UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): April 20, 2015

LAM RESEARCH CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

0-12933 |

|

94-2634797 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

4650 Cushing Parkway

Fremont, California 94538

(Address of principal executive offices including zip code)

(510) 572-0200

(Registrant’s telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Table of Contents

| Item 2.02. |

Results of Operations and Financial Condition |

On April 20, 2015, Lam Research Corporation (the

“Company”) issued a press release announcing its financial results for the fiscal quarter ended March 29, 2015, the text of which is attached hereto as Exhibit 99.1.

The information in this Current Report on Form 8-K, including the exhibit, is furnished pursuant to Item 2.02 and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities under that Section. Furthermore, the information in the Current Report on Form 8-K, including the exhibit, shall not be

deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933, as amended.

| Item 9.01. |

Financial Statements and Exhibits |

(d) Exhibits

|

|

|

| 99.1 |

|

Press Release dated April 20, 2015 announcing financial results for the fiscal quarter ended March 29, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Date: April 20, 2015

|

|

|

| LAM RESEARCH CORPORATION |

|

|

| By: |

|

/s/ Douglas R. Bettinger |

|

|

Douglas R. Bettinger |

|

|

Executive Vice President, Chief Financial Officer |

|

|

(Principal Financial Officer and Principal Accounting Officer) |

EXHIBIT INDEX

|

|

|

| 99.1 |

|

Press Release dated April 20, 2015 announcing financial results for the fiscal quarter ended March 29, 2015. |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Lam Research Corporation

Contact:

Audrey Charles, Investor Relations, phone: 510-572-1615, e-mail: audrey.charles@lamresearch.com

Lam Research Corporation Reports Financial Results for the Quarter Ended March 29, 2015

FREMONT, Calif., April 20, 2015 - Lam Research Corp. (NASDAQ: LRCX) today announced financial results for the quarter ended March 29, 2015 (the

“March 2015 quarter”).

Highlights for the March 2015 quarter were as follows:

| |

• |

|

Shipments of $1,497 million, up 20% from the prior quarter. |

| |

• |

|

Revenue of $1,393 million, up 13% from the prior quarter. |

| |

• |

|

GAAP gross margin of 43.1%, GAAP operating margin of 17.2%, and GAAP diluted EPS of $1.16 |

| |

• |

|

Non-GAAP gross margin of 44.7%, non-GAAP operating margin of 19.9%, and non-GAAP diluted EPS of $1.40 |

Lam Research Corporation

Financial Highlights for the Quarters Ended March 29, 2015 and December 28, 2014

(in thousands, except per share data and percentages)

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP |

|

| |

|

March 2015 |

|

|

December 2014 |

|

|

Change Q/Q |

|

| Revenue |

|

$ |

1,393,333 |

|

|

$ |

1,232,241 |

|

|

|

13 |

% |

| Gross margin as percentage of revenue |

|

|

43.1 |

% |

|

|

43.6 |

% |

|

|

-50 |

bps |

| Operating margin as percentage of revenue |

|

|

17.2 |

% |

|

|

15.3 |

% |

|

|

190 |

bps |

| Diluted EPS |

|

$ |

1.16 |

|

|

$ |

1.00 |

|

|

|

16 |

% |

|

| Non-GAAP |

|

| |

|

March 2015 |

|

|

December 2014 |

|

|

Change Q/Q |

|

| Revenue |

|

$ |

1,393,333 |

|

|

$ |

1,232,241 |

|

|

|

13 |

% |

| Gross margin as percentage of revenue |

|

|

44.7 |

% |

|

|

45.4 |

% |

|

|

-70 |

bps |

| Operating margin as percentage of revenue |

|

|

19.9 |

% |

|

|

18.7 |

% |

|

|

120 |

bps |

| Diluted EPS |

|

$ |

1.40 |

|

|

$ |

1.19 |

|

|

|

18 |

% |

GAAP Financial Results

For the March 2015 quarter, revenue was $1,393.3 million, gross margin was $600.6 million, or 43.1% of revenue, operating expenses were $360.6

million, operating margin was 17.2% of revenue, and net income was $206.3 million, or $1.16 per diluted share on a GAAP basis. This compares to revenue of $1,232.2 million, gross margin of $536.7 million, or 43.6% of revenue, operating

expenses of $347.9 million, operating margin of 15.3% of revenue, and net income of $176.9 million, or $1.00 per diluted share, for the quarter ended December 28, 2014 (the “December 2014 quarter”).

