UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 28, 2015

IAC/INTERACTIVECORP

(Exact name of registrant as specified in charter)

|

Delaware |

|

0-20570 |

|

59-2712887 |

|

(State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

|

of incorporation) |

|

File Number) |

|

Identification No.) |

|

555 West 18th Street, New York, NY |

|

10011 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (212) 314-7300

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

Item 7.01 Regulation FD Disclosure.

On April 28, 2015, the Registrant issued a press release announcing its results for the quarter ended March 31, 2015. The full text of the press release, appearing in Exhibit 99.1 hereto, is incorporated herein by reference.

Prepared remarks by the Registrant’s management for the quarter ended March 31, 2015 and forward-looking statements, appearing in Exhibit 99.2 hereto and as posted on the “Investors” section of the Registrant’s website (www.iac.com) on April 28, 2015, are incorporated herein by reference.

Exhibits 99.1 and 99.2 are being furnished under both Item 2.02 “Results of Operations and Financial Condition” and Item 7.01 “Regulation FD Disclosure.”

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

IAC/INTERACTIVECORP |

|

|

|

|

|

|

By: |

/s/ Gregg Winiarski |

|

|

Name: |

Gregg Winiarski |

|

|

Title: |

Executive Vice President, |

|

|

|

General Counsel and Secretary |

Date: April 28, 2015

3

EXHIBIT INDEX

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

Press Release of IAC/InterActiveCorp dated, April 28, 2015. |

|

|

|

|

|

99.2 |

|

Prepared Remarks by IAC/InterActiveCorp Management, dated April 28, 2015. |

4

Exhibit 99.1

IAC REPORTS Q1 2015 RESULTS

NEW YORK— April 28, 2015—IAC (NASDAQ: IACI) released first quarter 2015 results today and published management’s prepared remarks on the Investors section of its website at www.iac.com/Investors.

SUMMARY RESULTS

($ in millions except per share amounts)

|

|

|

Q1 2015 |

|

Q1 2014 |

|

Growth |

|

|

Revenue |

|

$ |

772.5 |

|

$ |

740.2 |

|

4 |

% |

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

75.2 |

|

108.1 |

|

-30 |

% |

|

Adjusted Net Income |

|

38.4 |

|

51.6 |

|

-26 |

% |

|

Adjusted EPS |

|

0.43 |

|

0.59 |

|

-27 |

% |

|

|

|

|

|

|

|

|

|

|

Operating Income |

|

35.1 |

|

71.7 |

|

-51 |

% |

|

Net Income |

|

26.4 |

|

35.9 |

|

-26 |

% |

|

GAAP Diluted EPS |

|

0.30 |

|

0.41 |

|

-28 |

% |

|

|

|

|

|

|

|

|

|

|

See reconciliations of GAAP to non-GAAP measures beginning on page 10.

· Consolidated revenue increased 4% year-over-year in the first quarter driven by solid growth at The Match Group, Media and eCommerce, partially offset by modest declines at Search & Applications.

· The Match Group revenue increased 13%, or 19% excluding the effects of foreign exchange, driven by contributions from The Princeton Review and FriendScout24, acquired on August 1, 2014 and August 31, 2014, respectively, and 16% growth in Dating paid subscribers to over 4.0 million globally. Dating revenue increased 2%, or 8% excluding the effects of foreign exchange.

· Search & Applications revenue decreased 4% driven by 7% and 1% declines at Websites and Applications, respectively.

· In the Media segment, Vimeo grew paid subscribers 29% to nearly 600,000. IAC Films contributed revenue of $5.3 million during the quarter with While We’re Young released in theaters in March 2015.

· In the eCommerce segment, HomeAdvisor domestic revenue and service requests increased 34% and 38%, respectively, while overall HomeAdvisor revenue grew 24%.

· Consolidated Adjusted EBITDA decreased 30% year-over-year in the first quarter driven by increased investment at The Match Group, Media and eCommerce and lower revenue at Search & Applications, partially offset by lower Corporate expenses.

· IAC repurchased 3.0 million shares of common stock between February 3, 2015 and April 24, 2015 at an average price of $67.68 per share, or $200.0 million in aggregate.

· IAC declared a quarterly cash dividend of $0.34 per share, payable on June 1, 2015 to IAC stockholders of record as of the close of business on May 15, 2015.

SEE IMPORTANT NOTES AT END OF THIS DOCUMENT

DISCUSSION OF FINANCIAL AND OPERATING RESULTS

|

|

|

Q1 2015 |

|

Q1 2014 |

|

Growth |

|

|

|

|

$ in millions |

|

|

|

|

Revenue |

|

|

|

|

|

|

|

|

Search & Applications |

|

$ |

382.9 |

|

$ |

398.0 |

|

-4 |

% |

|

The Match Group |

|

239.2 |

|

211.2 |

|

13 |

% |

|

Media |

|

43.6 |

|

36.4 |

|

20 |

% |

|

eCommerce |

|

107.0 |

|

94.8 |

|

13 |

% |

|

Intercompany Elimination |

|

(0.2 |

) |

(0.2 |

) |

-27 |

% |

|

|

|

$ |

772.5 |

|

$ |

740.2 |

|

4 |

% |

|

Adjusted EBITDA |

|

|

|

|

|

|

|

|

Search & Applications |

|

$ |

78.9 |

|

$ |

82.1 |

|

-4 |

% |

|

The Match Group |

|

25.9 |

|

47.4 |

|

-45 |

% |

|

Media |

|

(14.6 |

) |

(7.9 |

) |

-85 |

% |

|

eCommerce |

|

(3.1 |

) |

2.8 |

|

NM |

|

|

Corporate |

|

(11.9 |

) |

(16.3 |

) |

27 |

% |

|

|

|

$ |

75.2 |

|

$ |

108.1 |

|

-30 |

% |

|

Operating Income (Loss) |

|

|

|

|

|

|

|

|

Search & Applications |

|

$ |

64.3 |

|

$ |

70.3 |

|

-9 |

% |

|

The Match Group |

|

25.3 |

|

39.8 |

|

-36 |

% |

|

Media |

|

(15.4 |

) |

(8.6 |

) |

-79 |

% |

|

eCommerce |

|

(6.9 |

) |

(1.6 |

) |

-339 |

% |

|

Corporate |

|

(32.3 |

) |

(28.3 |

) |

-14 |

% |

|

|

|

$ |

35.1 |

|

$ |

71.7 |

|

-51 |

% |

Search & Applications

Websites revenue decreased 7% due primarily to a decline in revenue at Ask.com, partially offset by strong growth at About.com. Applications revenue decreased 1% due to lower queries in B2B (our partnership operations), partially offset by strength in our B2C business, including query growth in our desktop search applications, as well as the contribution from mobile applications (via our acquisition of Apalon on November 3, 2014) and SlimWare (acquired April 1, 2014). Adjusted EBITDA decreased 4% due primarily to the lower revenue and the impact of the write-off of $2.3 million of deferred revenue in connection with the acquisition of SlimWare. Operating income decreased 9% as the current year period was negatively impacted by a $4.0 million contingent consideration fair value adjustment.

