Current Report Filing (8-k)

February 22 2017 - 4:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): February 16, 2017

EQUINIX, INC.

(Exact

Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Delaware

|

|

000-31293

|

|

77-0487526

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification Number)

|

One Lagoon Drive

Redwood City, California 94065

(650)

598-6000

(Addresses of principal executive offices)

Check the appropriate box below

if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Effective February 16, 2017, the Compensation Committee of the Board of Directors (the “Board”) of Equinix, Inc.

(“Equinix”) approved the Equinix Annual Incentive Plan and related award agreement for the fiscal year ending December 31, 2017 (collectively, the “2017 Plan”) for eligible employees of Equinix, including executive officers.

Under the 2017 Plan, an annual target bonus amount will be assigned to each executive officer. The annual target bonus amounts under the

2017 Plan will be a percentage of each executive’s base salary, ranging from 85% to 130% depending on the executive’s position, and will be payable in cash. For executives, the awards are capped at the target payout, with no greater payout

for over-performance. The actual annual bonus is determined on the basis of Equinix’s performance against revenue (weighted at 50%) and adjusted funds from operations (“AFFO”) (weighted at 50%) goals, based on the Board-approved

operating plan, adjusted from time to time throughout the plan year (the “Goals”). The Goals will exclude the impact of

one-time

events affecting the operating plan, such as expansion projects or

acquisitions not contemplated in the approved operating plan, and will exclude the impact of fluctuations in foreign currencies against the foreign currency rates applied in the operating plan. 100% of the 2017 Plan will be funded if the Goals are

met. For every 1% below the Goals for revenue, the revenue portion of the bonus pool shall be reduced by 20%, and for every 1% below the Goals for AFFO, the AFFO portion of the bonus pool shall be reduced by 20%. No bonuses will be paid if revenue

and AFFO are 95% or less of the Goals. In addition, at its discretion the Compensation Committee may reduce or eliminate the actual award that otherwise would be payable.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

EQUINIX, INC.

|

|

|

|

|

|

|

DATE: February 22, 2017

|

|

|

|

By:

|

|

/s/ Keith D. Taylor

|

|

|

|

|

|

|

|

Keith D. Taylor

|

|

|

|

|

|

|

|

Chief Financial Officer

|

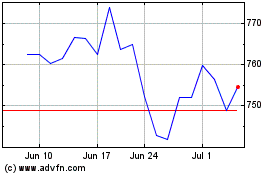

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

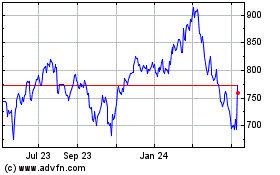

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Apr 2023 to Apr 2024