Copart, Inc. (NASDAQ: CPRT) today reported financial results for

the quarter and nine months ended April 30, 2015.

For the three months ended April 30, 2015, revenue, gross margin

and net income were $297.1 million, $127.4 million and $57.6

million, respectively. These represent a decrease in revenue of

$12.6 million, or 4.1%; a decrease in gross margin of $4.8 million,

or 3.7%; and an increase in net income of $16.7 million, or 40.8%,

respectively, from the same quarter last year. Fully diluted

earnings per share for the three months were $0.44 compared to

$0.31 last year, an increase of 41.9%.

For the nine months ended April 30, 2015, revenue, gross margin

and net income were $863.8 million, $364.6 million and $162.4

million, respectively. These represent a decrease in revenue of

$12.3 million, or 1.4%; an increase in gross margin of $13.0

million, or 3.7%; and an increase in net income of $34.7 million,

or 27.2%, respectively, from the same period last year. Fully

diluted earnings per share for the nine months were $1.23 compared

to $0.97 last year, an increase of 26.8%.

Included in the operating results of the prior year is an

impairment charge of $29.1 million recorded in the third quarter

resulting primarily from the abandonment of work previously

capitalized in connection with the development of a third-party

enterprise operating system.

On Thursday, May 28, 2015, at 11 a.m. Eastern time, Copart will

conduct a conference call to discuss the results for the quarter.

The call will be webcast live at

http://stream.conferenceamerica.com/copart052815. A replay of the

call will be available through July 27 by calling (877) 919-4059.

Use confirmation code # 33373930.

About Copart

Copart, founded in 1982, provides vehicle sellers with a full

range of remarketing services to process and sell salvage and clean

title vehicles to dealers, dismantlers, rebuilders, exporters and,

in some states, to end users. Copart remarkets the vehicles through

Internet sales utilizing its VB3 technology. Copart sells

vehicles on behalf of insurance companies, banks, finance

companies, fleet operators, dealers, car dealerships and others as

well as cars sourced from the general public. The company currently

operates in the United States and Canada (www.copart.com), the

United Kingdom (www.copart.co.uk), Brazil (www.copart.com.br),

Germany (www.copart.de), the United Arab Emirates

(www.copartmea.com), and Spain (www.autoresiduos.com). Copart links

sellers to more than 750,000 members in over 150 countries

worldwide through its multi-channel platform. Copart was recently

ranked at the top of Deloitte’s “Exceptional 100” list of

companies, which reviewed U.S. publicly traded companies based upon

a multidimensional approach to measuring financial performance. For

more information, or to become a member,

visit www.copart.com.

Cautionary Note About Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of federal securities laws, and these forward-looking

statements are subject to substantial risks and uncertainties.

These forward-looking statements are subject to certain risks,

trends and uncertainties that could cause actual results to differ

materially from those projected or implied by our statements and

comments. For a more complete discussion of the risks that could

affect our business, please review the “Management's Discussion and

Analysis” and the other risks identified in Copart’s latest Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current

Reports on Form 8-K, as filed with the Securities and Exchange

Commission. We encourage investors to review these disclosures

carefully. We do not undertake to update any forward-looking

statement that may be made from time to time on our behalf.

Copart, Inc.

Consolidated Statements of

Income

(In thousands, except per share data)

(Unaudited)

Three Months Ended

April 30,

Nine Months Ended

April 30,

2015 2014 2015

2014 Service revenues and vehicle sales: Service

revenues $ 256,564 $ 255,045 $ 741,692 $ 717,140 Vehicle sales

40,578 54,677 122,094 158,899

Total service revenues and vehicle

sales

297,142

309,722

863,786

876,039

Operating expenses:

Yard operations 125,348 122,422 367,124 358,888 Cost of vehicle

sales 34,503 46,263 103,694 135,996 Yard depreciation and

amortization 9,248 8,110 26,655 27,665 Yard stock-based payment

compensation 626 675 1,721 1,856

Gross margin

127,417 132,252 364,592 351,634 General and administrative 25,940

29,908 86,741 95,364 General and administrative depreciation and

amortization 2,916 4,659 8,646 12,684 General and administrative

stock-based payment compensation 3,794 5,948 11,569 15,406

Impairment of long-lived assets - 29,104 - 29,104 Total

operating expenses 202,375 247,089 606,150 676,963 Operating

income 94,767 62,633 257,636 199,076 Other (expense) income:

Interest expense, net (5,656 ) (2,023 ) (11,932 ) (6,226 ) Other

income, net (815 ) 708 4,919 3,301 Total other expense

(6,471 ) (1,315 ) (7,013 ) (2,925 ) Income before income taxes

88,296 61,318 250,623 196,151 Income taxes 30,733 20,441 88,252

68,507 Net income $ 57,563 $ 40,877 $ 162,371 $ 127,644

Basic net income per common share $ 0.46 $ 0.32 $

1.29 $ 1.02 Weighted average common shares outstanding

126,415 125,794 126,309 125,604 Diluted net income

per common share $ 0.44 $ 0.31 $ 1.23 $ 0.97 Diluted

weighted average common shares outstanding 132,124 131,486

131,837 131,095

Copart, Inc.