SEE IMPORTANT NOTES AT END OF THIS DOCUMENT

The Match Group

Dating revenue grew 2% due primarily to 8% growth in North America driven by increased paid subscribers, partially offset by 8% lower International revenue due to foreign exchange effects, despite an increase in paid subscribers. Excluding foreign exchange effects, total Dating revenue would have increased 8% and International revenue would have increased 9%. Non-dating(1) revenue, which benefited from the acquisition of The Princeton Review, grew 372%. Adjusted EBITDA decreased 45% due to increased marketing spend at Dating and DailyBurn, losses from The Princeton Review, which was not in the prior year period, $3.3 million of costs in the current year related to the ongoing consolidation and streamlining of our technology systems and European operations at our Dating businesses as well as a $3.9 million benefit in the prior year related to the expiration of the statute of limitations for a non-income tax matter. Operating income reflects a positive $11.0 million contingent consideration fair value adjustment in the current year period.

Media

Revenue increased 20% due principally to the contribution from IAC Films and solid growth at Vimeo. The Adjusted EBITDA loss was larger than the prior year due primarily to increased investment in Vimeo.

eCommerce

Revenue increased 13% due to significant growth at HomeAdvisor. Adjusted EBITDA losses were $3.1 million in the first quarter versus profits in the prior year due primarily to increased investment at HomeAdvisor.

Corporate

The Corporate Adjusted EBITDA loss decreased due primarily to lower compensation costs. Corporate operating loss reflects an increase of $8.3 million in stock-based compensation expense due primarily to a higher number of forfeited awards in the prior year and the impact of a modification of certain awards in the current year.

OTHER ITEMS

The effective tax rates for continuing operations in Q1 2015 and Q1 2014 were 22% and 38%, respectively, and the effective tax rates for Adjusted Net Income in Q1 2015 and Q1 2014 were 34% and 36%, respectively. The effective rate for continuing operations was lower in Q1 2015 due primarily to the non-taxable gain on contingent consideration fair value adjustments in the current year.

Note 1: Includes The Princeton Review, Tutor.com and DailyBurn.

SEE IMPORTANT NOTES AT END OF THIS DOCUMENT

LIQUIDITY AND CAPITAL RESOURCES

As of March 31, 2015, IAC had 81.9 million common and class B common shares outstanding. As of April 24, 2015, the Company had 5.6 million shares remaining in its stock repurchase authorization. IAC may purchase shares over an indefinite period on the open market and in privately negotiated transactions, depending on those factors IAC management deems relevant at any particular time, including, without limitation, market conditions, share price and future outlook.

As of March 31, 2015, IAC had $877.2 million in cash and cash equivalents and marketable securities as well as $1.1 billion in long-term debt. The Company has $300 million in unused borrowing capacity under its revolving credit facility.

SEE IMPORTANT NOTES AT END OF THIS DOCUMENT

OPERATING METRICS

|

|

|

Q1 2015 |

|

Q1 2014 |

|

Growth |

|

|

|

|

|

|

|

|

|

|

|

SEARCH & APPLICATIONS (in millions) |

|

|

|

|

|

|

|

|

Revenue |

|

|

|

|

|

|

|

|

Websites (a) |

|

$ |

189.7 |

|

$ |

203.7 |

|

-7 |

% |

|

Applications (b) |

|

193.2 |

|

194.3 |

|

-1 |

% |

|

Total Revenue |

|

$ |

382.9 |

|

$ |

398.0 |

|

-4 |

% |

|

|

|

|

|

|

|

|

|

|

Websites Page Views (c) |

|

6,385 |

|

8,276 |

|

-23 |

% |

|

Applications Queries (d) |

|

5,081 |

|

5,183 |

|

-2 |

% |

|

|

|

|

|

|

|

|

|

|

THE MATCH GROUP |

|

|

|

|

|

|

|

|

Dating Revenue (in millions) |

|

|

|

|

|

|

|

|

North America (e) |

|

$ |

145.2 |

|

$ |

134.5 |

|

8 |

% |

|

International (f) |

|

64.9 |

|

70.5 |

|

-8 |

% |

|

Total Dating Revenue |

|

$ |

210.1 |

|

$ |

205.0 |

|

2 |

% |

|

|

|

|

|

|

|

|

|

|

Dating Paid Subscribers (in thousands) |

|

|

|

|

|

|

|

|

North America (e) |

|

2,702 |

|

2,389 |

|

13 |

% |

|

International (f) |

|

1,310 |

|

1,079 |

|

21 |

% |

|

Total Dating Paid Subscribers |

|

4,012 |

|

3,468 |

|

16 |

% |

|

|

|

|

|

|

|

|

|

|

HOMEADVISOR (in thousands) |

|

|

|

|

|

|

|

|

Domestic Service Requests (g) |

|

1,811 |

|

1,310 |

|

38 |

% |

|

Domestic Accepts (h) |

|

2,233 |

|

1,635 |

|

37 |

% |

|

|

|

|

|

|

|

|

|

|

International Service Requests (g) (i) |

|

284 |

|

234 |

|

22 |

% |

|

International Accepts (h) (i) |

|

548 |

|

518 |

|

6 |

% |

(a) Websites revenue is principally composed of Ask.com, About.com, CityGrid, Dictionary.com, Investopedia, PriceRunner and Ask.fm.

(b) Applications revenue includes B2C, B2B, SlimWare and Apalon.

(c) Websites page views include Ask.com, About.com, CityGrid, Dictionary.com, Investopedia and PriceRunner. Historical figures have been adjusted to exclude Urbanspoon which was sold in Q4 2014.

(d) Applications queries include B2C and B2B.

(e) North America includes Match, Chemistry, People Media, OkCupid, Tinder and other dating businesses operating within the United States and Canada.

(f) International includes Meetic, Tinder and all dating businesses operating outside of the United States and Canada.

(g) Fully completed and submitted customer service requests on HomeAdvisor.

(h) The number of times service requests are accepted by service professionals. A service request can be transmitted to and accepted by more than one service professional.

(i) HomeAdvisor International historical figures have been adjusted to include the Netherlands business and exclude certain operations that ceased in Q4 2014.