Non-GAAP Financial Results

For the March 2015 quarter,

non-GAAP gross margin was $622.2 million or 44.7% of revenue, non-GAAP operating expenses were $345.0 million, non-GAAP operating margin was 19.9% of revenue, and non-GAAP net income was $244.9 million, or $1.40 per diluted share on a non-GAAP

basis. This compares to non-GAAP gross margin of $560.0 million or 45.4% of revenue, non-GAAP operating expenses of $330.2 million, non-GAAP operating margin of 18.7% of revenue, and non-GAAP net income of $207.6 million, or $1.19 per diluted

share for the December 2014 quarter.

“Lam’s March quarter results reached record levels further extending our outperformance trajectory,”

said Martin Anstice, Lam Research’s president and chief executive officer. “Our differentiated products and services are directly addressing the market driving technology inflections of multi-patterning, 3D device architecture and advanced

packaging. Through ever closer collaboration with our customers we are partnering to solve their most critical challenges solidifying our growth opportunity.”

~more~

page 1 of 8

Balance Sheet and Cash Flow Results

The successful issuance of $1.0 billion in bonds in the March 2015 quarter helped increase cash and cash equivalents, short-term investments, and restricted

cash and investment balances to $4.1 billion at the end of the March 2015 quarter compared to $3.0 billion at the end of the December 2014 quarter. Cash provided by operating activities was utilized for approximately $124.9 million of treasury

stock purchases, including net share settlement on employee stock-based compensation, $31.9 million of capital expenditures and $28.7 million of cash dividends paid to stockholders during the March 2015 quarter.

Deferred revenue at the end of the March 2015 quarter increased to $485.2 million as compared to $373.7 million at the end of the December 2014 quarter.

Deferred profit at the end of the March 2015 quarter increased to $303.3 million as compared to $254.8 million at the end of the December 2014 quarter. Lam’s deferred revenue balance does not include shipments to Japanese customers, to

whom title does not transfer until customer acceptance. Shipments to Japanese customers are classified as inventory at cost until the time of acceptance. The anticipated future revenue from shipments to Japanese customers was approximately $45.4

million as of March 29, 2015.

Geographic Distribution

The geographic distribution of shipments and revenue during the March 2015 quarter is shown in the following table:

|

|

|

|

|

|

|

|

|

| Region |

|

Shipments |

|

|

Revenue |

|

| Korea |

|

|

34 |

% |

|

|

35 |

% |

| Taiwan |

|

|

19 |

% |

|

|

20 |

% |

| China |

|

|

19 |

% |

|

|

15 |

% |

| Japan |

|

|

10 |

% |

|

|

11 |

% |

| United States |

|

|

10 |

% |

|

|

10 |

% |

| Europe |

|

|

6 |

% |

|

|

7 |

% |

| Southeast Asia |

|

|

2 |

% |

|

|

2 |

% |

Outlook

For the quarter

ending June 28, 2015, Lam is providing the following guidance:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

