Copart, Inc. (NASDAQ: CPRT) today reported financial results for

the quarter ended October 31, 2016.

For the three months ended October 31, 2016, revenue, gross

margin, and net income were $346.0 million, $145.3 million, and

$167.3 million, respectively. These represent an increase in

revenue of $57.2 million, or 19.8%; an increase in gross margin of

$24.4 million, or 20.2%; and an increase in net income of $114.7

million, or 218.0%, respectively, from the same quarter last year.

Fully diluted earnings per share for the three months were $1.41

compared to $0.41 last year, an increase of 243.9%.

Excluding the impact of foreign currency-related gains, certain

income tax benefits and payroll taxes related to accounting for

stock option exercises, non-GAAP fully diluted earnings per share

for the three months ended October 31, 2016 and 2015, were $0.57

and $0.41, respectively. A reconciliation of non-GAAP financial

measures to the most directly comparable financial measures

computed in accordance with U.S. generally accepted accounting

principles (GAAP) can be found in the tables attached to this press

release.

On Tuesday, November 22, 2016, at 11 a.m. Eastern time, Copart

will conduct a conference call to discuss the results for the

quarter. The call will be webcast live and can be accessed at

http://stream.conferenceamerica.com/copart112216. A replay of the

call will be available through January 20, 2017 by calling (877)

919-4059. Use confirmation code # 16477400.

About Copart

Copart, founded in 1982, provides vehicle sellers with a full

range of remarketing services to process and sell salvage and clean

title vehicles to dealers, dismantlers, rebuilders, exporters, and

in some states, to end users. Copart remarkets the vehicles through

Internet sales using its VB3 technology. Copart sells vehicles on

behalf of insurance companies, banks, financial institutions,

charities, car dealerships, fleet operators, vehicle rental

companies, as well as vehicles sourced from the general public. The

company currently operates in the United States (www.copart.com),

Canada (www.copart.ca), the United Kingdom (www.copart.co.uk),

Brazil (www.copart.com.br), Germany (www.copart.de), the United

Arab Emirates, Oman and Bahrain (www.copartmea.com), Spain

(www.copart.es), Ireland (www.copart.ie), and India

(www.copart.in). Copart links sellers to more than 750,000 Members

in more than 150 countries worldwide through its multi-channel

platform. In 2015, Copart was ranked at the top of Deloitte’s “The

Exceptional 100” list of companies, which reviewed U.S. publicly

traded companies based upon a multidimensional approach to

measuring financial performance. For more information, or to become

a Member, visit www.copart.com.

Use of Non-GAAP Financial Measures

Included in this release are certain non-GAAP financial

measures, including non-GAAP net income per diluted share, which

reflect the impact of foreign currency-related gains, certain

income tax benefits and payroll taxes related to accounting for

stock option exercises. These non-GAAP financial measures do not

represent alternative financial measures under GAAP. In addition,

these non-GAAP financial measures may be different from non-GAAP

financial measures used by other companies. Furthermore, these

non-GAAP financial measures do not reflect a comprehensive view of

Copart’s operations in accordance with GAAP and should only be read

in conjunction with the corresponding GAAP financial measures. This

information constitutes non-GAAP financial measures within the

meaning of Regulation G adopted by the U.S. Securities and Exchange

Commission. Accordingly, Copart has presented herein, and will

present in other information it publishes that contains these

non-GAAP financial measures, a reconciliation of these non-GAAP

financial measures to the most directly comparable GAAP financial

measures.

Copart believes the presentation of non-GAAP net income per

diluted share included in this release in conjunction with the

corresponding GAAP financial measures provides meaningful

information for investors, analysts and management in assessing

Copart’s business trends and financial performance. From a

financial planning and analysis perspective, Copart management

analyzes its operating results with and without the impact of

foreign currency-related gains, certain income tax benefits and

payroll taxes related to accounting for stock option exercises.

Cautionary Note About Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of federal securities laws, and these forward-looking

statements are subject to substantial risks and uncertainties.