SEE IMPORTANT NOTES AT END OF THIS DOCUMENT

DILUTIVE SECURITIES

IAC has various tranches of dilutive securities. The table below details these securities as well as potential dilution at various stock prices (shares in millions; rounding differences may occur).

|

|

|

|

|

Avg. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exercise |

|

As of |

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

Price |

|

4/24/15 |

|

Dilution at: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Price |

|

|

|

|

|

$ |

72.14 |

|

$ |

75.00 |

|

$ |

80.00 |

|

$ |

85.00 |

|

$ |

90.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Absolute Shares as of 4/24/15 |

|

82.1 |

|

|

|

82.1 |

|

82.1 |

|

82.1 |

|

82.1 |

|

82.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RSUs and Other |

|

5.0 |

|

|

|

5.0 |

|

4.8 |

|

4.5 |

|

4.3 |

|

4.1 |

|

|

Options |

|

7.9 |

|

$ |

47.75 |

|

2.8 |

|

2.9 |

|

3.2 |

|

3.5 |

|

3.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Dilution |

|

|

|

|

|

7.7 |

|

7.7 |

|

7.7 |

|

7.8 |

|

7.8 |

|

|

% Dilution |

|

|

|

|

|

8.6 |

% |

8.6 |

% |

8.6 |

% |

8.6 |

% |

8.7 |

% |

|

Total Diluted Shares Outstanding |

|

|

|

|

|

89.8 |

|

89.8 |

|

89.8 |

|

89.8 |

|

89.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONFERENCE CALL

IAC will audiocast a conference call to answer questions regarding the Company’s first quarter 2015 results and management’s published remarks on Wednesday, April 29, 2015, at 8:30 a.m. Eastern Time. This call will include the disclosure of certain information, including forward-looking information, which may be material to an investor’s understanding of IAC’s business. The live audiocast will be open to the public at, and management’s remarks have been posted on, www.iac.com/Investors.

SEE IMPORTANT NOTES AT END OF THIS DOCUMENT

GAAP FINANCIAL STATEMENTS

IAC CONSOLIDATED STATEMENT OF OPERATIONS

($ in thousands except per share amounts)

|

|

|

Three Months Ended March 31, |

|

|

|

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

772,512 |

|

$ |

740,247 |

|

|

Operating costs and expenses: |

|

|

|

|

|

|

Cost of revenue (exclusive of depreciation shown separately below) |

|

191,553 |

|

209,234 |

|

|

Selling and marketing expense |

|

357,666 |

|

298,599 |

|

|

General and administrative expense |

|

114,794 |

|

95,089 |

|

|

Product development expense |

|

45,257 |

|

38,816 |

|

|

Depreciation |

|

15,568 |

|

14,818 |

|

|

Amortization of intangibles |

|

12,555 |

|

11,979 |

|

|

Total operating costs and expenses |

|

737,393 |

|

668,535 |

|

|

|

|

|

|

|

|

|

Operating income |

|

35,119 |

|

71,712 |

|

|

|

|

|

|

|

|

|

Interest expense |

|

(14,064 |

) |

(14,064 |

) |

|

Other income (expense), net |

|

6,988 |

|

(1,958 |

) |

|

Earnings from continuing operations before income taxes |

|

28,043 |

|

55,690 |

|

|

Income tax provision |

|

(6,180 |

) |

(21,385 |

) |

|

Earnings from continuing operations |

|

21,863 |

|

34,305 |

|

|

Earnings (loss) from discontinued operations, net of tax |

|

125 |

|

(814 |

) |

|

Net earnings |

|

21,988 |

|

33,491 |

|

|

Net loss attributable to noncontrolling interests |

|

4,417 |

|

2,394 |

|

|

Net earnings attributable to IAC shareholders |

|

$ |

26,405 |

|

$ |

35,885 |

|

|

|

|

|

|

|

|

|

Per share information attributable to IAC shareholders: |

|

|

|

|

|

|

Basic earnings per share from continuing operations |

|

$ |

0.31 |

|

$ |

0.44 |

|

|

Diluted earnings per share from continuing operations |

|

$ |

0.30 |

|

$ |

0.42 |

|

|

|

|

|

|

|

|

|

Basic earnings per share |

|

$ |

0.32 |

|

$ |

0.44 |

|

|

Diluted earnings per share |

|

$ |

0.30 |

|

$ |

0.41 |

|

|

|

|

|

|

|

|

|

Dividends declared per common share |

|

$ |

0.34 |

|

$ |

0.24 |

|

|

|

|

|

|

|

|

|

Stock-based compensation expense by function: |

|

|

|

|

|

|

Cost of revenue |

|

$ |

245 |

|

$ |

(8 |

) |

|

Selling and marketing expense |

|

1,723 |

|

196 |

|

|

General and administrative expense |

|

14,598 |

|

7,952 |

|

|

Product development expense |

|

2,345 |

|

1,473 |

|

|

Total stock-based compensation expense |

|

$ |

18,911 |

|

$ |

9,613 |

|

SEE IMPORTANT NOTES AT END OF THIS DOCUMENT

IAC CONSOLIDATED BALANCE SHEET

($ in thousands)

|

|

|

March 31, |

|

December 31, |

|

|

|

|

2015 |

|

2014 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

671,597 |

|

$ |

990,405 |

|

|

Marketable securities |

|

205,621 |

|

160,648 |

|

|

Accounts receivable, net |

|

232,464 |

|

236,086 |

|

|

Other current assets |

|

184,261 |

|

166,742 |

|

|

Total current assets |

|

1,293,943 |

|

1,553,881 |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

297,956 |

|

302,459 |

|

|

Goodwill |

|

1,720,901 |

|

1,754,926 |

|

|

Intangible assets, net |

|

469,552 |

|

491,936 |

|

|

Long-term investments |

|

123,679 |

|

114,983 |

|

|

Other non-current assets |

|

52,074 |

|

56,693 |

|

|

TOTAL ASSETS |

|

$ |

3,958,105 |

|

$ |

4,274,878 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

Accounts payable, trade |

|

$ |

83,446 |

|

$ |

81,163 |

|

|

Deferred revenue |

|

214,476 |

|

194,988 |

|

|

Accrued expenses and other current liabilities |

|

327,830 |

|

397,803 |

|

|

Total current liabilities |

|

625,752 |

|

673,954 |

|

|

|

|

|

|

|

|

|

Long-term debt |

|

1,080,000 |

|

1,080,000 |

|

|

Income taxes payable |

|

29,300 |

|

32,635 |

|

|

Deferred income taxes |

|

407,784 |

|

409,529 |

|

|

Other long-term liabilities |

|

34,260 |

|

45,191 |

|

|

|

|

|

|

|

|

|

Redeemable noncontrolling interests |

|

28,295 |

|

40,427 |

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

Common stock |

|

253 |

|

252 |

|

|

Class B convertible common stock |

|

16 |

|

16 |

|

|

Additional paid-in capital |

|

11,434,220 |

|

11,415,617 |

|

|

Retained earnings |

|

322,848 |

|

325,118 |

|

|

Accumulated other comprehensive loss |

|

(143,273 |

) |

(87,700 |

) |

|

Treasury stock |

|

(9,861,350 |

) |

(9,661,350 |

) |

|

Total IAC shareholders’ equity |

|

1,752,714 |

|

1,991,953 |

|

|

Noncontrolling interests |

|

— |

|

1,189 |

|

|

Total shareholders’ equity |

|

1,752,714 |

|

1,993,142 |

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

$ |

3,958,105 |

|

$ |

4,274,878 |

|

SEE IMPORTANT NOTES AT END OF THIS DOCUMENT

IAC CONSOLIDATED STATEMENT OF CASH FLOWS

($ in thousands)

