Ebay Reports Another Drop in Revenue -- 2nd Update

January 27 2016 - 6:57PM

Dow Jones News

By Greg Bensinger

EBay Inc. failed to lift sales during the lucrative holiday

season and signaled a tough start to the year, troubling signs for

the online marketplace that has been overshadowed by Amazon.com

Inc.

The San Jose, Calif., online marketplace on Wednesday reported

$2.32 billion in sales in the fourth quarter, virtually flat with a

year earlier and the fourth straight quarter without growth. Profit

dropped by more than half to $477 million.

EBay expects the rough patch to continue in the first quarter,

projecting sales and profits will come up short of Wall Street

estimates. EBay's shares fell more than 11% to $23.48 in

after-hours trading.

The weak report card underscores eBay's struggles to convince

consumers to begin their online shopping on its namesake site. The

company has sought to boost its standing in Alphabet Inc.'s Google

search results, but eBay says that project will take some time to

show dividends.

"EBay needs to do a better job of getting customers to think of

shopping there," said Kerry Rice, a Needham & Co. analyst. "The

picture people have is used and collectible items."

EBay has fought that reputation for years as the majority of

items it sells are fixed-price rather than by auction. But its

efforts to take on Amazon and other retailers with new offerings

from well-known brands have largely fizzled.

As a result, EBay has been embracing more cost-conscious

consumers, while emphasizing the unique and hard-to-find inventory

for which it became known. In some respects, eBay is returning to

its roots as a pure marketplace after having sold off its

Enterprise division and other assets, such as its stake in

Craigslist Inc.

The period marks eBay's second without its PayPal Holdings Inc.

payments subsidiary, which it spun off as its own publicly traded

company last summer. By contrast, EBay's former division on

Wednesday posted a 17% jump in sales, driving the shares up about

5% after market close.

"Six months ago we began a series of platform, inventory, and

policy changes which we believe are critical to make our business

more competitive over the long term," said Chief Executive Devin

Wenig, acknowledging some of eBay's challenges on a call with

analysts. "We don't expect to see material benefit from them for

some time to come."

Mr. Wenig pointed to unfavorable foreign exchange rates as

limiting sales growth. By that measure, sales would have gained 5%,

eBay said.

In a first, eBay began disclosing some results for its StubHub

ticket-sales site and its Classifieds ad-listing unit. StubHub

logged $232 million in sales, up 34% from a year earlier, while

Classifieds grew 2% to $183 million in sales. The company said it

had no plans to disclose the units' profitability.

Excluding PayPal and the former Enterprise division, eBay's

earnings from continuing operations fell 28% to $523 million.

EBay said the total value of merchandise it sold grew 4%, a

slower rate than in the third quarter. The retailer's active buyers

rose 1.9% to 162 million from the previous three months.

In this year's first quarter, eBay said it expects per-share

earnings excluding certain items of between 43 cents and 45 cents

on revenue between $2.05 billion and $2.10 billion. Analysts, on

average, were expecting earnings of 48 cents a share on revenue of

$2.16 billion.

For 2016, eBay sees per-share earnings excluding certain items

of between $1.82 and $1.87 on revenue between $8.5 billion and $8.8

billion. Analysts, on average, were expecting earnings of $1.98 a

share on revenue of $8.99 billion.

Write to Greg Bensinger at greg.bensinger@wsj.com

(END) Dow Jones Newswires

January 27, 2016 18:42 ET (23:42 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

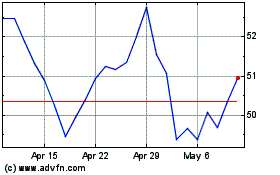

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Aug 2024 to Sep 2024

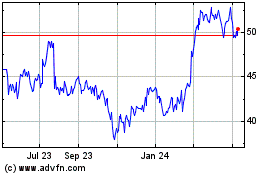

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Sep 2023 to Sep 2024