Report of Foreign Issuer (6-k)

September 24 2014 - 10:59AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of September, 2014

Commission File Number: 0-30852

GRUPO

FINANCIERO GALICIA S.A.

(the “Registrant”)

Galicia Financial Group S.A.

(translation of Registrant’s name into English)

Tte. Gral. Juan D. Perón 430, 25th Floor

(CP1038AAJ) Buenos Aires, Argentina

(address of principal executive offices)

Indicate by check mark whether

the Registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark whether by furnishing the information contained in this form, the Registrant is also thereby furnishing the information to the

Securities and Exchange Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If “Yes” is

marked, indicate below the file number assigned to the Registrant in connection with Rule 12g3-2(b): 82-

FORM 6-K

Commission File No. 0-30852

|

|

|

|

|

| Month Filed |

|

Event and Summary |

|

Exhibit No. |

|

|

|

| September, 2014 |

|

Notice of Material Event, dated September 23, 2014 regarding the merger of Galicia Cayman S.A. and Banco de Galicia y Buenos Aires S.A. |

|

99.1 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GRUPO FINANCIERO GALICIA S.A.

(Registrant) |

|

|

|

|

|

|

|

|

|

|

|

| Date: |

|

September 24, 2014 |

|

|

|

By: |

|

/s/ Pedro Alberto Richards |

|

|

|

|

|

|

|

|

Name: Pedro Alberto Richards |

|

|

|

|

|

|

|

|

Title: Chief Executive Officer |

Exhibit 99.1

September 23, 2014

Buenos Aires

To: Comisión

Nacional de Valores (National Securities Commission)

Ref.: Material Event

To whom it may concern,

We are writing to

inform you that on September 23, 2014, Banco de Galicia y Buenos Aires S.A. (“Banco Galicia”) has entered into a Preliminary Merger Agreement to implement the merger of Galicia Cayman S.A. and Banco Galicia, with Banco Galicia being

the surviving corporation of such merger. The Special Merger Balance Sheet and the Consolidated Merger Balance Sheet are as of June 30, 2014 and the effective date for such merger will be October 1, 2014.

Currently, Banco Galicia owns 99.99% of the capital stock of Galicia Cayman S.A. and has a call option for 0.01% of the remaining capital

stock. This option will be exercised prior to entering the Definitive Merger Agreement. Therefore, Banco Galicia will not increase its capital as a result of said merger.

Yours faithfully,

Patricia Lastiry

Attorney-in-fact

Banco de Galicia y Buenos Aires S.A.

This document constitutes an unofficial translation into English of the original document in Spanish, which document shall govern in all

respects, including with respect to any matters of interpretation.

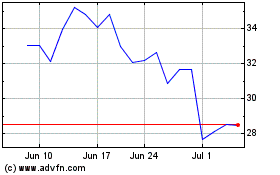

Grupo Financiero Galicia (NASDAQ:GGAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

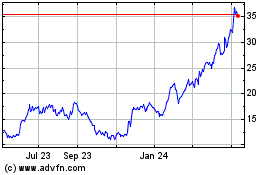

Grupo Financiero Galicia (NASDAQ:GGAL)

Historical Stock Chart

From Apr 2023 to Apr 2024