|

|

|

Three Months Ended March 31, |

|

|

|

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

Cash flows from operating activities attributable to continuing operations: |

|

|

|

|

|

|

Net earnings |

|

$ |

21,988 |

|

$ |

33,491 |

|

|

Less: earnings (loss) from discontinued operations, net of tax |

|

125 |

|

(814 |

) |

|

Earnings from continuing operations |

|

21,863 |

|

34,305 |

|

|

Adjustments to reconcile earnings from continuing operations to net cash (used in) provided by operating activities attributable to continuing operations: |

|

|

|

|

|

|

Stock-based compensation expense |

|

18,911 |

|

9,613 |

|

|

Depreciation |

|

15,568 |

|

14,818 |

|

|

Amortization of intangibles |

|

12,555 |

|

11,979 |

|

|

Excess tax benefits from stock-based awards |

|

(16,846 |

) |

(24,203 |

) |

|

Deferred income taxes |

|

867 |

|

3,799 |

|

|

Equity in losses of unconsolidated affiliates |

|

283 |

|

1,935 |

|

|

Acquisition-related contingent consideration fair value adjustments |

|

(6,996 |

) |

(27 |

) |

|

Other adjustments, net |

|

(476 |

) |

3,985 |

|

|

Changes in assets and liabilities, net of effects of acquisitions: |

|

|

|

|

|

|

Accounts receivable |

|

(3,847 |

) |

(20,387 |

) |

|

Other assets |

|

6,775 |

|

(4,100 |

) |

|

Accounts payable and other current liabilities |

|

(33,420 |

) |

(11,655 |

) |

|

Income taxes payable |

|

(41,359 |

) |

6,697 |

|

|

Deferred revenue |

|

23,001 |

|

16,917 |

|

|

Other changes in assets and liabilities, net |

|

(689 |

) |

(1,035 |

) |

|

Net cash (used in) provided by operating activities attributable to continuing operations |

|

(3,810 |

) |

42,641 |

|

|

Cash flows from investing activities attributable to continuing operations: |

|

|

|

|

|

|

Acquisitions, net of cash acquired |

|

(5,709 |

) |

(77,981 |

) |

|

Capital expenditures |

|

(12,876 |

) |

(9,721 |

) |

|

Proceeds from maturities and sales of marketable debt securities |

|

6,050 |

|

— |

|

|

Purchases of marketable debt securities |

|

(47,930 |

) |

(32,848 |

) |

|

Purchases of long-term investments |

|

(8,345 |

) |

(7,861 |

) |

|

Other, net |

|

2,843 |

|

(157 |

) |

|

Net cash used in investing activities attributable to continuing operations |

|

(65,967 |

) |

(128,568 |

) |

|

Cash flows from financing activities attributable to continuing operations: |

|

|

|

|

|

|

Purchase of treasury stock |

|

(200,000 |

) |

— |

|

|

Dividends |

|

(28,675 |

) |

(20,004 |

) |

|

Issuance of common stock, net of withholding taxes |

|

(10,339 |

) |

920 |

|

|

Excess tax benefits from stock-based awards |

|

16,846 |

|

24,203 |

|

|

Purchase of noncontrolling interests |

|

(15,338 |

) |

(30,000 |

) |

|

Funds returned from escrow for Meetic tender offer |

|

— |

|

12,354 |

|

|

Acquisition-related contingent consideration payments |

|

(180 |

) |

— |

|

|

Other, net |

|

110 |

|

(295 |

) |

|

Net cash used in financing activities attributable to continuing operations |

|

(237,576 |

) |

(12,822 |

) |

|

Total cash used in continuing operations |

|

(307,353 |

) |

(98,749 |

) |

|

Effect of exchange rate changes on cash and cash equivalents |

|

(11,455 |

) |

1,616 |

|

|

Net decrease in cash and cash equivalents |

|

(318,808 |

) |

(97,133 |

) |

|

Cash and cash equivalents at beginning of period |

|

990,405 |

|

1,100,444 |

|

|

Cash and cash equivalents at end of period |

|

$ |

671,597 |

|

$ |

1,003,311 |

|

SEE IMPORTANT NOTES AT END OF THIS DOCUMENT

RECONCILIATIONS OF GAAP TO NON-GAAP MEASURES

IAC RECONCILIATION OF OPERATING CASH FLOW FROM CONTINUING OPERATIONS TO FREE CASH FLOW

($ in millions; rounding differences may occur)

|

|

|

Three Months Ended March 31, |

|

|

|

|

2015 |

|

2014 |

|

|

Net cash (used in) provided by operating activities attributable to continuing operations |

|

$ |

(3.8 |

) |

$ |

42.6 |

|

|

Capital expenditures |

|

(12.9 |

) |

(9.7 |

) |

|

Tax payments (refunds) related to sales of a business and an investment |

|

0.1 |

|

(0.8 |

) |

|

Free Cash Flow |

|

$ |

(16.6 |

) |

$ |

32.1 |

|

For the three months ended March 31, 2015, consolidated Free Cash Flow decreased $48.7 million due to lower Adjusted EBITDA, higher income tax payments and higher capital expenditures.

IAC RECONCILIATION OF GAAP EPS TO ADJUSTED EPS

(in thousands except per share amounts)

|

|

|

Three Months Ended March 31, |

|

|

|

|

2015 |

|

2014 |

|

|

Net earnings attributable to IAC shareholders |

|

$ |

26,405 |

|

$ |

35,885 |

|

|

Stock-based compensation expense |

|

18,911 |

|

9,613 |

|

|

Amortization of intangibles |

|

12,555 |

|

11,979 |

|

|

Acquisition-related contingent consideration fair value adjustments |

|

(6,996 |

) |

(27 |

) |

|

Gain on sale of VUE interests and related effects |

|

— |

|

968 |

|

|

Discontinued operations, net of tax |

|

(125 |

) |

814 |

|

|

Impact of income taxes and noncontrolling interests |

|

(12,382 |

) |

(7,607 |

) |

|

Adjusted Net Income |

|

$ |

38,368 |

|

$ |

51,625 |

|

|

|

|

|

|

|

|

|

GAAP Basic weighted average shares outstanding |

|

83,453 |

|

82,484 |

|

|

Options and RSUs, treasury method |

|

5,305 |

|

4,720 |

|

|

GAAP Diluted weighted average shares outstanding |

|

88,758 |

|

87,204 |

|

|

Impact of RSUs |

|

326 |

|

284 |

|

|

Adjusted EPS weighted average shares outstanding |

|

89,084 |

|

87,488 |

|

|

|

|

|

|

|

|

|

GAAP Diluted earnings per share |

|

$ |

0.30 |

|

$ |

0.41 |

|

|

|

|

|

|

|

|

|

Adjusted EPS |

|

$ |

0.43 |

|

$ |

0.59 |

|

For Adjusted EPS purposes, the impact of RSUs on shares outstanding is based on the weighted average number of RSUs outstanding, including performance-based RSUs outstanding that the Company believes are probable of vesting. For GAAP diluted EPS purposes, RSUs, including performance-based RSUs for which the performance criteria have been met, are included on a treasury method basis.

