California Business Bank Announces 4th Quarter and Year 2007 Financial Results

January 11 2008 - 2:00PM

Business Wire

California Business Bank (OTCBB:CABB) announced today its fourth

quarter 2007 net profit in the amount of $144,000, compared with

net loss of ($67,000) in the fourth quarter of 2006. For the twelve

months ended December 31, 2007, net profit was $569,000, or 30

cents per share, compared with net loss of ($1,209,000), or (66)

cents per share for the prior year ended December 31, 2006. Mr.

Charles Wood, President and Chief Executive Officer, stated, �The

improvement in earnings resulted from solid loan and deposit growth

while controlling human assets, and fixed overhead. The Bank will

continue to invest in technology, delivery channels, and human

resources to achieve our strategic objectives. Furthermore, we

intend to expand our market footprint by establishing strategic

locations to better serve our business deposit and relationships.�

2007 Year End Key Performance Highlights Total assets increased to

$117.8 million, an increase of $32.7 million or 38% from the prior

year ended December 31, 2006. Total loans outstanding grew to $83.7

million, up 57% or $30.2 million over the previous year. Total

Deposit increased to $94.2 million, increased by 38% or $26.0

million over the previous year. Provision for loan losses was

$346,000 for 2007 and allowance for loan losses to total loans was

at 1.11%. Return on average asset was 0.54%, compared with (2.13%)

for 2006. Return on equity was 3.32%, compared with (7.14%) for

2006. Net interest margin increased to 4.15%, compared with 3.90%

for 2006. The Bank continued to be �well-capitalized� under

regulatory guidelines with Tier 1 leverage capital ratio of 15.4%,

Tier 1 risk based capital ratio of 18.9% and Total risk based

capital ratio of 19.9%. Additionally, we are pleased to announce

Ms. Jane Auerswald has joined our team as Executive Vice President

and Chief Credit Officer. Jane has over 30 years of banking

experience and over 15 years as Chief Credit Officer.

Forward-Looking Statements Certain matters discussed in this press

release constitute forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995, and are

subject to the safe harbors created by the act. These

forward-looking statements refer to the Company�s current

expectations regarding future operating results, and growth in

loans, deposits, and assets. These forward-looking statements are

subject to certain risks and uncertainties that could cause the

actual results, performance, or achievements to differ materially

from those expressed, suggested, or implied by the forward-looking

statements. These risks and uncertainties include, but are not

limited to (1) the impact of changes in interest rates, a decline

in economic conditions, and increased competition by financial

service providers on the Company�s results of operation, (2) the

Company�s ability to continue its internal growth rate, (3) the

Company�s ability to build net interest spread, (4) the quality of

the Company�s earning assets, and (5) governmental regulations.

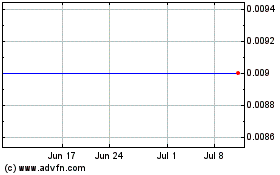

California Business Bank (CE) (USOTC:CABB)

Historical Stock Chart

From Apr 2024 to May 2024

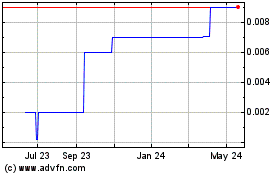

California Business Bank (CE) (USOTC:CABB)

Historical Stock Chart

From May 2023 to May 2024