GAAP |

|

Reconciling

Items |

|

Non-GAAP |

| Shipments |

|

$1.60 Billion |

|

+/- |

|

$50 Million |

|

— |

|

$1.60 Billion |

|

+/- |

|

$50 Million |

|

|

| Revenue |

|

$1.46 Billion |

|

+/- |

|

$50 Million |

|

— |

|

$1.46 Billion |

|

+/- |

|

$50 Million |

|

|

| Gross margin |

|

44.1% |

|

+/- |

|

1% |

|

$21 Million |

|

45.5% |

|

+/- |

|

1% |

|

|

| Operating margin |

|

18.5% |

|

+/- |

|

1% |

|

$37 Million |

|

21.0% |

|

+/- |

|

1% |

|

|

| Earnings per share |

|

$1.21 |

|

+/- |

|

$0.07 |

|

$39 Million |

|

$1.46 |

|

+/- |

|

$0.07 |

|

|

| Diluted share count |

|

177 Million |

|

3 Million |

|

174 Million |

The information provided above is only an estimate of what the Company believes is realizable as of the date of this release,

and does not incorporate the potential impact of any business combinations, asset acquisitions, divestitures, financing arrangements, other investments, or other significant transactions that may be completed after the date of this release. GAAP to

non-GAAP reconciling items provided include only those items that are known and can be estimated as of the date of this release. Actual results will vary from this model and the variations may be material. Reconciling items included above are as

follows:

| |

• |

|

Gross margin - amortization related to intangible assets acquired in the Novellus transaction, $21 million. |

| |

• |

|

Operating margin - amortization related to intangible assets acquired in the Novellus transaction, $37 million. |

| |

• |

|

Earnings per share - amortization related to intangible assets acquired in the Novellus transaction, $37 million; amortization of note discounts, $9 million; and associated tax benefit for non-GAAP items ($7) million;

totaling $39 million. |

| |

• |

|

Diluted share count - impact of a note hedge issued contemporaneously with the convertible notes due in 2016 and 2018, 3 million shares. |

Use of Non-GAAP Financial Results

In addition to GAAP

results, this press release also contains non-GAAP financial results. The Company’s non-GAAP results for both the March 2015 and December 2014 quarters include the impact of the note hedge issued contemporaneously with the convertible notes due

in 2016 and 2018 and exclude amortization related to intangible assets acquired in the Novellus transaction; acquisition-related inventory fair value impact; selected restructuring charges, net; the amortization of note discounts; and tax benefit of

non-GAAP items. Additionally, the March 2015 quarter non-GAAP results exclude the tax benefit on the successful resolution of certain tax matters. The December 2014 quarter non-GAAP results exclude the net tax benefit on the reinstatement of the

research and development credit.

Management uses non-GAAP gross margin, operating income, operating expenses, operating margin, net income, and net

income per diluted share to evaluate the Company’s operating and financial results. The Company believes the presentation of non-GAAP results is useful to investors for analyzing business trends and comparing performance to prior periods, along

with enhancing investors’ ability to view the Company’s results from management’s perspective. Tables presenting reconciliations of non-GAAP results to GAAP results are included at the end of this press release and on the

Company’s web site at http://investor.lamresearch.com.

page 2 of 8

Lam Announces Financial Results for the March 2015 Quarter

Caution Regarding Forward-Looking Statements

Statements

made in this press release that are not of historical fact are forward-looking statements and are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements relate to, but are not

limited to, the anticipated revenue from shipments to Japanese customers; our ability to continue to reach record levels and outperform the semiconductor equipment industry; our ability to collaborate with our customers and partner to solve their

most critical challenges; our ability to continue to grow our revenue and make progress on our market share objectives; our ability to differentiate our products and services, address market driving technology inflections, and deliver performance

that meets or exceeds our plans, including our abilities to execute on our priorities, and deliver growth; the scope of opportunities we have; our ability to expand our served market; the ability of the market to continue to expand and the extent of

any such expansion; and our guidance for shipments, revenue, gross margin, operating margin, earnings per share, and diluted share count. Some factors that may affect these forward-looking statements include: business conditions in the consumer

electronics industry, the semiconductor industry and the overall economy; the strength of the financial performance of our existing and prospective customers; the introduction of new and innovative technologies; the occurrence and pace of technology

transitions and conversions; the actions of our competitors, consumers, semiconductor companies and key suppliers and subcontractors; and the success of research and development and sales and marketing programs. These forward-looking

statements are based on current expectations and are subject to uncertainties and changes in condition, significance, value and effect as well as other risks, including those detailed in documents filed by us with the Securities

and Exchange Commission, including specifically our report on Form 10-K for the year ended June 29, 2014 and our reports on Form 10-Q for the quarters ended September 28, 2014 and December 28, 2014. These uncertainties

and changes could cause actual results to vary from expectations. The Company undertakes no obligation to update the information or statements made in this press release.

