EARNINGS PREVIEW: Casinos Reap Benefits From More Visits

April 17 2012 - 12:27PM

Dow Jones News

TAKING THE PULSE: Much like last year, the biggest casino

operators' upcoming first-quarter results are expected to benefit

from economic growth that has driven more well-heeled gamblers from

East Asia to properties in Singapore and Macau. A modest but marked

economic recovery in the U.S. has also pumped up visitor numbers on

the Las Vegas Strip to levels close to their 2007 peak, before the

economic downturn, though rising fuel prices still threaten to damp

demand. Some regional casino operators are also facing stiff

competition from an increasingly crowded field in some parts of the

U.S. That's not the case in Macau, where demand easily outstrips

the tightly-controlled supply of table games.

COMPANIES TO WATCH:

Penn National Gaming Inc. (PENN) - reports April 19

Wall Street Expectations: Analysts polled by Thomson Reuters

project a 59-cent per-share profit with $701 million of revenue. A

year earlier, the company earned 48 cents a share and generated

$667 million of revenue.

Key Issues: Penn National's February earnings outlook revealed

how cautious the U.S. casino operator remains about the domestic

economy. Still-high unemployment remains a drag on its top line,

while cannibalization from competing casinos threatens to hurt

margins in some East Coast markets. Wall Street is a little more

sanguine, with analysts' consensus first-quarter profit view

already ahead of the company's target. Net revenue has steadily

climbed for more than a year, and Penn National recently reached a

deal with the state of Ohio to relocate two racetracks, which the

company had previously said it wanted to do.

Caesars Entertainment Corp. (CZR) - TBA

Wall Street Expectations: Analysts polled by Thomson Reuters

expect a $1.02 per-share loss with $2.11 billion of revenue. A year

earlier, Caesars's closely held predecessor posted a loss of $2.05

for each share held with $2.18 billion of revenue.

Key Issues: Investors snapped up shares of the U.S. casino giant

after it managed a tiny initial public offering in February, even

though the company said its owners would continue to float more

shares. Improvements on the Las Vegas Strip have been helpful to

Caesars and its properties there, but performance has lagged at

other properties in Atlantic City, Louisiana and Mississippi. The

company remains highly levered, and interest expenses will continue

to take a big bite out of earnings in the near term. In future

quarters, Caesars is hoping to see gains if Internet gambling

becomes legal in the U.S., but that is still murky.

Las Vegas Sands Corp. (LVS) - TBA

Wall Street Expectations: Forecasts call for a 59-cent per-share

profit on $2.57 billion in revenue. The company a year earlier

reported a profit of 28 cents a share, or 37 cents excluding the

impact of preferred dividends and other items, as revenue reached

$2.11 billion.

Key Issues: Las Vegas Sands gained a bigger foothold in Macau

this month with the official launch of Sands Cotai Central, its

fourth casino in the Chinese gambling enclave. The company is in a

good position with Macau gambling revenue still posting

double-digit increases, though advisory firm Janney has raised

questions about the company's near-term growth rate in Singapore,

which benefited in the fourth quarter because customers took home

less in winnings. The company's Las Vegas Strip casinos are also

poised to benefit from improving market fundamentals, though growth

will be more modest than in Macau.

MGM Resorts International (MGM) - TBA

Wall Street Expectations: Analysts forecast a loss of 16 cents a

share with $2.26 billion of revenue. A year earlier, MGM posted an

18-cent per-share loss--a loss of 16 cents excluding certain

items--on $1.5 billion in revenue.

Key Issues: MGM's heavy exposure to the Las Vegas Strip should

help its bottom line as visitor numbers improve and its

joint-venture stake in the newer CityCenter property--a source of

punishing write-downs in the past--delivers stronger revenue. The

company is gradually climbing out from under a heavy debt load and

recently sought consents from some bondholders that would allow its

biggest shareholder to cut its stake to less than 15% without

triggering a change of control.

Wynn Resorts Ltd. (WYNN) - TBA

Wall Street Expectations: Analysts project a $1.41 per-share

profit with $1.34 billion of revenue. A year ago, the casino

operator reported a $1.39 per-share profit--$1.38 excluding certain

items--as net revenue reached $1.26 billion.

Key Issues: Wynn's continued earnings growth has been

overshadowed in recent months by the company's headline-grabbing

spat with Japanese gambling tycoon Kazuo Okada. The company in

February forcibly bought out Okada's 20% stake in the company at a

steep discount and accused him of making improper payments to

gambling regulators in the Philippines. Okada has filed a

counterclaim. The risk of further litigation hasn't brought down

Wynn's stock price, however, as still-strong growth in Macau and

improving convention-related visits in Las Vegas help its top

line.

-By Drew FitzGerald, Dow Jones Newswires; 212-416-2909;

andrew.fitzgerald@dowjones.com

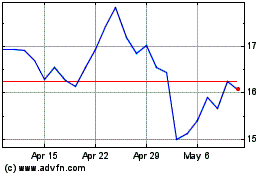

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Mar 2024 to Apr 2024

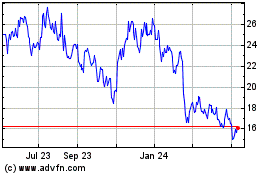

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Apr 2023 to Apr 2024