SEE IMPORTANT NOTES AT END OF THIS DOCUMENT

IAC RECONCILIATION OF SEGMENT NON-GAAP MEASURE TO GAAP MEASURE

($ in millions; rounding differences may occur)

|

|

|

For the three months ended March 31, 2015 |

|

|

|

|

Adjusted

EBITDA |

|

Stock-based

compensation

expense |

|

Depreciation |

|

Amortization of

intangibles |

|

Acquisition-related

contingent

consideration fair

value adjustments |

|

Operating

income (loss) |

|

|

Search & Applications |

|

$ |

78.9 |

|

$ |

— |

|

$ |

(3.6 |

) |

$ |

(7.0 |

) |

$ |

(4.0 |

) |

$ |

64.3 |

|

|

The Match Group |

|

25.9 |

|

(0.6 |

) |

(7.1 |

) |

(3.9 |

) |

11.0 |

|

25.3 |

|

|

Media |

|

(14.6 |

) |

(0.1 |

) |

(0.2 |

) |

(0.4 |

) |

— |

|

(15.4 |

) |

|

eCommerce |

|

(3.1 |

) |

(0.4 |

) |

(2.0 |

) |

(1.3 |

) |

— |

|

(6.9 |

) |

|

Corporate |

|

(11.9 |

) |

(17.7 |

) |

(2.7 |

) |

— |

|

— |

|

(32.3 |

) |

|

Total |

|

$ |

75.2 |

|

$ |

(18.9 |

) |

$ |

(15.6 |

) |

$ |

(12.6 |

) |

$ |

7.0 |

|

$ |

35.1 |

|

|

|

|

For the three months ended March 31, 2014 |

|

|

|

|

Adjusted

EBITDA |

|

Stock-based

compensation

expense |

|

Depreciation |

|

Amortization of

intangibles |

|

Acquisition-related

contingent

consideration fair

value adjustments |

|

Operating

income (loss) |

|

|

Search & Applications |

|

$ |

82.1 |

|

$ |

— |

|

$ |

(4.5 |

) |

$ |

(7.3 |

) |

$ |

— |

|

$ |

70.3 |

|

|

The Match Group |

|

47.4 |

|

— |

|

(5.8 |

) |

(1.8 |

) |

— |

|

39.8 |

|

|

Media |

|

(7.9 |

) |

(0.2 |

) |

(0.3 |

) |

(0.3 |

) |

— |

|

(8.6 |

) |

|

eCommerce |

|

2.8 |

|

— |

|

(1.7 |

) |

(2.6 |

) |

— |

|

(1.6 |

) |

|

Corporate |

|

(16.3 |

) |

(9.4 |

) |

(2.5 |

) |

— |

|

— |

|

(28.3 |

) |

|

Total |

|

$ |

108.1 |

|

$ |

(9.6 |

) |

$ |

(14.8 |

) |

$ |

(12.0 |

) |

$ |

— |

|

$ |

71.7 |

|

SEE IMPORTANT NOTES AT END OF THIS DOCUMENT

IAC’S PRINCIPLES OF FINANCIAL REPORTING

IAC reports Adjusted EBITDA, Adjusted Net Income, Adjusted EPS and Free Cash Flow, all of which are supplemental measures to GAAP. These measures are among the primary metrics by which we evaluate the performance of our businesses, on which our internal budgets are based and by which management is compensated. We believe that investors should have access to, and we are obligated to provide, the same set of tools that we use in analyzing our results. These non-GAAP measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results. IAC endeavors to compensate for the limitations of the non-GAAP measures presented by providing the comparable GAAP measures with equal or greater prominence and descriptions of the reconciling items, including quantifying such items, to derive the non-GAAP measures. We encourage investors to examine the reconciling adjustments between the GAAP and non-GAAP measures, which are included in this release. Interim results are not necessarily indicative of the results that may be expected for a full year.

Definitions of Non-GAAP Measures

Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA) is defined as operating income excluding: (1) stock-based compensation expense; (2) depreciation; and (3) acquisition-related items consisting of (i) amortization of intangible assets and goodwill and intangible asset impairments and (ii) gains and losses recognized on changes in the fair value of contingent consideration arrangements. We believe Adjusted EBITDA is a useful measure for analysts and investors as this measure allows a more meaningful comparison between our performance and that of our competitors. Moreover, our management uses this measure internally to evaluate the performance of our business as a whole and our individual business segments. The above items are excluded from our Adjusted EBITDA measure because these items are non-cash in nature, and we believe that by excluding these items, Adjusted EBITDA corresponds more closely to the cash operating income generated from our business, from which capital investments are made and debt is serviced.

Adjusted Net Income generally captures all items on the statement of operations that have been, or ultimately will be, settled in cash and is defined as net earnings attributable to IAC shareholders excluding, net of tax effects and noncontrolling interests, if applicable: (1) stock-based compensation expense, (2) acquisition-related items consisting of (i) amortization of intangibles and goodwill and intangible asset impairments and (ii) gains and losses recognized on changes in the fair value of contingent consideration arrangements, (3) income or loss effects related to IAC’s former passive ownership in VUE, and (4) discontinued operations. We believe Adjusted Net Income is useful to investors because it represents IAC’s consolidated results taking into account depreciation, which management believes is an ongoing cost of doing business, as well as other charges that are not allocated to the operating businesses such as interest expense, income taxes and noncontrolling interests, but excluding the effects of any other non-cash expenses.

Adjusted EPS is defined as Adjusted Net Income divided by fully diluted weighted average shares outstanding for Adjusted EPS purposes. We include dilution from options and warrants in accordance with the treasury stock method and include all restricted stock units (“RSUs”) in shares outstanding for Adjusted EPS, with performance-based RSUs included based on the number of shares that the Company believes are probable of vesting. This differs from the GAAP method for including RSUs, which are treated on a treasury method, and performance-based RSUs, which are included for GAAP purposes only to the extent the performance criteria have been met (assuming the end of the reporting period is the end of the contingency period). Shares outstanding for Adjusted EPS purposes are therefore higher than shares outstanding for GAAP EPS purposes. We believe Adjusted EPS is useful to investors because it represents, on a per share basis, IAC’s consolidated results, taking into account depreciation, which we believe is an ongoing cost of doing business, as well as other charges, which are not allocated to the operating businesses such as interest expense, income taxes and noncontrolling interests, but excluding the effects of any other non-cash expenses. Adjusted Net Income and Adjusted EPS have the same limitations as Adjusted EBITDA, and in addition, Adjusted Net Income and Adjusted EPS do not account for IAC’s former passive ownership in VUE. Therefore, we think it is important to evaluate these measures along with our consolidated statement of operations.

SEE IMPORTANT NOTES AT END OF THIS DOCUMENT

IAC’S PRINCIPLES OF FINANCIAL REPORTING - continued

Free Cash Flow is defined as net cash provided by operating activities, less capital expenditures. In addition, Free Cash Flow excludes, if applicable, tax payments and refunds related to the sales of certain businesses and investments, including IAC’s interests in VUE, an internal restructuring and dividends received that represent a return of capital due to the exclusion of the proceeds from these sales and dividends from cash provided by operating activities. We believe Free Cash Flow is useful to investors because it represents the cash that our operating businesses generate, before taking into account non-operational cash movements. Free Cash Flow has certain limitations in that it does not represent the total increase or decrease in the cash balance for the period, nor does it represent the residual cash flow for discretionary expenditures. For example, it does not take into account stock repurchases. Therefore, we think it is important to evaluate Free Cash Flow along with our consolidated statement of cash flows.