About Lam Research

Lam Research Corp. (NASDAQ: LRCX) is

a trusted global supplier of innovative wafer fabrication equipment and services to the semiconductor industry. Lam’s broad portfolio of market-leading deposition, etch, strip, and wafer cleaning solutions helps customers achieve success on the

wafer by enabling device features that are 1,000 times smaller than a grain of sand, resulting in smaller, faster, and more power-efficient chips. Through collaboration, continuous innovation, and delivering on commitments, Lam is transforming

atomic-scale engineering and enabling its customers to shape the future of technology. Based in Fremont, Calif., Lam Research is a NASDAQ-100 Index ® and S&P 500 ® company whose common stock trades on the NASDAQ ® Global Select Market™ under the symbol LRCX. For more information, please visit

http://www.lamresearch.com. (LRCX-F)

Consolidated Financial Tables Follow.

###

page 3 of 8

Lam Announces Financial Results for the March 2015 Quarter

LAM RESEARCH CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data and percentages)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

March 29,

2015 |

|

|

December 28,

2014 |

|

|

March 30,

2014 |

|

|

March 29,

2015 |

|

|

March 30,

2014 |

|

| Revenue |

|

$ |

1,393,333 |

|

|

$ |

1,232,241 |

|

|

$ |

1,227,392 |

|

|

$ |

3,777,942 |

|

|

$ |

3,358,512 |

|

| Cost of goods sold |

|

|

792,731 |

|

|

|

695,584 |

|

|

|

696,594 |

|

|

|

2,135,144 |

|

|

|

1,908,067 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross margin |

|

|

600,602 |

|

|

|

536,657 |

|

|

|

530,798 |

|

|

|

1,642,798 |

|

|

|

1,450,445 |

|

| Gross margin as a percent of revenue |

|

|

43.1 |

% |

|

|

43.6 |

% |

|

|

43.2 |

% |

|

|

43.5 |

% |

|

|

43.2 |

% |

| Research and development |

|

|

217,865 |

|

|

|

196,768 |

|

|

|

185,978 |

|

|

|

603,567 |

|

|

|

531,022 |

|

| Selling, general and administrative |

|

|

142,772 |

|

|

|

151,148 |

|

|

|

152,883 |

|

|

|

442,227 |

|

|

|

457,604 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

360,637 |

|

|

|

347,916 |

|

|

|

338,861 |

|

|

|

1,045,794 |

|

|

|

988,626 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

239,965 |

|

|

|

188,741 |

|

|

|

191,937 |

|

|

|

597,004 |

|

|

|

461,819 |

|

| Operating margin as a percent of revenue |

|

|

17.2 |

% |

|

|

15.3 |

% |

|

|

15.6 |

% |

|

|

15.8 |

% |

|

|

13.8 |

% |

| Other expense, net |

|

|

(11,389 |

) |

|

|

(9,799 |

) |

|

|

(9,855 |

) |

|

|

(26,836 |

) |

|

|

(27,954 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

228,576 |

|

|

|

178,942 |

|

|

|

182,082 |

|

|

|

570,168 |

|

|

|

433,865 |

|

| Income tax expense |

|

|

22,291 |

|

|

|

2,002 |

|

|

|

17,686 |

|

|

|

45,862 |

|

|

|

34,971 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

206,285 |

|

|

$ |

176,940 |

|

|

$ |

164,396 |

|

|

$ |

524,306 |

|

|

$ |

398,894 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic net income per share |

|

$ |

1.30 |

|

|

$ |

1.11 |

|

|

$ |

1.01 |

|

|

$ |

3.28 |

|

|

$ |

2.46 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted net income per share |

|

$ |

1.16 |

|

|

$ |

1.00 |

|

|

$ |

0.96 |

|

|

$ |

2.96 |

|

|

$ |

2.33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Number of shares used in per share calculations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