These forward-looking statements are subject to certain risks,

trends and uncertainties that could cause actual results to differ

materially from those projected or implied by our statements and

comments. For a more complete discussion of the risks that could

affect our business, please review the “Management's Discussion and

Analysis” and the other risks identified in Copart’s latest Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current

Reports on Form 8-K, as filed with the Securities and Exchange

Commission. We encourage investors to review these disclosures

carefully. We do not undertake to update any forward-looking

statement that may be made from time to time on our behalf.

Copart, Inc.

Condensed Consolidated Statements of

Income

(In thousands, except per share data)

(Unaudited)

Three Months Ended October 31, 2016

2015 Service revenues and vehicle sales:

Service revenues $ 307,078 $ 250,967 Vehicle sales 38,913

37,871 Total service revenues and vehicle sales 345,991

288,838 Operating expenses: Yard operations 157,362 126,878 Cost of

vehicle sales 33,087 32,068 Yard depreciation and amortization

9,448 8,345 Yard stock-based payment compensation 801 686

Gross margin 145,293 120,861 General and administrative

30,924 26,711 General and administrative depreciation and

amortization 5,261 3,176 General and administrative stock-based

payment compensation 4,284 4,728 Total operating

expenses 241,167 202,592 Operating income 104,824

86,246 Other (expense) income: Interest expense, net (5,622 )

(5,513 ) Other income, net 3,332 1,027 Total other

expenses (2,290 ) (4,486 ) Income before income taxes 102,534

81,760 Income tax (benefit) expense (64,746 ) 29,150 Net

income $ 167,280 $ 52,610 Basic net income per

common share $ 1.48 $ 0.44 Weighted average common

shares outstanding 112,718 120,155 Diluted net

income per common share $ 1.41 $ 0.41 Diluted

weighted average common shares outstanding 118,879 127,144

Copart, Inc.

Condensed Consolidated Balance

Sheets

(In thousands)

(Unaudited)

October 31, 2016 July 31, 2016 ASSETS

Current assets: Cash and cash equivalents $ 168,421 $ 155,849

Accounts receivable, net 294,358 266,270 Vehicle pooling costs and

inventories 40,202 38,987 Income taxes receivable 110,923 18,751

Deferred income taxes 711 1,444 Prepaid expenses and other assets

16,096 18,005 Total current assets 630,711 499,306

Property and equipment, net 840,587 816,791 Intangibles, net 10,241

11,761 Goodwill 255,093 260,198 Deferred income taxes 1,912 23,506

Other assets 31,852 38,258 Total assets $ 1,770,396

$ 1,649,820

LIABILITIES AND STOCKHOLDERS’

EQUITY Current liabilities: Accounts payable and accrued

liabilities $ 175,969 $ 192,379 Deferred revenue 3,975 4,628 Income

taxes payable 6,583 5,625 Current portion of long-term debt,

revolving credit facility, and capital lease obligations 171,151

76,151 Total current liabilities 357,678 278,783

Deferred income taxes 3,380 3,816 Income taxes payable 26,867

25,641 Long-term debt and capital lease obligations, net of

discount 573,030 564,341 Other liabilities 2,034 2,783

Total liabilities 962,989 875,364 Commitments and

contingencies Stockholders' equity: Preferred stock — — Common

stock 11 11 Additional paid-in capital 416,125 392,445 Accumulated

other comprehensive loss (127,969 ) (109,194 ) Retained earnings

519,240 491,194 Total stockholders' equity 807,407

774,456 Total liabilities and stockholders' equity $

1,770,396 $ 1,649,820

Copart, Inc.