Non-Cash Expenses That Are Excluded From Our Non-GAAP Measures

Stock-based compensation expense consists principally of expense associated with the grants, including unvested grants assumed in acquisitions, of stock options, restricted stock units and performance-based RSUs. These expenses are not paid in cash, and we include the related shares in our fully diluted shares outstanding using the treasury stock method; however, performance-based RSUs are included only to the extent the performance criteria have been met (assuming the end of the reporting period is the end of the contingency period). We view the true cost of stock options, restricted stock units and performance-based RSUs as the dilution to our share base, and such awards are included in our shares outstanding for Adjusted EPS purposes as described above under the definition of Adjusted EPS. Upon the exercise of certain stock options and vesting of restricted stock units and performance-based RSUs, the awards are settled, at the Company’s discretion, on a net basis, with the Company remitting the required tax-withholding amount from its current funds.

Depreciation is a non-cash expense relating to our property and equipment and is computed using the straight-line method to allocate the cost of depreciable assets to operations over their estimated useful lives.

Amortization of intangible assets and goodwill and intangible asset impairments are non-cash expenses relating primarily to acquisitions. At the time of an acquisition, the identifiable definite-lived intangible assets of the acquired company, such as content, technology, customer lists, advertiser and supplier relationships, are valued and amortized over their estimated lives. Value is also assigned to acquired indefinite-lived intangible assets, which comprise trade names and trademarks, and goodwill that are not subject to amortization. An impairment is recorded when the carrying value of an intangible asset or goodwill exceeds its fair value. While it is likely that we will have significant intangible amortization expense as we continue to acquire companies, we believe that intangible assets represent costs incurred by the acquired company to build value prior to acquisition and the related amortization and impairment charges of intangible assets or goodwill, if applicable, are not ongoing costs of doing business.

Gains and losses recognized on changes in the fair value of contingent consideration arrangements are accounting adjustments to report contingent consideration liabilities at fair value. These adjustments can be highly variable and are excluded from our assessment of performance because they are considered non-operational in nature and, therefore, are not indicative of current or future performance or ongoing costs of doing business.

Income or loss effects related to IAC’s former passive ownership in VUE are excluded from Adjusted Net Income and Adjusted EPS because IAC had no operating control over VUE, which was sold for a gain in 2005, had no way to forecast this business, and did not consider the results of VUE in evaluating the performance of IAC’s businesses.

Free Cash Flow

We look at Free Cash Flow as a measure of the strength and performance of our businesses, not for valuation purposes. In our view, applying “multiples” to Free Cash Flow is inappropriate because it is subject to timing, seasonality and one-time events. We manage our business for cash and we think it is of utmost importance to maximize cash — but our primary valuation metrics are Adjusted EBITDA and Adjusted EPS.

SEE IMPORTANT NOTES AT END OF THIS DOCUMENT

OTHER INFORMATION

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995

This press release and our conference call, which will be held at 8:30 a.m. Eastern Time on April 29, 2015, may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The use of words such as “anticipates,” “estimates,” “expects,” “intends,” “plans” and “believes,” among others, generally identify forward-looking statements. These forward-looking statements include, among others, statements relating to: IAC’s future financial performance, IAC’s business prospects and strategy, anticipated trends and prospects in the industries in which IAC’s businesses operate and other similar matters. These forward-looking statements are based on management’s current expectations and assumptions about future events, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. Actual results could differ materially from those contained in these forward-looking statements for a variety of reasons, including, among others: changes in senior management at IAC and/or its businesses, changes in our relationship with, or policies implemented by, Google, adverse changes in economic conditions, either generally or in any of the markets in which IAC’s businesses operate, adverse trends in the online advertising industry or the advertising industry generally, our ability to convert visitors to our various websites into users and customers, our ability to offer new or alternative products and services in a cost-effective manner and consumer acceptance of these products and services, operational and financial risks relating to acquisitions, changes in industry standards and technology, our ability to expand successfully into international markets and regulatory changes. Certain of these and other risks and uncertainties are discussed in IAC’s filings with the Securities and Exchange Commission (“SEC”). Other unknown or unpredictable factors that could also adversely affect IAC’s business, financial condition and results of operations may arise from time to time. In light of these risks and uncertainties, these forward-looking statements may not prove to be accurate. Accordingly, you should not place undue reliance on these forward-looking statements, which only reflect the views of IAC management as of the date of this press release. IAC does not undertake to update these forward-looking statements.

About IAC

IAC (NASDAQ: IACI) is a leading media and Internet company. It is organized into four segments: The Match Group, which consists of dating, education and fitness businesses with brands such as Match.com, OkCupid, Tinder, The Princeton Review and DailyBurn; Search & Applications, which includes brands such as About.com, Ask.com, Dictionary.com and Investopedia; Media, which consists of businesses such as Vimeo, Electus, The Daily Beast and CollegeHumor; and eCommerce, which includes HomeAdvisor and ShoeBuy. IAC’s brands and products are among the most recognized in the world reaching users in over 200 countries. The Company is headquartered in New York City and has offices worldwide. To view a full list of IAC companies, please visit www.iac.com.

Contact Us

IAC Investor Relations

Mark Schneider / Alexandra Caffrey

(212) 314-7400

IAC Corporate Communications

Isabelle Weisman

(212) 314-7361

IAC

555 West 18th Street, New York, NY 10011 (212) 314-7300 http://iac.com

* * *

SEE IMPORTANT NOTES AT END OF THIS DOCUMENT

Exhibit 99.2

IAC Q1 2015 Management’s Prepared Remarks

Set forth below are IAC management’s prepared remarks relating to IAC’s earnings announcement for the first quarter of 2015. IAC will audiocast a conference call to answer questions regarding the Company’s Q1 financial results and these prepared remarks on Wednesday, April 29, 2015 at 8:30 a.m. Eastern Time. The live audiocast will be open to the public at www.iac.com/Investors. These prepared remarks will not be read on the call.

Non-GAAP Financial Measures

These prepared remarks contain references to certain non-GAAP measures which, as a reminder, include Adjusted EBITDA, to which we’ll refer in these prepared remarks as “EBITDA” for simplicity. These non-GAAP financial measures should be considered in conjunction with, but not as a substitute for, financial information presented in accordance with GAAP. Please refer to our Q1 2015 press release and the investor relations section of our website for all comparable GAAP measures and full reconciliations for all material non-GAAP measures.

Please see the Safe Harbor Statement at the end of these remarks.

The Match Group (Greg Blatt, Chairman, The Match Group)

The Match Group had a strong first quarter.

