China Eases Path for Foreign Drugmakers' Hepatitis C Treatments

April 22 2016 - 6:44AM

Dow Jones News

SHANGHAI-- China will grant four global drug companies

priority-review status to launch groundbreaking new hepatitis C

treatments in China, a rare move to open the lucrative market to

foreign players.

China's Food and Drug Administration expedites domestic drug

applications to encourage innovation. But its lengthy drug-approval

process for foreign companies means none of the direct-acting

antiviral agents that have been shown to cure more than 90% of

hepatitis C patients within a few months have been approved in

China, which has among the highest rates of the disease in the

world with an estimated 10 million people infected.

Chinese patients tired of old-generation therapies such as

interferon injections have increasingly traveled overseas to access

the new therapies.

Hepatitis C treatments from Gilead Sciences Inc., AbbVie Inc.,

Bristol-Myers Squibb Co and Janssen Pharmaceuticals Inc.'s Chinese

joint venture Xian Janssen are now expected to enter the world's

second-largest pharmaceuticals market in a shorter time, according

to an announcement from the Center for Drug Evaluation this week.

Two domestic companies and a Taiwanese company also will get

priority review-status for hepatitis C drugs.

Industry experts say priority-review status doesn't guarantee

approval but welcomed the move.

"It shows that the CFDA is serious about prioritizing important

new innovative medicines that address real unmet medical need or

improve substantially on what's currently available, whether they

originate in domestic or [global] pharma companies," said Laura

Nelson Carney, senior research analyst at Bernstein Research.

In a rare response to a request to comment on its strategy, the

CFDA said it welcomes innovative drugs to enter China, "the

earlier, the better." But it stressed that speed shouldn't trump

quality and that the review process would follow strict

standards.

Spokespeople for Gilead Sciences, AbbVie, Xian Janssen and

Bristol-Myers Squibb all welcomed the decision and said they were

looking forward to bringing new hepatitis C treatments to people in

China.

It is unclear how much sooner the foreign drugs will reach the

Chinese patients. The drug regulator says it will start the review

process within 10 days for drugs that have been prioritized. On

average, standard applications to start trials take about 17 months

while applications to market drugs take a further 20 months,

according to the analysis by IMS Health.

Since a policy was enacted in February to prioritize innovative

treatments for a number of diseases, including viral hepatitis,

AIDS and tuberculosis, several domestic companies have secured

priority status. The latest batch of companies was the first

including foreign ones.

The treatments must show significant advantage over drugs

already on the market.

The policy also encourages foreign companies to manufacture

drugs in China, saying companies will qualify for priority

treatment if they submit applications for approvals in China

simultaneously with U.S. and European Union approvals and use the

same production standards as in those markets.

Global drugmakers have long complained that the delay of drug

approvals in China has squeezed their profits. The sales of

off-patent branded drugs are still the main source of revenue for

global companies in China, partly because they are of better

quality than domestic generic drugs and partly because the long

approval process means companies only have a short window to profit

from patented brand drugs before patents expire.

The Chinese drug regulator has pledged to lift the quality of

domestic generics as part of an effort to bring down drug prices

and bring them more in line with branded drugs from foreign

companies.

Some global drugmakers have shifted focus away from mature drugs

in China toward innovative ones. In February, British

pharmaceutical giant AstraZeneca PLC sold the regional commercial

rights of two best-selling heart drugs, Plendil and Imdur, to China

Medical System Holdings Ltd. for $310 million and $190 million

respectively. The company also disclosed that it is developing

three innovative products in China via local manufacturing.

Fanfan Wang

(END) Dow Jones Newswires

April 22, 2016 06:29 ET (10:29 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

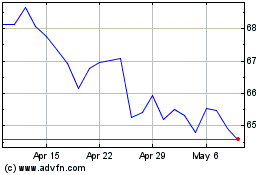

Gilead Sciences (NASDAQ:GILD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gilead Sciences (NASDAQ:GILD)

Historical Stock Chart

From Apr 2023 to Apr 2024