Condensed Consolidated Statements of

Cash Flows

(In thousands)

(Unaudited)

Three Months Ended October 31, 2016

2015 Cash flows from operating activities: Net income

$ 167,280 $ 52,610 Adjustments to reconcile net income to net cash

provided by operating activities: Depreciation and amortization,

including debt cost 14,820 11,562 Allowance for doubtful accounts

22 1,032 Equity in losses of unconsolidated affiliates 349 158

Stock-based payment compensation 5,085 5,414 Loss (gain) on sale of

property and equipment 38 (60 ) Deferred income taxes 22,088 (870 )

Changes in operating assets and liabilities: Accounts receivable

(29,472 ) (16,910 ) Vehicle pooling costs and inventories (1,783 )

(2,252 ) Prepaid expenses and other current assets 1,392 (1,115 )

Other assets (202 ) (1,036 ) Accounts payable and accrued

liabilities (14,828 ) 77 Deferred revenue (602 ) (5 ) Income taxes

receivable (92,172 ) 5,136 Income taxes payable 2,615 23,483 Other

liabilities (337 ) (433 ) Net cash provided by operating activities

74,293 76,791

Cash flows from investing activities:

Purchases of property and equipment (38,209 ) (20,167 ) Investment

in unconsolidated affiliate (1,050 ) — Proceeds from sale of

property and equipment 190 443 Purchases of marketable securities —

(21,119 ) Net cash used in investing activities (39,069 )

(40,843 )

Cash flows from financing activities:

Proceeds from the exercise of stock options 13,977 368 Payments for

employee stock-based tax withholdings (134,615 ) — Proceeds from

revolving loan facility, net of repayments 103,900 — Principal

payments on long-term debt — (18,750 ) Net cash used in

financing activities (16,738 ) (18,382 ) Effect of foreign currency

translation (5,914 ) (662 ) Net increase in cash and cash

equivalents 12,572 16,904 Cash and cash equivalents at beginning of

period 155,849 456,012 Cash and cash equivalents at

end of period $ 168,421 $ 472,916

Supplemental

disclosure of cash flow information: Interest paid $ 4,333

$ 5,723 Income taxes paid, net of refunds $ 2,677

$ 1,292

Additional Financial

Information

Reconciliation of GAAP to Non-GAAP

Financial Measures

(In thousands)

(Unaudited)

Three Months Ended October 31,

2016 2015 GAAP net income $ 167,280 $

52,610 Effect of foreign currency-related gains, net of tax (2,847

) (560 ) Effect of income tax benefit of ASU 2016-09 adoption, net

of tax (1) (101,395 ) (197 ) Effect of payroll taxes on executive

stock compensation, net of tax 3,307 48 Non-GAAP net

income $ 66,345 $ 51,901 GAAP diluted net

income per common share $ 1.41 $ 0.41 Non-GAAP

diluted net income per common share $ 0.57 $ 0.41

GAAP diluted weighted average common shares outstanding

118,879 127,144 Effect on common equivalent shares from ASU 2016-09

adoption(1) (1,549 ) (1,572 ) Non-GAAP diluted weighted average

commons shares outstanding 117,330 125,572

(1) In March 2016, the FASB issued ASU No. 2016-09, Improvements

to Employee Share-Based Payment Accounting. Under this standard,

all excess tax benefits and tax deficiencies related to exercises

of stock options are recognized as income tax expense or benefit in

the income statement as discrete items in the reporting period in

which they occur. Additionally, excess tax benefits are classified

as an operating activity on the consolidated statements of cash

flows. The Company early adopted ASU 2016-09 during the fourth

quarter of fiscal 2016 on a modified retrospective basis. For a

more complete discussion, please review the Company's Annual Report

on Form 10-K, filed with the Securities and Exchange Commission on

September 28, 2016.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161121006252/en/

Copart, Inc.Melissa Perry, 972-391-5090Executive Support

Manager, Office of the Chief Financial

Officermelissa.perry@copart.com

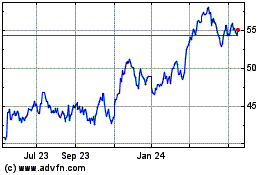

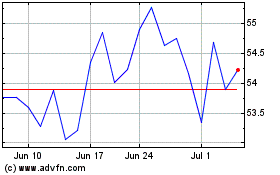

Copart (NASDAQ:CPRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Copart (NASDAQ:CPRT)

Historical Stock Chart

From Apr 2023 to Apr 2024