158,992 |

|

|

|

159,248 |

|

|

|

162,238 |

|

|

|

159,975 |

|

|

|

161,904 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

177,531 |

|

|

|

177,046 |

|

|

|

171,636 |

|

|

|

177,231 |

|

|

|

171,051 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash dividend declared per share |

|

$ |

0.18 |

|

|

$ |

0.18 |

|

|

$ |

— |

|

|

$ |

0.54 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

page 4 of 8

Lam Announces Financial Results for the March 2015 Quarter

LAM RESEARCH CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

March 29,

2015 |

|

|

December 28,

2014 |

|

|

June 29,

2014 |

|

| |

|

(unaudited) |

|

|

(unaudited) |

|

|

(1) |

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

1,635,636 |

|

|

$ |

981,275 |

|

|

$ |

1,452,677 |

|

| Short-term investments |

|

|

2,313,495 |

|

|

|

1,902,402 |

|

|

|

1,612,967 |

|

| Accounts receivable, net |

|

|

1,046,800 |

|

|

|

944,014 |

|

|

|

800,616 |

|

| Inventories |

|

|

919,679 |

|

|

|

913,390 |

|

|

|

740,503 |

|

| Other current assets |

|

|

145,357 |

|

|

|

173,731 |

|

|

|

176,899 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

6,060,967 |

|

|

|

4,914,812 |

|

|

|

4,783,662 |

|

| Property and equipment, net |

|

|

579,824 |

|

|

|

585,372 |

|

|

|

543,496 |

|

| Restricted cash and investments |

|

|

164,300 |

|

|

|

155,455 |

|

|

|

146,492 |

|

| Goodwill and intangible assets |

|

|

2,242,977 |

|

|

|

2,282,006 |

|

|

|

2,360,303 |

|

| Other assets |

|

|

190,473 |

|

|

|

173,044 |

|

|

|

159,353 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

9,238,541 |

|

|

$ |

8,110,689 |

|

|

$ |

7,993,306 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current liabilities |

|

$ |

1,734,996 |

|

|

$ |

1,708,656 |

|

|

$ |

1,582,001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Long-term debt, convertible notes, and capital leases |

|

$ |

1,831,094 |

|

|

$ |

830,880 |

|

|

$ |

817,202 |

|

| Income taxes payable |

|

|

205,536 |

|

|

|

205,535 |

|

|

|

258,357 |

|

| Other long-term liabilities |

|

|

189,291 |

|

|

|

183,678 |

|

|

|

122,662 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

3,960,917 |

|

|

|

2,928,749 |

|

|

|

2,780,222 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Senior convertible notes |

|

|

180,569 |

|

|

|

181,505 |

|

|

|

183,349 |

|

|

|

|

|

| Stockholders’ equity (2) |

|

|

5,097,055 |

|

|

|

5,000,435 |

|

|

|

5,029,735 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

9,238,541 |

|

|

$ |

8,110,689 |

|

|

$ |

7,993,306 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Derived from audited financial statements |

| (2) |

Common shares issued and outstanding were 158,485 shares as of March 29, 2015, 159,294 shares as of December 28, 2014 and 162,350 shares as of June 29, 2014. |

