Comcast to Buy DreamWorks for $3.8 Billion--2nd Update

April 28 2016 - 10:43AM

Dow Jones News

By Anne Steele, Ben Fritz and Dana Mattioli

Comcast Corp. on Thursday said it agreed to buy DreamWorks

Animation SKG Inc. for about $3.8 billion, a deal that could make

the cable giant a rival to Walt Disney Co. in the lucrative

family-entertainment business.

In the transaction, expected to close by the end of the year,

DreamWorks Animation stockholders will receive $41 in cash for each

DreamWorks share.

The purchase price is a premium of 27% over DreamWorks' close on

Wednesday and a premium of 51% over its closing price on Tuesday,

before The Wall Street Journal reported the companies were in

merger talks.

DreamWorks will operate under Comcast's NBCUniversal in its

Universal Filmed Entertainment Group, which includes Universal

Pictures, Fandango, and NBCUniversal Brand Development.

DreamWorks Animation co-founder Chief Executive Jeffrey

Katzenberg will become chairman of DreamWorks New Media, which will

be comprised of the company's ownership interests in Awesomeness TV

and NOVA.

Mr. Katzenberg has been seeking a buyer for his studio, one of

the last in Hollywood not part of a larger conglomerate, for

several years.

"NBCUniversal is the perfect home for our company," said Mr.

Katzenberg.

The pact includes a $200 million reverse breakup fee related to

antitrust approval, according to Comcast filings. Comcast also said

the deal is valued at $4.1 billion including the assumption of

debt.

Comcast's Universal Pictures studio has enjoyed success in

recent years with its animated "Despicable Me" and "Minions" movies

but is still a relatively small player.

Its parent company, though, has been moving aggressively to

mimic Disney by using its animation properties to build out its

consumer products and theme parks businesses, a strategy that could

be accelerated by the addition of DreamWorks, which makes the

"Shrek," "Kung Fu Panda," and "Madagascar" movies, among

others.

The deal will also add DreamWorks' classic media library,

including "Where's Waldo," "Casper," "Lassie," and "Rudolph The

Red-Nosed Reindeer" to NBCUniversal's portfolio

The Justice Department and the Federal Trade Commission will

decide which agency reviews the transaction from an antitrust

perspective, according to the Comcast filing. The transaction

doesn't require Federal Communications Commission approval.

In 2014, DreamWorks held talks with Japan's SoftBank Corp. and

toy maker Hasbro Inc. More recently it has held discussions with

potential buyers in China, said people close to the company.

Several box-office flops between 2012 and 2014 forced the

company in early 2015 to lay off 500 employees, close a Northern

California operation and cut its feature-film output to two movies

a year, from three.

DreamWorks is in the midst of a multiyear deal to produce

hundreds of hours of television for Netflix Inc.and has recently

enjoyed success with digital video company AwesomenessTV, which it

acquired in 2013.

Shares of Comcast rose 16 cents to $61.46 in early trading while

DreamWorks shares jumped 24% to $39.90.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

April 28, 2016 10:28 ET (14:28 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

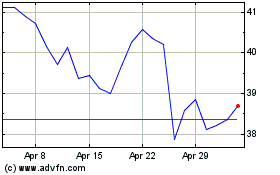

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

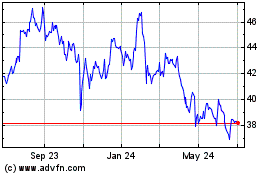

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024