Current Report Filing (8-k)

October 09 2015 - 9:23AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 5, 2015

Supernova

Energy, Inc.

(Exact

name of registrant as specified in its charter)

| |

Nevada |

333-165373 |

98-0628594 |

|

| |

(State or other jurisdiction

of

incorporation) |

(Commission File

Number) |

(IRS

employer Identification

Number) |

|

265

Sunrise Hwy, Ste 1-276, Rockville Centre, New York 11570

(Address

of principal executive offices) (Zip Code)

| |

|

|

|

| |

Registrant’s telephone number,

including area code: |

(702)

839-4029 |

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

| [

] |

Written communications

pursuant to Rule 425 under the Securities Act |

| |

|

| [

] |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act |

| |

|

| [

] |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act |

| |

|

| [

] |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act |

| Item 1.01 Entry

into a Material Definitive Agreement. |

On

October 5, 2015, the registrant entered into a Lease and Well Purchase Agreement (the “Lease”) with OMR Drilling and

Acquisition, LLC. Under the Lease, the registrant will pay OMR $135,000 to purchase a 50% working interest and a 37.5% net revenue

interest on the Monroe Lease with three wells located in Monroe County. OMR agreed to carry the registrants share of the operation

and maintenance expenses associated with the operation of the three wells for the first twelve months of the registrants ownership.

| Item 9.01 |

Financial

Statements and Exhibits |

| 10.1 |

Lease and Well Purchase

Agreement |

| |

|

| |

|

SIGNATURES

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

Dated

October 8, 2015

Supernova

Energy, Inc.

| |

|

|

|

| By: /s/

Kevin Malone |

|

|

|

| Kevin G. Malone, President,

CEO, CFO |

EXHIBIT

INDEX

| 10.1 |

Lease and Well Purchase

Agreement |

LEASE

and WELL PURCHASE AGREEMENT

MONROE LEASE

with THREE OIL WELLS located in

MONROE COUNTY,

KENTUCKY

Total Acreage:

500 +/- acres

THIS

Purchase Agreement is made and entered into on this 5th day of October 2015, by and between the undersigned, SUPERNOVA

ENERGY, whose address is 265 Sunrise Hwy STE 1-276 Rockville Centre, New York 11570, hereinafter referred to as “SUPERNOVA”,

and OMR Drilling and Acquisition LLC, a Kentucky corporation, whose address is 5405 S. Highway 127, Albany, Kentucky, hereinafter

referred to as “OMR DRILLING”.

WITNESSETH

WHEREAS,

OMR DRILLING owns a certain Oil, Gas and Mineral Lease and three oil wells (the “Lease”)

in and to lands situated in the counties and states noted hereinabove in an area known to the parties hereto by the project

name noted hereinabove; and,

WHEREAS,

SUPERNOVA desires to purchase 50% of said lease and wells.

NOW,

THEREFORE, in consideration of the premises, the parties hereto do hereby agree and stipulate as follows, to-wit:

| 1. | SUPERNOVA

agrees to pay to OMR DRILLING the amount of $135,000 in order to purchase a 50% working

interest and a 37.5% net revenue interest in the three existing wells and in the remaining

undeveloped portions of the lease. |

| 2. | OMR

DRILLING agrees to carry SUPERNOVA’S share of the operation and maintenance expenses

associated with the operation of the three wells for the first twelve months of ownership. |

| 3. | OMR

DRILLING covenants to keep the location(s) free and clear of liens and encumbrances arising

out of operations, and to provide reasonable amounts of insurance as required by the

State of Kentucky. OMR DRILLING shall be liable to SUPERNOVA only for gross negligence

or intentional acts which might prove to be the proximate cause of any loss to SUPERNOVA.

Any loss which may be caused by an

act of God (force majeure) or caused by any force or reason beyond the control of OMR DRILLING shall not create any liability

upon either party beyond its, proportionate share of any location or well ownership. In the event of such loss, both parties agree

to pay their proportionate share of liability from the proceeds of oil and/or gas sales from the subject well(s) to settle claims,

or losses, as a result of the operation of the properties. Each of the parties shall always have the right and privilege of receiving

in kind, or separately disposing of its’ share of oil and/or gas production. Any extra expenses incurred by reason of separate

disposition, or taking in kind, or its’ share of production, by either party privileges and obligations of this contract

shall be assumed by any Third Party receiving SUPERNOVA’s working interest through assignment or transfer. |

4.

SUPERNOVA does hereby constitute and appoint OMR DRILLING as its agent, attorney in fact, to negotiate and contract for the sale

of oil and/or gas, and to receive and disburse proceeds of sale, including the power to deduct normal and reasonable operation

expense.

5.

SUPERNOVA shall have access to the Lease Well at all reasonable times for the purpose of inspection and observation.

6.

SUPERNOVA agrees and accepts the conditions of this Agreement and further acknowledges that the oil and gas business is inherently

risky and that all or part of any investment on this project may be lost. With this in mind, OMR DRILLING makes no representation

or guarantee regarding any amount of possible oil or gas production or the numerous risks in connection with an investment in

this project. SUPERNOVA further states that it can withstand the total loss of investment without causing a change in lifestyle.

7.

This Agreement embodies the entire agreement between the parties hereto, and supersedes any and all prior negotiations or agreements

in regard thereto. No alteration or extensions of this Agreement shall be binding unless in writing and signed by the parties

hereto.

| 8. | The

parties hereto acknowledge that they have read the above and foregoing Agreement thoroughly,

that there has been adequate opportunity to consult legal counsel concerning this Agreement

and that they have executed the same freely and voluntarily on the date hereof. |

IN

WITNESS WHEREOF, this Agreement has been agreed to and signed by each of the parties hereto, as of the day first above written.

SUPERNOVA

ENERGY

BY:

_________________________________

Kevin

Malone, President and Sole Director

OMR

Drilling and Acquisition, LLC.

BY:

_________________________________

NICHOLAS

A. UPCHURCH

MANAGING

MEMBER

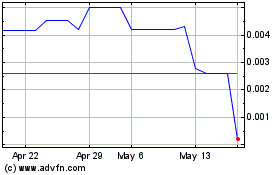

Supernova Energy (CE) (USOTC:SPRN)

Historical Stock Chart

From Apr 2024 to May 2024

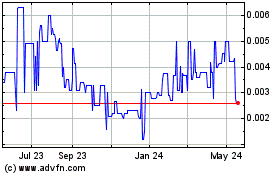

Supernova Energy (CE) (USOTC:SPRN)

Historical Stock Chart

From May 2023 to May 2024