page 5 of 8

Lam Announces Financial Results for the March 2015 Quarter

LAM RESEARCH CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

March 29,

2015 |

|

|

December 28,

2014 |

|

|

March 30,

2014 |

|

|

March 29,

2015 |

|

|

March 30,

2014 |

|

| CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

206,285 |

|

|

$ |

176,940 |

|

|

$ |

164,396 |

|

|

$ |

524,306 |

|

|

$ |

398,894 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

70,322 |

|

|

|

69,536 |

|

|

|

73,256 |

|

|

|

207,743 |

|

|

|

221,139 |

|

| Deferred income taxes |

|

|

1,739 |

|

|

|

3,320 |

|

|

|

(816 |

) |

|

|

8,245 |

|

|

|

11,641 |

|

| Impairment of long-lived asset |

|

|

— |

|

|

|

— |

|

|

|

4,000 |

|

|

|

— |

|

|

|

11,632 |

|

| Equity-based compensation expense |

|

|

32,948 |

|

|

|

30,632 |

|

|

|

24,334 |

|

|

|

95,620 |

|

|

|

70,615 |

|

| Income tax benefit on equity-based compensation plans |

|

|

2,438 |

|

|

|

1,141 |

|

|

|

— |

|

|

|

13,440 |

|

|

|

— |

|

| Excess tax benefit on equity-based compensation plans |

|

|

(2,204 |

) |

|

|

(599 |

) |

|

|

— |

|

|

|

(13,207 |

) |

|

|

— |

|

| Amortization of convertible note discount |

|

|

8,749 |

|

|

|

8,609 |

|

|

|

8,313 |

|

|

|

25,867 |

|

|

|

24,652 |

|

| Gain on sale of business |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(7,431 |

) |

|

|

— |

|

| Other, net |

|

|

1,902 |

|

|

|

1,607 |

|

|

|

2,741 |

|

|

|

9,035 |

|

|

|

4,428 |

|

| Changes in operating assets and liabilities: |

|

|

(131,142 |

) |

|

|

(129,947 |

) |

|

|

13,986 |

|

|

|

(370,181 |

) |

|

|

(271,843 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

|

191,037 |

|

|

|

161,239 |

|

|

|

290,210 |

|

|

|

493,437 |

|

|

|

471,158 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital expenditures and intangible assets |

|

|

(31,898 |

) |

|

|

(61,363 |

) |

|

|

(41,638 |

) |

|

|

(135,132 |

) |

|

|

(103,739 |

) |

| Cash paid for business acquisition |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,137 |

) |

|

|

(18,388 |

) |

| Net purchases of available-for-sale securities |

|

|

(359,416 |

) |

|

|

(321,590 |

) |

|

|

(82,744 |

) |

|

|

(671,361 |

) |

|

|

(128,931 |

) |

| Purchase of other investment |

|

|

(2,500 |

) |

|

|

— |

|

|

|

— |

|

|

|

(2,500 |

) |

|

|

— |

|

| Repayment of notes receivable |

|

|

— |

|

|

|

3,978 |

|

|

|

— |

|

|

|

3,978 |

|

|

|

10,000 |

|

| Proceeds from sale of business, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

41,212 |

|

|

|

— |

|

| Proceeds from sale of assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

21,635 |

|

| Transfer of restricted cash and investments |

|

|

(822 |

) |

|

|

100 |

|

|

|

28,572 |

|

|

|

(700 |

) |

|

|

28,722 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash used for investing activities |

|

|

(394,636 |

) |

|

|

(378,875 |

) |

|

|

(95,810 |

) |

|

|

(765,640 |

) |

|

|

(190,701 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Principal payments on long-term debt and capital lease obligations |