Growth in Dating paid member count (PMC) accelerated dramatically. Part of this is attributable to the launch of Tinder Plus in March, but healthy performance in the other businesses also contributed meaningfully. Specifically, PMC growth rates for the quarter in North America, excluding Tinder, nicely exceeded the 5% rate we ended the year with, reinforcing our general belief in the overall expansion of the market and the portfolio approach to capturing it.

Dating revenue was up only 2% year over year, but this was depressed by FX effects. Holding FX constant to the year-ago period, Dating revenue was up 8%. Given Tinder Plus launched in the final

1

month of the quarter, its revenue impact was muted, and stronger revenue contributions are expected the rest of the year. Revenue for The Match Group was up 13% over last year (19% without FX effects) driven both by solid increases in DailyBurn and the acquisition of The Princeton Review.

As expected, EBITDA was down meaningfully this quarter, driven by factors outlined in our earnings release.

We launched Tinder Plus globally in March of Q1. Payment and renewal rates came in solidly against expectations. As we mentioned previously, however, there is lots of learning in these early stages, and while we expect momentum and contribution to build meaningfully over time, we don’t expect it to build on a straight line basis. Our principal focus will continue to be on maximizing the customer experience, with revenue growth a secondary consideration in the near term, and there likely will be pivots along the way that make the near term growth trajectory a little bumpy. Christopher Payne started with us as the new CEO a month ago, and we’re confident his addition to the team positions Tinder to achieve our lofty objectives for this business.

With respect to our other businesses, the trends we were experiencing in January have generally continued. Registrations increased substantially in the quarter, driven in part by an expanding number of profitable paid marketing opportunities, especially in mobile. Additionally, the costs of registrations are coming down. However, the substantial shift to mobile also pushes down conversion rates, both from the secular shift from desktop to mobile, although this gap is narrowing due to product work, and from the expanding traffic sources and new audiences coming in through mobile channels, which have a lower propensity to convert. The net of all this is meaningful growth in users, trailed by growth in PMC at more modest, albeit solid, rates. It’s a good start to the year following a volatile 2014 for these businesses.

Our technology consolidation continues, as does the execution of the related project to consolidate Meetic from 7 principal locations down to 3. In Q1, we incurred approximately $3.3 million of costs in connection with these projects. In Q2 we expect to incur approximately $9 million of these costs with approximately $5 million in the second half of the year. (When discussing EBITDA numbers for The Match Group, in both these and future remarks, I do so excluding these costs.)

Turning to our non-Dating businesses, Q1 is the pivotal quarter for the DailyBurn business, and ours was a good one, growing subscribers meaningfully. Marketing efforts will ratchet down for the rest of the

2

year while product development continues, as we strive to take advantage of the wave of streaming content consumption. At The Princeton Review, we completed the launch of our integrated consumer offering, with academic tutoring and test prep services now being offered through a unified product under a unified brand. Over the remainder of the year we will continue to integrate operations and add to the consumer experience and expect to have real momentum exiting 2015. We expect that The Princeton Review will be worthy of real investor interest in 2016.

Tinder continues to infuse this year’s projections with a greater deal of uncertainty than usual, just by virtue of its early stage of development. However, taking that into account as best we can:

· We expect revenue growth in Dating to climb into the high single digits in Q2, with The Match Group into the high teens, with comparable or modestly higher year over year growth rates in the second half of the year.

· We expect Q2 EBITDA growth to be positive, though modest, given what appear to be increasing opportunities to spend marketing dollars profitably. For the full year, we expect EBITDA growth to be at solid double digit levels.

Overall, this continues to be a heavy execution and transitional year, but so far so good. We expect a lot of growth over the next few years.

Search & Applications (Joey Levin, CEO, Search & Applications)

The quarter came in as expected, with nice growth in our publishing businesses and consumer applications as we continue to invest in great content, new apps and richer user experiences across all devices. As discussed last quarter, contribution from Ask and the B2B desktop business did decline, and continued to shrink as a portion of the overall economic picture for IAC Search & Applications.

On our publishing platform, we are starting to reach critical scale. We have begun to see the benefits not only to individual businesses when applying best practices across each property, led by About.com, but we’re also starting to see technology investments driving results across all the businesses horizontally. For example, we deployed a system for optimizing yield on programmatic ad inventory across multiple brands that on Dictionary.com alone has delivered a nearly 20% lift to the value of display ads so far

3

while improving user experience with more relevant ads. And we have higher expectations as we extend to more properties.

As we have added new brands to our portfolio and expanded our audience, we’re now much more capable of matching the right users with the right advertisers at the best price. About.com’s evolution to become a true premium publisher is most advanced; total display ad revenue grew 40% and mobile display ad revenue more than doubled y/y. This effort has required real investment in technology, scale in audience, and a liquid market of advertiser demand, which benefits all the properties. And most importantly, we’re delivering the most beautiful content experience we’ve ever had for both users and advertisers across multiple devices.

We are also continuing to improve content creation. Our seasoned editorial teams are now supported by the data of all of our brands, using custom-built internal systems that help us understand the interests, user-paths, and behavior of our audiences. As a result, we create content that appeals to both users and advertisers more effectively. We’re able to execute that content strategy across over 1,000 topics and multiple brands by leveraging our Expert network and technological infrastructure. At About, we now have data to prove we are hiring better Experts (attracting audience faster), enabling them to select better topics to cover (higher topic success rate), and helping them write more engaging content (as compared to Experts brought on the network prior to our changes). So we are seeing positive trends in terms of our ability to produce and monetize at scale.

As far as distribution, our most successful channel in attracting users at scale has been through search, both algorithmic and paid, where we get well over 100 million domestic users a month to our properties, with mobile audience continuing to grow nicely. As users search for the content they want across more devices, we continue to see opportunity throughout the globe in these tried and true channels because we’ve built the systems capable of matching our content with relevant users in real-time on a global basis. Social media will be another meaningful source for us — particularly as we develop our tools and targeting to better tease out indicia of intent. We more than doubled our traffic from social sources since last summer’s redesign on About.com, but it’s still tiny as a fraction of total users and we see tremendous room for growth. And traffic from email subscribers are growing even faster.

Few if any other digital publishers have reached our scale in publishing content custom built for all the distribution outlets that matter today, including search, social, email, and content networks. The amount of distribution available through these platforms is poised to continue to grow for some time as each platform invests more in augmenting their audience intelligence systems while the traditional media

4

“push” platforms continue to shed audience, mindshare, and advertisers. We are building our content businesses to embrace the ongoing reality that about $1 billion of circulation and advertising revenue shifts out of print every year, and we expect to continue to capture a growing portion of that opportunity.

At Ask.com, as discussed last quarter, we have been retooling the business since our ability to market the product through certain channels was impacted earlier this year. We have been creating an improved knowledge base comprised of vetted, reliable, and proprietary answers to user questions and have found early test results encouraging. The combination of our algorithmic search expertise with systems that enable us to produce superior quality answers at scale means better relevancy. And from a UI perspective, the question and answer output looks and feels much more like a high-gloss publication than a user-generated web forum. We’ll need to prove this model out over the next few quarters.

