CORRECT: US Stocks End At Multiyear Highs On US Manufacturing Report

April 02 2012 - 7:28PM

Dow Jones News

NEW YORK (Dow Jones)--Stocks rose to multiyear highs on the

first session of the new quarter after a solid reading on domestic

manufacturing.

Major indexes started near the flat line but drifted higher as a

result of the report on March manufacturing activity. The Dow Jones

Industrial Average climbed 52.45 points, or 0.40%, to 13264.49, its

highest close since December 2007.

On Friday, the Dow rose 66 points to close out the best

first-quarter point gain--994.48 points--in its history, and the

best first-quarter percentage performance--8.1%--since 1998.

The Standard & Poor's 500-stock index gained 10.57 points,

or 0.75%, to 1419.04, its highest finish since May 2008. The Nasdaq

Composite rose 28.13 points, or 0.91%, to 3119.70.

"After a massive run, what's better than putting a cherry on

top?" said Barry James, president of James Investment Research.

"When you've got the market running higher, it likes to keep going

higher until something really takes place. From an economic

standpoint, there are enough positive markers for people to say

that's OK right now."

All 10 sectors of the S&P 500 advanced, paced by the

materials and technology sectors. Oil-and-gas company Denbury

Resources rose, while coal producer Alpha Natural Resources

increased.

Beauty-products seller Avon Products led the index higher,

climbing 17% after receiving a $10 billion buyout offer from Coty,

a closely held fragrance company. Avon rejected the bid, saying it

was opportunistic and substantially undervalued the company.

The U.S. manufacturing sector's expansion continued in March and

employment perked up, according to data released by the Institute

for Supply Management. "The ISM number is a positive sign for the

market but still pretty much flat," said Joe Bell, senior equity

analyst at Schaeffer's Investment Research. "It's probably going to

be a slow week, with a lot of eyes on the unemployment results on

Friday."

But spending on construction projects in the U.S. fell for the

second straight month in February, showing the sector is struggling

to build on momentum late last year. The drop was the biggest since

July and fell short of economists' average forecast for an

increase.

In Europe, the Stoxx Europe 600 index gained 1.5%, with the U.S.

manufacturing data providing a boost. The U.K.'s FTSE 100 index

rose 1.9% and Germany's DAX index advanced 1.5%.

Asian bourses were mixed following a reading of Chinese

manufacturing activity. The government's survey showed a strong

expansion in activity in March, but that was in contrast to

readings of contraction shown by an HSBC survey over a week ago.

Hong Kong's Hang Seng Index slipped 0.2% while Japan's Nikkei Stock

Average tacked on 0.3%.

Crude-oil prices rose 2.1%, to settle at $105.23 a barrel, while

gold prices rose 0.5% to settle at $1,677.50 a troy ounce. The

dollar gained ground against the euro but slipped against the yen.

The yield on the 10-year Treasury note fell to 2.196%.

In other corporate news, Groupon slumped 17% after the online

coupon provider revised lower previously reported fourth-quarter

earnings and revenue as a result of an increase to its refund

reserve accrual. In addition, Groupon said its independent auditor

included a statement of a material weakness in its internal

controls in its annual 10-K filing with the Securities and Exchange

Commission.

Keryx Biopharmaceuticals plunged 65% after the company said a

Phase III trial to evaluate its treatment for colorectal cancer

didn't meet the primary endpoint. Keryx is the licensee partner of

Canada's Aeterna Zentaris, which also tumbled.

Theravance climbed 19% as it entered into a deal in which

GlaxoSmithKline would increase its ownership in Theravance by 10

million shares. Following the purchase, Glaxo would own 25.81

million, or about 26.8% of outstanding Theravance shares.

Hartford Financial Services Group rose 4.1% after agreeing to

pay $2.43 billion to buy back securities it sold to Allianz in the

depths of the financial crisis. The agreement allows Hartford to

replace $1.75 billion it owes to Allianz with new debt at a lower

cost.

Express Scripts added 2.4% after closing its $29.1 billion

acquisition of peer Medco Health Solutions. The deal followed a

Federal Trade Commission decision that the combination of the two

largest pharmacy-benefits management companies in the U.S. wouldn't

change the competitive landscape in the sector.

Wireless broadband network services provider Towerstream jumped

9.9% after disclosing a Wi-Fi agreement with a national wireless

carrier.

Abercrombie & Fitch climbed 4.1% after Brean Murray analysts

raised their rating on the teen clothing-retailer's stock to "buy,"

saying the "worst appears over" for the company.

Regional carrier Pinnacle Airlines tumbled 49% after filing for

Chapter 11 bankruptcy protection. The Memphis, Tenn.-based carrier

is seeking to restructure its agreements with Delta Air Lines and

cut ties with United Airlines and US Airways Group.

-By Matt Jarzemsky, Dow Jones Newswires; 212-416-2240;

matthew.jarzemsky@dowjones.com

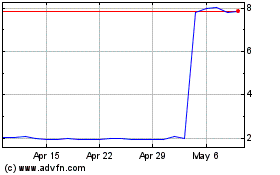

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Mar 2024 to Apr 2024

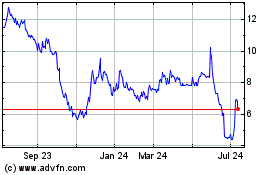

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Apr 2023 to Apr 2024