|

|

(119 |

) |

|

|

(674 |

) |

|

|

(112 |

) |

|

|

(900 |

) |

|

|

(919 |

) |

| Proceeds from issuance of long-term debt, net issuance costs |

|

|

991,880 |

|

|

|

— |

|

|

|

— |

|

|

|

991,880 |

|

|

|

— |

|

| Excess tax benefit (expense) on equity-based compensation plans |

|

|

2,204 |

|

|

|

599 |

|

|

|

(296 |

) |

|

|

13,207 |

|

|

|

(296 |

) |

| Treasury stock purchases |

|

|

(124,943 |

) |

|

|

(65,536 |

) |

|

|

(52,415 |

) |

|

|

(498,901 |

) |

|

|

(204,610 |

) |

| Dividends paid |

|

|

(28,724 |

) |

|

|

(29,381 |

) |

|

|

— |

|

|

|

(87,345 |

) |

|

|

— |

|

| Reissuances of treasury stock related to employee stock purchase plan |

|

|

14,934 |

|

|

|

— |

|

|

|

13,210 |

|

|

|

31,853 |

|

|

|

28,329 |

|

| Proceeds from issuance of common stock |

|

|

7,403 |

|

|

|

4,223 |

|

|

|

5,111 |

|

|

|

16,235 |

|

|

|

26,134 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by (used for) financing activities |

|

|

862,635 |

|

|

|

(90,769 |

) |

|

|

(34,502 |

) |

|

|

466,029 |

|

|

|

(151,362 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Effect of exchange rate changes on cash |

|

|

(4,675 |

) |

|

|

(3,998 |

) |

|

|

(152 |

) |

|

|

(10,867 |

) |

|

|

733 |

|

| Net increase (decrease) in cash and cash equivalents |

|

|

654,361 |

|

|

|

(312,403 |

) |

|

|

159,746 |

|

|

|

182,959 |

|

|

|

129,828 |

|

| Cash and cash equivalents at beginning of period |

|

|

981,275 |

|

|

|

1,293,678 |

|

|

|

1,132,555 |

|

|

|

1,452,677 |

|

|

|

1,162,473 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at end of period |

|

$ |

1,635,636 |

|

|

$ |

981,275 |

|

|

$ |

1,292,301 |

|

|

$ |

1,635,636 |

|

|

$ |

1,292,301 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

page 6 of 8

Lam Announces Financial Results for the March 2015 Quarter

Non-GAAP Financial Summary

(in thousands, except percentages, share, and per share data)

(unaudited)

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Three Months Ended |

|

| |

|

March 29,

2015 |

|

|

December 28,

2014 |

|

| Revenue |

|

$ |

1,393,333 |

|

|

$ |

1,232,241 |

|

| Gross margin |

|

$ |

622,196 |

|

|

$ |

560,044 |

|

| Gross margin as percentage of revenue |

|

|

44.7 |

% |

|

|

45.4 |

% |

| Operating expenses |

|

$ |

345,049 |

|

|

$ |

330,213 |

|

| Operating income |

|

$ |

277,147 |

|

|

$ |

229,831 |

|

| Operating margin as a percentage of revenue |

|

|

19.9 |

% |

|

|

18.7 |

% |

| Net income |

|

$ |

244,911 |

|

|

$ |

207,631 |

|

| Net income per diluted share |

|

$ |

1.40 |

|

|

$ |

1.19 |

|

| Shares used in per share calculation - diluted |

|

|

174,471 |

|

|

|

174,316 |

|

Reconciliation of U.S. GAAP Net Income to Non-GAAP Net Income and U.S. GAAP number of dilutive shares to

Non-GAAP number of dilutive shares

(in thousands, except share and per share data)

(unaudited)

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Three Months Ended |

|

| |

|

March 29,

2015 |

|

|

December 28,

2014 |

|

| U.S. GAAP net income |

|

$ |

206,285 |

|

|

$ |

176,940 |

|

| Pre-tax non-GAAP items: |

|

|

|

|

|

|

|

|

| Amortization related to intangible assets acquired in Novellus transaction - cost of goods sold |

|

|

21,286 |

|

|

|

21,286 |

|

| Acquisition-related inventory fair value impact - cost of goods sold |

|

|

308 |

|

|

|

2,101 |

|

| Amortization related to intangible assets acquired in Novellus transaction - operating expenses |