On the Applications side, the B2C products continue to do very well. The desktop business had a great quarter and we’ve ramped marketing back up since the browser changes in the middle of last year. New products like Internet Speed Tracker are resonating with users; after launching last year it now ranks in our Top 10 free desktop applications by revenue. We’ve also retooled our marketing spend for the new environment, and are benefiting from increased revenue per query on desktop both in the US and internationally. And progress outside of search revenue continues with SlimWare, where we now have more than one million active, paid licenses and expect that figure to continue to grow throughout the year. GAAP losses at SlimWare have narrowed as we get past the deferred revenue write-downs from the acquisition. On the mobile side, Apalon now has 55 apps in 10 categories, and in 5 of those categories we have at least one app ranking in the Top 5. At the moment, our NOAA Radar Pro is the #3 ranked paid app in the App Store overall. While monetization in non-game mobile apps is still very early, we’re optimistic that a combination of paid, in-app sales, and advertising will start to grow our revenue per user to the point where we will be able to meaningfully expand our marketing potential.

All-in, we still expect to do over $300 million of EBITDA for the year, with Q2 down high single digits sequentially from Q1 on revenue and down slightly more on EBITDA as we will have a full quarter of the changes at Ask, in addition to pulling back on some experimental marketing spend in Q1 which drove revenue but didn’t deliver our expected returns. In addition to Ask, some of the other legacy businesses which are winding down or have been sold will be a drag on y/y revenue and profit growth for the year, but still deliver positive cash to the business. Those transitory issues, specifically on Websites revenue, will mask some of the growth in the key content publishing assets which are all individually expected to grow over the course of the year. So we’re on pace to grow the content publishing businesses and continue to adjust the Applications business to take advantage of today’s changing landscape.

5

Media and eCommerce (Jeff Kip, CFO, IAC)

HomeAdvisor turned in another strong performance in the first quarter, with 24% overall revenue growth year-over-year, or 27% before the impact of foreign currency. Our core U.S. business, which represents approximately 80% of total HomeAdvisor revenue, grew 34% in the first quarter — the 6th straight quarter in which revenue growth has accelerated — and April has accelerated yet again from there. Overall HomeAdvisor growth is modestly below the core business growth rate for the quarter (and will be similarly for the remainder of 2015) because, at the end of 2014, we restructured our European business and closed some unprofitable lines of revenue. We expect the business, which has been profitable since we acquired it as ServiceMagic in 2004, to continue to grow at its current pace and finish the year approaching $350 million in total revenue.

The key driver of HomeAdvisor’s success has been our ability to both drive demand and create a great user experience for both the consumer and professional sides of the home services marketplace. In our business, on the consumer side, the most critical factor for customer satisfaction is being matched with the appropriate service professional for the job — and HomeAdvisor is incredibly effective at doing so because of the depth and breadth of its network of more than 90,000 active professionals. Conversely, a professional is most satisfied when she or he is matched with a consumer who needs and is ready to pay for the specific services that professional offers — and we have been able to very efficiently acquire motivated consumers who in turn request services from our professionals on our site — service requests from consumers were up 38% year-over-year in the 1st quarter.

We have worked very hard to improve user experience for HomeAdvisor users, and we are continuing to innovate our product offering. We are currently in the process of rolling out our Instant Booking product, which allows consumers to book appointments into a service professional’s calendar directly from their desktop and mobile devices — and we are also rolling out subscription software to service professionals to make the process seamless for them. We are extremely excited about Instant Booking — it launched in its 7th and 8th markets and will be national this summer. We’ve received overwhelmingly positive feedback and seen increased satisfaction scores from both professionals and consumers who have used it. We believe that through Instant Booking and related products such as Instant Connect — where we connect the consumer directly by phone to an appropriate service professional — that we will transform the experience for both the consumer and the service professional and distance ourselves from the competition in the home services market.

6

In the Media segment, Vimeo continues to grow its leading platform for high quality online video distribution. Vimeo now has more than 20,000 titles for viewing in its Vimeo on Demand library and more than 600,000 subscribers to its creator product. Vimeo is doubling down on its content acquisition for the VOD platform, with the number of licensed titles up 5x year-over-year and plans to accelerate that growth, and viewing transactions are growing apace, having nearly tripled over the 1st quarter of 2014. Vimeo is currently preparing to roll out subscription video on demand this summer, giving creators the ability to deliver and consumers the ability to view content through a subscription offering.

Primarily due to timing issues at Electus, where we have seen some programming moving out of the 4th quarter and into 2016, and the decision to increase investment at Vimeo, we now expect upwards of $10 million of overall investment across the eCommerce and Media segments incremental to our prior expectation, with a significant majority of the total remaining investment for 2015 taking place in the 2nd quarter. At the same time, we now expect to see greater revenue growth for the two segments than we did previously, reaching the high teens percent in 2015, led by HomeAdvisor and Vimeo, as the investments we are making in those businesses yield returns. 2nd quarter revenue growth will be roughly in line with to somewhat stronger than 1st quarter revenue growth for the two segments.

Safe Harbor Statement

These prepared remarks contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The use of words such as “anticipates,” “estimates,” “expects,” “intends,” “plans” and “believes,” among others, generally identify forward-looking statements. These forward-looking statements include, among others, statements relating to: IAC’s future financial performance, IAC’s business prospects and strategy, anticipated trends and prospects in the industries in which IAC’s businesses operate and other similar matters. These forward-looking statements are based on management’s current expectations and assumptions about future events, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. Actual results could differ materially from those contained in these forward-looking statements for a variety of reasons, including, among others: changes in senior management at IAC and/or its businesses, changes in our relationship with, or policies implemented by, Google, adverse changes in economic conditions, either generally or in any of the markets in which IAC’s businesses operate, adverse trends in the online advertising industry or the advertising industry generally, our ability to convert visitors to our various websites into users and customers, our ability to offer new or alternative products and services in a cost-effective manner and consumer acceptance of these

7

products and services, operational and financial risks relating to acquisitions, changes in industry standards and technology, our ability to expand successfully into international markets and regulatory changes. Certain of these and other risks and uncertainties are discussed in IAC’s filings with the Securities and Exchange Commission. Other unknown or unpredictable factors that could also adversely affect IAC’s business, financial condition and results of operations may arise from time to time. In light of these risks and uncertainties, these forward-looking statements may not prove to be accurate. Accordingly, you should not place undue reliance on these forward-looking statements, which only reflect the views of IAC management as of the date of IAC’s Q1 2015 quarterly earnings announcement. IAC does not undertake to update these forward-looking statements.

8

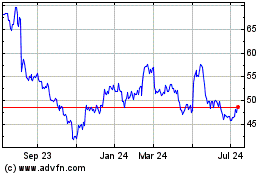

IAC (NASDAQ:IAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

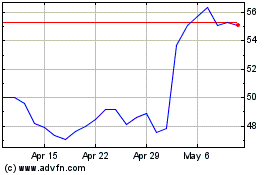

IAC (NASDAQ:IAC)

Historical Stock Chart

From Apr 2023 to Apr 2024