675 |

) |

|

|

|

|

|

|

|

Weighted average number of common shares outstanding - diluted |

|

|

145,662 |

|

|

|

|

|

|

|

|

Non-cash charges per share - diluted |

|

$ |

(1.28 |

) |

Patterson-UTI Energy, Inc.

Impact of Early Termination Revenues

(unaudited, dollars in thousands)

|

|

|

2015 |

|

|

|

|

Third |

|

|

Second |

|

|

|

|

Quarter |

|

|

Quarter |

|

|

Contract drilling revenues |

|

$ |

261,817 |

|

|

$ |

288,321 |

|

|

Operating days - Total |

|

|

10,067 |

|

|

|

11,211 |

|

|

Average revenue per operating day - Total |

|

$ |

26.01 |

|

|

$ |

25.72 |

|

|

Early termination revenues - Total |

|

$ |

28,869 |

|

|

$ |

15,591 |

|

|

Early termination revenues per operating day - Total |

|

$ |

2.87 |

|

|

$ |

1.39 |

|

|

Average revenue per operating day excluding early termination revenues - Total |

|

$ |

23.14 |

|

|

$ |

24.33 |

|

|

Direct operating costs - Total |

|

$ |

136,718 |

|

|

$ |

153,848 |

|

|

Average direct operating costs per operating day - Total |

|

$ |

13.58 |

|

|

$ |

13.72 |

|

|

Average margin per operating day excluding early termination revenues - Total |

|

$ |

9.56 |

|

|

$ |

10.60 |

|

Patterson-UTI Energy, Inc.

Pressure Pumping Adjusted EBITDA and Adjusted EBITDA Margin

(unaudited, dollars in thousands)

|

|

|

2015 |

|

|

|

|

Third |

|

|

Second |

|

|

|

|

Quarter |

|

|

Quarter |

|

|

Pressure Pumping: |

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

154,407 |

|

|

$ |

176,624 |

|

|

Direct operating costs |

|

|

138,597 |

|

|

|

142,756 |

|

|

Selling, general and administrative |

|

|

4,019 |

|

|

|

4,351 |

|

|

Adjusted EBITDA |

|

$ |

11,791 |

|

|

$ |

29,517 |

|

|

Adjusted EBITDA as a percentage of revenues |

|

|

7.6 |

% |

|

|

16.7 |

% |

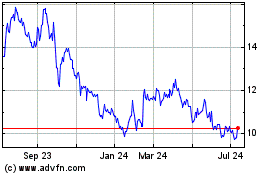

Patterson UTI Energy (NASDAQ:PTEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

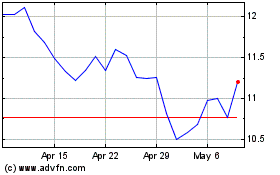

Patterson UTI Energy (NASDAQ:PTEN)

Historical Stock Chart

From Apr 2023 to Apr 2024