|

|

16,083 |

|

|

|

16,083 |

|

| Restructuring (benefits) charges - operating expenses |

|

|

(495 |

) |

|

|

1,620 |

|

| Amortization of note discounts - other expense, net |

|

|

8,749 |

|

|

|

8,609 |

|

| Net tax benefit on non-GAAP items |

|

|

(7,181 |

) |

|

|

(7,914 |

) |

| Net tax benefit on reinstatement of research and development credit |

|

|

— |

|

|

|

(11,094 |

) |

| Net tax benefit on successful resolution of certain tax matters |

|

|

(124 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net income |

|

$ |

244,911 |

|

|

$ |

207,631 |

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net income per diluted share |

|

$ |

1.40 |

|

|

$ |

1.19 |

|

|

|

|

|

|

|

|

|

|

| U.S. GAAP number of shares used for diluted per share calculation |

|

|

177,531 |

|

|

|

177,046 |

|

| Effect of convertible note hedge |

|

|

(3,060 |

) |

|

|

(2,730 |

) |

|

|

|

|

|

|

|

|

|

| Non-GAAP number of shares used for diluted per share calculation |

|

|

174,471 |

|

|

|

174,316 |

|

|

|

|

|

|

|

|

|

|

page 7 of 8

Lam Announces Financial Results for the March 2015 Quarter

Reconciliation of U.S. GAAP Gross Margin, Operating Expenses and Operating Income to Non-GAAP Gross Margin, Operating Expenses and Operating

Income

(in thousands, except percentages)

(unaudited)

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Three Months Ended |

|

| |

|

March 29,

2015 |

|

|

December 28,

2014 |

|

| U.S. GAAP gross margin |

|

$ |

600,602 |

|

|

$ |

536,657 |

|

| Pre-tax non-GAAP items: |

|

|

|

|

|

|

|

|

| Amortization related to intangible assets acquired in Novellus transaction - cost of goods sold |

|

|

21,286 |

|

|

|

21,286 |

|

| Acquisition-related inventory fair value impact - cost of goods sold |

|

|

308 |

|

|

|

2,101 |

|

|

|

|

|

|

|

|

|

|

| Non-GAAP gross margin |

|

$ |

622,196 |

|

|

$ |

560,044 |

|

|

|

|

|

|

|

|

|

|

| U.S. GAAP gross margin as a percentage of revenue |

|

|

43.1 |

% |

|

|

43.6 |

% |

| Non-GAAP gross margin as a percentage of revenue |

|

|

44.7 |

% |

|

|

45.4 |

% |

| U.S. GAAP operating expenses |

|

$ |

360,637 |

|

|

$ |

347,916 |

|

| Pre-tax non-GAAP items: |

|

|

|

|

|

|

|

|

| Amortization related to intangible assets acquired in Novellus transaction - operating expenses |

|

|

(16,083 |

) |

|

|

(16,083 |

) |

| Restructuring benefits (charges) - operating expenses |

|

|

495 |

|

|

|

(1,620 |

) |

|

|

|

|

|

|

|

|

|

| Non-GAAP operating expenses |

|

$ |

345,049 |

|

|

$ |

330,213 |

|

|

|

|

|

|

|

|

|

|

| Non-GAAP operating income |

|

$ |

277,147 |

|

|

$ |

229,831 |

|

|

|

|

|

|

|

|

|

|

| GAAP operating margin as a percent of revenue |

|

|

17.2 |

% |

|

|

15.6 |

% |

| Non-GAAP operating margin as a percent of revenue |

|

|

19.9 |

% |

|

|

18.7 |

% |

page 8 of 8

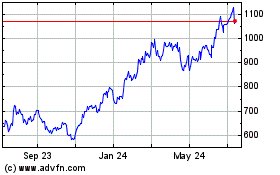

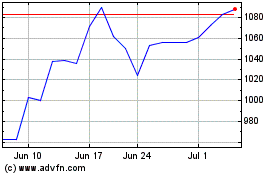

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Apr 2023 to Apr 2024