Consolidated Balance Sheets

(In thousands)

(Unaudited)

April 30,

2015

July 31,

2014

ASSETS Current assets: Cash and cash equivalents $

678,742 $ 158,668 Accounts receivable, net 217,003 196,985 Vehicle

pooling costs and inventories 32,762 31,697 Income taxes receivable

2,587 2,288 Deferred income taxes 5,053 1,803 Prepaid expenses and

other assets 18,312 20,850 Total current assets 954,459

412,291 Property and equipment, net 683,956 692,383 Intangibles,

net 19,715 25,242 Goodwill 271,484 283,780 Deferred income taxes

29,116 36,721 Other assets 44,247 56,387 Total assets $

2,002,977 $ 1,506,804

LIABILITIES AND

STOCKHOLDERS’ EQUITY Current liabilities: Accounts payable and

accrued liabilities $ 154,255 $ 152,156 Deferred revenue 4,612

4,170 Income taxes payable 5,660 8,284 Current portion of long-term

debt and capital lease obligations 64,921 79,674 Total

current liabilities 229,448 244,284 Deferred income taxes 6,334

7,372 Income taxes payable 26,982 23,771 Long-term debt and capital

lease obligations, net of discount 599,951 223,227 Other

liabilities 4,294 4,651 Total liabilities 867,009 503,305

Commitments and contingencies Stockholders’ equity: Preferred stock

— — Common stock 13 13 Additional paid-in capital 422,194 404,542

Accumulated other comprehensive loss (66,594

)

(20,060 ) Retained earnings 780,355 619,004 Total

stockholders’ equity 1,135,968 1,003,499 Total liabilities

and stockholders’ equity $ 2,002,977 $ 1,506,804

Copart, Inc.

Consolidated Statements of Cash

Flows

(In thousands)

(Unaudited)

Nine Months EndedApril 30, 2015

2014 Cash flows

from operating activities: Net income $ 162,371 $ 127,644

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 37,579 40,349

Allowance for doubtful accounts (453 ) 936 Impairment of long-lived

assets — 29,104 Stock-based payment compensation 13,290 17,262

Excess tax benefits from stock-based payment compensation (1,279 )

(1,219 ) Gain on sale of property and equipment (735 ) (1,696 )

Deferred income taxes 3,641 (12,609 ) Changes in operating assets

and liabilities, net of effects from acquisitions: Accounts

receivable (21,763 ) (9,161 ) Vehicle pooling costs and inventories

(1,874 ) (170 ) Prepaid expenses and other current assets 1,480

(3,539 ) Other assets 7,584 (12,133 ) Accounts payable and accrued

liabilities 2,042 15,269 Deferred revenue 445 316 Income taxes

receivable 985 7,305 Income taxes payable 1,313 8,229 Other

liabilities (1,257 ) 1,747 Net cash provided by operating

activities 203,369 207,634

Cash flows from investing

activities: Purchases of property and equipment including

acquisitions, net of cash acquired (49,079 ) (78,078 ) Proceeds

from sale of property and equipment 1,087 3,271 Net cash used in

investing activities (47,992 ) (74,807 )

Cash flows from

financing activities: Proceeds from the exercise of stock

options 3,372 5,680 Excess tax benefit from stock-based payment

compensation 1,279 1,219 Proceeds from the issuance of Employee

Stock Purchase Plan shares 1,495 1,115 Principal payments on

long-term debt (331,250 ) (56,250) Proceeds from the issuance of

long-term debt, net of discount 698,939 — Debt offering costs (955

) — Change in bank overdraft — (16,291 ) Repurchases of common

stock (1,737 ) (80 ) Net cash provided by (used in) financing

activities 371,143 (64,607 ) Effect of foreign currency

translation (6,446 ) 981 Net increase in cash and cash

equivalents 520,074 69,201 Cash and cash equivalents at beginning

of period 158,668 63,631 Cash and cash equivalents at end of period

$ 678,742 $ 132,832

Supplemental disclosure of cash flow

information: Interest paid $ 9,705 $ 6,599 Income taxes paid,

net of refunds $ 81,995 $ 65,769

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150527006690/en/

Copart, Inc.Wendy Lucero, 972-391-5043Assistant to the Chief

Financial Officerwendy.lucero@copart.com

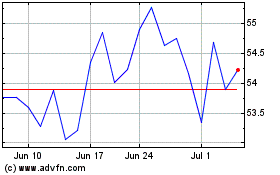

Copart (NASDAQ:CPRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

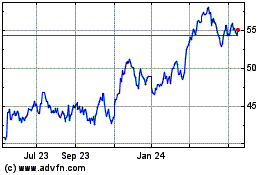

Copart (NASDAQ:CPRT)

Historical Stock Chart

From Apr 2023 to Apr 2024